Dive into KYB verification: history, current methods, and future trends. See how Decentro uses KYB to prevent fraud and secure transactions.

KYB Verification: History, Implementation, and Future Trends

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

When your business partners with another company, you must evaluate the risk of fraud associated with the counterparty.

Why you ask?

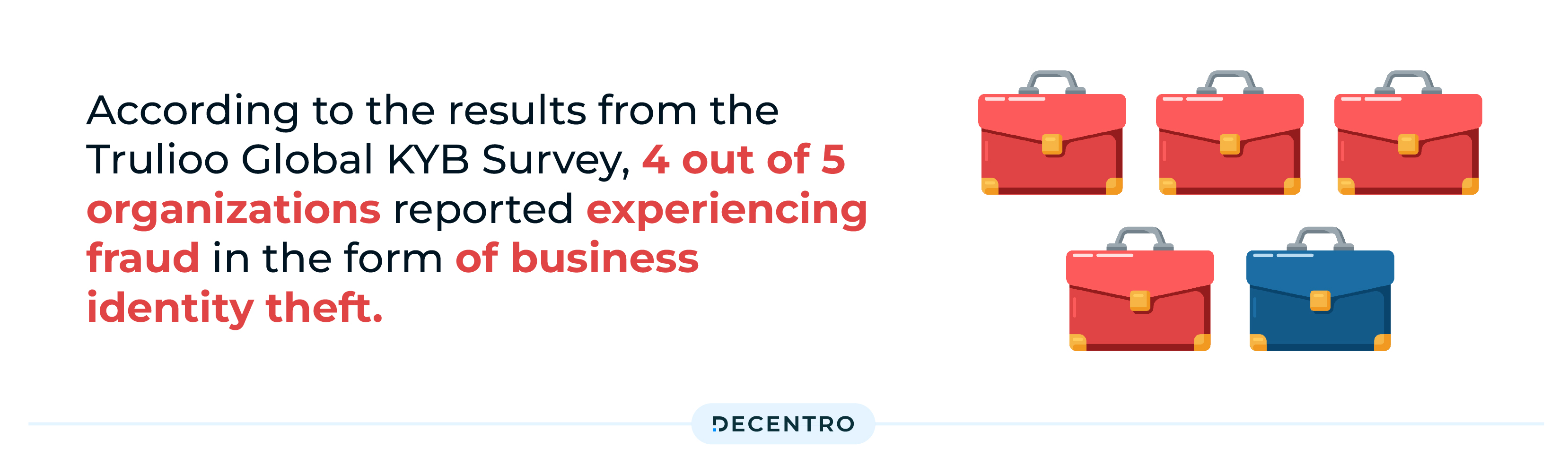

According to the results from the Trulioo Global KYB Survey, 4 out of 5 organizations reported experiencing fraud in the form of business identity theft. The survey compiled responses from 705 professionals in banking, healthcare, and government, among other industries, according to a company statement.

Half of those surveyed reported annual sales above $500 million. Sixty-five per cent of the organisations currently verify over 100 businesses each month, and 75 per cent noted they were likely to invest in business verification in the next year.

What is KYB?

Know Your Business (KYB) verification is the due diligence process in which enterprises and corporate clients are authenticated during onboarding. The numbers above paint a very clear picture of how KYB verification during business onboarding is the need of the hour to ensure the legitimacy of the company your business is dealing with.

In an era of digital transformation and increasing regulatory scrutiny, Know Your Business (KYB) verification has emerged as a critical component of India’s financial ecosystem. This process, aimed at verifying the legitimacy and credibility of companies, is essential for preventing fraud, money laundering, and other illicit activities. As the Indian economy continues to grow and evolve, so does the landscape of KYB verification.

Not just India, even the global E-KYB market size was valued at USD 157.4 million in 2021 and is expected to expand at a CAGR of 12.09% during the forecast period, reaching USD 312.1 million by 2027.

So let’s break down this process in the Indian context.

Understanding KYB Onboarding

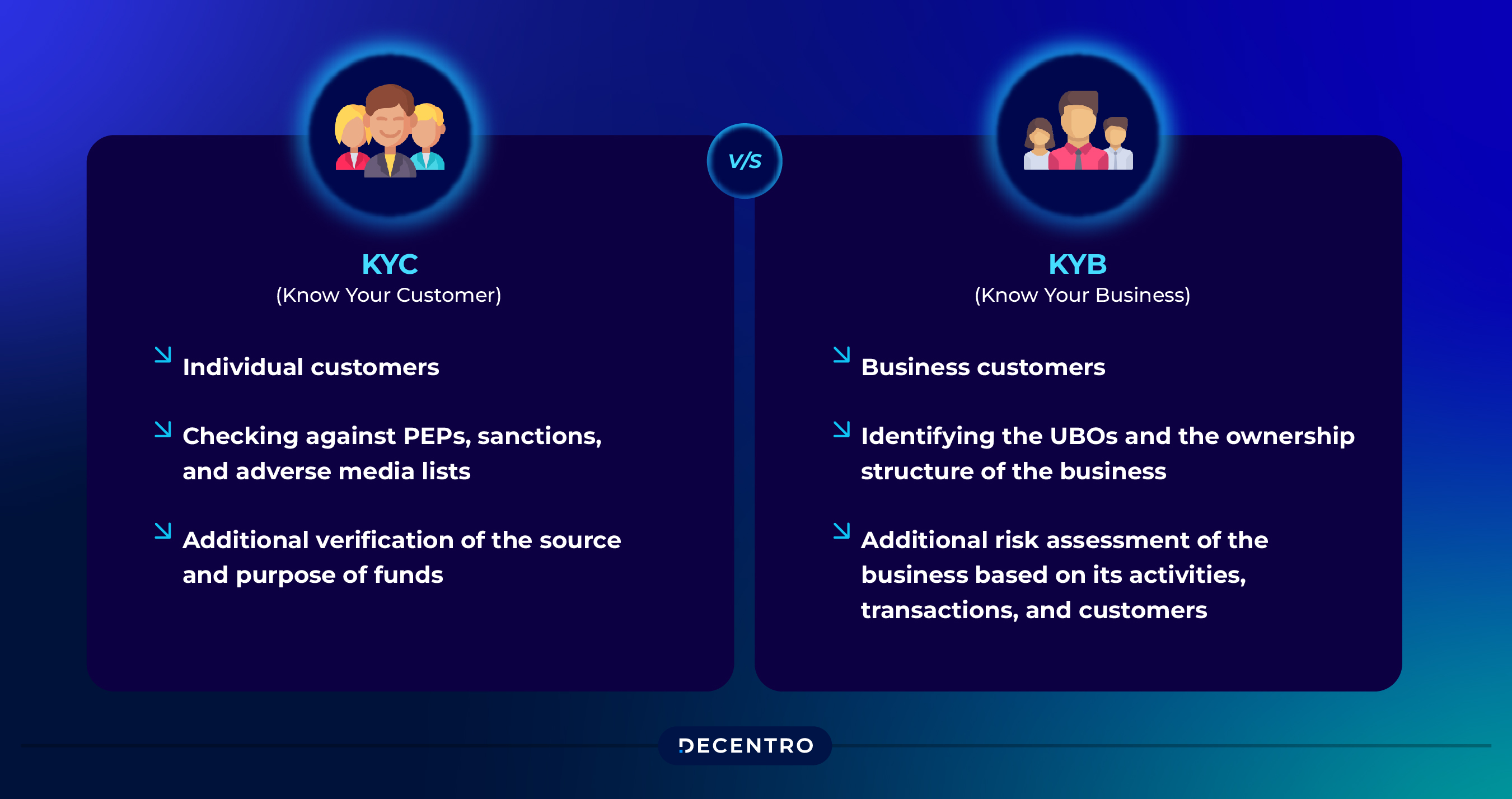

KYB, an extension of Know Your Customer (KYC) processes, focuses on verifying and understanding the entities and businesses with which an organisation conducts transactions. In India, KYB onboarding is governed by various regulatory requirements and frameworks, including those imposed by the Reserve Bank of India (RBI) and other industry-specific regulators. Businesses must differentiate between KYC and KYB onboarding processes to comply with the regulations effectively.

In simple terms:

- Know Your Business (KYB) is when a company carefully examines and checks the details of another business it works with. It is a rule that companies must follow to confirm the identity of their business customers. It stays valid for a B2B business model.

- Know Your Customer (KYC) is confirming the identity of individual customers, a rule that companies must follow to prevent financial crimes.

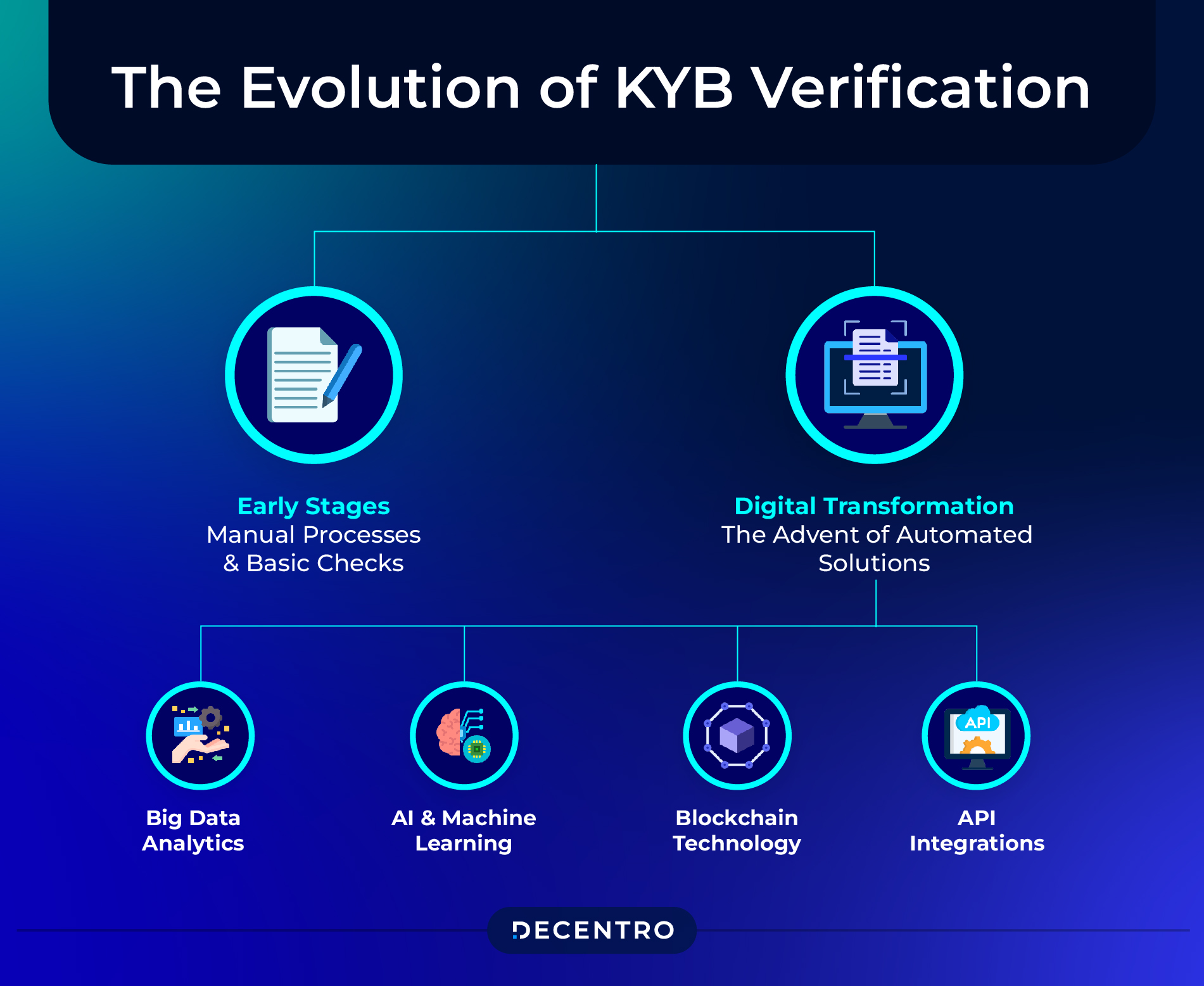

The Evolution of KYB Verification

While KYC regulations have been a standard feature of anti-money laundering regulations globally for decades, KYB processes are a much more recent addition to the world of AML compliance. Prior to the introduction of AML regulations in the US back in 1970, financial crimes and money laundering activities were at an all-time high.

In a bid to combat financial crimes, the Bank Secrecy Act (BSA) was introduced, which encompassed a number of common banking regulations that are still observed today, including tracking suspicious activity, foreign transaction monitoring and reporting cash transactions that exceed $10,000 a day.

Fast-forward to 2001, when the world was shocked by the 9/11 events, the world faced another significant AML compliance requirement with the Patriot Act – which obliges financial institutions to collect information on individuals holding or opening new financial accounts.

However, the Panama Papers scandal exposed the Patriot Act’s limitations. It soon became clear that enhanced due diligence measures were ineffective in stopping the rogue offshore finance industry from using illegal funds. To address this issue, in 2016, the government introduced new requirements specifically for onboarding business customers, known as KYB.

Early Stages of KYB in India: Manual Processes and Basic Checks

In its infancy, KYB verification in India was essentially a manual process. Financial institutions and businesses rely on physical documentation and in-person verification to assess a company’s legitimacy. Basic checks included verifying business registration documents, inspecting premises, and confirming the identities of key stakeholders. While these methods provided confident assurance, they were time-consuming, prone to errors, and difficult to scale.

Digital Transformation: The Advent of Automated Solutions

The advent of digital technology marked a significant turning point in KYB verification. Automated solutions began to replace manual processes, leveraging databases and online resources to streamline verification. The introduction of digital platforms and government databases, such as the Ministry of Corporate Affairs (MCA) portal, allowed for quicker and more accurate verification of business entities.

The launch of Aadhaar, India’s biometric identity system, further revolutionised KYB verification. With the integration of Aadhaar, businesses could verify the identities of their stakeholders with unprecedented accuracy and speed.

There has been a flurry of robust KYB processes-specific platforms which combine the following,

- Big Data Analytics: To sift through vast amounts of data quickly and identify patterns.

- AI and Machine Learning: To automate the verification process and continuously learn and improve.

- Blockchain Technology: To maintain immutable records of business verifications.

- API Integrations: Allowing for real-time checks with various databases and registries globally.

The Role of Regulatory Changes

Regulatory changes have played a crucial role in shaping KYB verification in India. The introduction of the Prevention of Money Laundering Act (PMLA) in 2002 and subsequent amendments have mandated stringent KYC (Know Your Customer) and KYB procedures for financial institutions. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have also issued guidelines to ensure robust verification processes across the financial sector.

In recent years, the push towards digital payments and the rise of fintech companies have further highlighted the need for comprehensive KYB verification. Regulations such as the RBI Digital Payments Security Controls have emphasised the importance of secure and reliable verification processes to protect consumers and maintain trust in digital financial services.

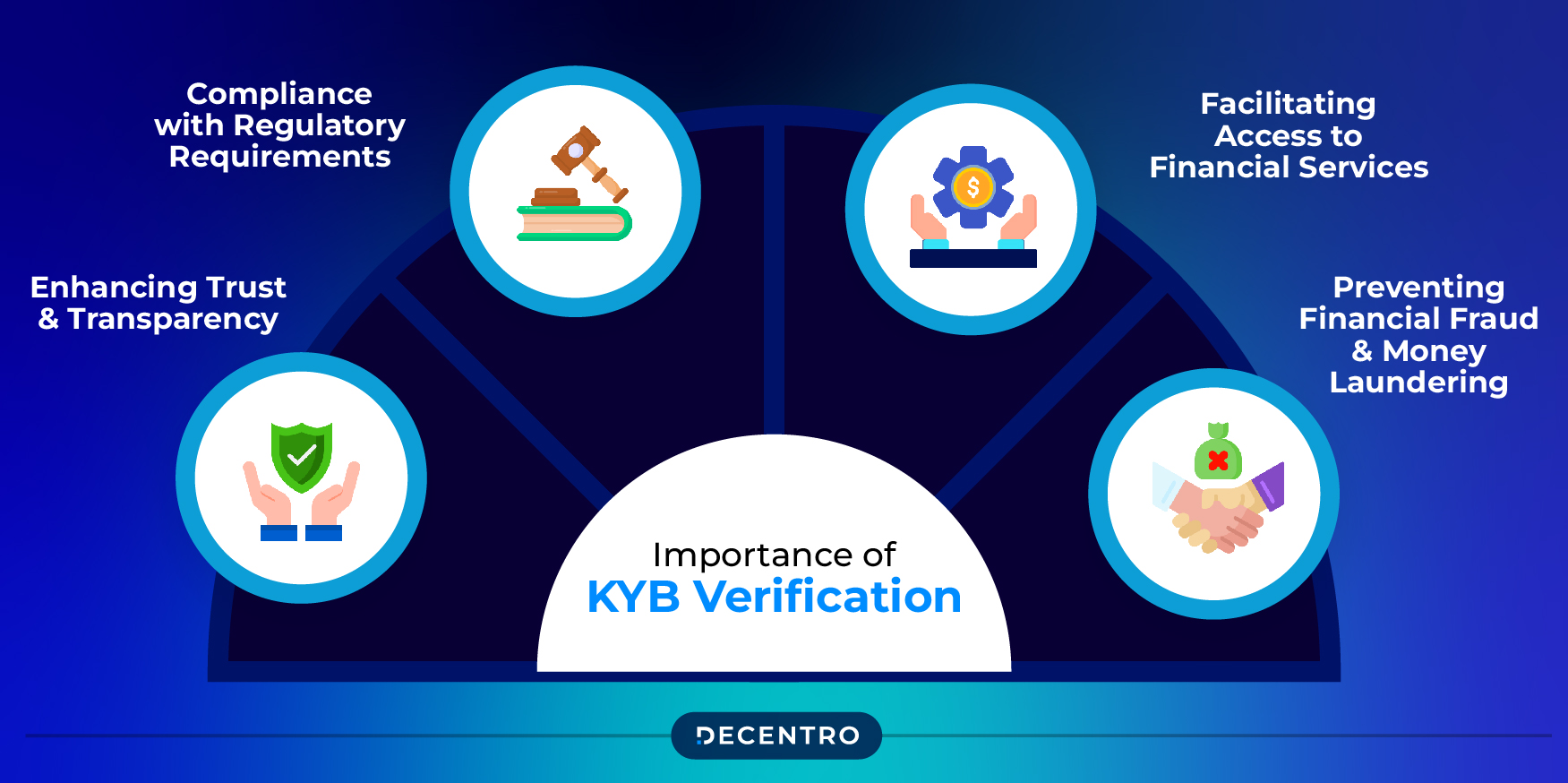

Importance of KYB Verification

Preventing Financial Fraud and Money Laundering

An estimated $500 billion to $1 trillion is laundered annually, about 2-5% of global GDP.

Naturally, one primary reason for KYB verification is to prevent financial fraud and money laundering. Financial institutions can identify and mitigate risks associated with fraudulent activities by verifying the legitimacy of businesses and their stakeholders. This is particularly crucial in a globalised economy where cross-border transactions are common and the potential for illicit activities is high.

Enhancing Trust and Transparency

KYB verification enhances trust and transparency in the business ecosystem. When businesses undergo thorough verification, it reassures customers, partners, and regulators of their credibility and integrity. This trust is essential for fostering long-term business relationships and ensuring the smooth functioning of financial markets.

Compliance with Regulatory Requirements

Compliance with regulatory requirements is another critical aspect of KYB verification. Failure to adhere to KYB regulations can result in severe penalties and reputational damage for businesses. By implementing robust KYB processes, companies can ensure compliance with national and international laws, avoid legal complications, and enhance their reputation.

Facilitating Access to Financial Services

For many small and medium-sized enterprises (SMEs) in India, access to financial services is often hindered by the need for proper verification. KYB verification helps bridge this gap by providing a transparent and standardised process for assessing the legitimacy of businesses. This, in turn, facilitates more accessible access to banking, credit, and other financial services, enabling SMEs to grow and contribute to the economy.

Factors to consider before implementing an effective KYB

Implementing Know Your Business (KYB) verification in India requires careful consideration of several factors to ensure compliance, efficiency, and effectiveness. Here are the key aspects to consider:

1. Regulatory Compliance

- Understand Local Regulations: Familiarize yourself with Indian regulations such as the Prevention of Money Laundering Act (PMLA) and guidelines from regulatory bodies like the Reserve Bank of India (RBI).

- Adherence to Global Standards: Ensure your KYB processes align with international standards to facilitate cross-border transactions and partnerships.

2. Technological Infrastructure

- Data Integration: Implement robust data integration systems to seamlessly connect with government databases, financial institutions, and other reliable data sources.

- Automation and AI: Leverage AI and machine learning to automate KYB processes, enhancing efficiency and reducing manual errors.

3. Data Security and Privacy

- Secure Data Handling: Ensure all business and customer data is handled securely, with strong encryption and secure data storage practices.

- Compliance with Data Privacy Laws: Adhere to data privacy regulations such as the Personal Data Protection Bill in India.

4. Comprehensive Risk Assessment

- Risk Profiling: Develop comprehensive risk profiling mechanisms to evaluate businesses’ legitimacy and risk levels based on their industry, geographical location, and transaction history.

- Continuous Monitoring: Implement continuous monitoring to detect and respond to any suspicious activities or changes in business behaviour.

5. User Experience

- Ease of Use: Design your KYB processes to be user-friendly to minimise friction for legitimate businesses during the verification process.

- Support and Training: Provide adequate support and training for businesses to understand and comply with KYB requirements.

6. Scalability

- Scalable Solutions: Ensure that your KYB systems are scalable to handle increasing volumes of verifications as your business grows.

- Future-Proofing: Stay updated with technological advancements and regulatory changes to continuously improve and adapt your KYB processes.

7. Vendor and Partner Selection

- Reliable Partners: Choose reliable technology vendors and data providers with a proven track record in KYB verification.

- Third-Party Integrations: Ensure smooth integration with third-party services, such as credit bureaus and legal databases, that can enhance your KYB processes.

8. Cost Efficiency

- Cost-Benefit Analysis: Conduct a thorough cost-benefit analysis to ensure that implementing KYB processes is cost-effective and provides a good return on investment.

9. Legal and Contractual Considerations

- Clear Policies: Establish policies and contracts regarding data usage, sharing, and retention to ensure compliance and protect business interests.

- Liability and Accountability: To mitigate risks, define liability and accountability for any breaches or failures in the KYB process.

How Decentro Ensures Automated KYB Checks

The process involves three steps.

- Onboarding the client with their name and registration number.

- Customising the KYB process by adding automation features. For example, creating a custom rule that automatically orders credit bureau reports via Bytes and collects shareholder data.

- Conducting an automated AML check for the company and its beneficiaries.

By following these steps, companies efficiently fulfil their KYB compliance requirements and review the results of the AML checks more easily to ensure a risk-free partnership.

Businesses can integrate with Decentro to verify their customers’ ID numbers or extract information from a public KYC ID. The major benefit of this offering is that customers do not have to upload or share document images, yet the business can seamlessly onboard customers with no hassle.

Supported Documents

Our Document Verification API supports a good number of widely used documents like PAN, RC, GSTIN, CIN, etc. Below is the list of all documents that can verified using Decentro’s Document Verification API:

| Supported Documents | Description |

| PAN | A 10-character alphanumeric PAN number |

| GSTIN | A 15-character GSTIN number |

| CIN | Corporate Identification Number provided by MCA |

| DIN | Director Identification Number (DIN) |

| Udyam | Another unique registration number for Micro, Small, and Medium Enterprises (MSMEs) is provided by the Indian Ministry of MSMEs |

| Udyog Aadhaar | 12-digit unique identification number provided by the Indian Ministry of MSMEs |

| FLLPIN | Foreign Limited Liability Partnership Identification Number issued to any foreign organisation incorporated as an LLP in India |

| LLPIN | Limited Liability Partnership Identification number issued to any organization incorporated an LLP in India |

| FCRN | 6-character Foreign Company Registration Number |

| FSSAI | The registration number provided by the Food Safety and Standards Authority of India |

To address these concerns, we offer a solution that allows companies to obtain all necessary data simply by providing the company name and registration number. That means businesses can check other companies without the hassle and, more importantly, anonymously.

Wish to integrate this verification suite for your business?

Future Trends in KYB Verification

As digital transformation continues to advance, the future of KYB lies in further integrating cutting-edge technologies. Innovations such as biometric verification, advanced data analytics, and real-time global compliance updates will further enhance the capabilities of Digital KYB solutions. We also have the following levers playing a crucial role in the evolution of this suite further,

Artificial Intelligence and Machine Learning

The future of KYB verification lies in integrating artificial intelligence (AI) and machine learning (ML) technologies. These technologies can potentially analyse vast amounts of data quickly and accurately, identifying patterns and anomalies that may indicate fraudulent activities. AI and ML can enhance the efficiency and accuracy of KYB processes, reducing the reliance on manual intervention and minimising errors.

Blockchain Technology

Blockchain technology is poised to revolutionise KYB verification by providing a secure and immutable ledger of business transactions and credentials. By leveraging blockchain, businesses can ensure their verification data is tamper-proof and easily accessible to authorised parties. This transparency can significantly reduce the risk of fraud and enhance the trustworthiness of the verification process.

Biometric Verification

Biometric verification, which has already made significant inroads with Aadhaar, is expected to play a more prominent role in KYB processes. Biometric identifiers such as fingerprints, facial recognition, and iris scans can provide an additional layer of security and accuracy in verifying the identities of business stakeholders. This technology can help prevent identity fraud and ensure that only legitimate individuals are associated with a business.

Real-Time Verification and Continuous Monitoring

The future of KYB verification will likely involve real-time verification and continuous monitoring of businesses. Instead of periodic checks, financial institutions will be able to monitor business activities and update verification statuses continuously in real-time. This approach can help detect and respond to suspicious activities promptly, ensuring ongoing compliance and security.

Enhanced Collaboration and Data Sharing

Enhanced collaboration and data sharing between financial institutions, regulatory bodies, and verification service providers will be crucial for the future of KYB verification. By creating a unified and interoperable data-sharing framework, stakeholders can access comprehensive and up-to-date information about businesses. This collaborative approach can streamline verification processes and improve overall efficiency.

As we look to the future, it is these innovations that promise to make KYB processes more efficient, accurate, and secure, further strengthening the trust and integrity of the Indian financial services landscape.

As a business looking for an effective KYB stack, remember to take the time to thoroughly research and evaluate potential KYB solutions, considering factors such as compliance, data security, integration, scalability, pricing, customer support, user experience, automation, customizability, and industry-specific features. By doing so, you can ensure that you choose a reliable and effective KYB solution that will serve your business well in the long run.

If you are looking to implement an effective KYB solution for your use case, we will be happy to connect.