Case study on how Decentro’s DigiLocker and KYC APIs empowered OnMeta to scale its crypto platform while maintaining security, compliance, and faster user transactions.

How Decentro Drove a 15% Boost in Success Rates for OnMeta

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

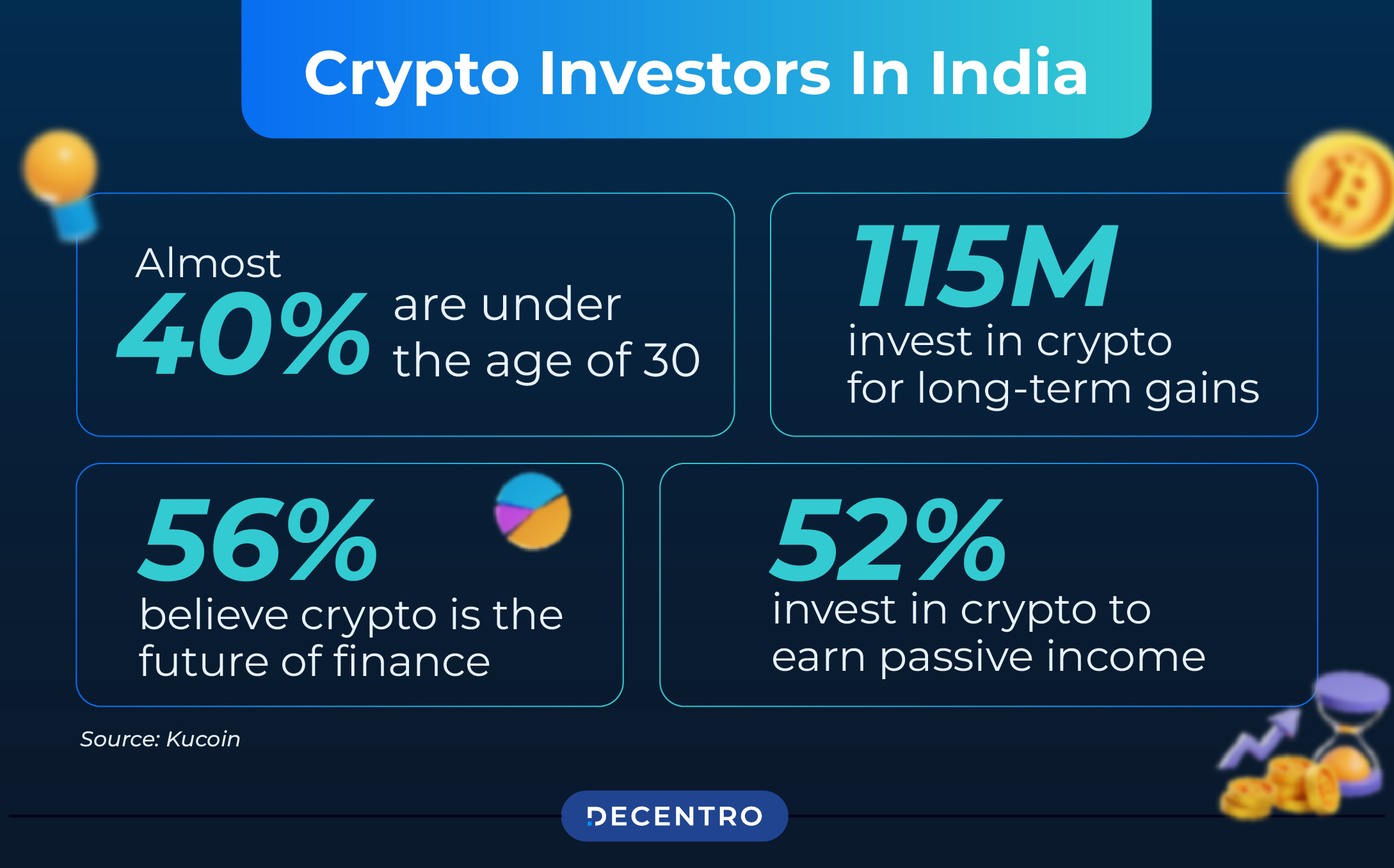

The global cryptocurrency market has witnessed unprecedented growth over the past decade. From being a niche concept to becoming a multi-trillion-dollar industry, cryptocurrencies are now integral to investing and decentralized finance (DeFi).

In India, the crypto market has gained significant traction despite regulatory uncertainties. With an estimated 115 million investors, the country is among the top crypto adopters globally. However, this growth comes with challenges, particularly in ensuring compliance with stringent KYC and AML norms while maintaining a seamless user experience.

In a landscape ridden with red tape, we have a player who has stayed compliant and pioneered the space with its offerings. OnMeta has enabled users to buy and transact seamlessly with cryptocurrencies and digital assets. By simplifying the process of acquiring crypto with regular fiat currency (like INR), OnMeta caters to users engaging in investing, or online transactions with digital assets.

So, let’s delve deeper into the case study and use case of OnMeta.

What is OnMeta?

OnMeta is a pioneering on/offramp service provider registered with the Financial Intelligence Unit (FIU) in India. It empowers users to buy and sell virtual digital assets using local payment methods like UPI and IMPS, ensuring secure and compliant transactions. OnMeta caters to a wide range of use cases, including investments, trading, NFTs, and more, making it a trusted partner for businesses and individuals navigating the digital asset ecosystem.

Challenges Faced by OnMeta

As an FIU-registered entity, OnMeta encountered several hurdles in maintaining compliance and delivering a seamless user experience:

- KYC Process:

Reliance on OCR for document collection led to issues like blurred or incomplete uploads, requiring manual verification and causing delays. - Compliance Complexity:

Meeting strict regulatory requirements such as DigiLocker-based Aadhaar collection and performing liveliness checks in a world of evolving threats like deepfakes posed significant challenges. - Diverse User Needs:

Supporting a broad clientele across technologies like web, React, and Flutter demanded a unified, simplified onboarding process that worked for all platforms.

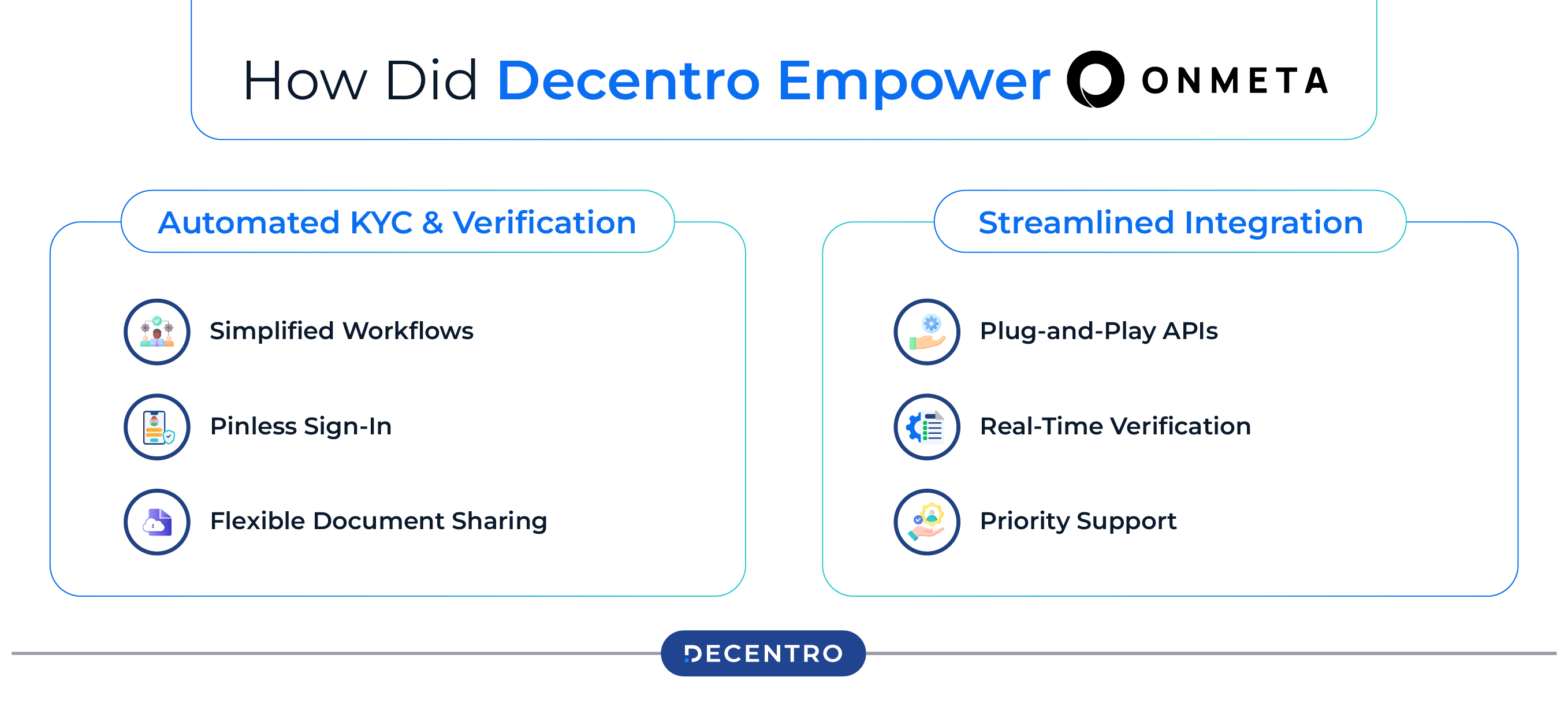

How Decentro Empowered OnMeta?

To overcome these challenges, OnMeta integrated Decentro’s KYC Verification APIs, automating workflows and easily ensuring regulatory compliance.

Automated KYC and Verification

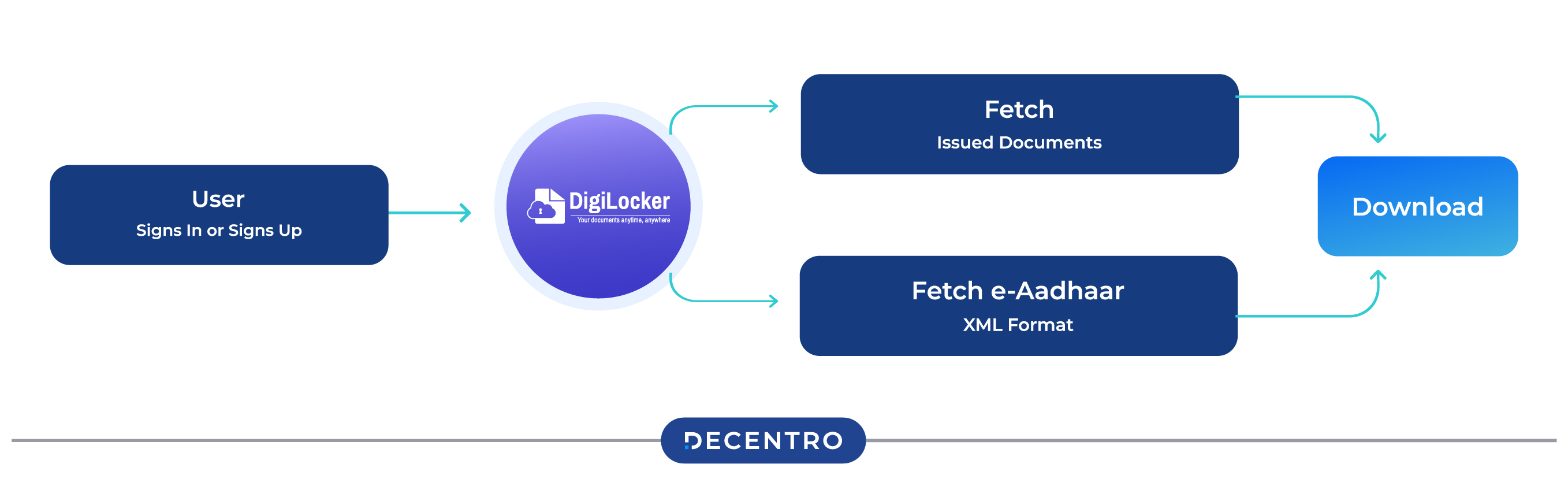

DigiLocker Integration: Enabled effortless document access with:

- Simplified Workflows: Optimized for seamless user journeys.

- Pinless Sign-In: Eliminated extra steps, enhancing user convenience.

- Flexible Document Sharing: Empowered users to share multiple IDs, ensuring compliance with FIU mandates.

Streamlined Integration

- Plug-and-Play APIs: Allowed quick and cost-effective integration.

- Real-Time Verification: Instant access to validated documents, reducing onboarding times.

- Priority Support: Dedicated assistance ensured smooth operations and issue resolution.

Results and Impact

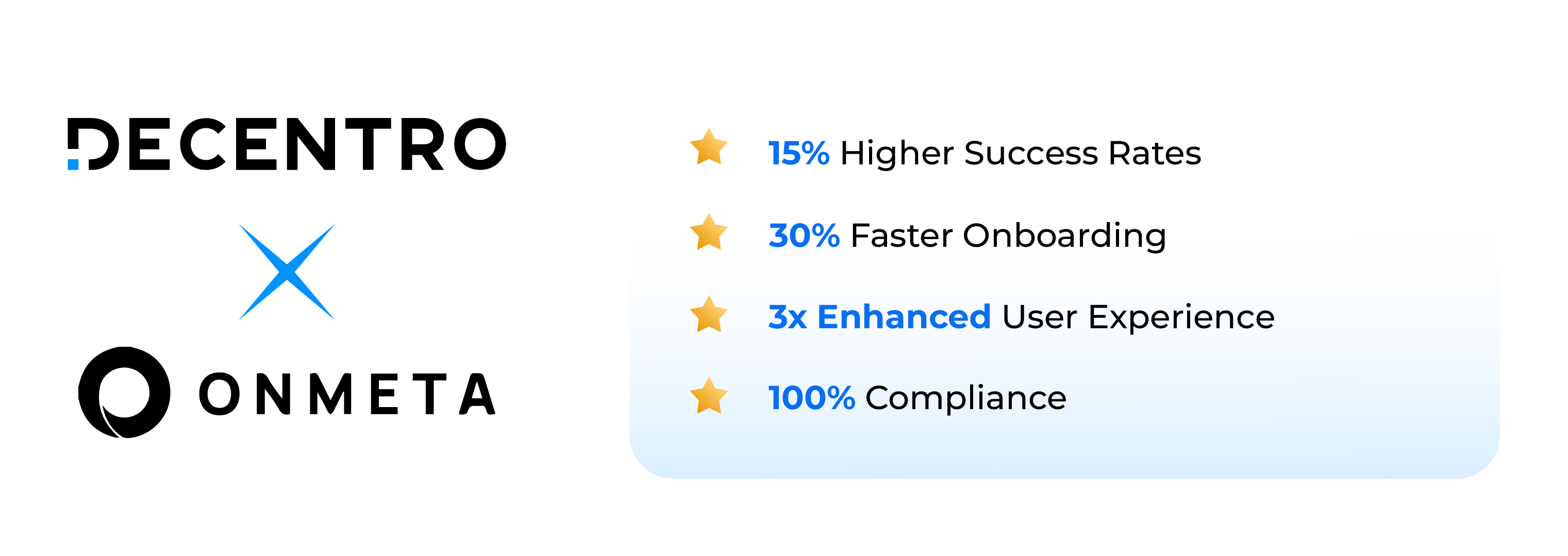

The implementation of Decentro’s solutions delivered measurable improvements to OnMeta’s operations. Here are the numbers to support the thesis

- 15% Higher Success Rates: Improved workflows enhanced user conversion.

- 30% Faster Onboarding: Automated processes reduced time spent on KYC.

- 3x Enhanced User Experience: Simplified and secure verification improved satisfaction.

- 100% Compliance: Full adherence to FIU regulations and national standards.

Speaking of the partnership, we have Nitin Gupta, shedding some light on the nature of this collaboration.

“At OnMeta, our mission is to make buying and selling virtual digital assets as smooth and secure as possible while staying fully compliant with FIU standards. Decentro’s DigiLocker APIs have been transformative in helping us automate and simplify user verification. The 10x faster integration timelines and support for all use cases have significantly enhanced our onboarding process. With streamlined workflows and improved conversion rates, we’ve created a more intuitive experience for users, increasing retention and satisfaction. We’re excited to continue this journey with Decentro to set new benchmarks in the industry.”

Nitin Gupta, Head of Product, Onmeta

Conclusion

By leveraging Decentro’s KYC and verification solutions, OnMeta transformed its onboarding process to meet regulatory requirements, enhance user trust, and deliver a much superior customer experience. The partnership highlights how Decentro’s cutting-edge technology empowers fintech platforms to navigate the regulatory landscape with ease and scale rapidly.

Our aim to empower fintech players has found fruition through such partners. Not just OnMeta but Decentro has enabled major companies—notably SalarySe, Dhan, MoneyTap (Freo), and others—to facilitate a better user transaction experience with sharper admin tracking and better compliance.

With over 800+ Identity validations, and 500+ OCR and extractions happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Ready to Streamline Your Onboarding?

If your organisation wants to overcome KYC and compliance challenges while enhancing operational efficiency, Decentro’s API solutions can help you achieve your goals.