An in-depth look at how Decentro is helping SalarySe onboard and verify their users faster. Learn more about SalarySe and how they are enabling Salaried Employees with their Credit-on-UPI Platform.

How Decentro Is Helping SalarySe Empower 100M+ Salaried Individuals

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

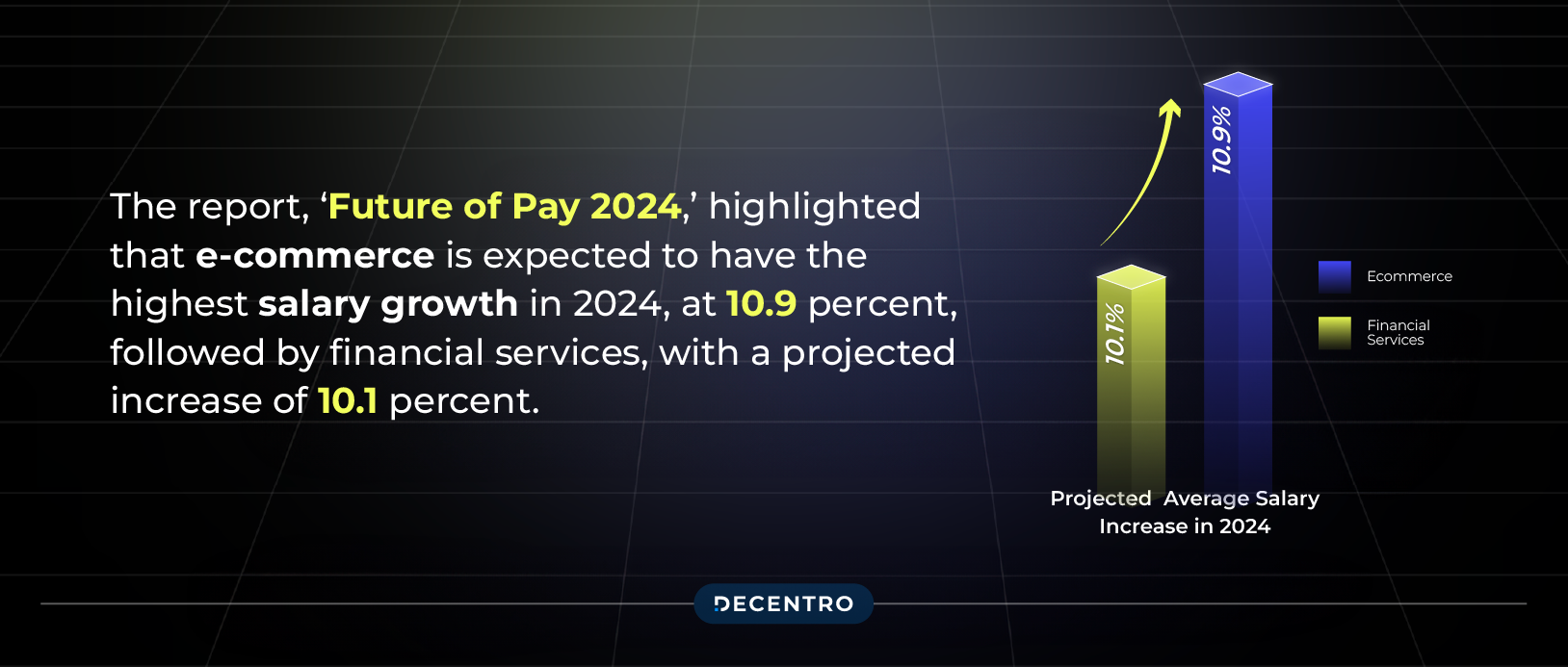

A recent report by EY has said that India Inc. may offer an average salary hike of 9.6 percent in 2024, just as in 2023. The report, ‘Future of Pay 2024,’ highlighted that e-commerce is expected to have the highest salary growth in 2024, at 10.9 percent, followed by financial services, with a projected increase of 10.1 percent.

While these numbers paint a very promising picture for the country this fiscal year, there is a side to this story that is often shrouded.

While the salary bracket has witnessed an uptick, a concerning trend has emerged recently.

An Ernst & Young (EY) study shows that 81% of Indian employees have faced a financial shortfall between pay cycles. With limited access to credit options and poor financial education, several tend to opt for high-interest loans without understanding the impact they could have. This often leads to a vicious cycle, causing massive financial stress.

India’s salaried demography suffers from this economy’s affordability, and our customer, SalarySe, is looking to fill this gap with their solution.

What is SalarySe?

SalarySe is a salary-powered fintech platform that redefines the landscape of financial services in India for the 10 Crore salaried individuals earning $300bn+ per year. It focuses on lower—to middle-class salaried employees, who constitute ~60% of the salaried income pool in India.

SalarySe provides revolving credit on UPI by integrating it with companies’ payroll systems. It also uses a lien on salary for repayments to reduce credit risk. In the process, they innovatively leverage technology to solve the core problem of high collection & credit costs for banks.

“The idea is to create a financial wellness platform for employees to access credit, invest and manage their wealth,” says Piyush Bagaria, cofounder of SalarySe.

How does SalarySe work?

SalarySe leverages UPI technology to provide financial wellness solutions, including credit, savings, financial literacy, etc., to salaried employees. Credit and investment products are offered to SalarySe’s customers by their banking partners using the SalarySe infrastructure.

SalarySe’s proprietary business model provides multiple benefits to employees, such as instant credit access on UPI, higher approved credit limits, credit at cheaper rates, and to employers, such as unblocking their working capital, reducing attrition and manpower costs, automating reimbursements, etc.

How does SalarySe leverage Decentro’s technology stack?

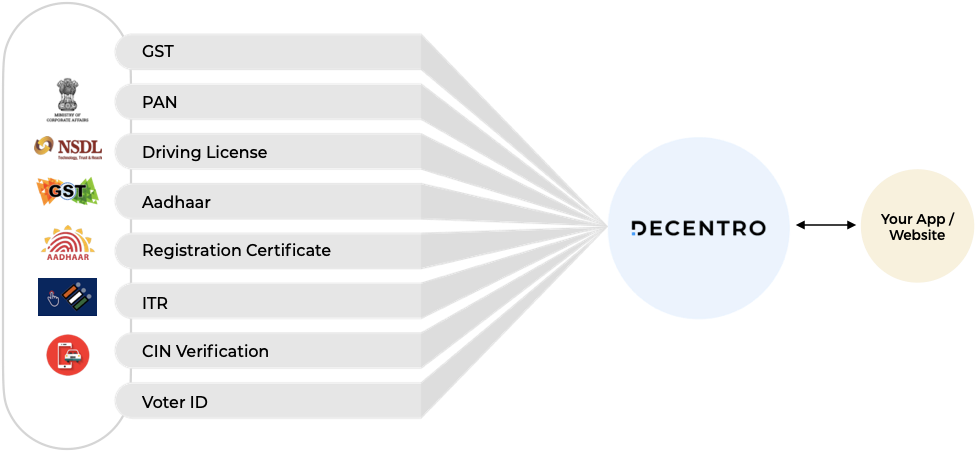

The wealth management business can be challenging due to high-volume disbursals, collections, and the need for credit assessment methods. At this disruptive stage of SalarySe, to connect with various financial institutions such as CERSAI, NSDL, UIDAI, and more, the company was looking for a partner who could absorb the complexity of these integrations and offer a simple API with faster response times.

This is where Decentro could stand out and differentiate itself from other players. Decentro’s KYC module helps to collect and validate multiple IDs from the database of various governmental authorities:

- PAN cards

- Aadhaar

- Voter IDs

- Driving License

- Vehicle Registration

- CKYC

- DigiLocker

Decentro also empowered SalarySe’s verification journey with Match Engine. This KYC Name Matching solution ensures not only accurate matching but also a comprehensive understanding and handling of Indian honorifics and a plethora of salutations.

What are the key areas where Decentro comes in and empowers SalarySe?

Decentro stepped in with its KYC and banking stacks to empower SalarySe:

- ID collection

- User Verification

This has allowed the organisation to collect information seamlessly from the user. Triangulating the collected data points and validating information allows SalarySE to determine the individual’s creditworthiness and chart the financial wellness plan.

Outcomes

Decentro’s robust APIs have allowed SalarySe to drive fantastic results.

- 93% of customers experience a successful single-click journey.

- Zero instances of KYC fraud.

- 10X faster integration timelines.

- Availed Decentro’s multi-channel customer support for any queries or resolution

Let us also consider what Saumeet Nanda, Founder of SalarySe, thinks about this association between two inclusivity-led organisations.

“As the founder of a financial wellness company, our journey is guided by a commitment to security, trust, and empowerment. With Decentro’s KYC APIs fueling our verification process, we’re not just verifying identities but building bridges to financial freedom; one verified user at a time”.

Saumeet Nanda, Founder of SalarySe

Conclusion

Decentro’s KYC and Banking infrastructure can help companies create seamless flows across industries. With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey. We have also written a comprehensive guide on the Types of KYC and their use cases to help you understand their fitment in your use cases.

From collecting and validating users’ IDs (individuals and companies) to verifying identities through face match and liveliness check and accessing databases like CKYC and DigiLocker, our compliant and comprehensive product suite has solved pertinent use cases for customers across industries.

Not just SalarySe but Decentro has enabled many other major companies—notably MoneyTap, CashE, and others—to facilitate better verification and validation with the promise of consistency and accuracy.

Do you have a platform requiring verification of customers or businesses you want to make live?