What are split payments? How does it work? How’s it a game-changer for businesses across industries?

Enabling Split Payments & Commission Settlements For Businesses

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

A thriving online marketplace. A buzzing retail chain. Or an SME SaaS platform. As a business owner, you must deal with countless customers, partners, vendors, or merchants day in and day out. Umpteen conditions, varied invoicing, money flow reconciliation… the list of things to take care of hardly seems to cease.

The Challenge of Cash Flow Management

To make matters worse, these factors soon pose major challenges to business owners. Did you know?

80% of businesses that handle cash flow every month survive; the 36% who manage it yearly in comparison.

Can split payments be the answer to a lot of these questions? Let’s find out!

What are Split Payments?

Do you remember the nightmare of splitting a simple food or travel bill while on a friends-night-out? Especially before the advent of UPI payments?

Now, imagine a business encountering similar but more severe hassles while engaging with multiple vendors, sellers, or merchants!

Split payments refer to the process of having multiple payment destinations for a single collection inflow. The money for these destinations (end party/seller/vendor) is collated & reconciled before settlements by the business.

With split payments, your business can:

- Automate your daily operations,

- Provide real-time payment visibility to all your stakeholders,

- Prevent settlement delays for your merchants, partners, or vendors,

- Manage commission settlements easily,

- Reroute & manage money flow 10X more efficiently.

How Does Split Payment Work?

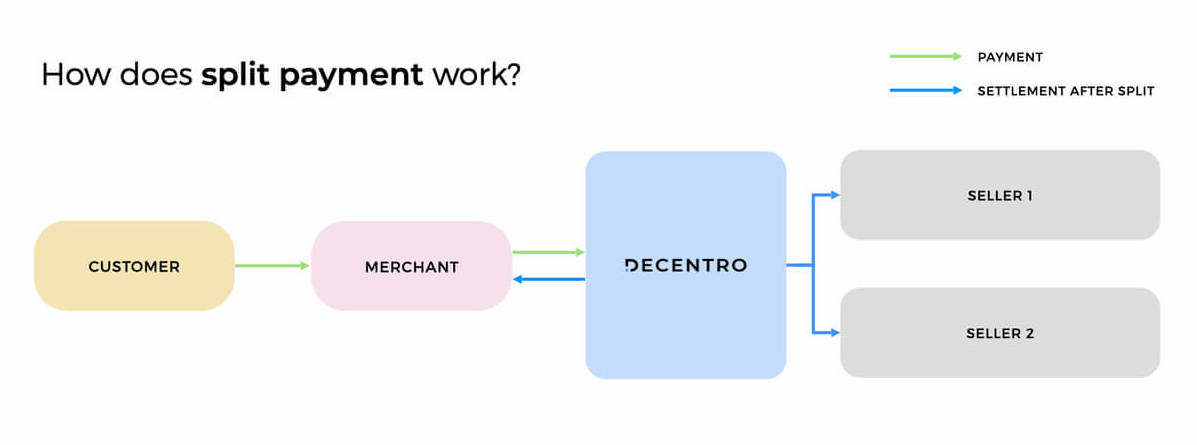

Your business may offer customers cash, card, or online transfer payment options. With split payments, you enable customers to choose their method and payment method. All while working like clockwork on the back end.

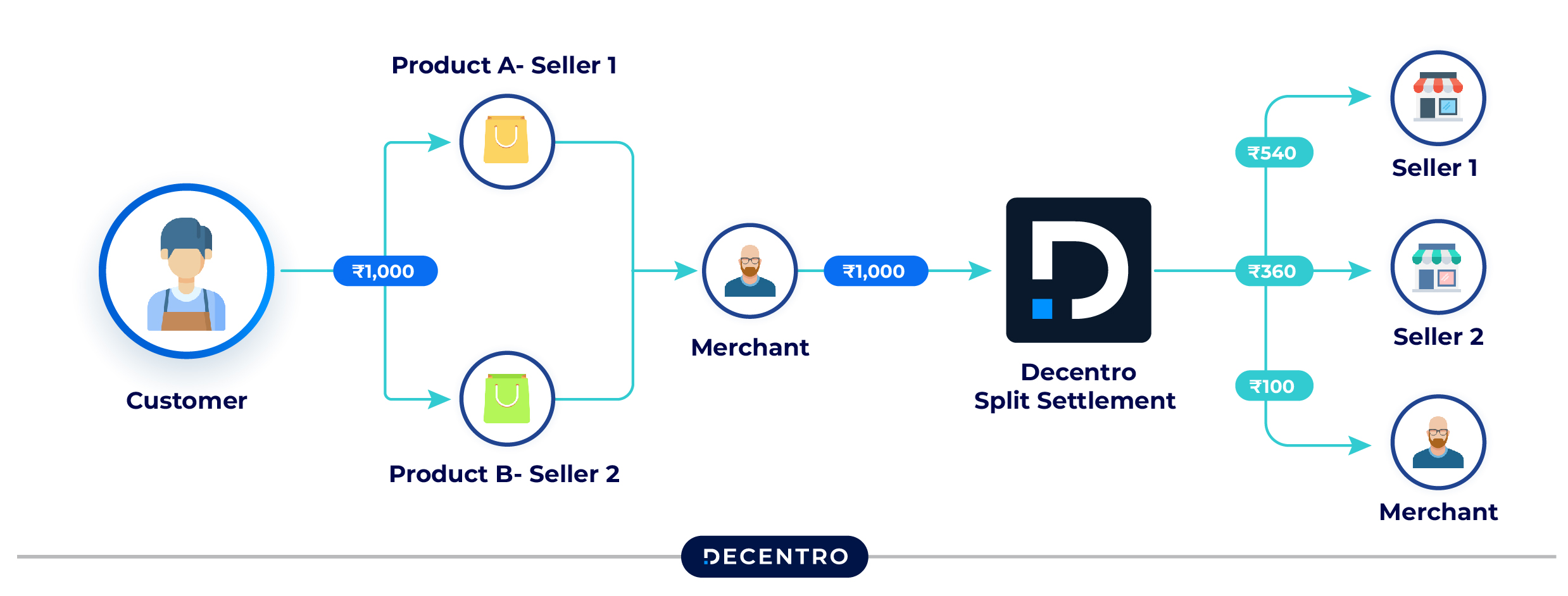

In the simplest form, here’s how split payments work. Let’s take the example of marketplace business.

- A customer places orders from multiple sellers on the marketplace.

- While the user pays the entire amount via a single transaction, for convenience, the marketplace uses the split payments feature to settle the funds to the different sellers, who then process the order and dispatch it.

- If a commission is signed between the marketplace owner and the sellers, it can be handled during fund settlements.

- A robust platform like Decentro can track these transactions and reconcile them, saving time, effort, and capital.

Where Can You Use Split Payments?

Split payments aren’t just a feature; they’re necessary for modern businesses. Let’s look at some broader businesses & horizontals where this is quite the godsend to managing cash flow and settlements.

Online Marketplaces

A marketplace is a hub where multiple sellers come together to interact with and sell to customers. It is one of the core businesses that benefit from split payments.

Example: Amazon or Flipkart facilitating multiple sellers to connect with customers.

Aggregator Platforms

Aggregator platforms benefit from easy payment settlements to merchants, transferring funds from users to service providers.

Example: Cab sharing platforms like Ola routing payments from multiple users to a driver.

Multi-Branch Retail Outlets

Managing money flow across multiple branches becomes seamless. Split payments track each order from a branch and simplify bookkeeping.

Example: Domino’s Pizza outlets.

E-learning Platforms

Easier payment transfers from students to tutors for specific courses.

Example: Unacademy or Coursera offering diverse courses.

Gig Platforms

Example: Platforms like Workflexi connecting freelancers with companies who are looking for short-term projects.

Why Split Payments Matter

Managing payments manually consumes time and introduces errors and delays, affecting business efficiency and partner trust. Split payments solve this by automating the allocation of funds from a single transaction to multiple stakeholders.

Introducing Settlr: Decentro’s Split Payment Solution

Handling payments for multiple vendors, partners, or accounts can be complex. Enter Settlr, a solution designed to automate split settlements seamlessly for your business. With Settlr, you can simplify payment flows, enhance transparency, and reduce operational hassles.s. Here’s why businesses trust Settlr:

- $5BN+ processed annually

- 900,000+ API hits daily

- 8,000+ transactions per hour

- 99.99% uptime

- Trusted by 1,200+ businesses globally

Key Benefits

- Faster Refunds: Streamline refund allocation.

- Finance Efficiency: Eliminate manual month-end closures.

- Automated Reconciliation: Real-time tracking of transactions.

- Real-Time Transfers: Distribute funds instantly.

- Enhanced Transparency: Detailed settlement insights.

- Comprehensive Reporting: Centralized transaction data.

How Can Decentro Empower Your Business?

During our chats with many customers, it became abundantly clear that they struggled with payments irrespective of the business size. While our Payments APIs helped with instant money transfers and settlements, split payments and commission settlements were features that we knew would empower hundreds of businesses to avoid cash flow problems.

Decentro’s banking API platform simplifies the entire flow of split payments in three key ways:

- Tech Decentro’s battle-tested APIs process millions of API hits per month with >99.9% uptime and 30% faster response times than industry standards.

- Business Our multi-bank architecture switches seamlessly during downtime or volume spikes, ensuring uninterrupted operations.

- Legal We route all transactions via nodal and escrow accounts, ensuring compliance and eliminating legal headaches.

What’s more?

10X Faster Go-live Timelines & >90% Reduced Expenses

Target faster go-to-market timelines with your payments. While a typical financial integration may take months together and burn a lot of capital, we help you reach there way faster, within weeks to be precise, and at 90% lesser overheads.

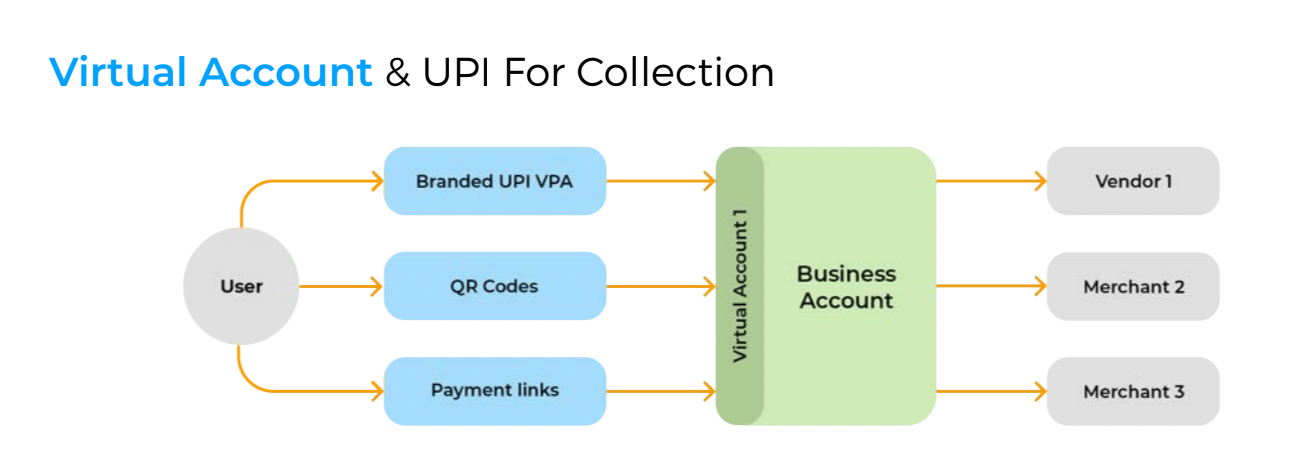

Automated, Real-time Reconciliation

The entire process becomes needlessly tiring if split payments don’t come with automated reconciliation. We help you track the source of all transactions, even failed ones, via virtual accounts. The reconciliation is done in real-time, fully automated! Did we say you can remove the risky bank transfers via a file completely out of the equation and ensure security at all levels as well?

Ready to Simplify Your Cash Flows?

Split payments aren’t just a feature—they’re a game-changer. Whether you’re a marketplace, aggregator, or platform, Settlr can streamline your operations and fuel your growth. Businesses like SalarySe, Dhan, Muthoot Finance, and MakeMyTrip already leverage Decentro’s solutions to simplify cash flows and elevate customer experiences.

Let’s Make Smarter Split Settlements

Frequently Asked Questions

Settlr is Decentro’s split payment gateway that automates fund distribution to vendors, partners, and accounts.

It’s the allocation of funds from a single transaction to multiple parties based on predefined rules.

Yes, Settlr supports custom schedules for vendors or partners.

Vendor onboarding is instant and hassle-free.

Absolutely! A centralized dashboard offers live transaction and settlement tracking.