Could conversational & contextual banking be the next disruptive thing in fintech? Let’s find out!

Taking The Next Step Towards Contextual & Conversational Banking

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

One-to-one messaging service. Simple Login with your phone number. Feature to share photos. Ability to share Location with loved ones. Voice messages, group chats, video-calling, and finally, payments!

We all know what I’m referring to here. Not a single day goes by where we don’t say, “Let me WhatsApp it to you, right away!”

India has more WhatsApp users than any other country, with 390.1 million monthly active users!

eMarketer

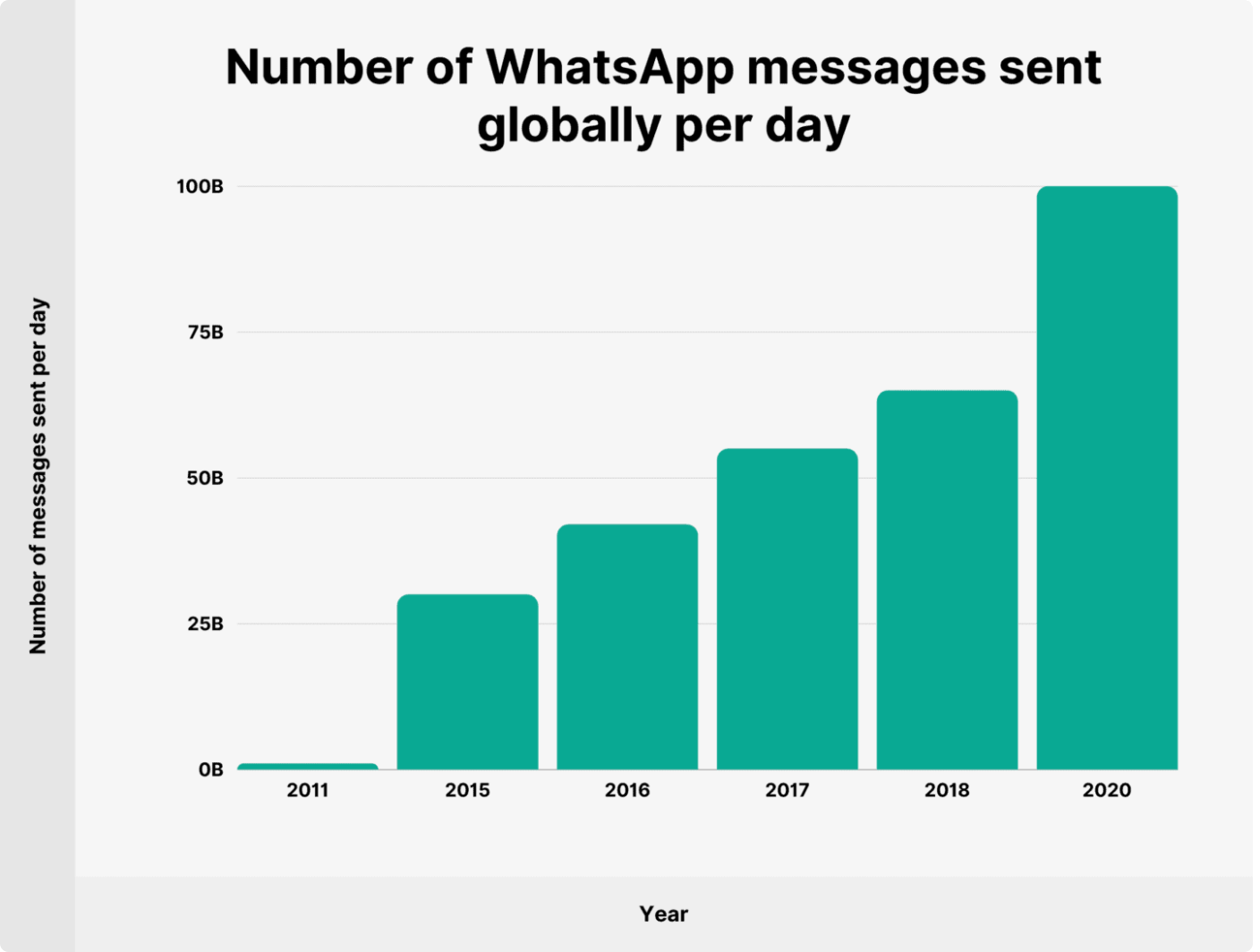

Not just that, the instant-messaging dragon enables more than 100 billion messages to be sent on the platform daily back in 2020!

Wondering how WhatsApp and banking are connected? In a few scrolls, let’s see how your business can meet your customers at the convenience-vantage-point with conversational banking.

Joining Hands with Gupshup

With a lot of happiness, we’re announcing our partnership & integration with Gupshup to empower businesses with conversational banking.

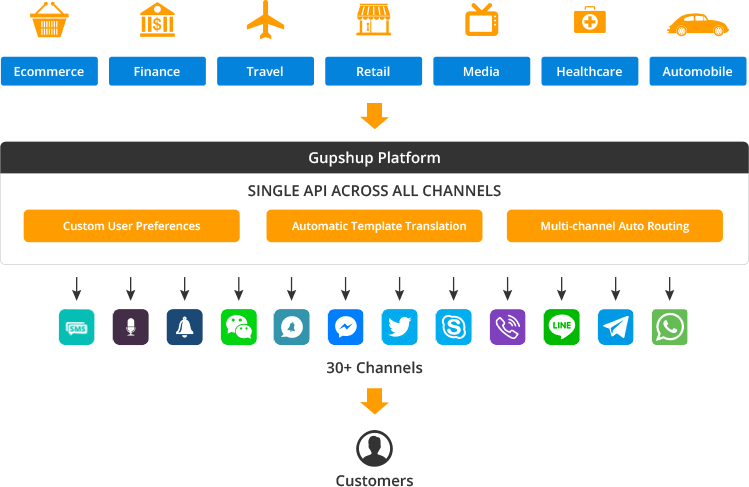

Gupshup is a conversational messaging platform that powers businesses to engage with their customers over 30+ channels, all using a single API endpoint.

This Silicon Valley-based Unicorn currently serves over 39,200 brands, processes more than 6 billion messages in a month, and steadily grows after processing 300 billion messages. With Gupshup, your business can automate customer interactions using bots or conversational messaging over different channels.

On the partnership announcement, Rohit Taneja, our Founder & CEO, said,

“In a digital-first and hyper-connected world, customers expect a seamless and native experience for every interaction. Chat-based interfaces like WhatsApp & Telegram are becoming deeply embedded into our daily lives with every passing day and it is highly powerful to be able to create a future where your financial activity might be serviced fully over a chat. We’re super excited to join hands with Gupshup, one of the leaders and pioneers in this space, in our ambitious journey to offer fintechs and legacy institutions the power to build engaging consumer experiences via conversational banking.”

Rohit Taneja, Founder & CEO, Decentro

Conversational Banking Via Instant Messaging Platforms

While banking and financial services have evolved over the years, these are yet to reach the zenith of a delightful customer experience.

Even with the meteoric rise in users, 200+ million, to speak, the financial market is vastly untapped; we’re yet to cut through all the noise and reach out to customers in a beeline. In other words, banks and legacy institutions are yet to set foot and operate where customers are.

With our partners, we aspire to bridge this gap.

Gupshup-Decentro integration enables large & small NBFCs, banks, fintechs, and businesses to provide banking & lending-related services to their customers with utmost convenience. Now, customers can avail loans, complete their KYC verification process, make payments instantly, all with just a tap and via their favorite communication channel.

What does this mean? Embedding banking & financial services seamlessly into their everyday lives.

Businesses can now tap into the ever-growing & popular WhatsApp & other Chat-based platforms to support, engage with, and serve their customers. The entire process happens in real-time and comes with fine automation capabilities to run like a well-oiled machine.

What we’re whipping up here is a fine blend of financial services APIs and conversational messaging APIs to create a conversational banking cocktail; a robust financial back-end powered by a conversational, engaging front-end.

Furthermore, fintech companies & neobanks, or any other financial institution would no longer require investing time or capital in building their custom apps to cater to customers.

Different Conversational Banking Models You Can Build

Let’s talk about some banking workflows businesses can create within WhatsApp, using Gupshup & Decentro.

Verify & Onboard Users Via KYC

Running background checks on users and verifying their identities before onboarding is crucial for any business, especially in the financial space. With Gupshup-Decentro integration, businesses can perform KYC or Know Your Customer checks and verification on users via WhatsApp.

Decentro’s KYC APIs run checks in the backend, bringing the relevant data required by businesses to peruse and make a judgment call. Furthermore, in the case of onboarding businesses, PAN & GSTIN verification can also be carried out.

A single API endpoint for multiple documents makes it easy for businesses and even easier for customers to complete the verification process—all in real-time and fully automated.

Facilitate Instant & One-Click Payments

Accept payments from customers securely and within a couple of clicks. The process is simple-

- Your customers can enter the amount they prefer

- Decentro’s Payments APIs check if the amount is valid

- Payment links are processed and sent to the user as a chat

- Transaction is securely & successfully completed

Initiate Seamless Payment Collections

Further, you can also set up Collections workflows to collect a pre-fixed amount from customers. Once the customer chooses to pay, the payment link is shared, followed by a secure checkout.

Simplify & Streamline Lending

If you are a fintech lender or a P2P lending platform, how about a process that helps you instantly evaluate the loan eligibility before disbursals? And, facilitate the same for your customers without making them undergo lengthy processes & verifications?

With this conversational banking lending workflow, we help you check the creditworthiness of each user, collect consent from them to fetch CKYC data, and instantly convey loan eligibility.

Conversational Banking: Some Pertinent Use-cases

We’ve seen the different conversational banking models your business can build with Decentro’s banking APIs on any chat-based application. Now, let’s take a look at some, not all, of the use-cases where this can do wonders!

Online Commerce Platforms: For Buyers as well as Sellers

An e-commerce platform owner can empower buyers and sellers with conversational banking. From enabling you to collect seamless UPI payments, a fully chat-based onboarding, to even helping your customers check their payment history, WhatsApp banking makes life easy for the buyers as well as the sellers.

Gig Platform Owners

One of the booming industries currently, along with neobanking, would be the Gig Economy. (Isn’t the rise in the number of gig economy platforms the proof for the same?)

With conversational banking via Gupshup & Decentro, gig platforms can KYC-verify & onboard both gig hirers and workers seamlessly over WhatsApp.

In addition, you can also facilitate real-time and instant payments via hirers and channel them to gig employees & freelancers on the platform.

Fintech Lenders & NBFCs

As we’d mentioned before, conversational banking can help fintech lenders and Non-Banking Financial Companies check a user’s creditworthiness before dispersing loans. With Decentro’s Credit Score Check APIs, you get a user’s credit scores from leading bureaus such as Equifax (with more credit reporting agencies en route) for your perusal and further risk analysis.

The possibilities are endless! And, we’re excited for the road ahead. We’d love to extend our heartfelt gratitude to the entire Gupshup team and our advisor Pratekk Agarwaal for joining hands in the pursuit of making lives 10X easier for businesses as well as the consumers!

Got a thought to share? Or, have any questions for us? We’re a ping away at hello@decentro.tech. Let’s catch up and brainstorm ways to provide a smoother experience for your customers!

Until then,

Cheers!