How are Non-banking Financial Companies different from banks? What is an NBFC’s importance in Indian Fintech?

What is an NBFC (Non Banking Financial Company)?

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

December 2020.

Zomato announced offering loans to registered restaurant and delivery partners.

Thoughtful, isn’t it?

With this initiative, restaurant owners can easily avail credit and set their operational costs in order, in this current pandemic crisis.

But. How’s that a food delivery app can offer lending services to the gen population?

Zomato’s partnership with InCred has made this feat possible. InCred is a Non-Banking Financial Company in India, focussing on consumer loans, home loans, education loans, and SME Lending.

Hmm, non-banking financial company?

What is an Non-banking Financial Company?

NBFC or Non-Banking Financial Companies are financial institutions that offer some banking services such as loan & disbursals but do not possess a banking license. It must be registered under the Companies Act, 1956 and is primarily involved in the following:

- Loans & advances

- Acquisition of shares, bonds, stocks, debentures, or securities issued by the Govt, or local authority, or other similar marketable securities

- Leasing

- Hire-purchase

- Insurance business

- Chit business

Some examples of non-banking financial companies include insurance agencies, mortgage lenders, peer-to-peer payment lenders, money market funds, hedge funds, private equity funds, etc.

What are the Criteria to Become an NBFC?

Non-banking Financial Companies come under the regulation of RBI or Reserve Bank of India who has set clear guidelines on its functioning. RBI states that any company whose principal business is financial activity can be deemed a Non-Banking financial company.

When a company’s primary business is financial activity, then:

- Its financial assets comprises more than 50% of total assets

- Income from these assets contributes to more than 50% of the gross income/revenue

Once both these criteria are fulfilled, the RBI registers the company as a Non-Banking financial company. In addition, it cannot indulge in a principal business whose primary activity is:

- Agriculture

- Industrial

- Purchase or sale of goods excluding securities

- Construction, sale, or acquisition of immovable assets

What are the Guidelines to Follow?

In addition to the criteria above, here are some of the guidelines a non-banking financial company must meet.

- Must be a company that’s registered under Section 3 of the companies Act, 1956

- Must possess a net owned fund not less than ₹200 lakh.

- Any non-banking financial company has to perform core management tasks internally. Ergo, these institutions cannot outsource activities such as conducting internal audits, managing the investment portfolio, performing comprehensive KYC checks.

- The board of NBFCs must approve the code of conduct for agents who execute direct sales & recovery.

- The agents must engage in cordial interactions with customers and cannot resort to harassment or intimidation of any kind while collecting debts.

And, a few more.

Non-banking Financial Companies Vs. Bank

Although there are many overlapping areas between a non-banking financial company and traditional banks, the key differences distinguishing the two are.

| Factor | Non-banking Financial Companies | Traditional Bank |

| License | Operates without a banking license and offers some of the banking services to public | No bank can operate without getting a license from RBI |

| Registration | Companies Act, 1956 | Section 22 of the Banking Regulation Act, 1949 |

| Services | Cannot accept demand deposits or issue cheque drawn to itself | Collects deposits from the public and loans it, managing cash flow |

| Payment System | Not authorized to take part in the payment & settlement system | Banks, under the supervision of RBI, are authorized for enabling payments via NEFT, IMPS, UPI, etc. |

| Foreign Investment Allowance | Up to 100% | Up to 74% for private sector |

| Legal reserve Ratios | Not required | Up to 10% of the deposit base |

| Deposit insurance facility | Not available | Available |

What are the Types of Non-banking Financial Companies?

The categorization is based on various factors such as:

- Type of liabilities as accepting deposit & non-deposit.

- Type of activity they perform

- Size of non-deposit taking non-banking financial companies

In this regard, the different types of non-banking financial companies are:

- Asset Finance Company (AFC)

- Investment Company (IC)

- Loan Company (LC)

- Infrastructure Finance Company (IFC)

- Systemically Important Core Investment Company (CIC-ND-SI)

- Infrastructure Debt Fund

- Micro Finance Institution

- Mortgage Guarantee Companies (MGC)

- Non-Operative Financial Holding Company (NOFHC)

- Non-Banking Financial Company – Factors

Asset Finance Company (AFC)

An AFC is one whose principal business, i.e., more than 60% of assets, is financing physical assets involved in activities such as automobiles, material handling equipment, lathe machinery, generators, general-purpose industrial machines, etc.

Investment Company (IC)

An IC has principal business involving acquiring securities and managing, selling, and trading funds with the general public.

Loan Company (LC)

A Loan Company deals with providing loans or advances to the general public and derives its principal business from the same.

Infrastructure Finance Company (IFC)

An IFC has a minimum of 75% of its assets invested in infrastructure loans and owns at least ₹300 crores as Net Owned Funds or NOF. Also, it must possess a minimum credit rating of ‘A’ or the likes, and has a CRAR(Capital to Risk-Weighted Assets Ratio) of 15%.

Where do NBFCs Fit in the Indian Landscape?

Banks alone can’t cater to the growing needs of a large population, especially in India. This is where non-banking financial companies come as a helping hand to enhance financial inclusion and provide services to the country’s under-served population.

Some of the critical functions of Non-banking Financial Companies that bring a positive impact to Indian fintech includes:

Growth of MSMEs & SMBs

Help with the growth of Micro, Small Medium Enterprise. Very often, it’s not easy for banks to cross-check the credit history of these businesses, especially SMBs, and sanction them a loan. Non-banking Financial Companies could step in to provide credit, loans, and any support services to aid in the business growth.

Simplify & Decentralize Lending

Meet the rising needs of loans, credit, insurance, and more. Non-banking Financial Companies remove the middlemen from the picture and provide services directly to those in need.

Offer wealth management by managing portfolios via investing in stocks, shares, and securities.

Strengthen Various Economic Sectors

According to the Govt data, only 60% of farmers can access financial services to drive their occupation forward. Further, this number sinks to an abysmal 15% for small farmers.

With the entry of Agri-NBFCs, farmers can use their crop/produce as collateral to receive credit facility and against storage receipts of commodities. In contrast, they fare over traditional banks since the loan sanction is quick and has less hassle due to reduced paperwork.

Similarly, a significant contribution to the infrastructure sector helps nation-building by routing suitable funds to infrastructure projects via IDFs.

Digitized Financial Services

Digitization has enabled Non-banking Financial Companies to incorporate the latest fintech technology, such as open banking and API banking, into their offerings, making financial services easy to avail & enjoy.

For instance, lending has simplified with Peer-to-peer offerings and has brought money to those in need. Consequently, it has paved the way for penetrating financial inclusion better. Moreover, the involvement & guidance to companies & businesses when it comes to investments and mergers help to channelize cash flow & manage money movement effectively.

Which are Some of the Top NBFCs in India?

Are we limiting ourselves to just a section? Absolutely not! We’ve curated an entire listicle of the Top NBFCs in India for 2021, right for you. Not just that, we’ve added the upcoming players who are already changing the lending landscape in the country, be it customer-centered, business-centric, or P2P focussed.

How is Decentro Helping & Empowering NBFCs?

It makes us immensely happy to do our part to enable non-banking financial companies to perform more seamlessly and remove any retardants in the process. Thus, we’ve developed a host of products to cater to their diverse needs.

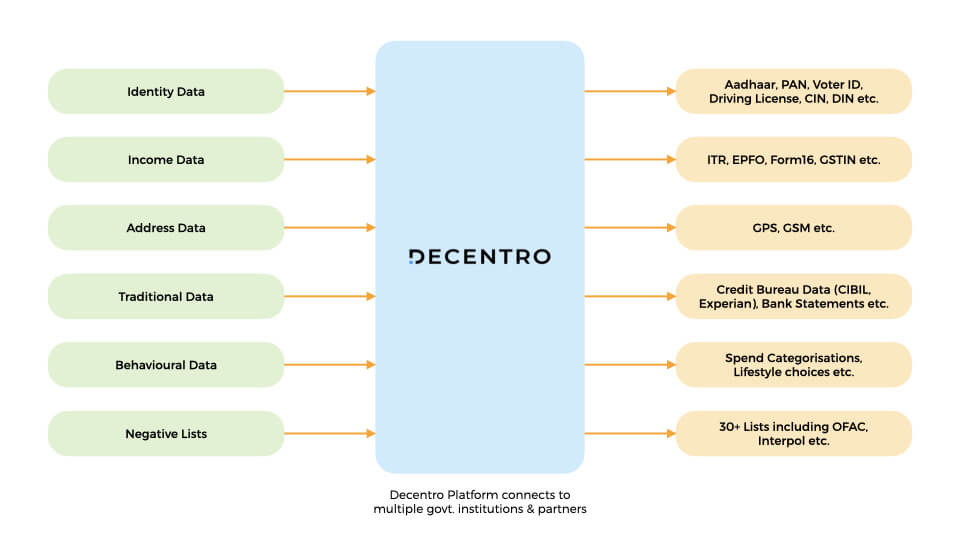

Authenticate & Onboard Customers Easily via KYC APIs

It’s up to financial institutions to ensure that entities engaging in financial services are not fraudulent or involved in money laundering or terrorist-related activities.

RBI has made KYC or know your customer mandatory to curb money laundering and terrorist financing. With Decentro’s KYC APIs, your NBFC can run comprehensive identity checks on customers before onboarding them. In just a matter of two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Be it identity checks via Aadhaar or PAN, income data checks via ITR or GSTIN, background checks via negative lists, or behavioral checks via lifestyle choices, know your transacting customers inside-out. Further, any NBFC or fintech lender can use CKYC to access creditworthiness before extending lending services.

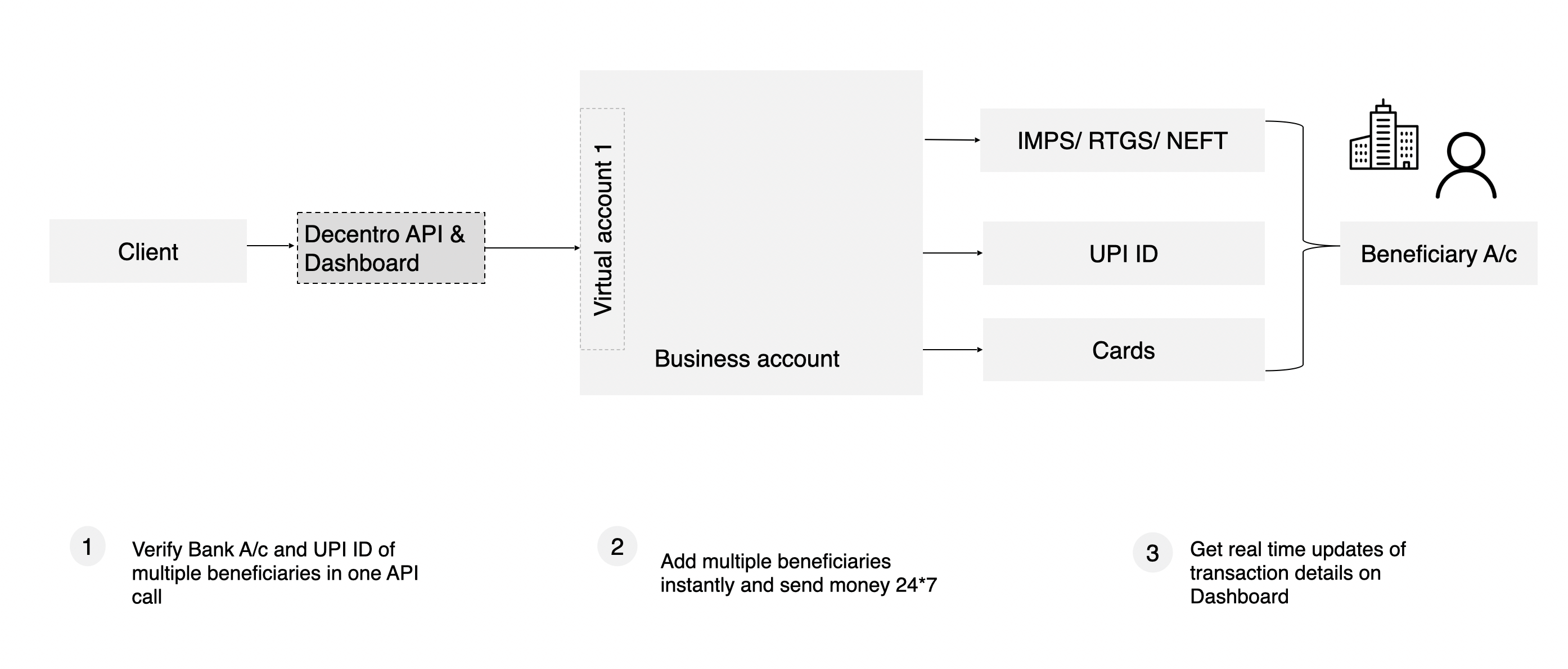

Streamline Disbursals & Automate Payouts

Set-up multiple virtual accounts on top of your business account to facilitate disbursements easily. Receive payments from your buyers and channel them to dedicated virtual accounts, making it easy to reconcile payments. Add beneficiaries to manage your payouts, without any cooling periods, after verifying their account details & UPI.

Furthermore, you can automate payouts using any method such as IMPS, RTGS, UPI, or cards. Track all the transaction details in real-time on your dashboard.

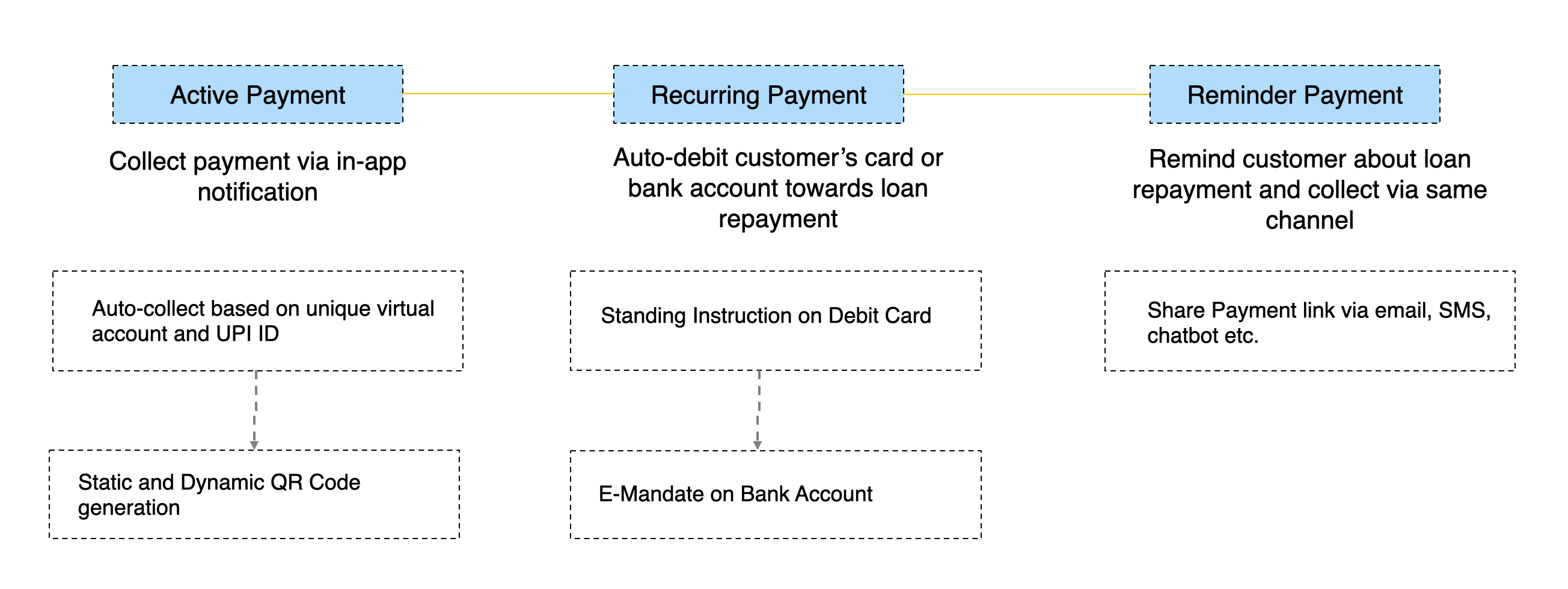

Make Payment Collections Instant

Collect payments automatically after setting up virtual accounts and UPI IDs. If not a UPI payment link, you can always opt for static or dynamic QR codes to collect payments from customers or partners.

Decentro’s APIs support multichannel payment options. Therefore, you can reach out to customers for payments via email, SMS, chatbots, social media, and the likes.

You can white-label the UPI ID as per your institution’s name and brand it.

Above all, it becomes all the more important to establish trust while transacting with customers, and that’s why we’ve set up the white-label feature for UPI.

Financial inclusion, especially for the underserved segment of society, is a path our country has already set on. We’d be delighted to do our bit to enable your business to serve customers better and make financial services more accessible.

If you have any interesting use cases that we can pick up, we’re just a chat or call away! Drop us a ‘Hey’ at hello@decentro.tech, and let’s catch up!

Cheers!

Comments are closed.