Dive into our guide to understand payment aggregators. Discover what they are, how they function, and why they’re essential for your business.

What is a Payment Aggregator? – A Comprehensive Guide

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

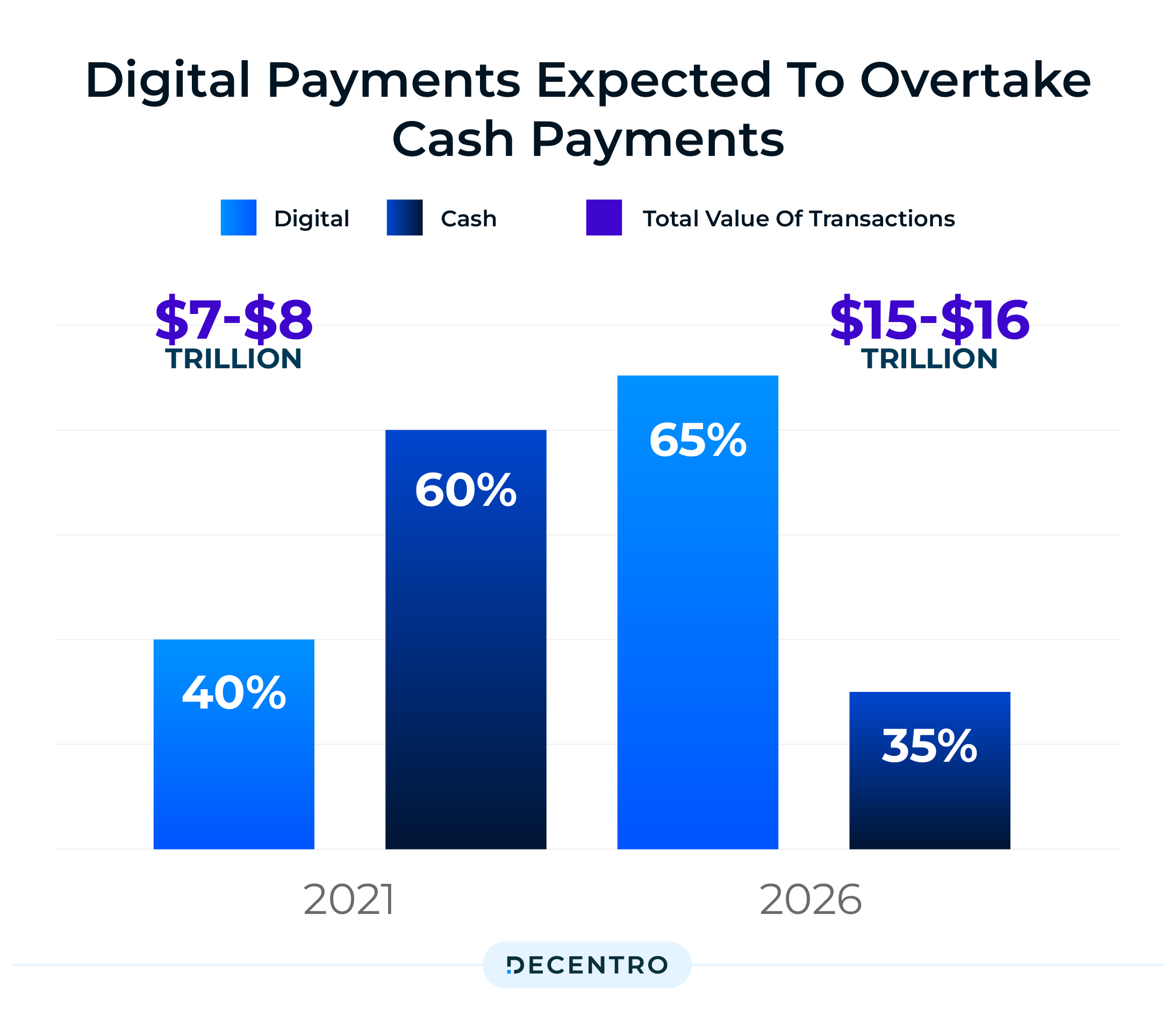

According to a research report, digital payments in India are expected to grow over three-fold to Rs 7,092 trillion by 2025 because of government policies around financial inclusion and the growing digitisation of merchants.

Merchants hold the key to this unprecedented growth, acting as the fulcrum on which the financial inclusion narrative hinges. They have become the focal point for fintech innovators, so much so that companies have pivoted their business use case to support specific aspects of online payment processing for merchants—and sometimes, their entire payment ecosystem.

A payment aggregator does just that, serving as a go-between for businesses, card companies and banks. So, what is a payment aggregator, and is it right for your business? Here’s how it works.

What is a Payment Aggregator?

Payment service providers—Merchant Service Providers or PSPs—are third parties that help merchants accept payments. Simply put, payment service providers enable merchants to accept credit and debit card payments (as well as direct debit, bank transfers, real-time bank transfers, etc.) by connecting them to the broader financial infrastructure. They provide a merchant account and a payment gateway, ensuring businesses can collect and manage their payments efficiently.

To accept credit card payments, merchants usually register with a bank for a merchant identification number (MID). In the case of a payment aggregator, the PA signs you up using its own MID, processing card transactions using a single master account. As a merchant, you are considered a sub-merchant and can start processing online payments immediately without registering your merchant account. Payment aggregators act as a conduit of accessibility for small- and medium-sized businesses (SMBs) and as intermediaries between the industry and the financial institutions that handle payment processing. Companies can avoid the intricacies of establishing direct relationships with these entities.

According to the report, the payment gateway aggregator market in India, estimated at Rs 9.5 trillion, is expected to grow by 2.4 times, driven by large-value transactions. It is expected to grow at a compounded annual growth rate of 19 percent in the next five years to reach Rs 22.6 trillion by FY 2025.

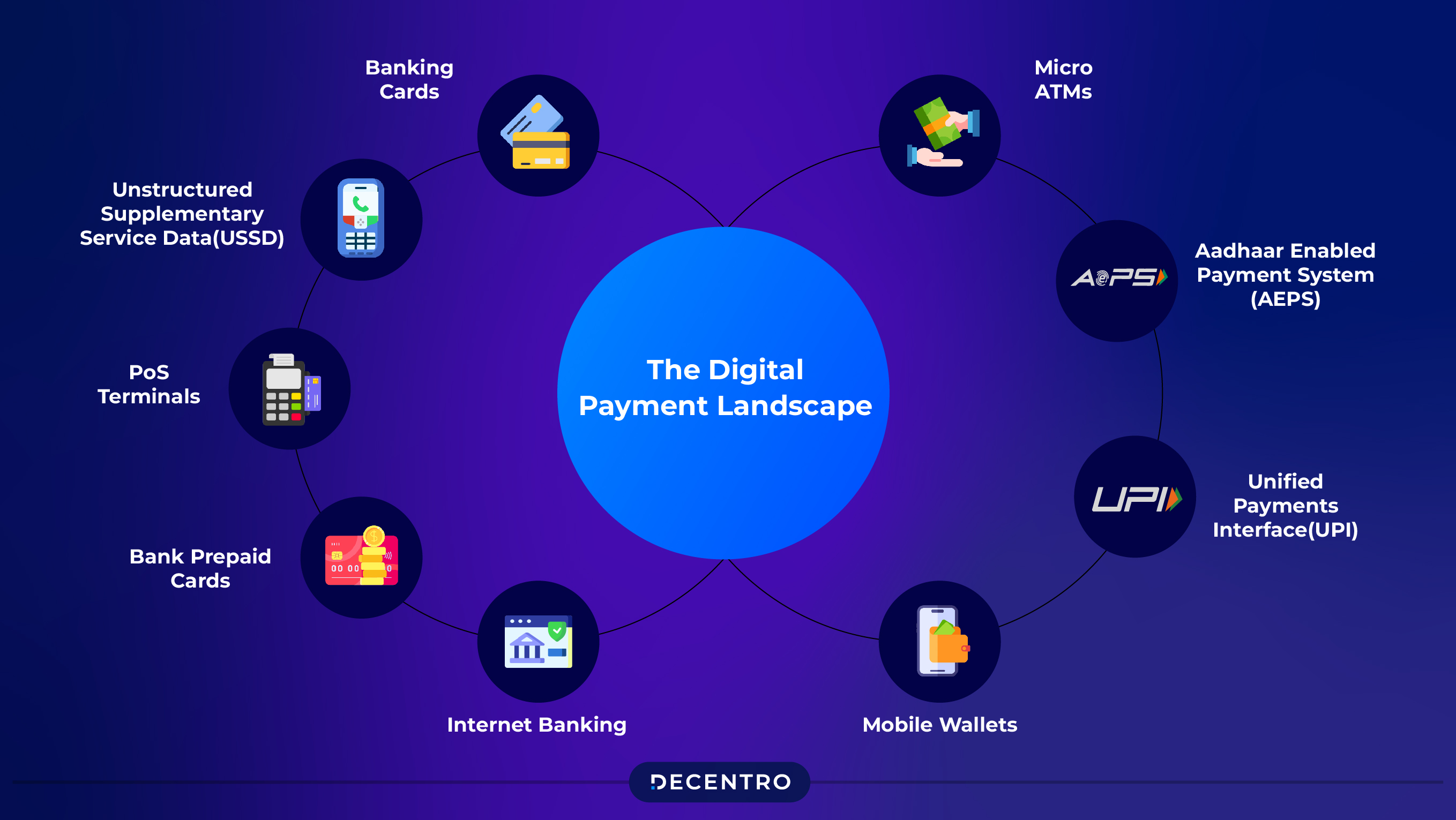

The Digital Payment Landscape

Before we delve into the nuances of the Aggregator framework, let’s take a step back and see the expanse of the digital payments footprint that India currently fosters.

Banking Cards

Indians widely use Banking cards, debit/credit cards, or prepaid cards as an alternative to cash payments. Andhra Bank launched the first credit card in India in 1981. Cards are preferred for multiple reasons, including, but not limited to, convenience, portability, safety, and security.

Unstructured Supplementary Service Data (USSD)

USSD was launched for those sections of India’s population which don’t have access to proper banking and internet facilities. Under USSD, mobile banking transactions are possible without an internet connection by dialling *99# on any essential feature phone.

This number is operational across all Telecom Service Providers (TSPs) and allows customers to avail of services including interbank account-to-account fund transfers, balance inquiry, and availing mini statements. To make this service accessible to all, it is available in 12 languages, including English and other Indian languages such as Hindi, Tamil, Bengali, and Kannada, to name a few.

Aadhaar Enabled Payment System (AEPS)

AEPS is a bank-led digital payment model initiated to leverage the presence and reach of Aadhar. Under this system, customers can use their Aadhaar-linked accounts to transfer money between two Aadhaar-linked Bank Accounts. Transactions using AePS have witnessed remarkable growth since its launch in 2016, as shown in the figure below. AePS transaction volume in the last fiscal year (2022-23) stood at 4.86 billion compared to 345 million in 2016-17.

AEPS doesn’t require physical activity like visiting a branch, using debit or credit cards or signing a document. This bank-led model allows digital payments at PoS (Point of Sale / Micro ATM) via a Business Correspondent(known as Bank Mitra) using Aadhaar authentication. The AePS fees for cash withdrawal at BC Points are around Rs.15.

Unified Payments Interface (UPI)

UPI is a payment system that consolidates numerous bank accounts into a single application, allowing money transfers between parties. Compared to NEFT, RTGS, and IMPS, UPI is far more well-defined and standardised across banks. You can use UPI to initiate a bank transfer anywhere with just a few clicks.

The benefit of using UPI is that it allows you to pay directly from your bank account without the need to type in the card or bank details. This method has become one of the most popular digital payment modes, with 2023 ending with a record of transactions worth ₹18-lakh crore, up 42% y-o-y via UPI.

Mobile Wallets

As the name suggests, mobile wallets are wallets where you can carry cash in a digital format. Often, customers link their bank accounts or banking cards to their wallets to facilitate secure digital transactions. Another way to use wallets is to add money to the Mobile Wallet and use the balance to transfer money.

According to the report, payments through mobile wallets are anticipated to grow at a compound annual growth rate (CAGR) of 23.9% between 2023 and 2027 and reach ₹472.6 trillion ($5.7 trillion) in 2027, said GlobalData, a data and analytics company, in its report. Digital wallets have become the norm, with banks and notable private companies establishing their presence in the space. Some popularly used ones include Paytm, Freecharge, Mobikwik, Airtel Money, Jio Money, etc.

Bank Prepaid Cards

A bank prepaid card is a pre-loaded debit card issued by a bank, usually single-use or reloadable for multiple uses. It differs from a standard debit card because it is linked to your bank account and can be used numerous times. This may or may not apply to a prepaid bank card.

PoS Terminals

PoS(Point of Sale) is the location or segment of a sale. PoS terminals were considered checkout counters in malls and stores where payments were made for a long time. The most common type of PoS machine is for debit and credit cards, where customers can make payments by simply swiping the card and entering the PIN.

According to the latest data by the Reserve Bank of India, the total PoS machines recorded in May 2023 were 79.6 lakhs, a tepid growth of only 1.6 per cent Month-on-month in May 2023. With digitisation and the increasing popularity of other online payment methods, new PoS methods have emerged, such as the contactless reader of a PoS machine.

Internet Banking

Internet Banking, also known as e-banking or online banking, allows the customers of a particular bank to make transactions and conduct other financial activities via the bank’s website. E-banking requires a steady internet connection to make or receive payments and access a bank’s Internet Banking website.

Micro ATMs

Micro ATM is a Business Correspondents (BC) device that delivers essential banking services to customers. These Correspondents, who could be local store owners, will serve as ‘micro ATMs’ to conduct instant transactions. They will use a device that lets you transfer money via your Aadhaar-linked bank account by merely authenticating your fingerprint.

Essentially, Business Correspondents will serve as banks for customers. Customers need to verify their authenticity using UIDs (Aadhaar). Micro ATMs will support withdrawal, deposit, money transfer, and balance inquiries. The only requirement for Micro ATMs is linking your bank account to Aadhaar.

Payment Service Provider Vs. Payment Gateways Vs. Payment Aggregator

PSP, PG, and PA are popular terms in the payment ecosystem. However, these still pose major confusion to most folks out there. How are PGs and PAs different from each other and a payment service provider?

Payment Service Providers— Merchant Service Providers or PSPs—are third parties that help merchants accept payments. Simply put, payment service providers enable merchants to accept credit and debit card payments (as well as direct debit, bank transfers, real-time bank transfers, etc.) by connecting them to the broader financial infrastructure. They provide a merchant account and a payment gateway, ensuring businesses can collect and manage their payments simply and efficiently. Payment Service Provider is the umbrella term that holds PGs and PAs together.

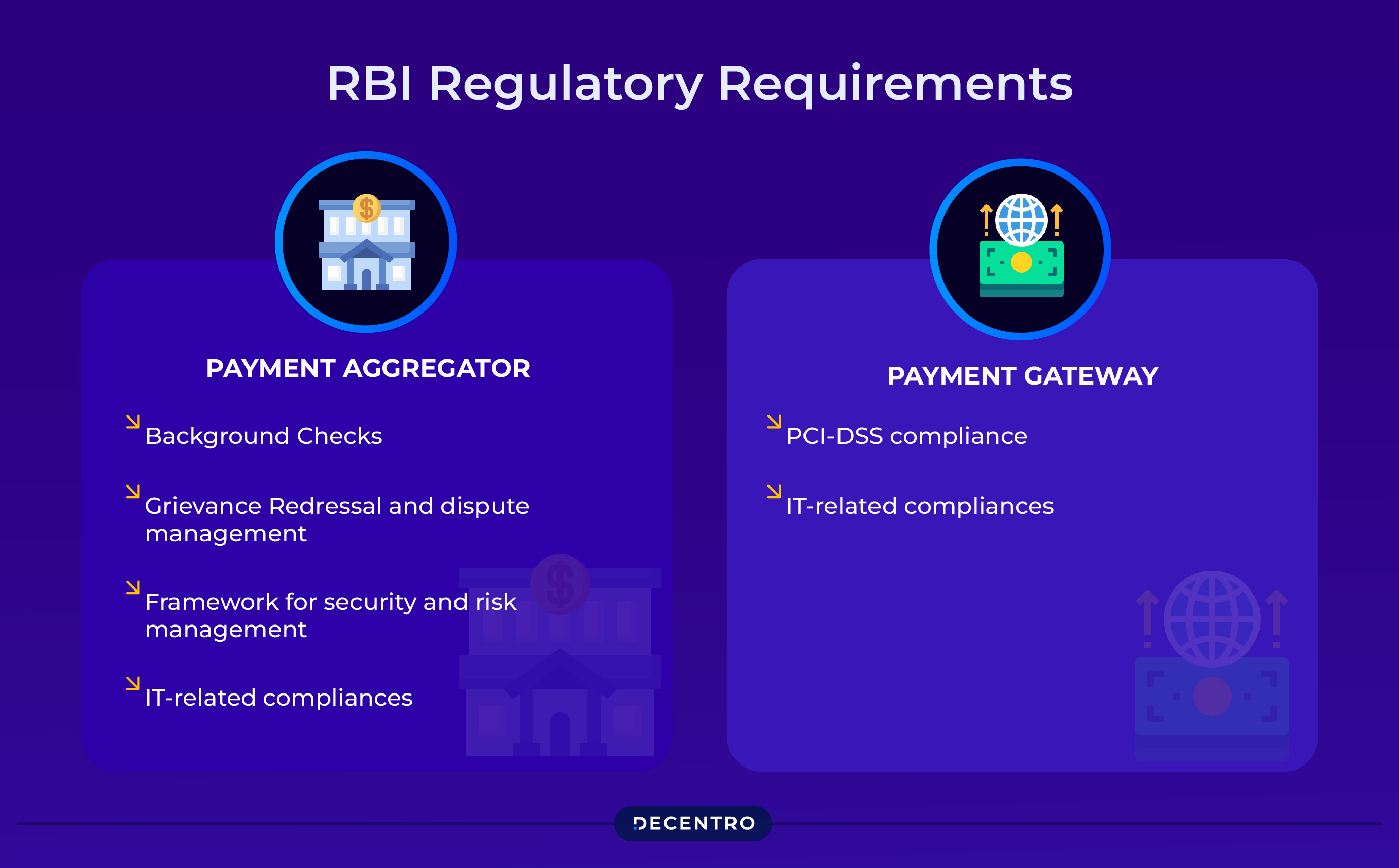

Let’s understand how the RBI has outlined an entity to be identified as a payment gateway or aggregator.

According to the RBI, Payment Aggregates (PAs) are entities that facilitate e-commerce sites and merchants’ acceptance of various payment instruments from customers to complete their payment obligations without the need for merchants to create a separate payment integration system. PAs facilitate merchants’ connection with acquirers. In the process, they receive customer payments, pool them, and transfer them to the merchants afterwards.

On the other hand, RBI defines Payment Gateways as entities that provide technology infrastructure to route and facilitate the processing of an online payment transaction without any involvement in the handling of funds.

In conclusion, a payment aggregator contracts with banks and regulated institutions for processing payments. On the other hand, a payment gateway deals directly with the merchant. Unlike PGs, a payment service provider offers a 360-degree service, processing payments and collecting funds.

Note: The latest RBI circular requires every payment gateway to comply as a payment aggregator

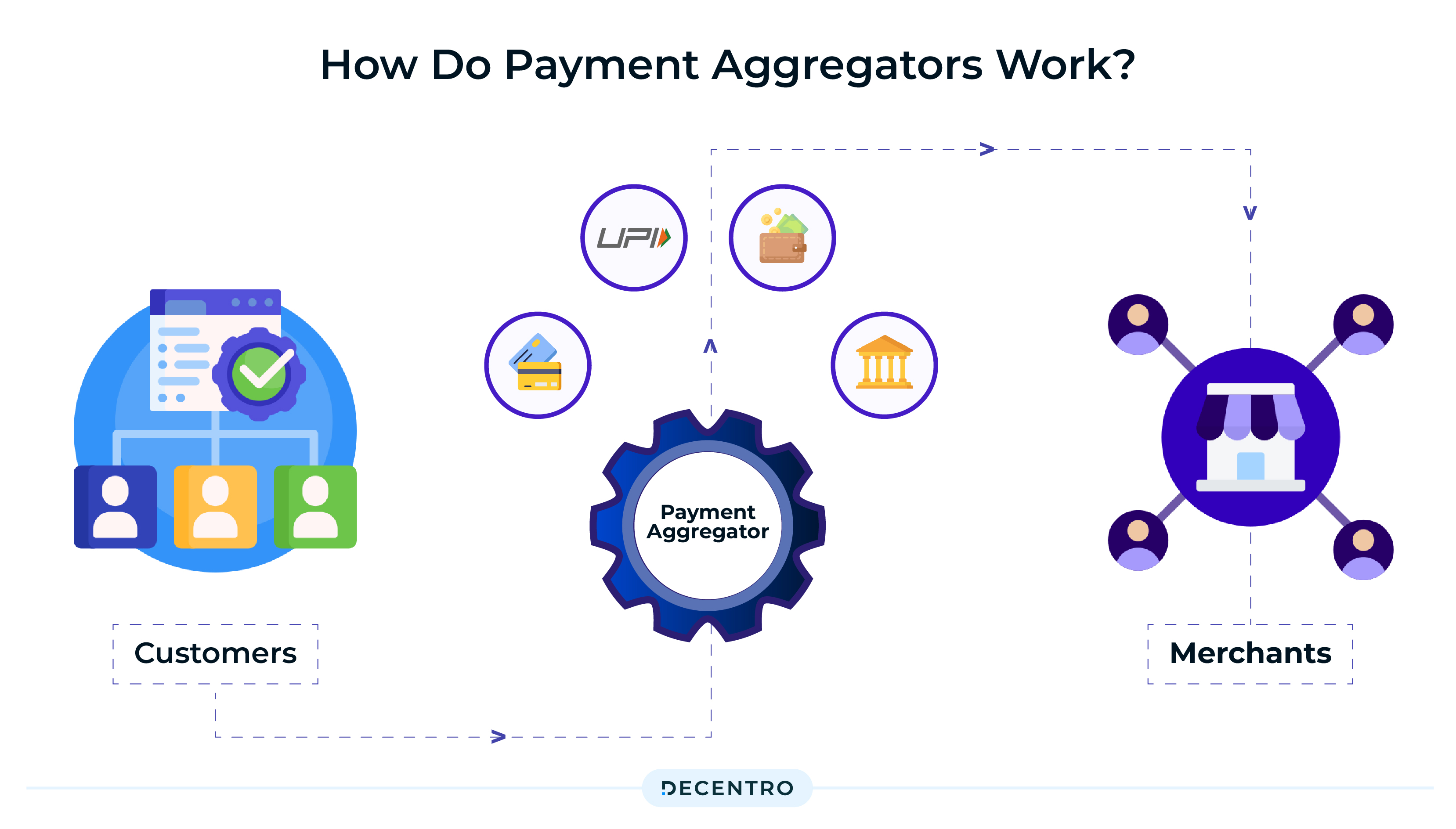

How Do Payment Aggregators Work?

Having established the differences between PSP, PA and PG, let us understand how payment aggregators help businesses accept online payments.

Merchants are onboarded

Before processing transactions, you must open a merchant account with a payment aggregator. Merchants integrate with a payment aggregator by incorporating their payment gateway or API (Application Programming Interface) into their website or mobile app. This allows customers to make payments securely using various payment methods, such as credit cards, debit cards, digital wallets, UPI or bank transfers.

Customers head to payment windows

When customers go to a payment window, they select a payment method and input their payment details. The payment aggregator tokenises this information and performs a fraud check at this stage.

Payment Aggregator processes the transaction in the background

The payment aggregator securely transmits the customer’s payment information to the appropriate payment processor or acquiring bank for authorisation and processing. This involves verifying the customer’s identity, checking for available funds, and assessing the risk associated with the transaction.

Fraud check

At this stage, the card company conducts a fraud check based on the customer’s past spending behaviour. Some card companies may also analyse databases of collections of card user transaction data to find patterns of fraud. Once the fraud check is complete, the transaction information is sent to the customer’s bank.

The customer’s bank processes the payment request

Once the customer’s bank receives the transaction information, it verifies whether the customer has enough funds for the transaction and whether the customer’s details are accurate. The transaction status, either approved or denied, is sent back through the same channel the transaction information came from. The merchant then finally passes on the status to the customer.

Settlement and Disbursement

Once the transaction is settled, typically within a few business days, the payment aggregator disburses the funds to the merchant’s designated bank account minus any applicable fees or transaction charges. This settlement process may vary depending on the terms agreed upon between the merchant and the payment aggregator.

Types of Payment Aggregators in India

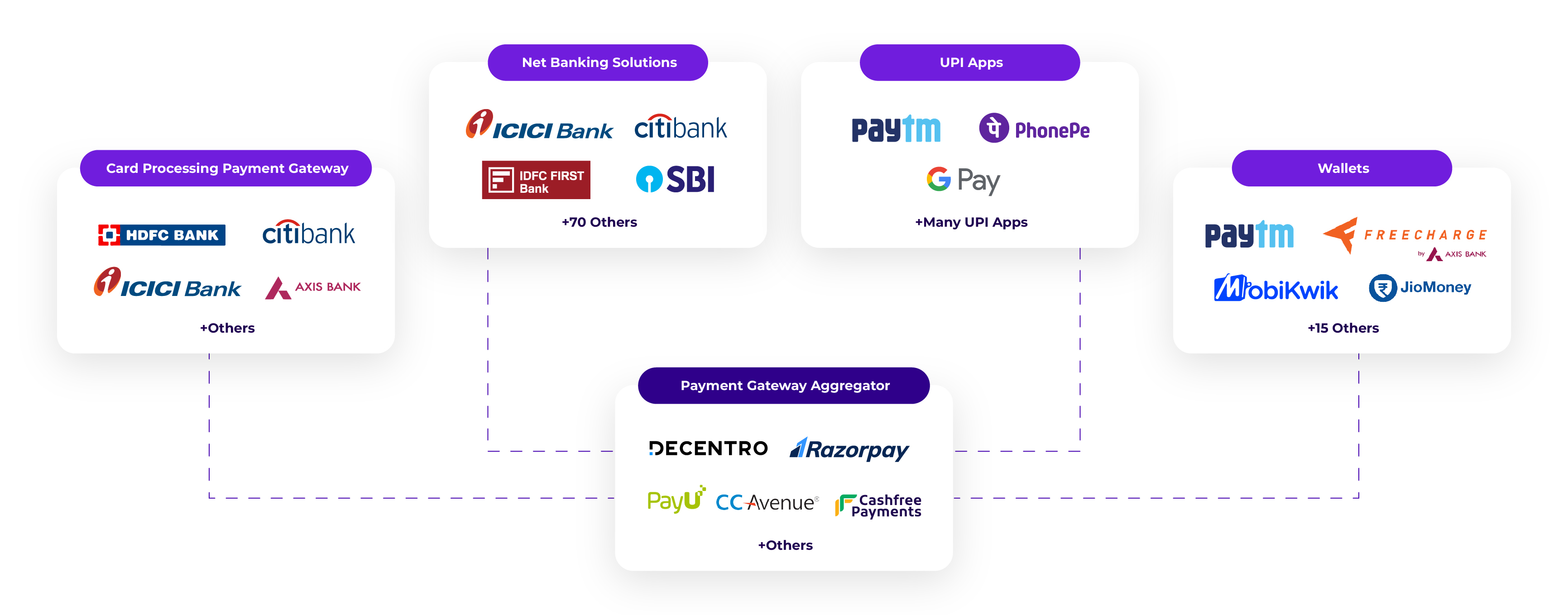

In India, payment aggregators can be divided into bank and third-party aggregators. Let’s examine each type in detail.

Bank Payment Aggregator

Bank payment aggregators were the first to grace the Indian market. Their design is more traditional, making their integration process slightly tricky. They are also expensive to set up, making it difficult for new businesses and small companies to engage their services. As a result, they are typically employed by large companies.

ICICI Bank, HDFC Bank, Axis Bank, and State Bank of India (SBI) are the famous Bank PAs offering businesses diverse payment solutions.

Third-party Payment Aggregators

Third-party payment aggregators entered the market after bank payment aggregators and have gained massive popularity over the years. They are more flexible and provide innovative, user-friendly, and business-oriented payment solutions, making them a preferred choice for merchants and business owners. Because of lower maintenance costs and annual management fees, they tend to be cheaper than bank payment aggregators.

PayU, BillDesk and CCAvenue serve as India’s oldest bank payment aggregators, with Razorpay, Paytm, and now Decentro, among many others, getting nods from RBI to operate as a PA.

While Payment Aggregators (PAs) were brought under the purview of the RBI in March 2020 and designated as Payment System Operators (PSOs), Offline payment aggregators (PAs) providing face-to-face transaction services at merchant outlets will now also come under the regulatory purview of the Reserve Bank of India. This decision means facilitating more secure, trustworthy, and accessible digital payment options to customers amidst the upsurge in debit cards, credit cards and UPI payments, and driving synergy in regulation, covering activities of PAs, who are integral to the digital payments system.

Features of Payment Aggregator

Apart from the apparent delegation of an intricate chain of hierarchies in the form of bank relationships, the following features make PA a very attractive option for businesses to explore.

Easy onboarding and sub-merchant account: Payment aggregators allow businesses to set up and accept payments quickly. They also provide sub-merchant accounts for each company, allowing for easy transaction tracking.

Highly secure: Payment aggregators use advanced security measures to protect customer data and prevent fraud. They also comply with industry-standard security regulations to ensure the highest level of security.

Instant refunds: Payment aggregators offer instant refunds, allowing businesses to process refunds for their customers quickly and efficiently.

Instant settlements: Payment aggregators provide instant settlements, which means businesses can access their funds as soon as the transaction is complete.

Reliable customer support: Payment aggregators offer excellent customer support, providing businesses access to experts who can help with any issues or questions.

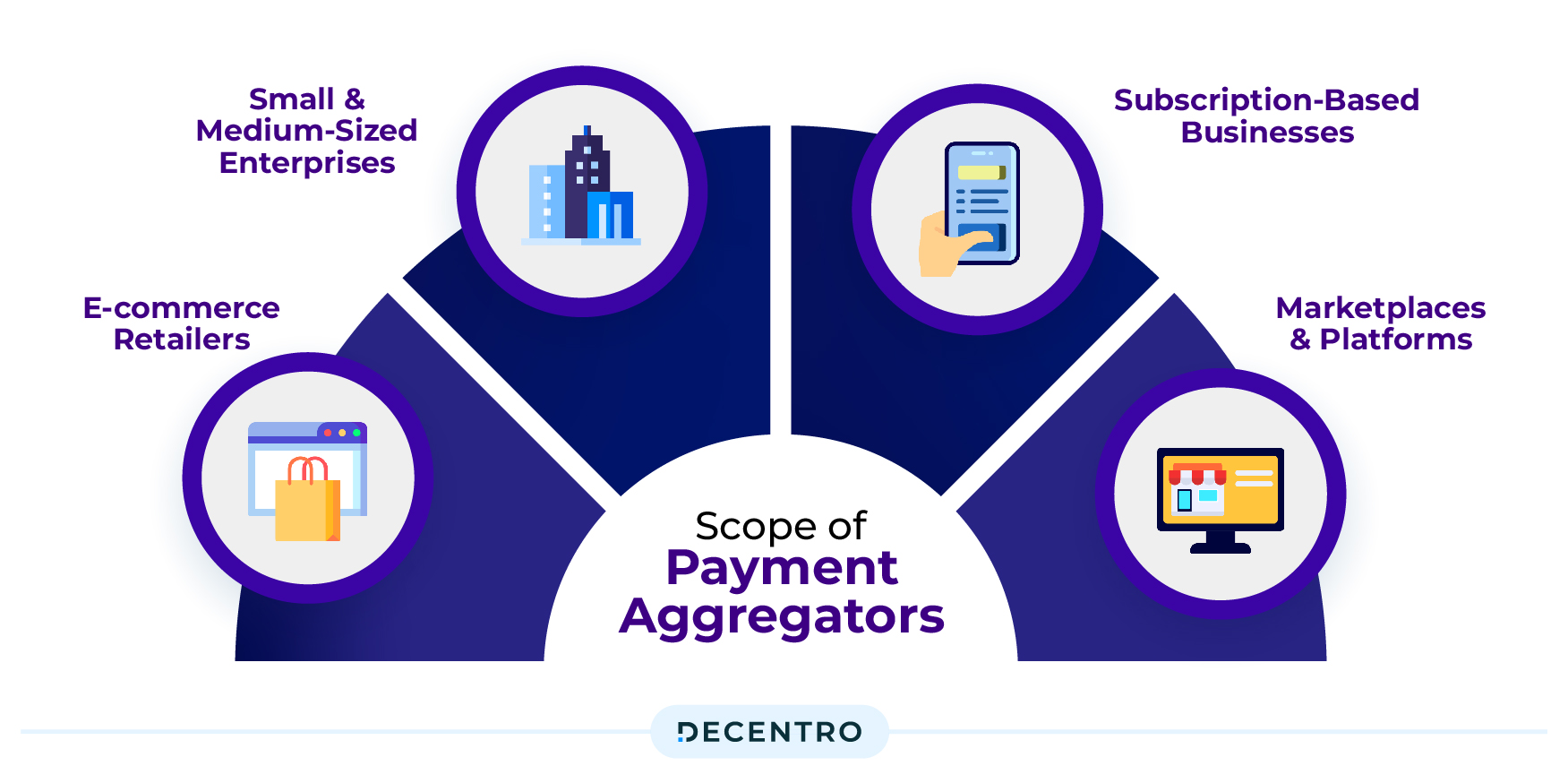

Scope of Payment Aggregators

The scope of Payment Aggregators for the industries they can cater to is vast due to their broad applicability and flexibility. This versatility can be applied to the following sectors,

E-commerce Retailers

Online retailers can leverage payment aggregators to accept payments for goods and services sold through their websites or mobile apps. PAs offer a wide range of payment options, making it convenient for customers to purchase online.

Small- and medium-sized enterprises (SMEs and MSMEs)

Payment aggregators are particularly popular among SMEs – such as local shops, service providers and startups – due to their ease of use and simple onboarding process. These businesses can quickly start accepting electronic payments without the complexities and higher costs associated with traditional merchant accounts.

Subscription-Based Businesses

Subscription-based businesses, such as streaming services, subscription boxes, and membership sites, can benefit from payment aggregators to manage recurring subscriber payments. PAs automate subscription billing processes and offer features for managing customer accounts and subscription plans.

Marketplaces and Platforms

Online marketplaces and platforms that connect buyers and sellers can integrate payment aggregators to facilitate transactions between parties. PAs provide secure escrow services, split payments, and disbursement capabilities, making managing costs within the marketplace ecosystem easy.

What should you look for in a Payment Aggregator?

While specific features may vary among different payment aggregators, here are some standard features typically offered by payment aggregators at an industry level:

- Multi-Payment Method Support: The ecosystem asks for versatility, and Payment Aggregators should cater to diverse customer preferences and expand their customer base. The PA deployed should support credit cards, debit cards, e-wallets, bank transfers, and alternative payment options.

- Quick Onboarding: Payment Aggregators should streamline and simplify the onboarding process and start the payment acceptance quickly.

- Seamless Integration: Payment Aggregators should provide various integration options, such as APIs, plugins, or SDKs, that facilitate easy integration of payment functionality into merchants’ websites, mobile apps, or other sales channels.

- Security and Fraud Prevention: Payment Aggregators must employ features like encryption, tokenization, and fraud detection mechanisms to ensure secure transactions and minimise the risk of fraud.

- Payment Analytics and Reporting: Payment Aggregator should ideally offer reporting and analytics tools that provide valuable insights into transaction data, sales volumes, revenue trends, and customer behaviour.

- Subscription Billing and Recurring Payments: Today’s ecosystem also demands support for subscription billing models and recurring payments. This is particularly useful for businesses offering services or products with recurring billing cycles, such as software subscriptions or membership fees.

- International Payments and Currency Support: Payment Aggregators are often also expected to facilitate cross-border transactions and support multiple currencies. This enables merchants to expand their customer base globally and accept payments from customers in different countries.

- Prompt Customer Support: Payment aggregators are typically expected to offer services to assist merchants with inquiries, technical issues, and payment-related concerns. This support may include email, phone, or live chat options to ensure prompt assistance.

The Decentro Connect

To ensure the safety of consumers and businesses, the RBI issued a payment aggregator framework in March 2020 (notification link here), which stated that payment gateways would be mandated to have a license to acquire merchants and provide them with digital payment acceptance solutions. As of 2023, more than 185 fintech companies had applied for the permit, with 32 entities receiving in-principle approval.

As a company that has always strived to break innovation barriers in the fintech infrastructure space, Decentro has received its final payment aggregator license from the Reserve Bank of India (RBI), becoming the youngest fintech company to receive the permit. With this final nod of approval by RBI, Decentro can now empower its customers seamlessly with enhanced payment solutions and security, especially large-scale platforms, marketplaces, and lenders, with our cutting-edge payment collection APIs, enabling seamless transactions across UPI, autopay, and e-mandates.

With our licensed capabilities and full-stack banking infrastructure, we aim to expand our existing capabilities across the following categories.

- NBFCs and Lenders

As a licensed PA, we aim to scale up and facilitate secure and efficient payment acceptance for our NBFC customer base through channels such as net banking, UPI (Unified Payments Interface), and wallets. We also now offer NBFCs and lenders the flexibility to offer diverse payment options to borrowers, including one-time payments, recurring payments, and scheduled payments. This flexibility caters to borrowers’ varied needs and preferences, improving convenience and reducing payment friction.

- Merchant Aggregators / Marketplaces

To accept payments on a website or an app through different modes such as cards, UPI, wallets, etc, merchants would need to integrate directly with multiple banks and issuing entities, which is a cumbersome process. Also, the merchants have to forge techno-commercial partnerships and follow the compliance requirements of banks, which is a rigorous task. On top of that, they would require a lot of development efforts to integrate with multiple processing entities. We at Decentro, a licensed PA, can now liaise between merchants and financial institutions. We can integrate with multiple financial institutions (acquiring banks, wallets, etc.), comply with regulatory guidelines to help reduce the merchants’ efforts, and offer them a bundled solution, enabling them to collect payments through multiple modes.

- Other Fellow Fintech companies and Software as a Service

Payment Aggregators (PAs) like us can enable fellow Fintech players and SaaS (Software as a Service) platforms to facilitate seamless user payment experiences. PAs offer robust payment integration APIs that fintech and SaaS platforms can leverage to embed payment functionalities directly into their software applications. These APIs enable platforms to accept user payments for subscriptions, enable collections via UPI, or facilitate compliant B2B payment via virtual accounts. By integrating with a provider like us, platforms can provide seamless access to financial products and services, enhancing their value proposition and user engagement.

With our customer base already leveraging payment collection capabilities, it is time for you to hop onto this compliant banking and payment flow journey.

So if you are searching for the perfect Payment Aggregator for all your transactional needs, drop us a line at hello@decentro.tech, and we will contact you.