Our in-depth guide on what is UPI and how it works. We dive into the various transaction flows and how you can incorporate them with Decentro’s UPI APIs.

What is UPI: Guide to Understanding Unified Payments Interface

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

The United Payments Interface (UPI) has been a prominent instant payment system crafted by the National Payments Corporation of India (NPCI) since its inception in 2016.

As of October 2023, UPI transactions have reached an unprecedented milestone, surging to a staggering 17.16 lakh crores and an impressive 11.41 billion transactions. This signifies a substantial 55% year-on-year transaction volume growth and a 42% increase in transaction value.

To understand UPI and its future prospects comprehensively, we invite you to delve into our in-depth exploration of this financial phenomenon. Furthermore, it discovered the reason behind Google’s endorsement of the UPI model, prompting the United States Federal Reserve Bank to consider its replication for the proposed inter-bank real-time gross settlement service, ‘FedNow’ and why UPI stands as a testament to India’s innovative strides in the realm of unified payment systems.

Background

In 2012, the RBI released a four-year vision statement that indicated commitment towards building a safe, efficient, accessible, inclusive, interoperable, and authorised payment and settlement system in India. The NPCI was then constituted as the body, under the guidance of the RBI, to create the new payment system. On 11th April 2016, UPI went live, becoming one of India’s most successful deep-tech financial innovations.

The major problem that UPI was trying to solve was to maximise financial inclusion, esp. for the underbanked citizens of the country. This needed a payment system that would be mobile-first, simple to use and operable across multiple banks. This was built on top of an open infrastructure so as to allow private entities to innovate and create applications on top of the existing public infrastructure.

What is UPI?

In technical terms, UPI is a payment markup language that helps facilitate inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions.

To execute a transaction on UPI, a person would need a Virtual Payment Address (VPA) or UPI ID. VPAs are widely accepted digital bank account numbers similar to email addresses. A consumer would need a bank account and a valid debit card to create a VPA. The UPI VPA starts acting as the addressing layer for the bank account it is associated with.

- One VPA can be linked to multiple banks.

- Multiple VPAs can be created on a single bank account.

- Bank accounts can be added or deleted.

Once the VPA is activated, users can transact on UPI using a payment app like Google Pay, PhonePe or PayTM.

UPI – Features

- UPI is a fast, real-time system available 24/7, 365 days a year.

- Regarding UPI charges: Individual UPI payments for peer-to-peer transactions are entirely free for now. From 1 April 2023, an extra interchange fee of 1.1 per cent was starting to be charged on merchant (the person or business receiving the payment) UPI transactions of over ₹2,000 using prepaid payment instruments (PPIs) – wallets or cards.

- UPI does not have any minimum limit on the transaction amount. Regular UPI transactions have a maximum daily limit of ₹1 Lakh.

UPI – Simplifying payments

UPI has introduced a few more modes to simplify payments on the UPI platform.

- UPI activation with Aadhaar – Google Pay has recently introduced an innovative feature – Aadhaar-based authentication for Unified Payments Interface (UPI). This advanced integration enables users to register for UPI using their Aadhaar credentials, thereby obviating the necessity for a debit card.

The deployment of the Aadhaar-based UPI onboarding process is strategically designed to simplify the establishment of UPI IDs for a broader spectrum of users, promoting the adoption of digital payments. This feature is available to account holders of participating banks, and we expect further expansion to include additional banks in the foreseeable future.

Capitalizing on this extensive penetration, Google Pay’s Aadhaar-based onboarding initiative is poised to significantly enhance financial inclusion by extending the reach of UPI services to a broader user demographic.

- QR Codes for Offline Payments – QR codes for UPI IDs have transformed how offline merchants handle payments. Prominently displayed at sales points, these codes make transactions smoother and lessen the dependence on cash. Customers scan the QR code using a compatible mobile app to make a quick and secure payment.

This technological advancement has streamlined the offline payment process and bolstered security by removing the manual entry of data. It’s a game-changer for everyone, from street vendors to larger businesses, ensuring a smooth, cashless payment process.

- Transacting without UPI PIN – NPCI has introduced UPI Lite, the ‘on-device wallet,’ which facilitates swift and small-scale transactions without needing a UPI PIN. This feature is particularly suitable for those who frequently make small payments. UPI Lite stands out for its convenience and flexibility, allowing users to close their accounts whenever they choose. Additionally, it allows for seamless transfers of funds from the Lite account to a bank account with a single click, free of charge.

The UPI Universe

There are a few key stakeholders in the UPI ecosystem. These are:

- Banks – UPI works directly with the bank accounts to send or receive money. The bank that is creating the VPA is called the Issuer Bank. Similarly, the bank that processes VPA transactions is called the Acquirer Bank.

- NPCI – As mentioned before, the Government of India set up the NPCI to facilitate digital payments in the country, and they look after various payment schemes in the country like BBPS, FASTag, etc. The NPCI operates the UPI Switch, through which the issuer and acquirer bank talk to each other.

- UPI Apps – Two types of entities can develop and operate UPI Apps

- Banks (Kotak Mahindra Bank, HDFC Bank, etc.)

- Fintech Companies (Google Pay, PhonePe, etc.)

As only banks can create VPAs on top of their accounts, fintech companies/PSPs usually tie up with these banks to create UPI Apps. The NPCI then ensures that the data flow between the banks and the payment apps is routed correctly.

UPI Transaction Flow

Now that we have gone through the basics of UPI and how it works, you must be thinking about what the payment flow looks like with multiple stakeholders involved at various levels. Let’s look at the various steps involved in UPI payments:

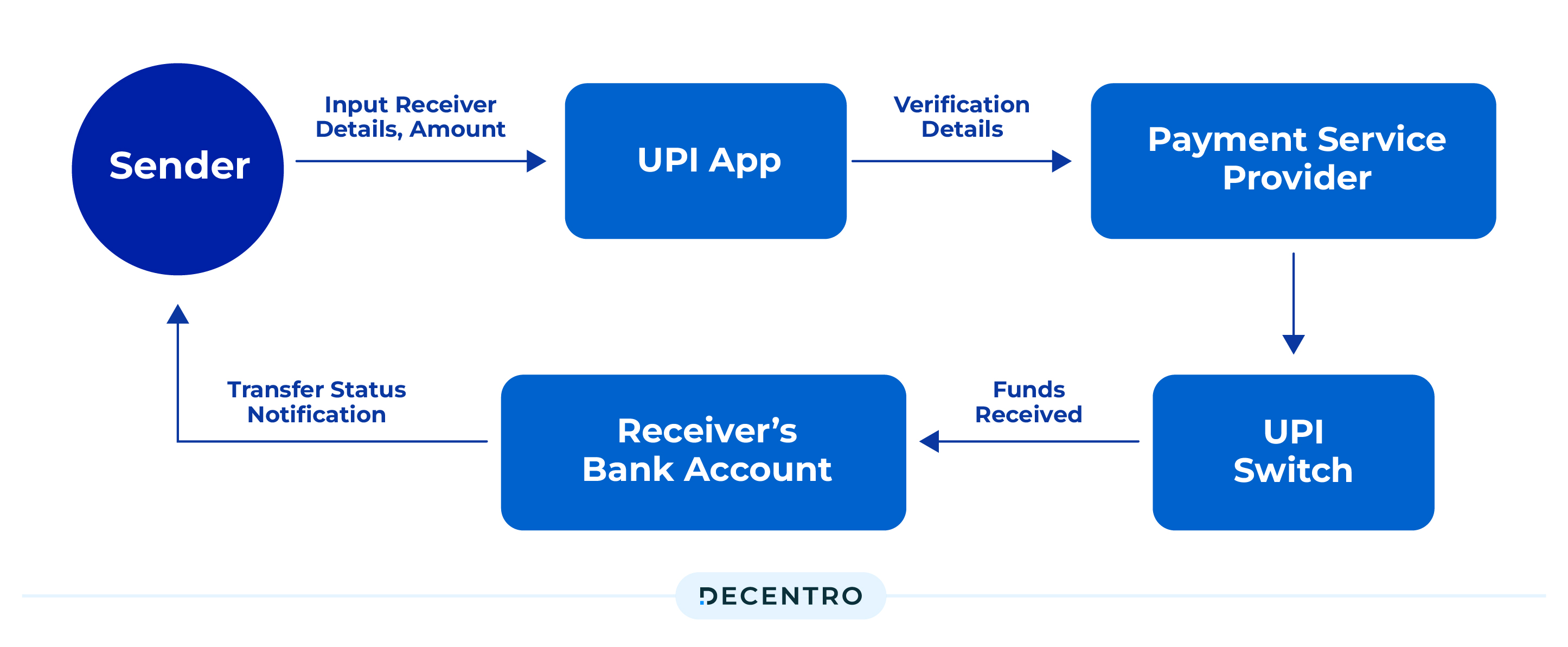

PUSH Transactions:

Simply put, when you make a payment using UPI, it’s called a push transaction. It’s like you’re pushing money from your account to someone else’s to pay for stuff or send money to friends and family.

Initiation:

- The Payment Apps User initiates the payment process through their apps using the recipient details and transfer amount.

- The payment request is then forwarded to the Payment Service Provider (PSP), which forwards the request to the NPCI.

- The issuing bank (the sender’s bank) verifies the transaction’s authenticity using various parameters like the customer’s details and the account balance.

- As soon as the transaction is authorised via the issuing bank, a digital signature for the transaction is generated.

Fund Transfer:

- The UPI Switch verifies the transaction using the issuing bank’s details and checks for fund availability.

- If the sender’s account has sufficient funds, UPI deducts the funds from the sender’s account.

- The acquiring or receiver bank receives the transferred funds and credits them to the payee’s account.

- UPI then sends a notification to the sender’s app confirming the successful transfer of the transfer amount, along with a transaction ID for future reference.

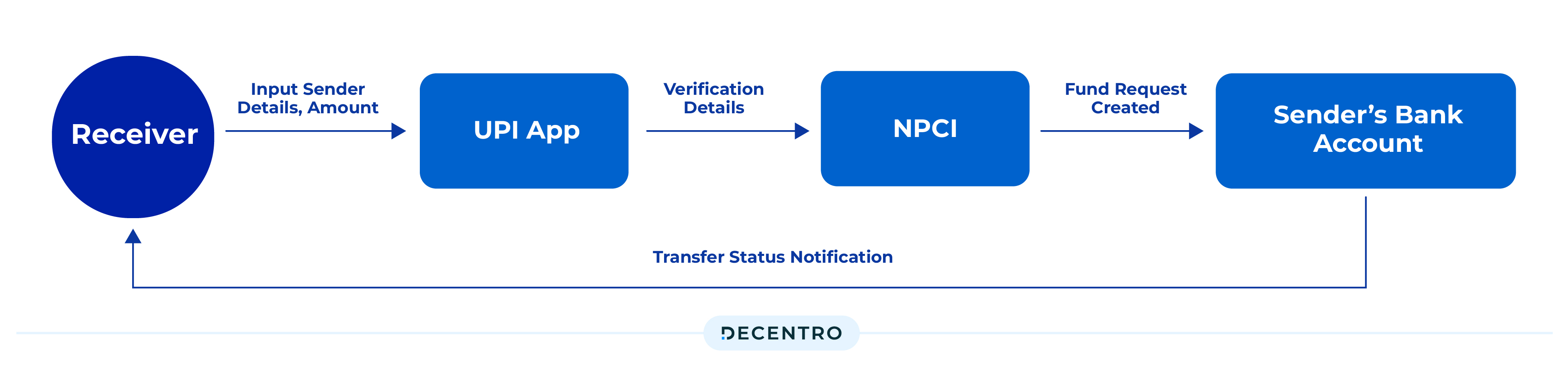

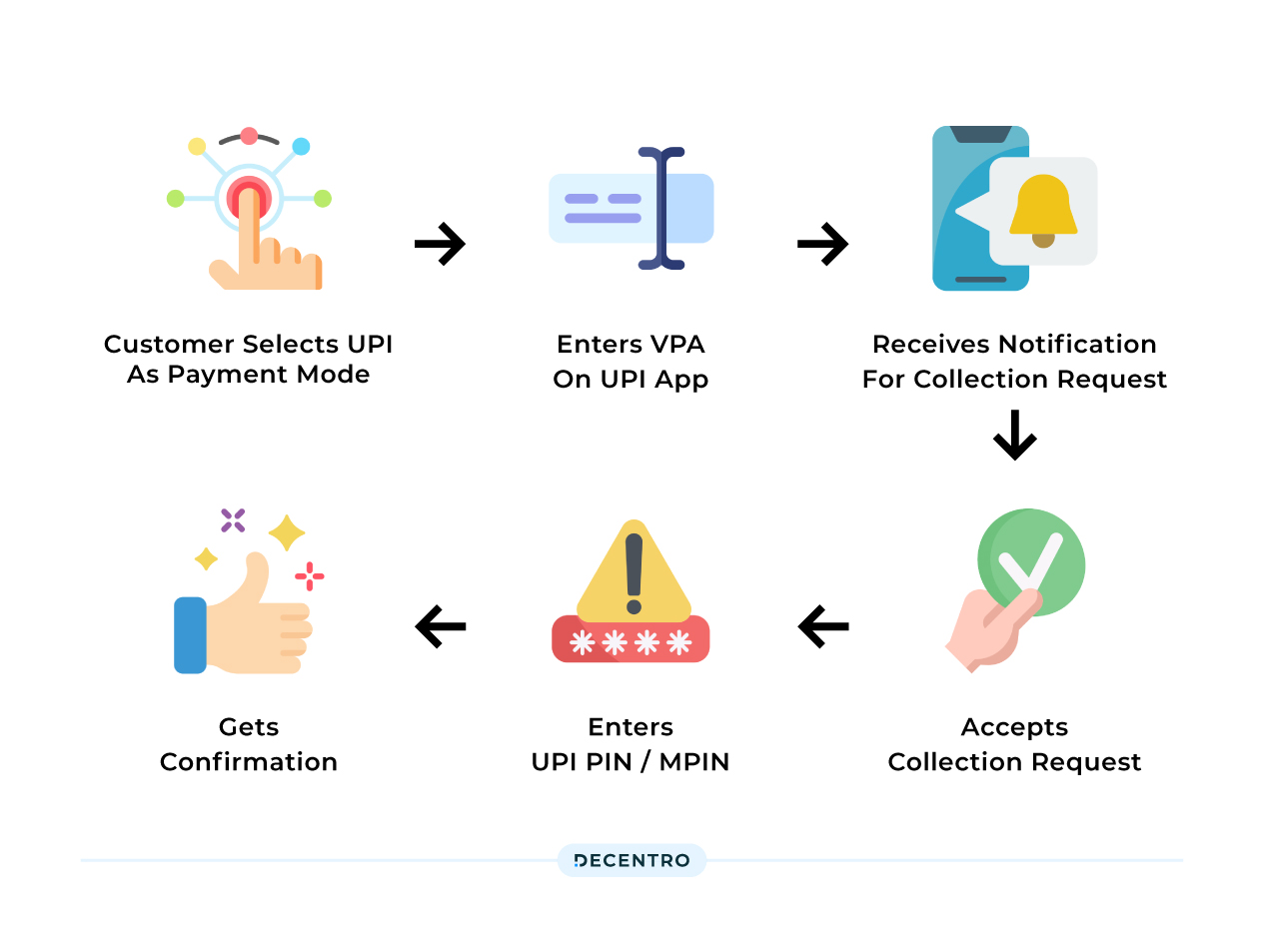

PULL Transactions:

Pull transactions happen when the person getting the money asks for it. This is common when paying bills, collecting money from customers, or getting cash from friends and family. The person receiving the money sends a request, and once the sender approves it, the payment is made. This way, the one getting the money is in control, ensuring it’s a secure and authorised way to get funds.

Initiation:

- Recipient Initiation: The person receiving the money creates a payment request using their UPI app, including all the needed details.

- Payment Message Flow: The payment request travels from the receiver’s app to UPI, indicating the intent to pull funds from the payer.

Fund Transfer:

- The payment request is sent from the creditor’s bank to the debtor’s bank through UPI.

- The debtor’s bank verified the request and checked for fund availability.

- If sufficient funds are available, a confirmation is shared with the NPCI and the amount is deducted from the debtor’s bank. The receiver’s bank is updated.

Settlements:

Settlements are the trickiest part of the entire UPI journey and flow. Since no actual money exchange occurs between the banks, the NPCI drives the settlement for every transaction on the UPI network.

Several banks are a part of the UPI network and have an account with the RBI. Every few hours, the NPCI combines all transactions on the UPI network and creates a bulk settlement file. Based on the settlement file, every bank calculates internally to determine how much money they owe or how much other banks owe them. Once the settlements are done, the RBI updates the overall ledger for all the banks on the UPI network.

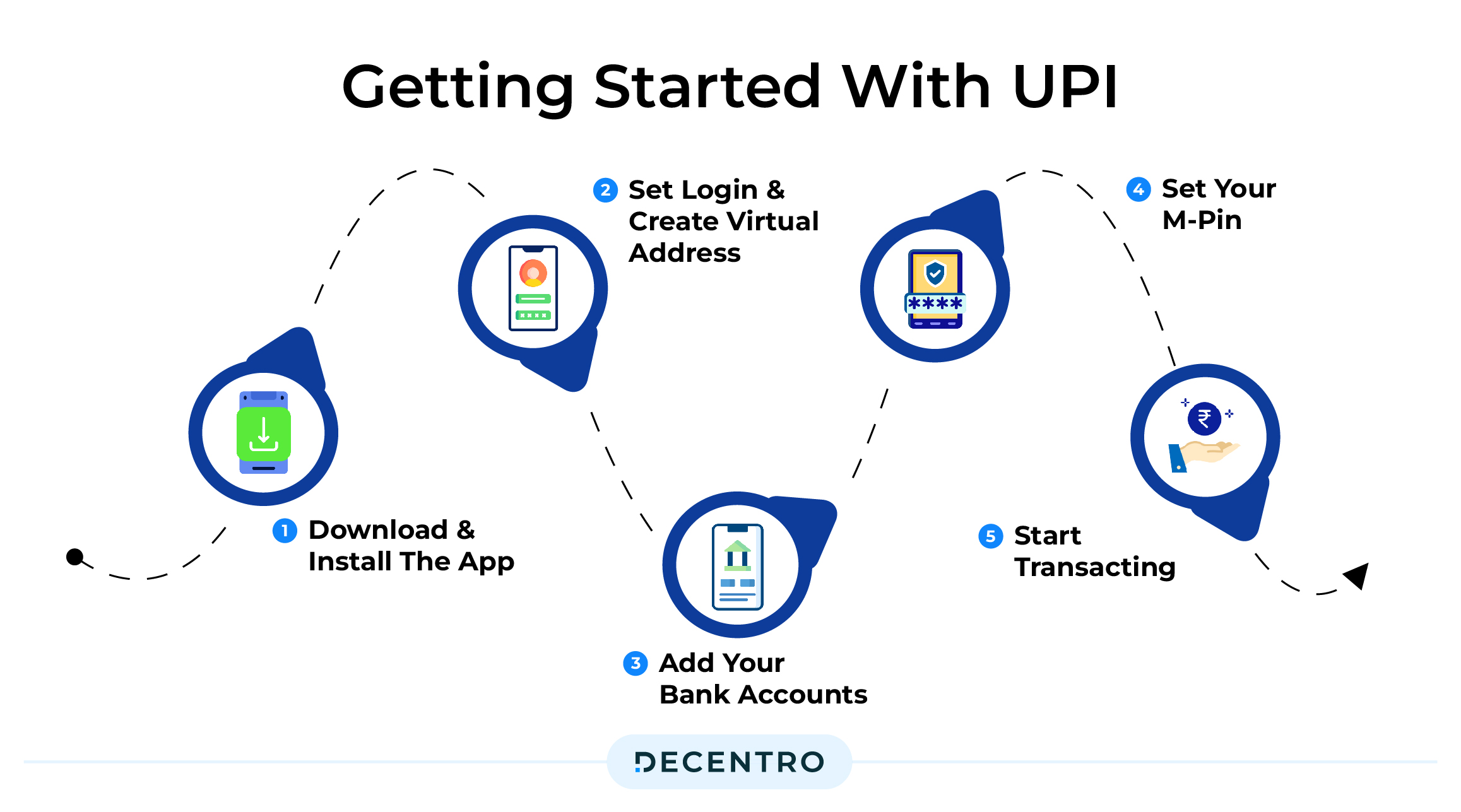

Start using UPI Payments

To start using UPI, please make sure of the following:

- Use a smartphone with an OS that supports UPI apps.

- Have an active bank account with a bank that offers UPI services.

- Link your mobile number to your bank account for verification.

- Make sure you have a stable internet connection for UPI to work well.

Once you have the above in place, the next steps are:

- Choose and install a UPI-enabled app from your phone’s app store.

- Register on the app using the mobile number linked to your bank account.

- Once you have verified the OTP on your mobile number, you must set a 4-digit or 6-digit PIN for transacting on the app.

- You can then create a Virtual Payment Address (VPA) and link your bank account to it. As mentioned before, you can link multiple accounts to the same VPA.

- To initiate your first transaction, you can enter the receiver’s phone number on your payment app, input the 4-digit/6-digit PIN, and you’re done.

Benefits of UPI

- Seamless Transactions: With UPI, say goodbye to the headache of entering lengthy account details and transferring money with just a few taps. No more remembering complex account numbers.

- 24/7 Accessibility: UPI allows you to make transactions anytime, anywhere. Whether it’s the middle of the night or the break of dawn, your money is always at your fingertips.

- Instant Gratification: UPI ensures that your transactions are lightning-fast and you receive instant notifications. It’s like the VIP lane of digital payments – quick, efficient, and gratifying.

How safe is UPI?

UPI is backed by various stringent regulations set by the RBI and safety protocols to make it a safe choice for businesses and individuals.

- 2-Factor Authentication: UPI prioritises transaction security through a robust Two-Factor Authentication (2FA) system. Users must input their exclusive Mobile Personal Identification Number (MPIN) to validate transactions. Going the extra mile, UPI enhances security by incorporating biometric authentication and using fingerprint or iris recognition features. This fortifies the payment process and minimises the chances of unauthorised access and fraudulent activities.

- Transaction Encryption: Since its establishment in 2016, UPI has also implemented cutting-edge encryption protocols to protect sensitive information. This commitment ensures that data stays confidential and secure throughout its transmission, maintaining an uncompromised level of security.

- Enhanced Security Measures: The Virtual Payment Address (VPA) is a unique identifier for UPI transactions, eliminating the need to share sensitive bank account details and reducing the risk of information exposure. Additionally, UPI-enabled applications are often bound to specific devices, preventing unauthorized access from different devices and adding an extra layer of security.

UPI vs RTGS vs IMPS vs NEFT

| Features comparison | Unified Payments Interface (UPI) | Real-time Gross Settlement (RTGS) | Immediate Payments Service (IMPS) | National Electronic Funds Transfer (NEFT) |

| Definition | UPI is an instant real-time payments system that can be used to transfer money between two banks | RTGS is a money transfer process of initiating, clearing, and settling payments in real-time | IMPS is an electronic funds transfer system that allows inter and intra-bank transfers | NEFT is an electronic one-to-one funds transfer system monitored by the government |

| Minimum Transfer Limit | No minimum limit | ₹2 Lakh | ₹1 | No minimum limit |

| Maximum Transfer Limit per day | ₹1 Lakh | No upper limits | ₹5 Lakhs (5 Lakhs per transaction) | No upper limits (₹50,000 per transaction) |

| Time Taken to Get the Funds Credited | Instant | Within 30 Minutes | Real-time | Up to 12 hours (usually within 2 hours) |

| Service Availability | Online + Offline (using UPI Lite) | Online + Offline | Online | Online + Offline |

| Service Fee | Free of Cost (currently) | No RTGS charges for online transactionsFor offline:₹2L to 5L trans: up to ₹25₹5L & above trans: ₹25 to ₹50 | ₹2.5 to ₹25 (varies bank to bank) | No charges on online NEFT transactionsOffline NEFT transactions are charged between ₹2.5 to ₹50 |

| GST charges | No charges (currently) | No GST charges for online RTGS trxn GST of 18% (of bank charges) is charged for offline RTGS trxn | GST charges are applicable | GST charges are applicable |

| Is the service accessible on bank holidays and off-working hours | Yes | Yes | Yes | Yes |

| Is the transfer refundable? | Yes (within 48 hours) | Yes (within 2 hours – may vary up to 48 hours from bank to bank) | Yes (within 48 hours) | Yes (within 24 to 48 hours) |

UPI 2.0

UPI 2.0, the upgraded version of the Unified Payments Interface, has significantly transformed digital payments. With its enhanced features and benefits, UPI 2.0 has made transactions even more convenient and secure for users across India.

One of the standout features of UPI 2.0 is the introduction of the ‘Overdraft Facility,’ allowing users to link their overdraft account to UPI for seamless transactions, even when their account balance falls short. This feature provides a safety net, ensuring essential payments are never delayed due to insufficient funds.

Additionally, UPI 2.0 offers ‘Invoice in the Inbox,’ which simplifies the process of receiving and reviewing invoices within the UPI app itself, making it easier for businesses and individuals to manage their financial records.

The benefits of UPI 2.0 extend beyond these new features. It continues to provide the same lightning-fast, 24/7 transaction capabilities, but now with an added layer of security through ‘Signed Intent and QR.’ This feature ensures that you can verify the authenticity of a transaction by digitally signing your intent before making a payment, reducing the risk of fraud.

UPI 2.0 also enhances the shopping experience with the ‘One-Time Mandate.’ It allows users to authorize recurring payments seamlessly, perfect for subscription services, utility bills, and loan repayments. In a world increasingly reliant on digital payments, UPI 2.0 is a testament to India’s commitment to providing its citizens with a safe, efficient, and user-friendly financial ecosystem.

UPI Lite

UPI Lite is a streamlined and user-friendly version of the Unified Payments Interface (UPI) that offers a range of impressive features and benefits, catering to a broad spectrum of users across India.

One of its standout features is its simplicity. UPI Lite is designed to be incredibly easy to use, making digital payments accessible to even those with minimal technological know-how. This accessibility empowers individuals in rural areas and those less familiar with smartphones to participate in the digital economy seamlessly. With UPI Lite, transferring money or making payments is as straightforward as sending a text message.

One of the significant benefits of UPI Lite is its versatility. It supports many transactions, from person-to-person transfers to bill payments and online shopping. Users can effortlessly pay utility bills, recharge their mobile phones, or shop online without needing multiple apps or complicated procedures.

Additionally, UPI Lite maintains the same high-level security standards as the full-fledged UPI, ensuring that users’ financial data and transactions remain safe and protected. Whether you’re a tech-savvy urban dweller or someone from a remote village, UPI Lite bridges the gap, making digital payments an inclusive and efficient experience for all.

UPI Autopay

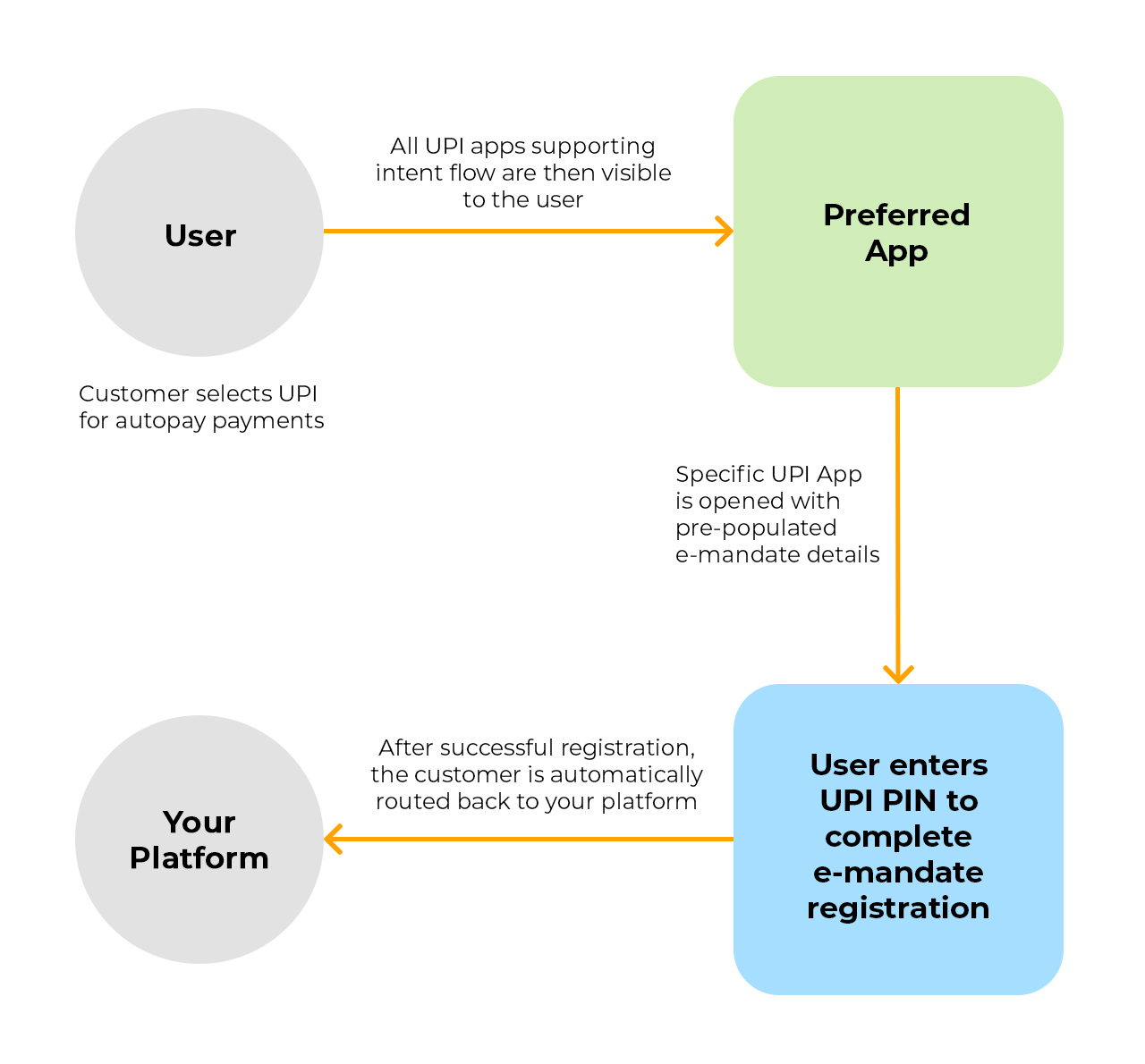

UPI Autopay is a simple and convenient feature that allows for automatic recurring payments directly from your bank account. It’s part of the Unified Payments Interface (UPI) system, widely used in India for digital transactions. With UPI AutoPay, you can set up recurring payments for various services like monthly bills, subscriptions, and EMIs (Equated Monthly Installments). Once you authorise a recurring payment, the specified amount is automatically debited from your account on the scheduled date, eliminating the need for manual payment each time. You don’t pay any transaction charges through Autopay, and being on the UPI platform, the failure probability is almost zero. It’s a hassle-free way to ensure your bills and subscriptions are paid on time, every time.

UPI for Businesses

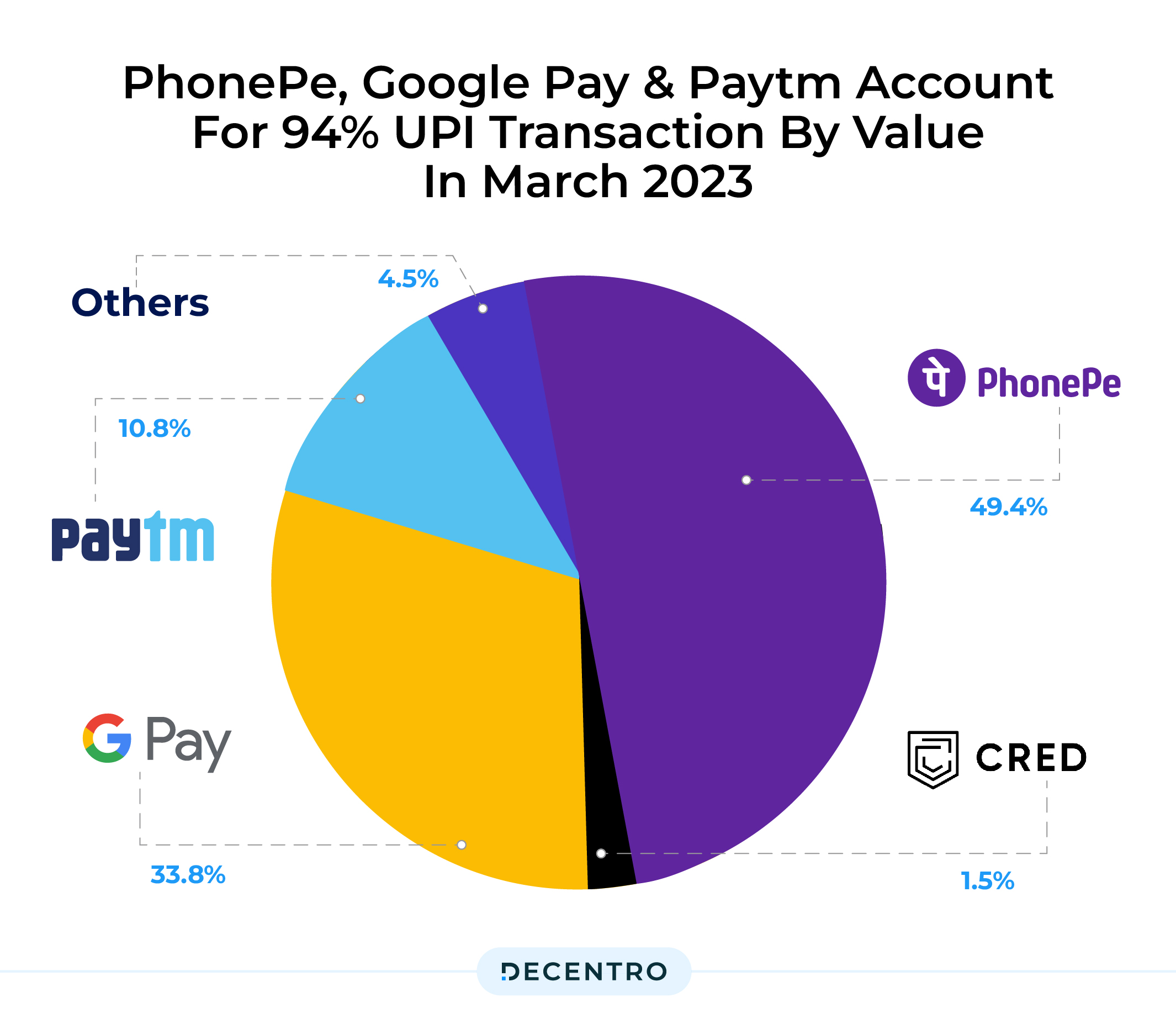

Understanding why your business should embrace UPI is crucial in today’s digital landscape. UPI has emerged as India’s undisputed champion of payment instruments thanks to its simplicity and widespread adoption. The process of taking out your phone, scanning a QR code, and making a payment couldn’t be easier. It’s no wonder that UPI has seen stratospheric growth. To harness the power of UPI, businesses can explore two main flows: UPI Collect and UPI Intent.

The UPI Collect flow is swift but vulnerable to human errors, as customers must manually input their Virtual Payment Address (VPA). On the other hand, UPI Intent eliminates the need for a VPA or QR code, offering a seamless App-to-App switch, reducing human errors, and providing better visibility over the transaction funnel.

In addition to these flows, businesses can benefit from In-App UPI payments, which offer exceptional customer experiences, higher conversion rates, and valuable customer insights. Moreover, leveraging QR codes, both static and dynamic, simplifies the process even further. UPI’s impressive success rates make it an attractive choice for businesses, but optimizing UPI Collect and UPI Intent flows can further enhance these rates, leading to smoother transactions and happier customers.

UPI also offers a range of benefits to businesses using it for payment processing:

- Rapid settlement: Rapid settlement cycles enabled by UPI help businesses maintain better cash flow. For early-stage and cash-intensive businesses, this can be a great advantage.

- Happy Customers: UPI doesn’t just help merchants; it also makes customers happy. The convenience and speed of UPI make customers satisfied, and they’re more likely to return for repeat business.

- Seamless Integration: UPI makes it easy for developers and tech-savvy merchants to integrate their platforms and offerings. Payment gateways and platforms offer APIs that allow a smooth connection of UPI services to online stores and apps.

- Reduced transaction costs: UPI offers reduced transaction costs to businesses compared to other payment modes like credit cards, debit cards, net banking, etc.

UPI’s platform has expanded its capabilities to support a whole range of use cases:

| UPI Feature | Use case |

| UPI Lite | Low-value transactions through a digital wallet |

| Rupay Credit Card on UPI | Credit cards on UPI |

| Cross-border payments | Cross-border transactions on UPI |

| UPI One World | Payment wallets for foreign nationals during G20 |

| NRE/NRI Accounts | NRIs/NREs from 10 countries can now make UPI transactions without an Indian mobile number |

| UPI Mandate | For recurring payments with a fixed frequency |

| UPI 123 | UPI on feature phones without an internet connection |

With its extended set of use cases, UPI can support completely new use cases across a number of industries:

- E-commerce

- Education/ Edtechs

- Software/ IT

- Retail

- Logistics

- Insurance

- Travel

- Utilities

- Non-profit organisations

UPI goes global

In recent weeks, UPI has welcomed three new countries to its user base – France, the United Arab Emirates, and Sri Lanka. This development opens up UPI in Europe and strengthens economic ties with Sri Lanka and the UAE.

Benefits of UPI’s International Acceptance:

- Indian travellers can seamlessly use UPI for foreign transactions, especially in France.

- UPI’s global presence enhances bilateral trade and tourism. It streamlines cross-border transactions, ensuring swift and secure settlements.

- Businesses can focus on building solid global relationships and expanding their reach. UPI’s introduction benefits Indian small and medium businesses, especially those engaging with France.

Looking Ahead:

Observers foresee promising growth for UPI, which constitutes 75% of India’s digital transactions. Projections suggest a four-fold increase by 2026, with UPI potentially making up 90% of retail digital payments in India. The global expansion holds immense potential, given the substantial overseas spending by Indians, which contributes significantly to India’s economic growth.

Challenges and Opportunities:

While UPI faces stiff competition from established global players like Visa and Mastercard, overcoming these challenges requires collaboration. UPI stakeholders are urged to work closely with global payment system providers and regulators to ensure compliance with local standards and regulations. This collaboration will be crucial in adapting UPI’s technology to the Western world’s broader customer base and addressing initial cost and regulatory challenges.

In conclusion, UPI’s global journey signifies a promising future with the potential to reshape India’s economic landscape on the international stage.

Decentro’s APIs for UPI Payments

With Decentro, you can now build a robust payment infrastructure for your business to facilitate collections, enable instant payments, authenticate VPAs, provide QR payments, and more. Decentro’s UPI Collections brings you a number of features that can add a lot of value to your existing payment stack:

Enable quick digital payments: Generate custom UPI IDs for your customers, merchants, and partners, and kickstart hassle-free payouts all across the country without any pesky settlement delays or waiting periods for the recipients.

Set up UPI intent flows: Set up the UPI intent flow on your platform to give your customers a super-smooth payment experience. Let them choose their favourite UPI app, pre-fill payment info, and wrap up the transaction in one shot. Alternatively, share static or dynamic QR codes linked to UPI IDs for hassle-free offline collections.

Set up recurring payments: Let your customers set up autopay for their subscriptions in a snap, whether it’s from their accounts or wallets. And hey, if you’re running a retail or e-commerce gig, you can also use Split Payments APIs to effortlessly split and settle funds from one customer to several vendors or sellers simultaneously. No more fuss!

Decentro’s UPI APIs can offer your business a range of benefits:

- White-label UPI IDs to reflect your branding with customers, partners, or vendors.

- Set up your payment vertical within weeks and not months. And, at 90%, reduced overheads!

- Save on the hefty fees you otherwise have to pay payment gateways for each transaction.

- Leverage multi-bank architecture in the backend so unexpected downtimes, black swan events, or volume spikes will never adversely affect your business.

- Track all transaction details in a dedicated dashboard for your business. Visit the ledger page with reconciled payments and peruse data.

- Leverage Conversational Banking & social payments via any messaging platform(such as WhatsApp) to onboard users via KYC & CKYC in real-time, request payments and disburse.

Feel free to access our documentation: API Documentation

Closing thoughts

The United Payments Interface (UPI) has emerged as a transformative force in the financial landscape since its inception in 2016. As of October 2023, UPI’s remarkable surge to 17.16 lakh crores and 11.41 billion transactions showcases its pivotal role in shaping India’s digital transactions.

Our exploration into the intricacies of UPI revealed its foundational role in the vision set by the RBI back in 2012, emphasizing a commitment to building a secure and inclusive payment system. UPI’s mobile-first approach and simplicity have successfully maximized financial inclusion, especially for underbanked citizens, making it one of India’s most successful deep-tech financial innovations.

The global expansion of UPI into France, the United Arab Emirates, and Sri Lanka reflects its growing influence beyond India’s borders. While challenges exist, including competition with established global players, collaboration with stakeholders and regulatory compliance is key to overcoming them.

In conclusion, UPI’s journey has been remarkable, contributing significantly to India’s digital transactions and poised for further growth. The prospect of becoming a dominant player in global digital payments underscores its potential to reshape India’s economic landscape on the international stage. Decentro’s UPI APIs provide a white-label solution, enabling businesses to reflect their branding, set up payment verticals efficiently, and navigate the evolving digital payment landscape seamlessly. As we continue to witness UPI’s evolution, its impact on financial inclusion and digital innovation remains a testament to its enduring power in unified payment systems.

Are you ready to explore 5X reduced payment collection costs for your business?

Frequently Asked Questions

UPI, or Unified Payments Interface, is a digital payment system in India that allows instant money transfer between bank accounts through a mobile platform. It works by linking your bank account to a UPI-enabled app, like BHIM, Google Pay, or Paytm. Once linked, you can make or receive payments using a UPI ID or QR code. Transactions are completed in real-time, and you only need the recipient’s UPI ID, avoiding the need to share bank account details. UPI is known for its ease of use, speed, and security.

In contrast to typical UPI transactions that require your bank account, payments made using UPI wallets don’t need you to link a bank account. However, this UPI wallet feature is not available in all UPI applications. Currently, UPI apps such as Paytm, PhonePe, and Amazon Pay provide the functionality of a UPI wallet, allowing for more flexible payment options.

To integrate UPI into your app, you’ll need to collaborate with a payment gateway provider that supports UPI transactions. Start by choosing a provider and signing up for their services. They’ll give you an API (Application Programming Interface) or SDK (Software Development Kit) to integrate into your app. Follow the documentation provided to implement UPI payment options, ensuring you comply with regulatory standards and security protocols. Once integrated, users can make payments through your app using their UPI IDs.

To automate UPI payments, use the UPI AutoPay feature available in many UPI apps. First, select the service you want to automate payments for, such as utility bills or subscriptions. Then, set up a recurring payment by choosing the amount and the frequency (like monthly or yearly). Confirm the transaction with your UPI PIN. Your payments will then be automatically debited from your linked bank account on the scheduled dates, ensuring timely and hassle-free payments.