From rapid expansion to enterprise depth, explore how Decentro strengthened fintech infrastructure and earned long-term trust in 2025.

Rewind 2025: How Decentro Became Core Infrastructure for Enterprises

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

Every transformative year reveals itself not in what you chase, but in what you choose to master.

2024 was our expansion year. Moving fast, testing boundaries, building momentum across every possible front. We said yes to opportunities, experimented aggressively, and proved we could scale.

2025 was different. This was the year we chose depth over velocity. The year enterprise relationships matured into genuine partnerships. The year our infrastructure faced its most demanding stress tests and emerged stronger. The numbers from this year tell a powerful story. But the journey behind them reveals something more profound: what it actually takes to build fintech infrastructure that India’s enterprises bet their core operations on.

The Strategic Shift: From Novelty to Volume

The most consequential decision we made in early 2025 was deceptively simple: Start building relationships worth defending.

Our new operating principle became crystalline: Intent-driven perusal of enterprise customers. Make each one wildly successful. Document measurable outcomes with authentic case studies and video testimonials. Use those proof points to accelerate the next partnership. Then compound the results.

This wasn’t a theoretical framework. It was a daily discipline that every team internalised. Sales conversations transformed from feature demonstrations to outcome-focused partnerships. Product roadmaps prioritised depth in existing capabilities over breadth in new announcements. Marketing shifted from awareness metrics to conversion quality.

The market validated this approach immediately. Enterprise buyers don’t want the newest features. No no. These seasoned players want reliable infrastructure backed by verifiable success stories from peers they respect.

That strategic clarity guided everything that followed.

The Numbers: Growth That Validates Our Thesis

Let me share the quantitative story of 2025:

- ₹1.09 Lakh Crores ($13+ billion) processed through our platform. Representing 118% year-over-year growth. To put that in perspective: we now process more in a single quarter than we handled in all of 2023.

- 8 Million+ identity verifications executed monthly. Every sixty seconds, our systems validate identities, verify credentials, and prevent fraud for businesses across financial services, lending, insurance, and emerging digital sectors.

- 99%+ API success rates maintained across all payment modes. When transactions flow through platforms powered by Decentro, they succeed. Consistently. Reliably. This isn’t aspirational engineering; it’s the operational foundation that earns enterprise trust.

- 320 Million+ API calls processed on average per month with 99%+ uptime. Financial infrastructure must deliver 24/7/365, through peak loads, system updates, and partner bank maintenance windows.

Behind these metrics lives a team that rebuilt integrations when “good enough” wasn’t sufficient. Engineers who optimised systems that most users will never consciously notice. Product managers who said “no” to distractions and “yes” to what genuinely mattered for customer outcomes.

Exponential growth has strict requirements. In 2025, we met them all.

The Enterprise Breakthrough: Where Strategy Met Execution

2025 was an eye-opener when it came to enterprise sales cycles.

Not the spray-and-pray approach of talking to everyone, but a focused, strategic, relentless pursuit of customers willing to stake their core operations on our infrastructure. The kind of customers whose due diligence processes take months, whose security requirements seem impossible, whose scale demands architecture that most teams spend years building.

The sales motion transformed entirely. Where 2024 conversations centred on capabilities—”Here’s our API documentation, here’s our feature list”—2025 conversations led with outcomes: “Here’s how Company X reduced payments costs by 40% and cut onboarding times by 60% after partnering with us.“

Average sales cycles extended to several months, longer than our initial projections. But contract values, integration depth, and relationship quality validated the patient approach. It was crystal clear that we’re not just processing transactions for these enterprises. We’re powering their core money movement, identity verification, and compliance infrastructure.

The 2026 pipeline reflects this shift: qualified inbound from banking institutions, large-scale fintech platforms, and enterprise sectors that were previously unreachable. Segments where credibility isn’t claimed, it’s earned through years of reliable delivery.

Flow: Payment Infrastructure That Powers India’s Digital Economy

Processing ₹1.09 Lakh Crores annually requires infrastructure that most companies spend half a decade building. We built it, stress-tested it, and scaled it—all while maintaining industry-leading reliability.

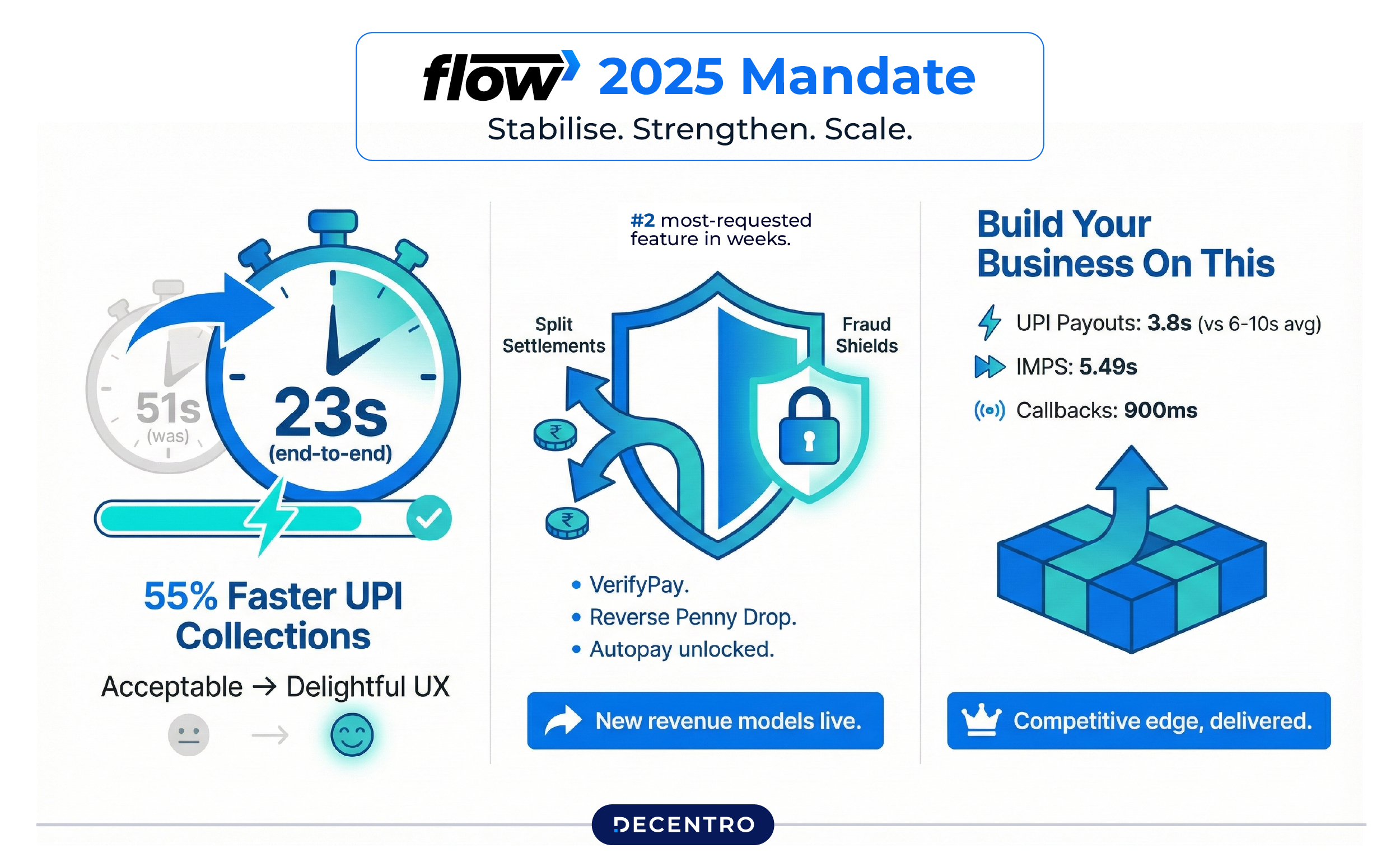

From a product perspective, 2025 became our “stabilise and strengthen” mandate. After the aggressive launch cadence of 2024, we faced technical debt to address, performance ceilings to break, and operational excellence to systematise.

Breakthrough Achievements

Payment processing times slashed by 55%: UPI collections now complete in 23 seconds end-to-end, down from 51 seconds. In user experience terms, that’s the difference between acceptable and delightful.

Split Settlements launched to immediate market demand, becoming our #2 most-requested feature within weeks. Marketplaces, platforms, and aggregators needed this capability—we delivered it with the reliability they require.

VerifyPay and Reverse Penny Drop are deployed as fraud prevention layers. In the fight against payment fraud, these verification mechanisms provide real-time protection while maintaining a seamless user experience.

Autopay, with first payment/down payment functionality unlocked, enabled entirely new subscription business models for our customers. A seemingly small feature that creates substantial new revenue opportunities.

Performance That Differentiates

The benchmarks that earn enterprise trust:

- UPI Payouts: 3.8 seconds (industry average: 6-10 seconds)

- IMPS Transfers: 5.49 seconds

- Settlement Callbacks: 900 milliseconds

This isn’t “fast for fintech.” This is “build your most critical workflows on this” fast. This is the performance level where infrastructure becomes a competitive advantage for our customers.

Fabric: The Identity Infrastructure India Relies On

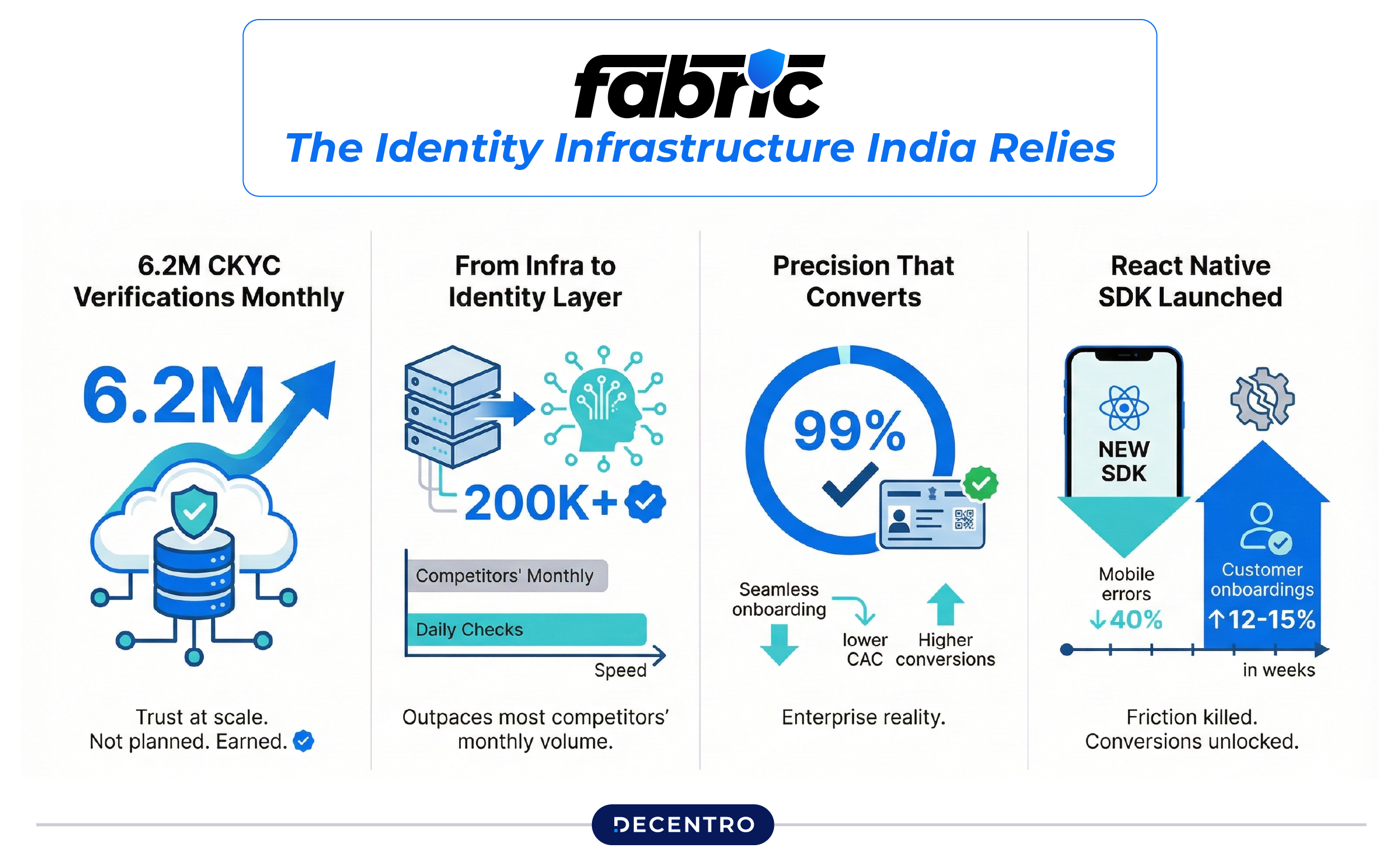

6.2 Million CKYC verifications processed monthly. That volume represents trust at scale.

We didn’t initially position Decentro as a verification specialist—we’re a comprehensive fintech infrastructure platform. But technical excellence and market demand converged: Fabric evolved into the identity layer that India’s digital economy increasingly relies on.

200,000+ daily CKYC checks. More verification volume than most competitors process in an entire month.

99% first-attempt PAN validation success rate. Seamless onboarding flows directly impact customer acquisition costs and conversion rates.

The breakthrough moment? When our engineering team shipped the React Native SDK for mobile, onboarding error rates dropped 40%. Removing friction doesn’t just improve experience—it directly increases conversion. Our customers saw 12-15% gains in completed onboardings within weeks of implementation.

Capabilities That Scale

2025 identity infrastructure expansions included:

- React Native SDK is reducing mobile verification errors by 40%

- Native Digilocker SDK with advanced Aadhaar processing capabilities

- Beacon service for automated MCA + GSTIN reporting (50% reduction in manual compliance work)

- Bulk SFTP operations enabling high-volume onboarding for large enterprises

- Expanded employment verification supporting CIN, LLPIN, FLLPIN, FCRN

Each enhancement serves one purpose: making identity verification invisible to end users while bulletproof for businesses.

The Technical Foundation That Enables Everything

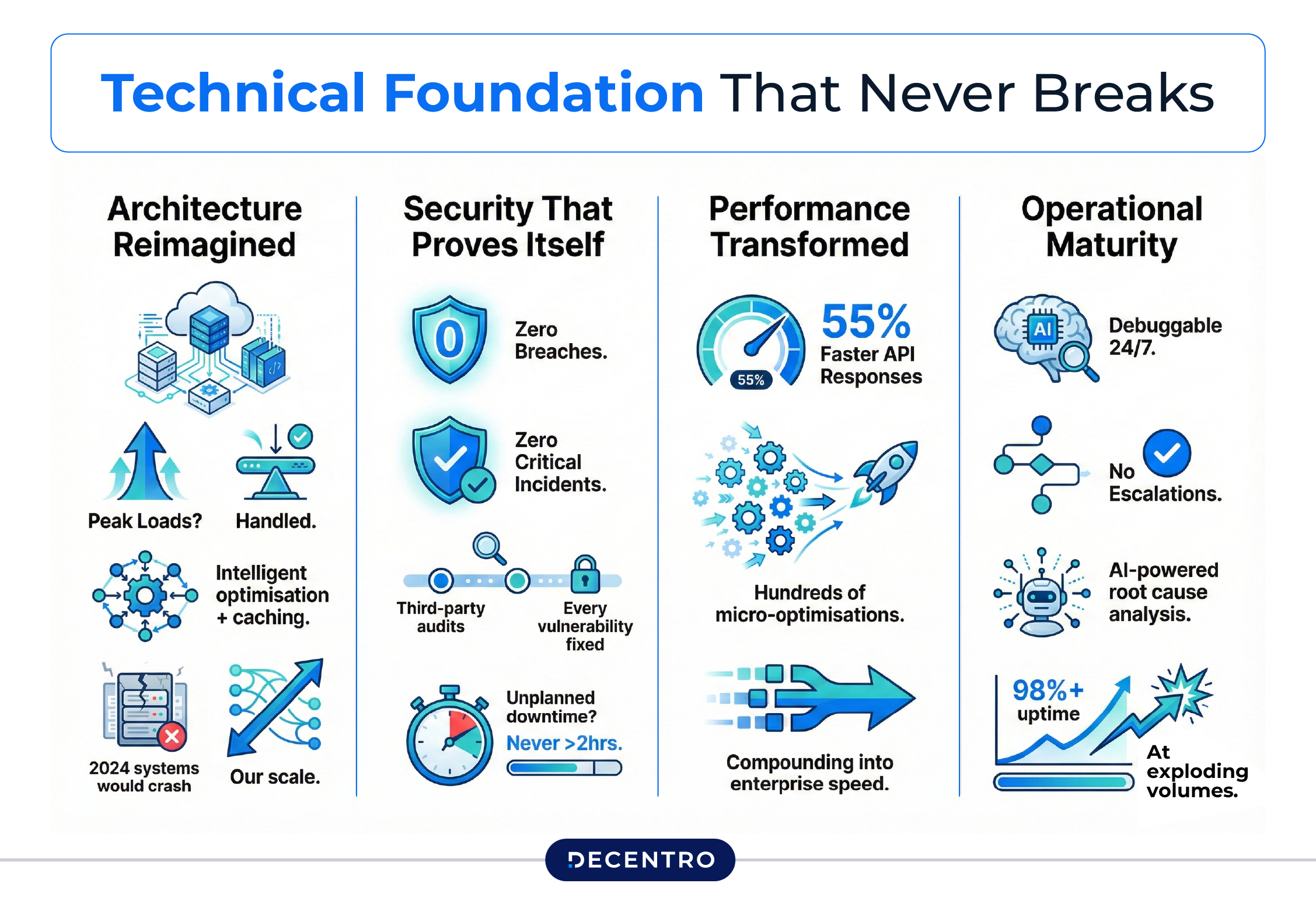

From an engineering perspective, 2025 was our year of building infrastructure that scales without compromise.

Architecture rebuilt to handle peak transaction loads that would have crashed our 2024 systems. Not through brute-force scaling, but through intelligent optimisation, caching strategies, and architectural decisions that compound efficiency.

Advanced security measures were implemented following comprehensive third-party audits. Every vulnerability identified, addressed, and strengthened. The result: zero data breaches, zero critical incidents, zero unplanned downtime exceeding two hours.

API response times improved 55% through systematic optimisation. Hundreds of small improvements that compound into transformative performance gains.

But our proudest achievement? Engineering systems that are debuggable at any hour without full-team escalation. That operational maturity—not just algorithmic sophistication—explains how we maintain 98%+ uptime while processing exponentially growing volume. This also comes from AI based root cause analysis on our systems.

Infrastructure Wins That Matter

- 2X improvement in turnaround times through intelligent optimisation

- No-code workflow tools which reduce the workload on repeated tasks

- AI-powered code reviews catch issues before production

- 100+ sustained average TPS without system strain

These aren’t features that generate applause at conferences. They’re the foundation that makes every customer-facing capability possible. This is what enterprises actually pay for—reliability you forget about because it just works.

Marketing Excellence: The Voice Behind Growth

Our marketing team delivered something remarkable in 2025: precision over volume, value over vanity metrics.

354,000 new users acquired, with 143,000 in Q4 alone, showing accelerating growth, not just linear expansion.

1,821 MQLs generated in Q2 FY26 (+111% growth), our strongest pipeline quarter ever, driven by content that actually converts.

250% QoQ increase from AI search platforms—while others worried about AI disrupting traditional search, we leaned in aggressively. As developers ask ChatGPT and Perplexity about payment infrastructure, Decentro increasingly becomes the recommended answer.

165% QoQ growth in global user acquisition—international expansion isn’t theoretical, it’s measurable and accelerating.

The Content Strategy That Converted

We created high-intent educational blogs that became the go-to resource for developers and decision-makers evaluating fintech infrastructure. Not promotional content, but genuinely helpful technical documentation and implementation guides.

The content strategy shifted from volume to value: every piece needed to either educate, convert, or accelerate deals. No vanity publishing.

SEO That Dominated

Our SEO strategy delivered top positions for high-intent keywords:

- “UPI API” – Rank 5.4

- “Best app to invest in gold” – Rank 2.9

- “Debt collection platform” – Rank 4

The results: 148% surge in organic traffic and 140% increase in new users. Organic search became a primary driver of qualified traffic, proving that technical SEO and content strategy compound over time.

Campaigns That Built Identity

From #TestimonialTuesdays and #PickMe to #DecentroDirectory, #DemoDives, and #DecentroDigest—our campaigns didn’t just create noise, they built brand identity and earned trust.

39% open rates on outbound campaigns. A 20,000-strong LinkedIn community. 17,000 newsletter subscribers who actually read what we send.

These aren’t vanity metrics. They’re proof that when you focus on delivering value, audiences respond.

Lessons From The Journey: What Success Taught Us

Every achievement offers insights. Here’s what 2025 revealed:

Enterprise trust compounds exponentially. Banks don’t route ₹500 crores through new platforms after impressive demos. They partner after months of questions answered, systems tested, and reliability proven under real-world conditions. That patient approach builds relationships measured in years, not quarters.

Ship and show convert better. One detailed success story, an extensive release note with verified metrics, outperforms dozens of capability matrices. When prospects see that Company X achieved Y result with Z% improvement, the conversation transforms from “Can you do this?” to “When can we start?”

Strategic product development beats feature velocity. We shipped thoughtfully in 2025, focusing on adoption and impact over announcement volume. This discipline, measuring success by customer outcomes rather than release notes, proved transformative.

Excellence in fundamentals enables ambitious growth. Our obsessive focus on reliability, uptime, and operational excellence created the foundation for exponential scaling. You can’t add complexity on shaky ground—but you can build empires on solid infrastructure.

The Year’s Defining Moments

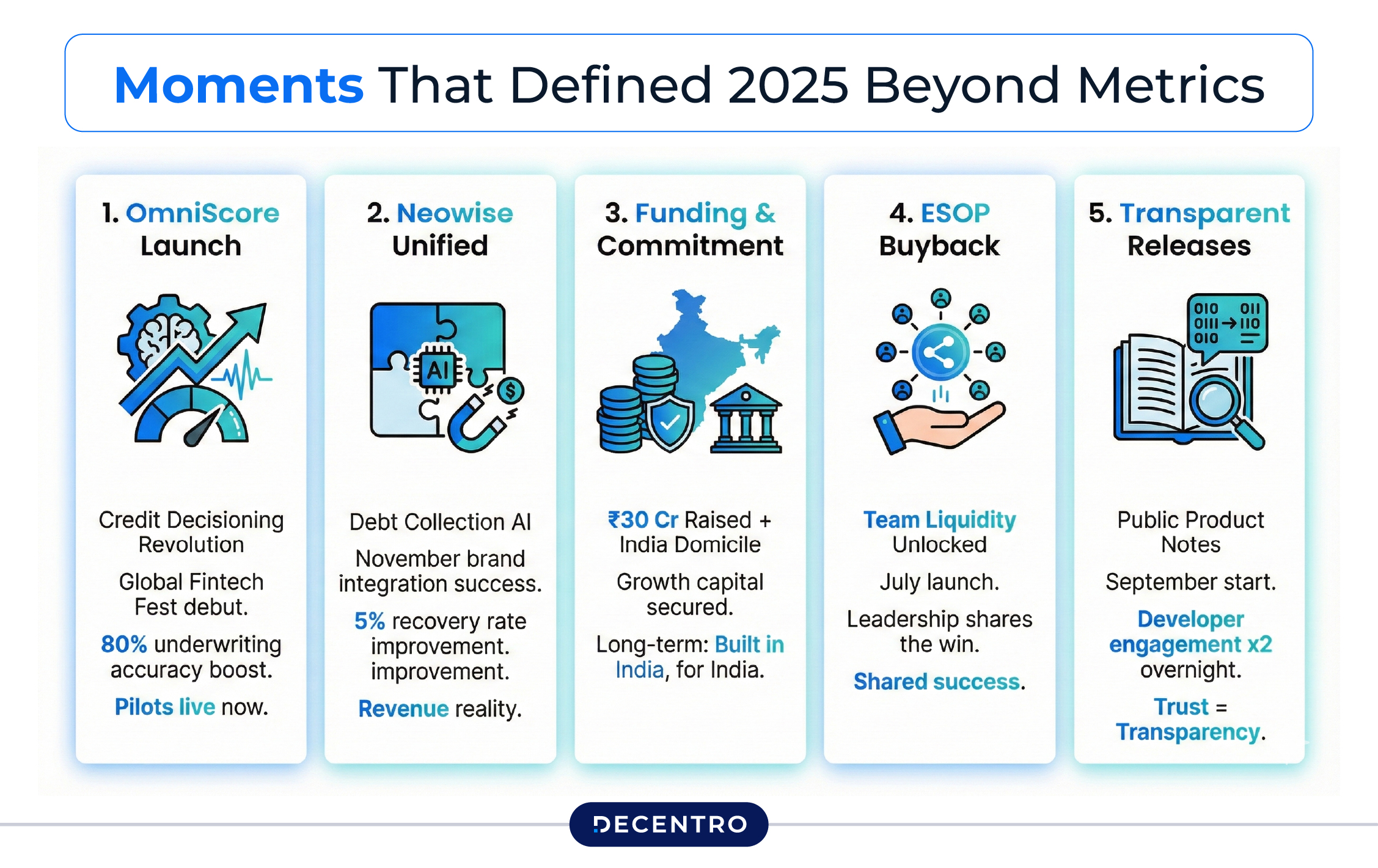

Some achievements transcend quarterly metrics:

OmniScore’s Market Debut: Previewed in May, officially launched at the Global Fintech Festival in October. Now piloting with multiple customers for credit decisioning, showing 80% improvement in underwriting accuracy for alternative data segments. This represents our bet on the future of credit assessment in India.

Neowise Integration Success: Our debt collection stack unified under Decentro in November. The AI-powered conversational bot demonstrates 5% improvement in recovery rates, a significant impact in an industry where single-digit improvements translate to substantial revenue.

Strategic Funding & Market Validation: ₹30 crores raised in June provided growth capital, but the decision to shift our domicile to India sent a stronger signal: Decentro’s long-term commitment to building India’s financial infrastructure from India.

ESOP Buyback Program: Launched in July, creating liquidity for team members who built this company. Leadership walking the talk on shared success.

Transparent Release Notes: Started publishing detailed product updates publicly in September. Developer community engagement doubled overnight. Transparency builds trust, full stop.

The 2026 Vision: Building On Solid Foundations

The opportunities ahead are substantial, but our approach remains disciplined:

The Trust Economy Thesis Advances: OmniScore embodies our belief that traditional credit scoring leaves massive opportunities untapped. Alternate data, behavioural signals, and real-time verification enable better lending decisions. This thesis will receive aggressive investment in 2026.

Enterprise Stack Completion: We excel at payments and identity verification. Enterprise customers increasingly want comprehensive solutions. 2026 expands our capabilities, either through internal development or strategic partnership, into the adjacent infrastructure needs our customers repeatedly request.

Scaling With Grace: Can 99%+ uptime persist as transaction volume triples? Can support quality remain exceptional with 50 enterprise customers instead of 15? These aren’t theoretical questions—they’re 2026’s operational imperatives. And the foundation we built in 2025 makes them achievable.

Marketing Evolution: Progressing from attention generation to pipeline development to ROI demonstration. Better attribution, tighter sales alignment, and obsessive focus on the metrics that actually drive business outcomes.

The Real Ambition: Infrastructure That Disappears

The ultimate goal for 2026 isn’t louder marketing or flashier features.

It’s becoming so reliable, so consistent, so deeply integrated into our customers’ operations that they stop thinking about the infrastructure layer. They simply build on it. They trust it implicitly. They recommend it without hesitation.

The best infrastructure becomes invisible. It just works, every single time, without drama or escalation. That’s the company we’re building. Not the loudest fintech, not the one chasing trends or raising the biggest rounds. The platform that India’s enterprises trust with billions in transactions and millions of customer identities.

2025 proved we can deliver that promise at scale. 2026 is about proving we can do it at 10x the scale, with the same excellence, reliability, and obsessive commitment to our customers’ success.

Here’s to the next chapter of infrastructure that transforms possibility into reality.

Rohit Taneja

CEO & Co-founder, Decentro

December 2025