Looking to build a Neobank? Avoid the pointers in this blog and you’ll have an easier time building & launching your neobank in the market.

Things to Look Out for When Building a Neobank in 2024

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

600 Mn digitally active consumers.

The number that organizations and innovators alike are catering to in terms of opting for the digital-first method. This large market has seen its maximum takers in banking and payment infrastructure. The players in this space are completely transforming their business use cases to make them more accessible to the masses.

On top of the acceleration that COVID-19 brought in adopting the digital-first methods, this has completely transformed the traditional banking world. It has created an opportunity to innovate, and almost all conventional banks supplemented their brick-and-mortar branches with sophisticated, built-for-customers digital versions of their services.

Taking this step further, we have Neobanks, fully operational digital-only banks with advanced features.

These Neobanks are challenging the present status of traditional banks by offering lower-cost models and hyper-distinctive customer-centric service and experiences. The convenience of opening and operating accounts, seamless payments, transfer and remittance solutions, and alternative methods for assessing creditworthiness are some features that attract the masses to Neobanks.

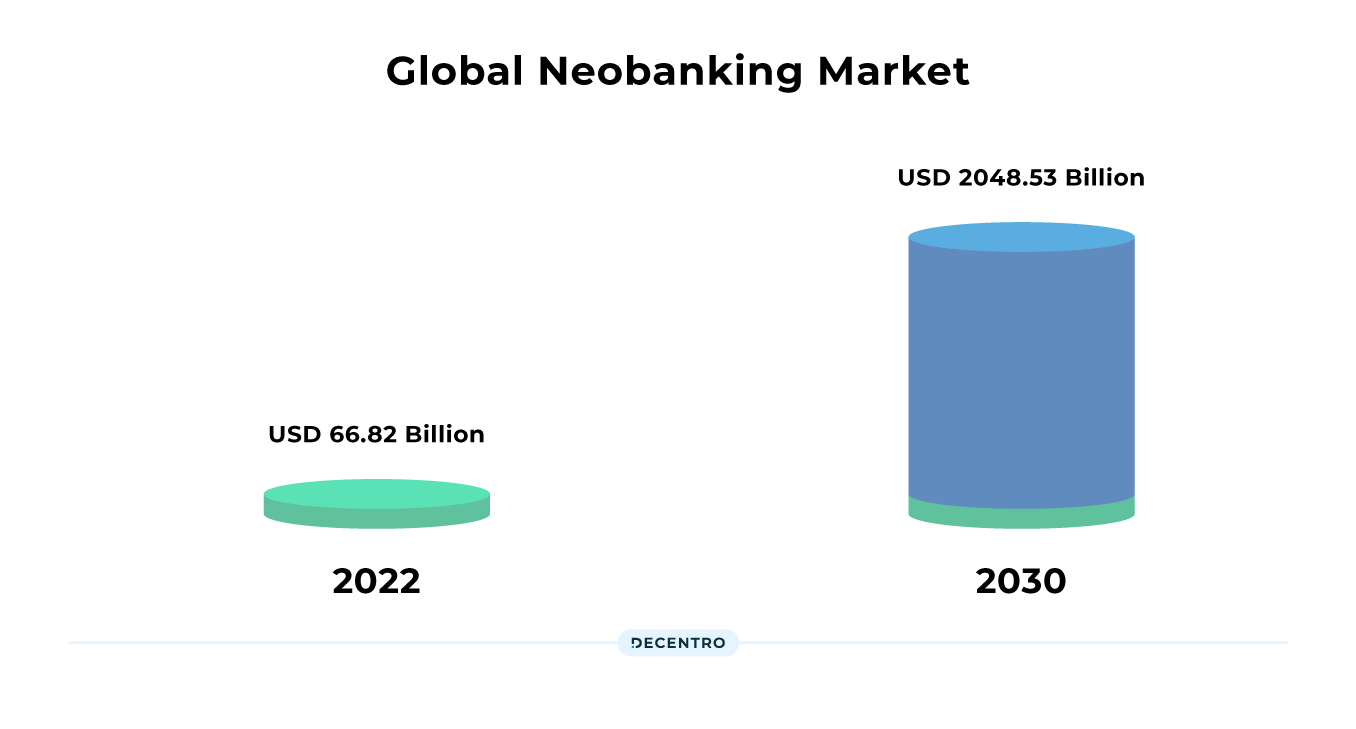

According to statistics, the worldwide neo-banking industry was worth $66.82 billion in 2022 and is expected to rise at a staggering 53.4 percent CAGR from 2022 to 2030.

As the third largest fintech ecosystem in the world after the US and China, the Indian fintech market is poised for further disruption with the emergence of Neobanks.

With a playing field so ready for disruption, There’s no shortage of content when it comes to figuring out the best practices that can come

handy while building your Neobank.

One Google search and your browser will be inundated with the following headlines.

- What are the best security practices for Neobanks

- How to Create a Neobank from Scratch in 2024

- How to Build a Neobank that stands out

- How to start a Neobank and succeed in the Fintech industry

- A step-by-step guide on how to create a Neobank

In a world where we are spoiled for choices, let us be your guiding light in determining precisely what would not work for your offering.

The red flags, if you may.

So here is a list of things you should avoid while building your Neobanking App.

Having only one banking partner

Currently, Neobanks are not permitted to have their banking license. Now, RBI allows Neobanks to collaborate with licensed banks or financial institutions and offer products.

Now, one of the critical reasons for the high growth trajectory of Neobanks is that it is tapping the vast, underserved market segment of financially excluded, tech-savvy consumers. To cater to a demographic inclusive of small business owners, college students, young adults, and low-income groups, there is a certain amount of flexibility that is needed from the solution.

Rather than getting locked in with a traditional bank, why not leverage a fintech solution that takes care of that aspect on your behalf? With Banking as a Service (BaaS) providers taking on the licensing workload and cracking partnerships with multiple banks, the Neobanks can tap into their trusted network of banking partners. This takes a substantial amount of regulatory stress off the Neobanks plates.

This regulatory bypass accelerates product launch and enables a single mind to focus on the problem statement, paving the way for efficient solutions.

Building your own APIs

APIs sit at the core of your Neobank, and while developing them from scratch may allow you what you think is end-to-end control, most of the time, outsourcing them to a BaaS provider becomes more efficient. Also, as India’s regulations do not permit 100% digital banks, API banking is the only way to implement this.

With the custom model heavy on capital investment, a significant chunk of your manpower is invested in this activity. Also, you would concentrate on only a given service at a given time. Having a BaaS partner is a gateway to a broader range of financial services by tapping into a host of their capabilities. From KYC APIs, end to end lending solutions, one BaaS provider can help you with multiple use cases.

With Neobanks, the differentiator lies in market engagement and retention of customers using innovative strategies. To concentrate on figuring out how to cater to the unserved segment, it is better to let a platform like Decentro take that API load off you. This decision will catapult your go-to-market speed to the next level with lower investment in time and effort.

Additionally, looking for APIs that allow you to integrate the platform into your existing systems is imperative. Chunky, expensive, or hard-to-maintain customization should be avoided at all costs.

Hosting on your servers

The cloud has been a significant enabler of Neobanks’ success, giving developers an agile environment to develop, test and deploy new services quickly and an effortless user experience. Instead of managing in-house servers, many fintech developers now rely on simple and efficient cloud platforms, such as React JS hosting, to quickly deploy applications without the hassle of server maintenance. Hosting the entire workings on an in-house server acts as a burden with maintaining the records via a datacentre to staying on top of security patches and compliance changes falling entirely on the Neobank. To top it off, there is a need to remain relevant regarding new developments on the cloud, which adds stress to the in-house team working on the same.

In such a case working with a fintech hosting provider can help create an environment for a Neobank configured to its specifications but with the cloud’s cornerstone flexibility to expand or reduce digital banking infrastructure as needed.

By working with a bespoke hosting partner to create your desired environment, you get precisely what you pay for. From helping lower the operation cost, a fintech hosting provider is also an excellent option to create a decentralized, hybrid infrastructure.

A bespoke hosting partner offering low-cost, scalable services may seem too good to be true, but it can be your Neobank’s gateway for a faster go-to-market strategy.

Being a slave to your Tech

The sweet spot for full-stack Neobanks when it comes to technology is a banking system that is flexible enough to allow for agile technology development at the speed of innovation. Here, working with a BaaS partner is the right option as these service providers can be the extended tech team for the Neobank, helping them solve last-mile challenges, and keep up with changing regulations.

Whether it is around-the-clock support, string data protection, or effective compliance measure, these third-party providers come with the promise of delivering seamless service and getting the seal of approval from regulators.

As Asia’s top fintech hub with 87% fintech adoption, India is one of the forerunners in the Neobanking revolution. Still, it gets plagued with the question of its sustainability in the longer run. Although Neobanks are gathering momentum, most are yet to show sustained profitability.

Unlike their traditional counterparts, Neobanks aren’t constrained by legacy systems, tightly integrated value chains, complex administrative structures, and high regulatory requirements. These challenger banks operate on a low-cost model with minimal to zero monthly fees on deposits and withdrawals and rock-bottom balance conditions. These drivers bring consumers and businesses across income levels into the fintech fold, fostering financial inclusion. This play promises longevity for Neobanks in the fintech ecosystem.

Are you a Neobank looking to spread your wings and kick-start growth in this evolving sector? Or, are you an existing Neobank who wishes to expand services & product offerings to your clients? We can help!

Decentro’s simple plug-and-play banking APIs help Neobanks such as yours to perform any banking operations efficiently on your platform and enable the same for your customers, partners, and vendors.

- Create accounts in real-time.

- Verify all users and onboard them in real time with our KYC APIs,

- Simplify your collections via UPI,

- Enable instant fund settlements,

- Reconcile all payments in real-time with virtual accounts and wallets.

We have enabled the same for our beloved customers FamPay, NorthLoop, OcareNeo, Freo by MoneyTap, and Mewt and, in turn, provide a superior experience to their customers, partners, and merchants.

In just a matter of two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Intrigued? Check out our APIs for Neobanks, along with the listicle of the top and upcoming Neobanking apps of 2024.

Put your Neobanking-wheels in motion with Decentro.

Frequently Asked Questions

A Neobank is an entity that provides banking services to customers. Since Neobanks in India have not yet been issued banking licenses by the Reserve Bank of India, they offer services in collaboration with a licensed bank.

No, Neobanks in India cannot accept deposits or offer any loans on their own. Accepting deposits and lending are reserved for entities with a banking license. Since Neobanks do not have a banking license, they can neither accept deposits nor issue loans on their books.

Neobanks offer several financial services digitally through collaborations with licensed banks in the country. They leverage technology, innovation, and a low-cost operational model to provide high-quality and personalized services to customers.

The following factors act as roadblocks for Neobanks

1. Regulatory challenges

2. Lack of funding

3. Technological challenges

4. Limited awareness and lack of trust

5. Competition with established banks and financial institutions

Neobanks are digital-only banks that operate without any physical branches or legacy systems.

Digital banks are traditional banks that have added digital channels to their services.

Both types of banks are regulated and offer financial services such as checking and savings accounts, loans, and debit cards.