From PAN verification to CKYC, FamApp used Decentro’s APIs to enhance compliance, reduce manual work, and scale seamlessly. Read the full case study here.

How FamApp Reduced Onboarding Time by 60% with Decentro

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Financial literacy is a critical life skill, yet a staggering four in five youths in the U.S. failed a financial literacy quiz, according to the FINRA Investor Education Foundation.

While schools and colleges focus on academic subjects, money management is often left out—until adulthood. FamApp is changing this narrative by empowering teenagers to manage money responsibly with India’s first UPI card for teens, supervised by parents.

But enabling seamless payments was just the beginning. As FamApp scaled, it faced new challenges in KYC verification and regulatory compliance—areas where Decentro’s APIs played a crucial role.

Where did we leave you?

FamPay started with a bold vision—to introduce financial literacy and responsible money management to teenagers through India’s first UPI and card for teens. Parents overseeing transactions taught teenagers the fundamentals of budgeting, saving, and spending wisely.

However, financial needs evolve beyond just spending. Transitioning from teens to young adults comes with new challenges—managing salaries, building credit, and making informed financial decisions. Recognising this, FamPay has now been rebranded as FamApp by Trio, expanding its scope to cater to a broader audience.

What’s New with FamApp by Trio?

Today, FamApp is no longer just about enabling teen payments—it’s a holistic financial ecosystem designed to help users save, spend, earn, and learn. The platform has evolved to provide:

- FamX Spending Account: A secure, rewards-driven account with cashback, discounts, and financial tools.

- Personalized FamX Cards: Numberless, customisable cards that ensure better security and personal branding.

- Educational Financial Tools: Resources that enhance financial literacy across all age groups.

This transformation required more than just an expansion of features—it demanded a robust financial infrastructure that could handle and scale compliance, security, and seamless onboarding. That’s where Decentro stepped in.

The Challenge: Scaling KYC & Compliance Without Friction

As FamPay transitioned into FamApp by Trio, its compliance and verification needs also scaled.

While our KYC APIs initially efficiently helped onboard teenagers and their parents, FamApp needed to go beyond verification and ensure full compliance. This led to leveraging Decentro’s CKYC (Central Know Your Customer) Upload API, which streamlined regulatory adherence.

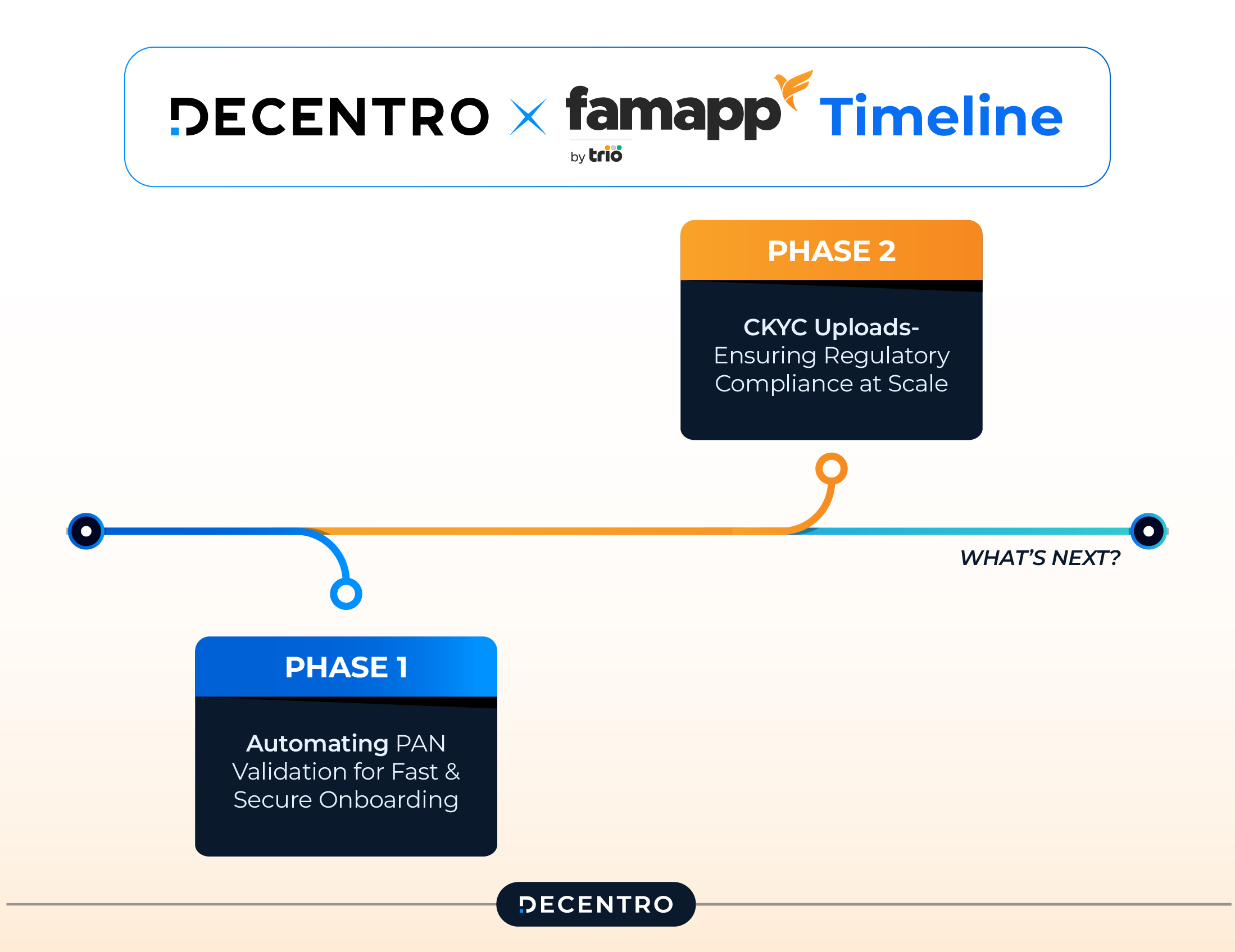

The Solution: From KYC to CKYC—Powered by Decentro

Phase 1: Automating PAN Validation for Fast & Secure Onboarding

With Decentro’s KYC API, FamApp was able to:

- Instantly validate PAN details against government databases, ensuring accuracy and compliance.

- Detect fraud in real time with AI-driven authentication, preventing identity theft.

- Reduce onboarding time by 60%, eliminating manual verifications and delays.

- Scale seamlessly, handling high traffic surges with Decentro’s load-balanced infrastructure.

Phase 2: CKYC Uploads—Ensuring Regulatory Compliance at Scale

As FamApp grew, compliance requirements evolved. CKYC uploads became mandatory to meet RBI’s evolving guidelines. Decentro’s CKYC Upload API enabled:

- Automated CKYC uploads to CERSAI, ensuring effortless regulatory adherence.

- Real-time borrower record creation & updates, maintaining data integrity.

- Seamless API integration, reducing implementation time by 10X.

- Embedded compliance workflows, eliminating manual inefficiencies.

The Impact: A Scalable & Compliant Onboarding Experience

From streamlining identity verification to ensuring compliance at scale, Decentro’s robust KYC stack has become the backbone of FamApp’s expansion—helping them onboard users faster, prevent fraud, and maintain seamless regulatory adherence. Speaking of this evolved partnership, Anchit Shukla from FamApp has the following to add,

“Our partnership with Decentro started with PAN verification at scale, ensuring smooth and efficient user onboarding. As we expanded, exploring other products like Digilocker and cKYC made the most sense and Decentro has been making that transition seamless. Their APIs have been a game-changer in ensuring compliance while allowing us to focus on what we do best—building the future of financial literacy.”

Anchit Shukla, Founding Team Member FamApp

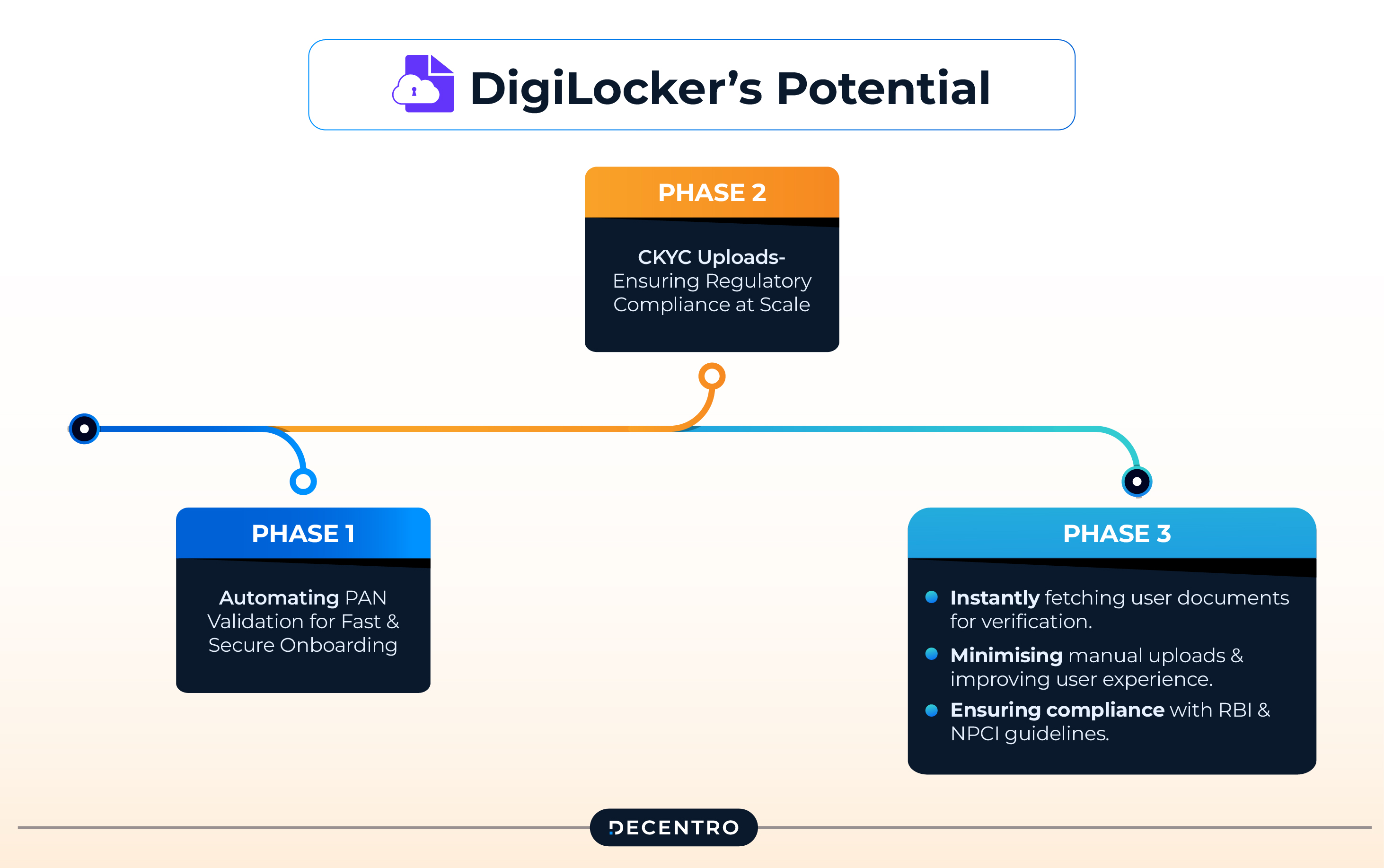

What’s Next? Unlocking DigiLocker’s Potential

To make onboarding even smoother, FamApp is exploring DigiLocker integration—further reducing friction by:

- Instantly fetching user documents for verification.

- Minimising manual uploads and improving user experience.

- Ensuring compliance with RBI & NPCI guidelines.

As FamApp continues to innovate, Decentro remains its trusted partner, ensuring compliance, scalability, and a frictionless experience for young users managing their finances.

Looking to Solve a Similar Challenge?

Decentro’s payments and banking stack is built to simplify compliance, onboarding, and payments—whether you’re a fintech startup, a lending platform, or a digital bank. With numbers as impressive as mentioned below, we remain an undisputed partner for our entire portfolio.

- 500+ Identity Verifications per Hour – Ensuring seamless onboarding with real-time verification.

- 250+ Image Recognitions per Hour – Enhancing fraud detection with AI-powered accuracy.

- 300+ Repository Fetches per Hour – Accelerating document validation and reducing manual errors.

If you’re facing friction in compliance or user verification, let’s fix that together. Drop us an email at hello@decentro.tech, and let’s build the future of finance!