An in-depth analysis of how Decentro is enabling CreditFair to provide instalment loans to every Indian with its CKYC & Banking APIs.

How Decentro is Enabling Credit Fair’s Vision of Fair Finance for Everyone

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

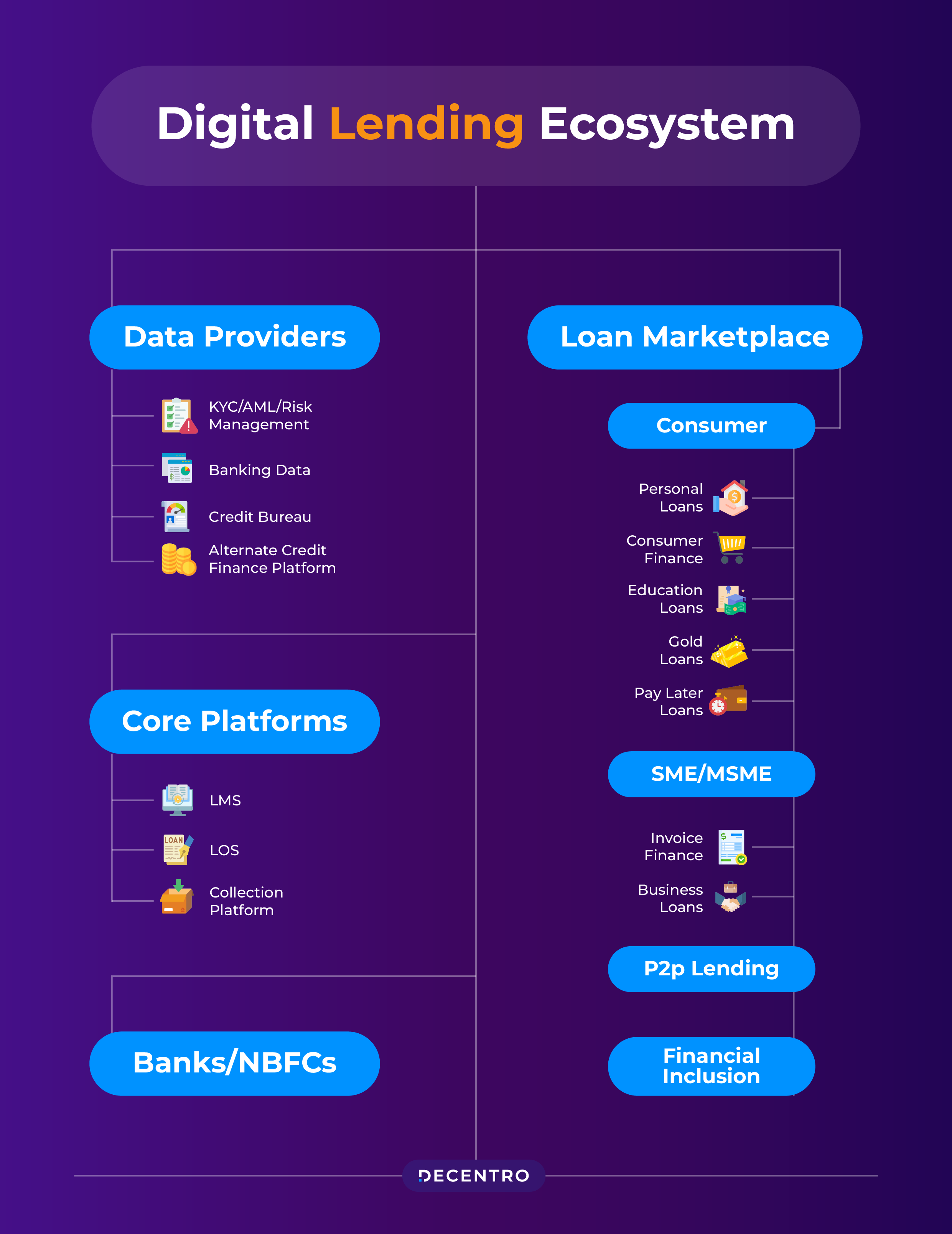

The Indian digital consumer lending market is projected to surpass $720 Bn by 2030, representing nearly 55% of the total $1.3 Tn+ digital lending market opportunity in the country, as per Inc42’s State Of Indian Fintech Report, Q3 2023 InFocus: Consumer Lending – Inc42 Media

Over the years, the proliferation of digital lending apps, simplified KYC validation, and streamlined repayment options have facilitated increased access to credit, leading to a surge in lending through digital channels.

Naturally, this segment has seen a new crop of startups looking to solve the needs of India’s diverse consumer lending landscape. Traditionally, formal credit was restricted to financial products like auto, home, and personal loans. However, in the last few years, banks, NBFCs, and other fintech companies have introduced new products to consumers by shifting their focus to credit cards, credit EMIs, and buy now pay later (BNPL) schemes.

One such startup is Credit Fair, which offers lending solutions and unsecured loan options at the point of sale to businesses and consumers at no or low cost. Today, let’s delve into how Credit Fair is looking to extend India’s access to the right amount of credit at the right price at the right time via the capabilities of Decentro’s APIs.

What is Credit Fair?

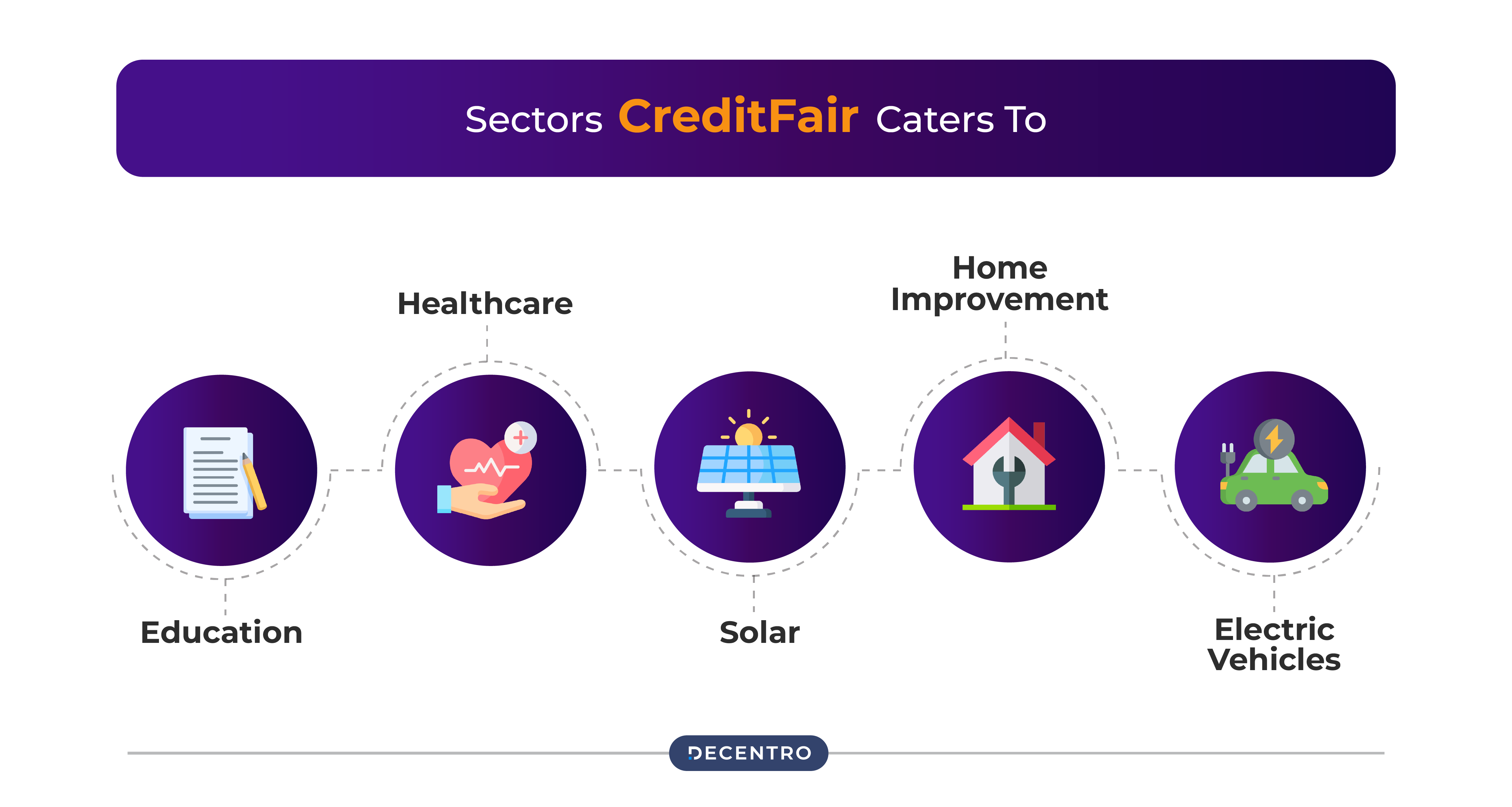

Founded in 2018, Credit Fair is a consumer lending fintech startup that offers lending solutions and unsecured loan options at the point of sale to businesses and consumers at no or low cost. With over 1000 partners and over 10,000 customers served across 80-plus cities, Credit Fair has been serving the underserved population of India with convenient credit solutions.

The organisation has begun its journey by offering installment loans in the following key sectors: Education, healthcare, solar, home improvement, and electric vehicles. It looks to grow its annual disbursement run rate to $360 million.

How Does Credit Fair Leverage Decentro’s APIs?

Credit Fair offers tech-driven and simplistic credit solutions to businesses and individuals and democratises credit for the underserved population category.

However, verifying users and claims before providing credit was crucial for Credit Fair to prevent fraud right at onboarding.

How did CreditFair achieve this?

To connect with various financial institutions such as CERSAI, NSDL, UIDAI, and more, Credit Fair was looking for a partner who could absorb the complexity of these integrations and offer a simple API with faster response times.

Decentro’s CKYC APIs stood to offer precisely that. Decentro stepped in with its CKYC prowess to empower Credit Fair with:

- ID collection

- Verification of users

This has allowed Credit Fair to collect and validate user information seamlessly. Triangulating the collected data points and validating information allows Credit Fair to determine the individual’s creditworthiness and ability to afford and pay for any loan schemes they seek.

What were Credit Fair’s Outcomes?

Decentro’s robust APIs have allowed Credit Fair to drive the following results:

- Over 1.4 Lakh CKYC Search and Validate APIs hit for user verification

- Additionally, Deploying CKYC flow in their user onboarding flow has helped Credit Fair enhance operational efficiency and customer experience for Credit Fair users.

- 10X faster integration timelines.

- 24×7 multi-channel customer support from Decentro for any queries or resolution.

Speaking of the association,

“At Credit Fair, we believe in redefining convenience for our customers. With Decentro’s CKYC APIs powering our onboarding process, we’re not just streamlining operations; we’re creating seamless experiences that empower our customers to achieve their financial goals faster. This is the new era of hassle-free lending, and we are glad to have Decentro as our technology partner in this journey.”

Aditya Damani, Founder, CreditFair

In Conclusion

It is a transformative era for the digital lending economy in India. Two key factors bolstering growth in the digital lending space are the increasing internet penetration (reaching nearly 49% of the Indian population) and the robust digital infrastructure encompassing India Stack, which comprises components such as e-KYC, UPI, and account aggregator frameworks.

Having operated in this landscape and enabled players like MoneyTap and CreditWise to overcome the barriers to banking or financial integration, we are witnessing this transformative era from the forefront. We couldn’t be more excited about the future in the same account.

Our host of products has also solved pertinent use cases for customers across the lending industry. With Decentro’s debt collection stack via Neowise, you can access a one-stop shop to manage loan recollections and KYC verification while ensuring full adherence to the digital lending guidelines set forth by the RBI (Reserve Bank of India).

Are you curious to know more? With compliance and efficiency being our promise, feel free to reach out if your business wants to solve a use case involving anything linked to banking.