We’re back with another Learning blog; and this time it’s all about how we increased the website traffic by 631% just with organic marketing!

How We Grew Our Website Traffic by 7X In 11 Months By Organic Marketing Alone!

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

What a roller-coaster of a year it has been!

There were some definite lows and some chirpy highs to balance it. When the tsunami of the 2nd wave hit all of us, the only thing constant was uncertainty. We feel grateful to have been able to do our bit to help umpteen businesses out there during these trying times.

Last time, we’d come to all of you with our learning in the first 9 months of the product cycle. A lot has changed since then.

Today, we bring you our journey of Marketing. How things shaped up in the last 11 months, the things we tried, what worked, what could have been better.

We hope this helps your ventures as well!

The Start: Word of Mouth + Existing Networks

“A brand is no longer what we tell the consumer it is- it’s what consumers tell each other it is.”

Scott Cook

At Decentro, we are an API-driven company. As a founder, I had witnessed the challenges of financial integrations when I crossed paths with legacy institutions. The road isn’t easy at all, but we want it to be for our customers and any business out there entering the fintech space. This has been hardwired into the entire team, and marketing ideology was no different.

What we are building is ultimately solving one of the biggest & long-standing problems in the world of fintech & banking. And at the same time, we are progressing to a stage where every company will someday turn into a fintech company.

This means that it’s not just financial companies & fintechs that would require such a solution. There could be umpteen businesses out there who may not even know such a problem exists, or worse, the fact that it can be solved 10X faster and at 90% reduced capital & operational expenditure.

As we edged closer to our product launch in July 2020, it was imperative to create a buzz. For any company starting out, this would be through the team, especially the founders. In our case, we leveraged the background & network of the founding team to make some noise, especially for our product launch across social media, official website & blog, and accelerator platforms such as Hackernews, Product Hunt.

Keeping this at heart, going forward, we spent time analyzing the challenges and then familiarized people with the problem being solved. For the same, the founding team contributed, be it by writing emails or engaging with their immediate network of ex-colleagues and founders.

Further, being incubated by YCombinator came with its own perks. In addition to their coveted mentoring, the exposure we got (and still get is) second to none!

Building The Marketing Engine: SEO & More!

We were clear on what we wanted and how to structure our marketing efforts. This helped us round in what to look for in the first hire; since this was crucial to map the road ahead. Furthermore, we had the insights from previous ventures to guide us, especially as a second-time Founder. I would love to share some of them with all of you!

Organic >>> Inorganic

Any day. Organic growth is slower in comparison but grows steadily with time. Something you can bank on always. The rewards you can reap from organic marketing is huge in the long run!

A company is buying a core aspect of their business from you, aka money movement. And, this makes it all the more important to follow the next couple of points that follow. ‘

Trust >>> Everything

Trust in fintech is everything. Capitalize on that by building a strong brand. Winning a customer’s heart is the first step towards nurturing a long-standing relationship. Ensure a strong foundation and then build and scale on top of it.

Metrics You Monitor

It’s easy to get carried away, especially at the start. All the more reason why you should monitor only 2-3 key metrics as a whole for any internal team, including marketing.

Accountability & Transparency

Make yourself accountable, and your customers will love you for it. Transparency breeds a mutual environment of trust, and it becomes a core part of your culture.

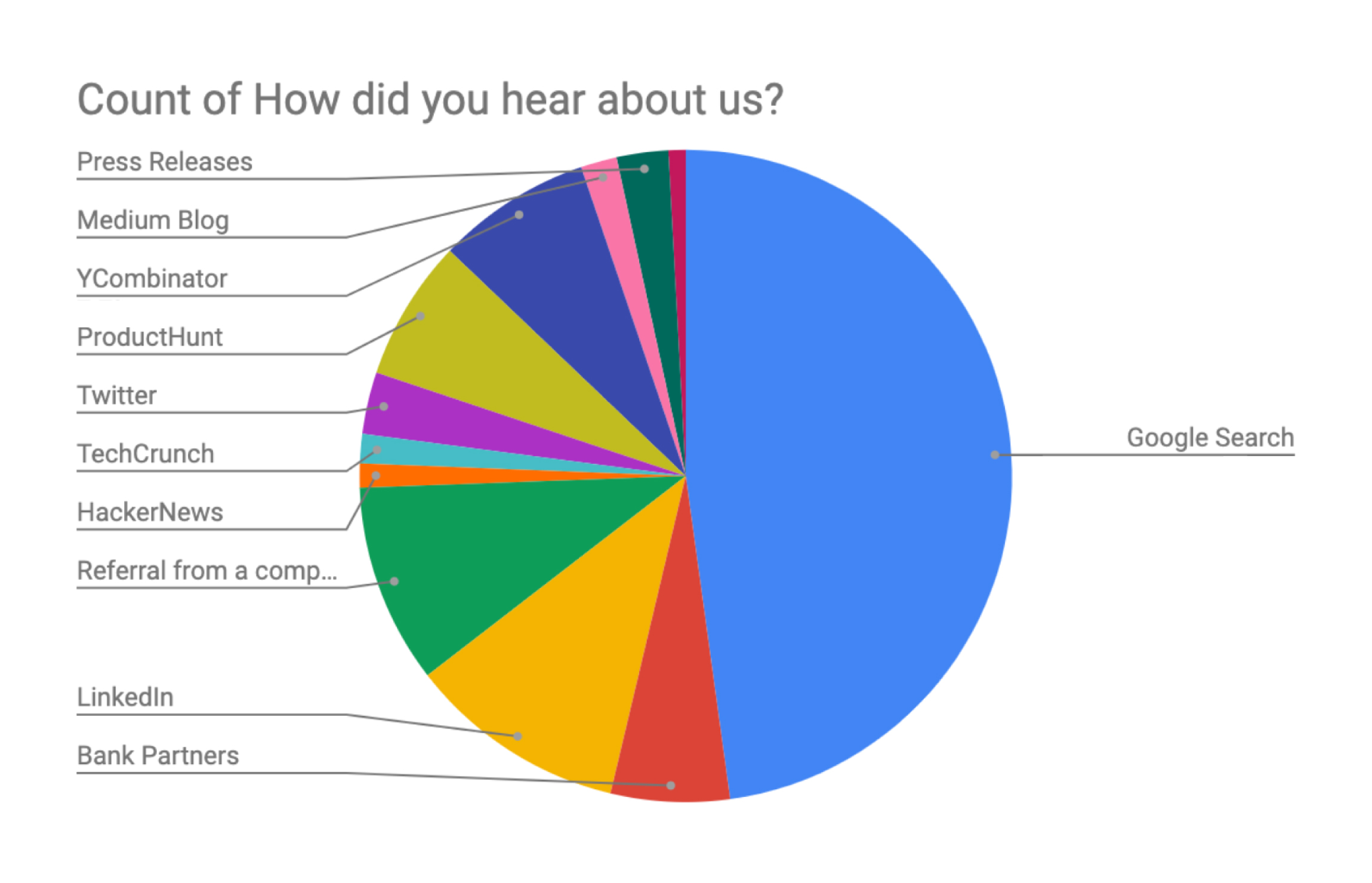

We asked. Still do- The source where our leads find us. This threw light on the channels where we could focus. And, the ones that are high-effort, low-impact.

First Marketing Hire

Making the first hire for any team is both challenging and crucial. Getting it right would require you, as a founder, to have clarity on what to expect & a bird’s-eye view on the outcomes. For founders who are in the place right now, here’s a resource I found handy!

In Decentro’s case, our compass would primarily point to organic marketing via blogging, social media, or email. Therefore, we had to onboard someone who can tackle all these forms and have a natural comfort with content marketing.

After filtering through umpteen profiles, we rounded in on a hire who came with an avid interest in SEO, content & product marketing. However, with no background in fintech. I firmly believe that a non-fintech background shouldn’t deter anyone from pursuing it- the learning curve is always rewarding! And in fact, the additional outsider perspective helps a lot in many places.

The entire team contributed to suggest ideas and formed a steady feedback cycle for marketing. We were always open to experimenting and with all the combined efforts, we reached the point of- well, the title of this blog. 🙂

Finding our Focus

Like I’d mentioned previously, our core focus was to drive the marketing engine organically alone. For the same, we decided to invest heavily in SEO, content, and social media marketing. Before diving in, here’s a quick tip we implemented.

Quick Takeaway: We joined customer calls to understand the key problems they faced, incorporated their feedback, and then structured our messaging. Problem points always make an excellent marketing pitch, even against competitors!

Content Marketing & SEO

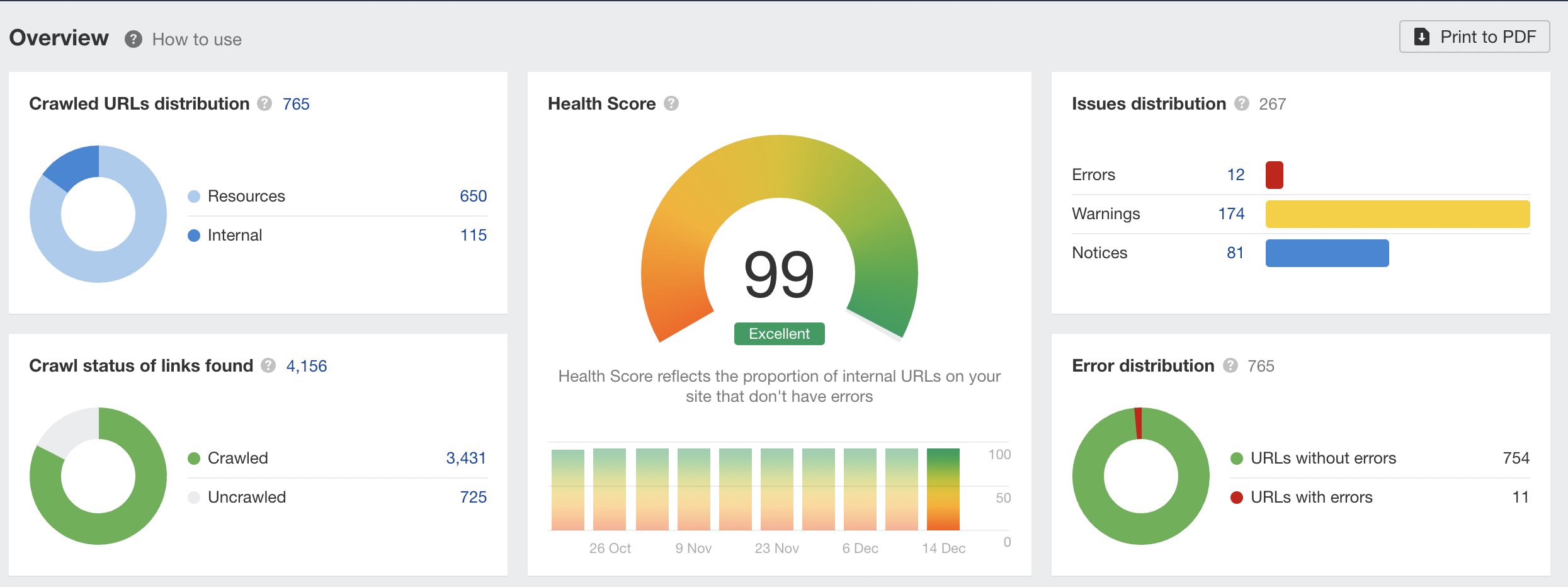

One of the first things we started with was cleaning up our website via a Site-wide Audit and measuring its SEO health. For the same, we used SEO tools such as Ahrefs(later on Semrush) to run audits and find the key problems. Perhaps the images on a blog might not have been optimized, or the heading tags on a webpage aren’t in order- we resolved it to strengthen the foundation before we proceeded to build on top.

The score was already good, to begin with – 87. But we worked to make it to a 100 soon enough! Alongside, there were regular audits to ensure we didn’t miss out on anything crucial.

The next step saw us prune the content for the website-

- One to ensure consistency and better user experience

- Two to optimize for the keywords we were targeting

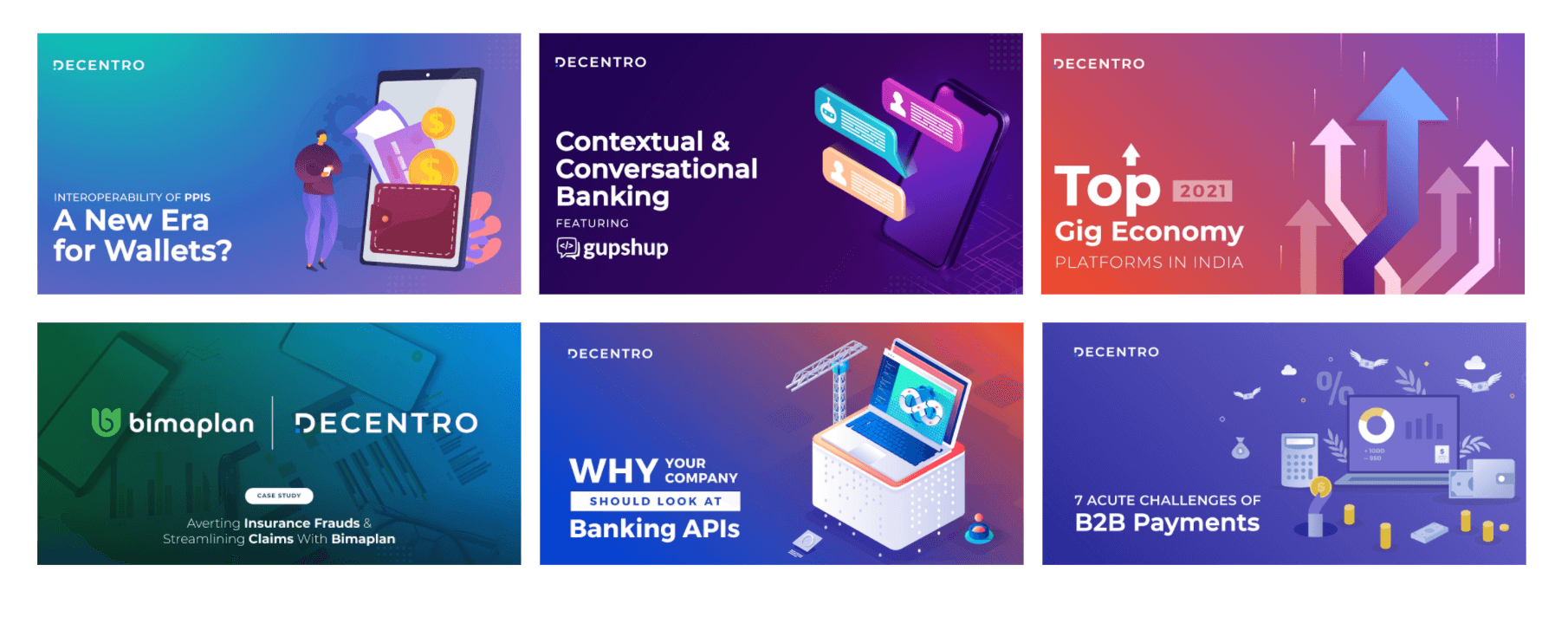

The coming months saw us drafting blogs relevant to our target audience and customers. This was a mix of information-driven content, case studies with our clients, tech & engineering blogs, and product & module-driven content.

Our plan was to turn the blog into a steady source of organic traffic to the website. We were sure to do the following things before taking up any blog. Call them the key learnings for us and takeaways for you!

Takeaways:

- Check the topic relevance & trends, if any.

- Research the keywords we wished to target

- We were sure not to always go by the search volume. In many cases, we outweighed search volumes with the search intent since this would bring in users who are keen & resolute to purchase our solution.

- We wrote for people first, and bots next. As AI-assisted writing becomes more common across industries, it’s essential to humanize such content before publishing. There are many tools that are designed to help teams preserve brand tone and clarity when using AI-generated drafts.

- Hard marketing was not employed here.

- Ensured to add necessary image breaks so as to not overwhelm the readers with rich content.

- While our primary audience would be knowledgeable, we wanted visitors to gain knowledge from our blogs. Thus, we always ensured to uncomplicate and convey our messages in a simple format. I’d say this is where we leveraged our senior content marketer’s non-fintech background.

- Merely writing & publishing content wasn’t enough. We distributed content across social media, Medium blog, and likes. Ergo, a strong on-page & off-page SEO game!

Now, let’s get to some numbers, and you can see for yourself the impacts of implementing SEO, the natural way. And, most importantly, TRUSTING it.

P.S. We’ve removed the exact numbers and retained the percentages throughout for obvious reasons! 🙂

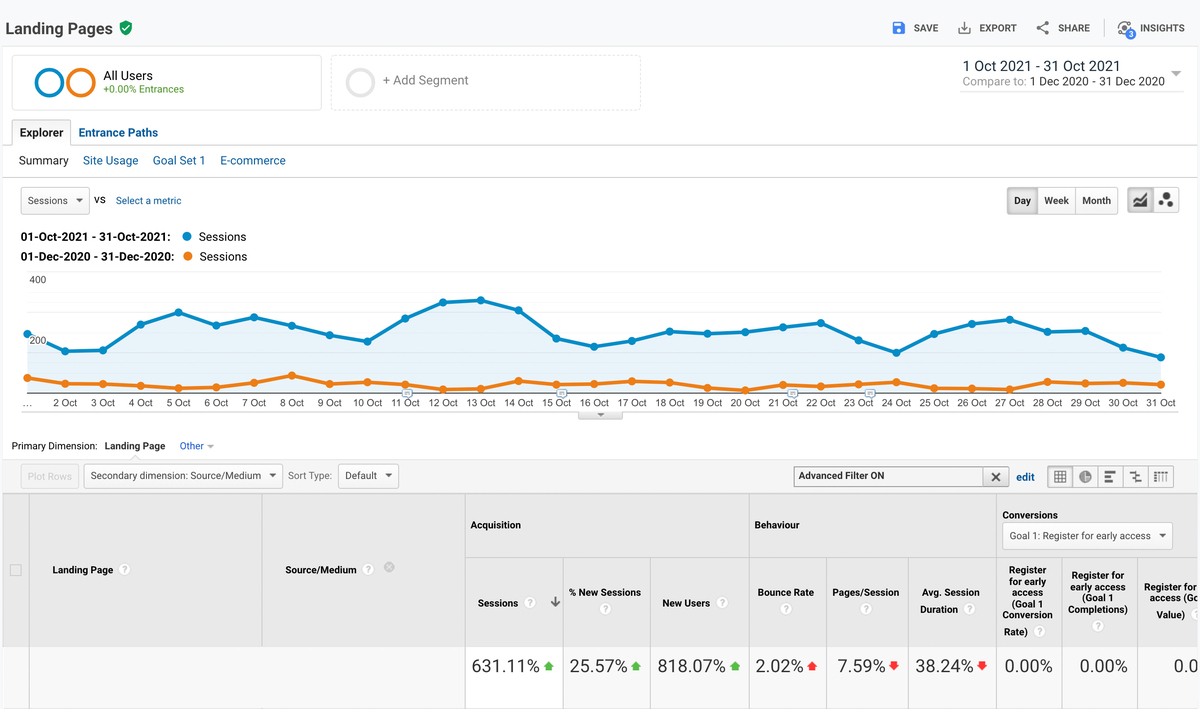

Organic Traffic Filtered Out

- 7X growth from organic sources | 631.11%

- 9X new users | 818.07%

This included any source of organic traffic, excluding direct, referrals, & more!

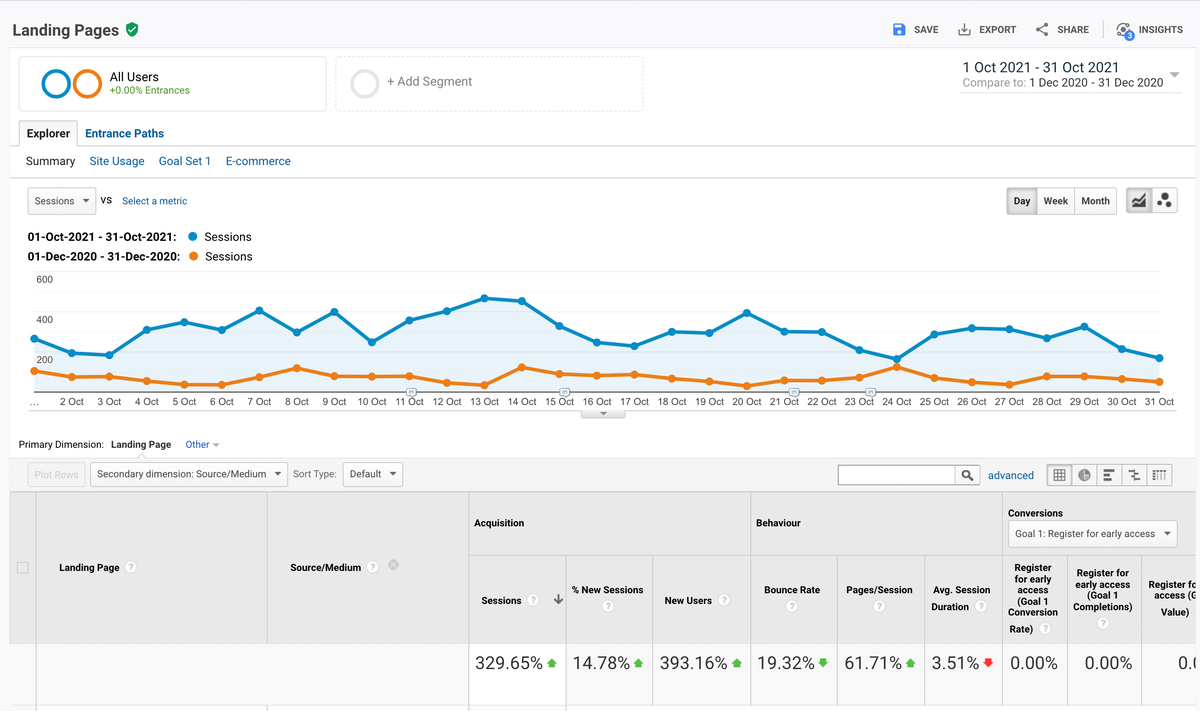

Overall Website Traffic

With time, our overall traffic that was once dominated by the Direct Source, due to word-of-mouth marketing, started bringing traction from other sources as well. Even the, we stayed away from paid marketing, be it for social media or on search engines.

- More than 4X growth | 329.65% growth

- ~ 6X new users | 393.16%

- Reduced bounce rates by 19.32%

- Increased pages/session by 61.71%

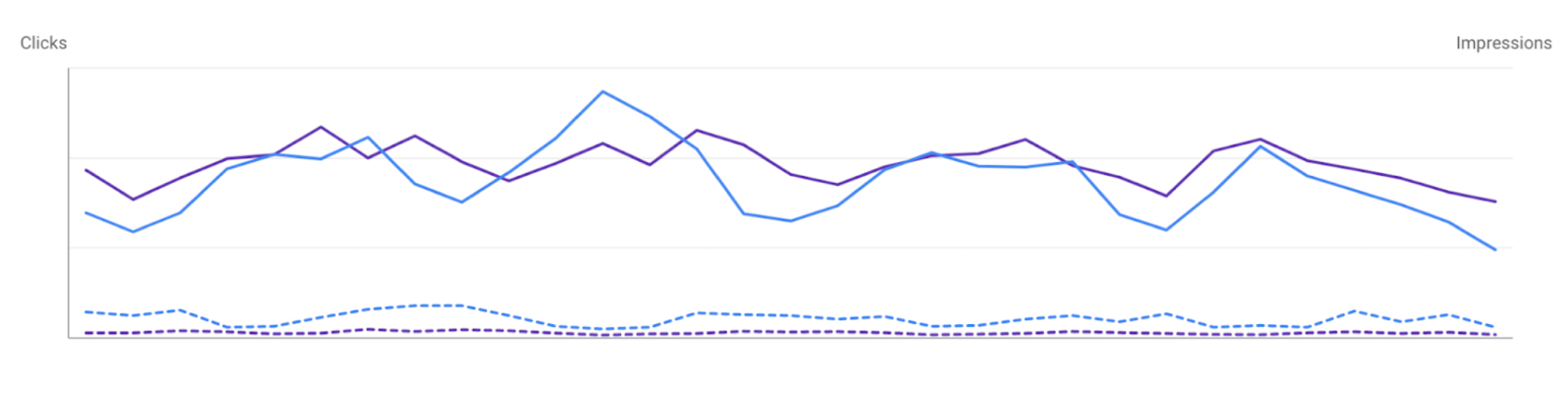

Impressions & Clicks

And, our overall presence across Google’s SERPs looked something like this.

- Impressions: 32X growth

- Clicks: 8X growth

P.S. Here’s the legend to make sense of the graph!

- Blue → Clicks

- Violet → Impressions

- Dotted Line → December

- Solid Line → October

Wondering why strong content & efficient content distribution is important? Hackernoon has chosen us as the finalists for their annual Noonies Awards for Contributor of the Year- Banking.

Cracking featured snippets, and pushing our pages further up the SERP ladder is something we constantly strived for. Alongside, we also tested a growth hack of using listicle blogs. The Neobanks in India, for instance, drove us 10X more traffic and even inspired three other websites to create similar blogs, one of them being our competitor! 🙂 Like they say, imitation is the sincerest form of flattery!

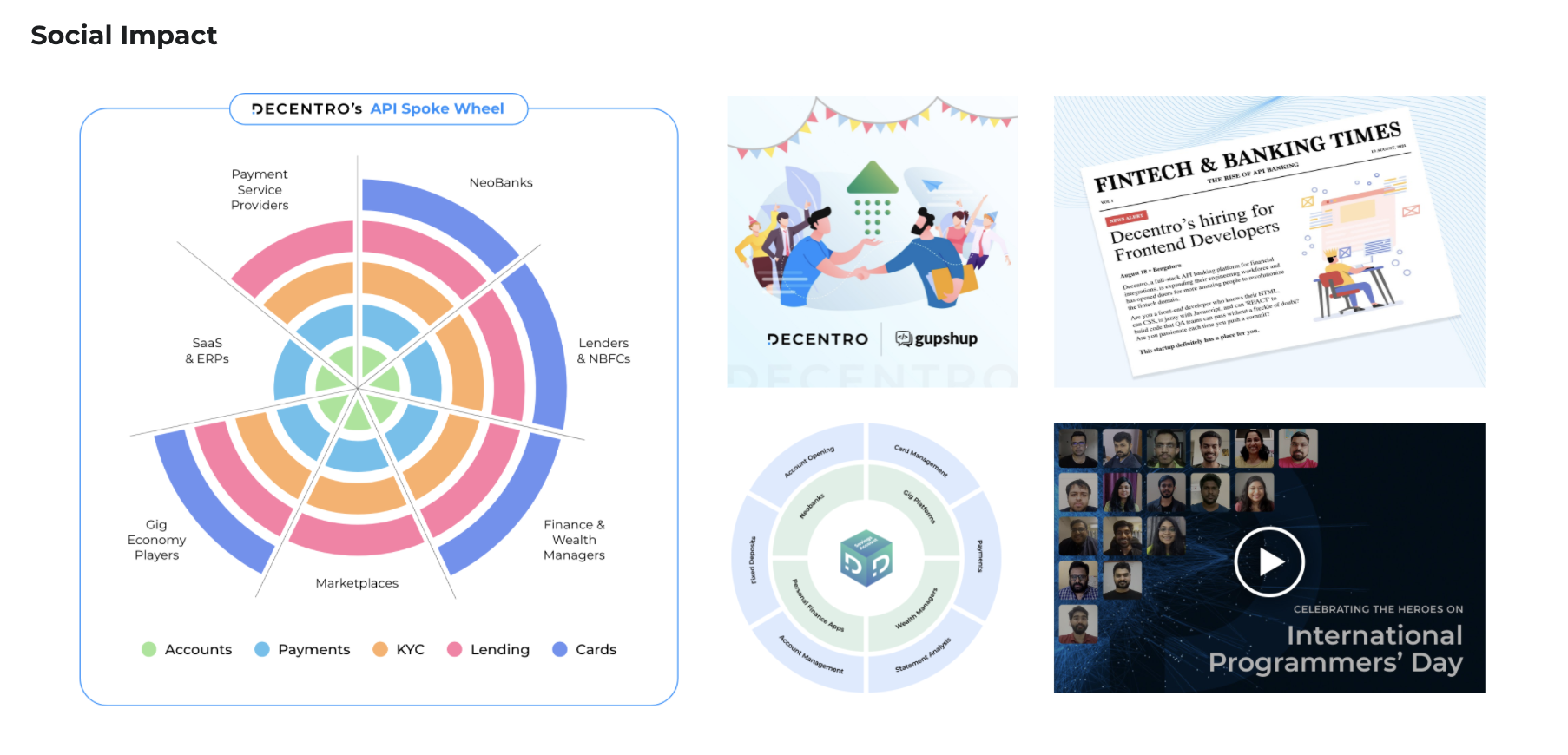

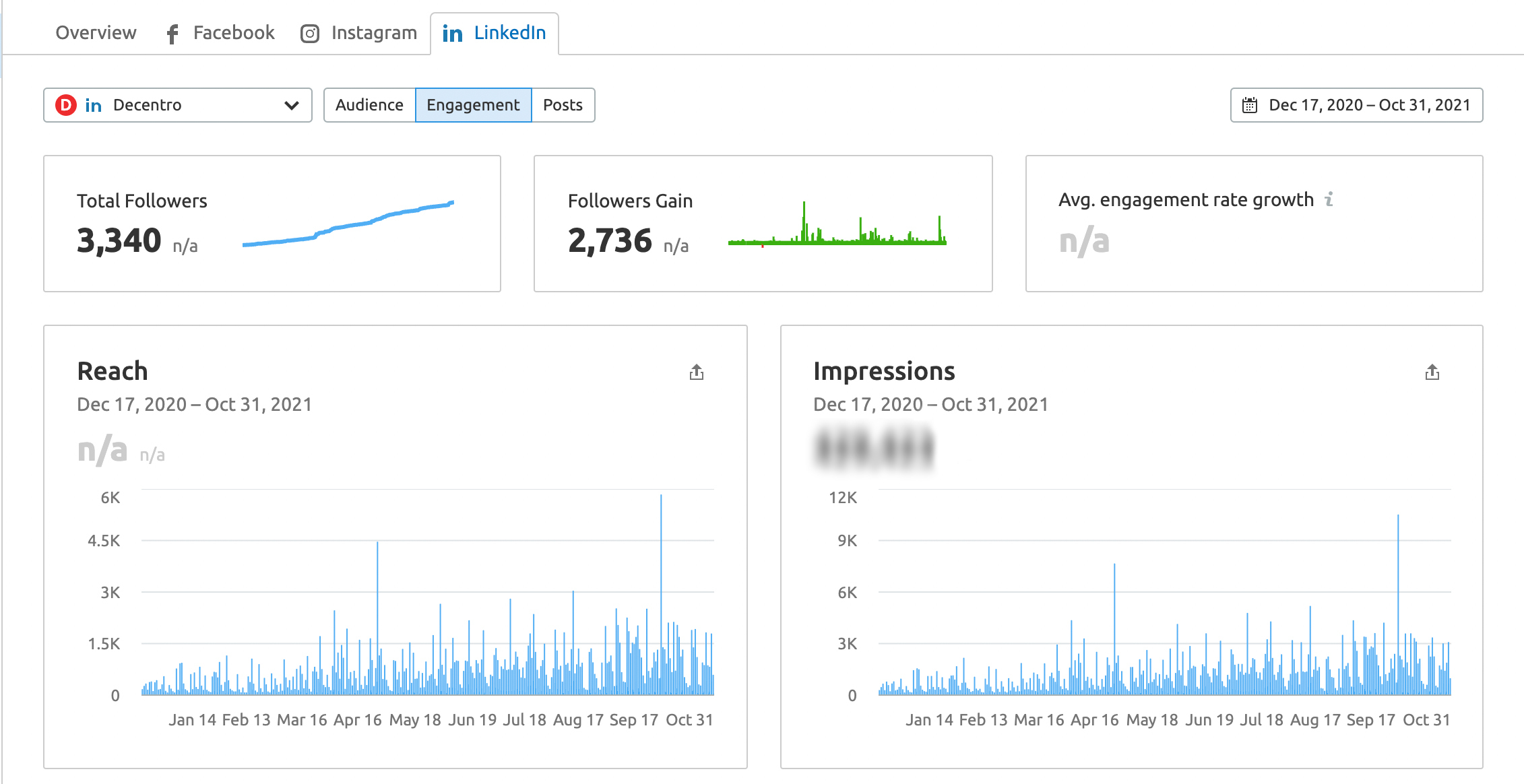

Social Media Marketing

We used our social media handles like a megaphone- we spoke to the world through it. Shared every milestone, our website content, new product launches, and engaged with users from & outside the fintech space.

Considering the domain we were in, Twitter & LinkedIn were our core focus areas. And, experimenting was a routine affair- testing with the time, day, and frequency of posting. We also tested different formats of content- gifs, creatives, hiring alerts, carousels, memes, videos, employee testimonials.

In particular, memes helped our audience relate better to the problem we’re solving. Oh, and it tickled all our funny bones too; they never disappoint, do they?

Since developers consume our product first-hand, we wanted to do something special on International Developer’s Day! This humble campaign of ours featured developers from diverse backgrounds, at their most candid self, talking about what they love about what they do.

Takeaway:

The one thing we found that worked best was- consistency. We posted all 5 days a week, sometimes Saturdays too! Twitter had us sending tweets, at times twice a day.

Similar to LinkedIn, we were able to hit 6-digit Impressions on Twitter with consistent tweets.

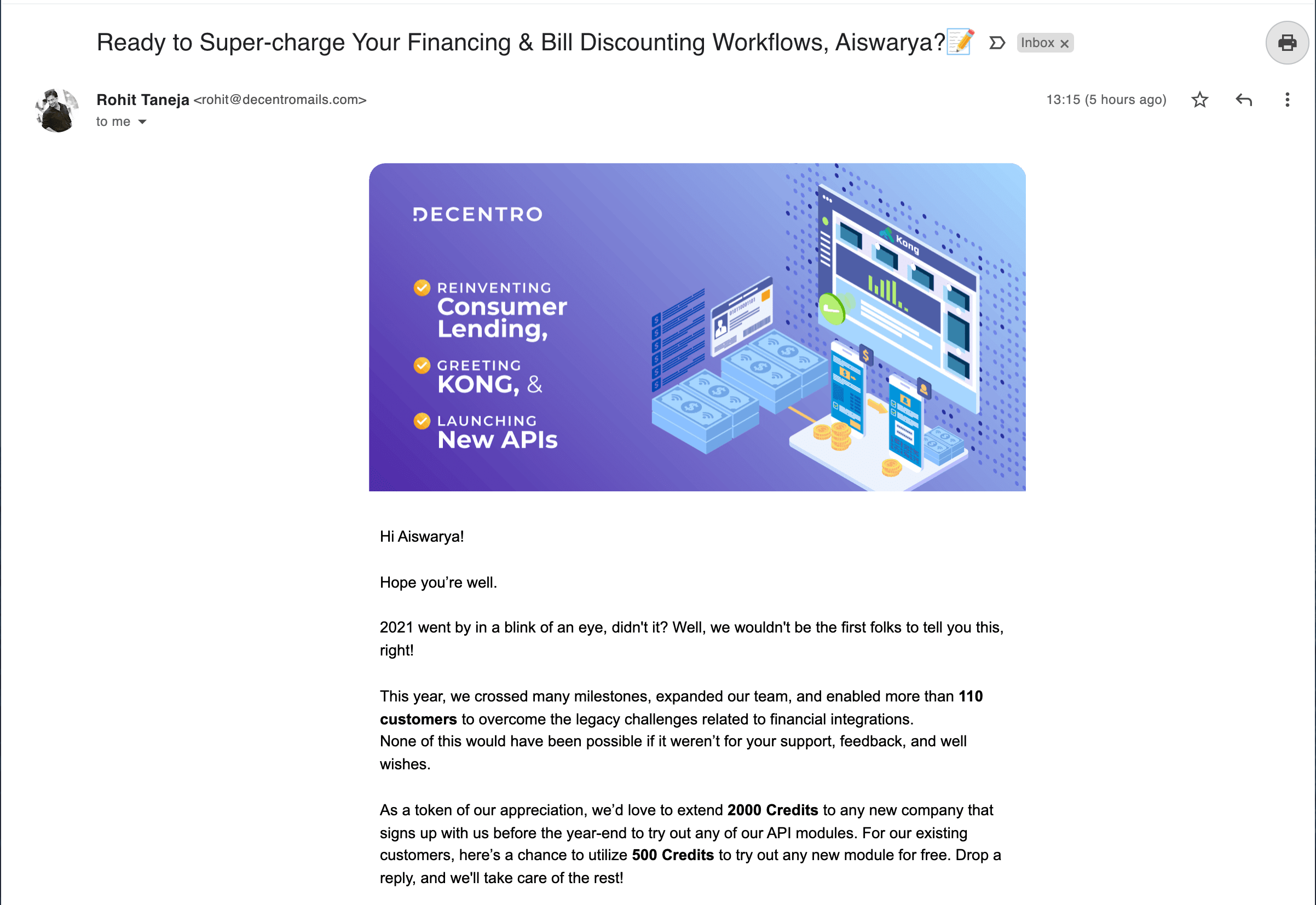

Email Marketing: Fortnightly Newsletters

We leveraged one more channel to distribute our content and reach out to potential leads to convert them. The good old emails! The newsletter reaches the inbox of our subscribers twice a month and contains everything that happened that month, plus anything interesting in the fintech & banking space. This helped us get positive traction for Decentro Chronicles!

We even converted a few customers that earlier had gone cold, simply via consistent newsletter updates, in addition to drawing 3-digit traffic to our website.

PR & Media

In March, we launched India’s first-ever Fintech Fellowship program. While this was aimed to encourage & nurture the essence of building in young minds, we got featured in umpteen publications, which invited thousands of applications.

In addition, our journey got featured in publications such as Analytics India Magazine, India Today, IBS Intelligence for our partnership announcements, advisory council expansion, and more!

We also crossed 100+ paying platforms using our API banking suite in November, and we have just started! Be it enabling NBFCs, fintechs with easy streamlined lending & collections, simplifying payments with UPI for gig platforms, helping neobanks to provide a seamless experience to their customers, or ensuring thorough background checks for businesses via KYC & CKYC!

The road ahead sure is exciting! 🚀

We hope this blog is handy, especially for early-stage founders and their marketing teams. Until next time, where we greet you with another blog on the things we’ve learned!

Cheers!