How can PPIs help your business grow? What are the fundamentals behind it? Let’s find out!

Thinking Of Prepaid Payment Instruments For Your Business? Look No Further!

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

We’ve come a long way when it comes to transactions, isn’t it? Right from the barter system that reigned on exchanges to freshly forged coins in circulation, we’ve now reached the era of paper currency.

Well, let me scratch that.

We’re en route to a cashless economy that thrives on digital payments.

Prepaid payment instruments have had a crucial role in aiding this. With India crossing 25 million real-time transactions and retaining the top spot, the rise of PPIs as a critical component in the banking & fintech space is undisputed.

Let’s understand how prepaid payment instruments can help your business grow & scale. Besides, if you’re yet to employ them as growth catalysts in 2021, here’s why you shouldn’t waste any more time.

What are Prepaid Payment Instruments?

Recall your day-to-day wallet apps such as PayTM? Can we imagine a day without these, now? They are a type of prepaid instrument.

We can put across the definition as,

Prepaid Payment Instruments or PPIs are like holding accounts that enable their customers to make purchases using the money loaded in them.

Usually, the money is loaded into a wallet that has an underlying physical bank account, and all subsequent transactions are made from it. Above all, prepaid instruments can have different form factors such as physical or virtual cards, internet accounts, digital wallets, and the likes.

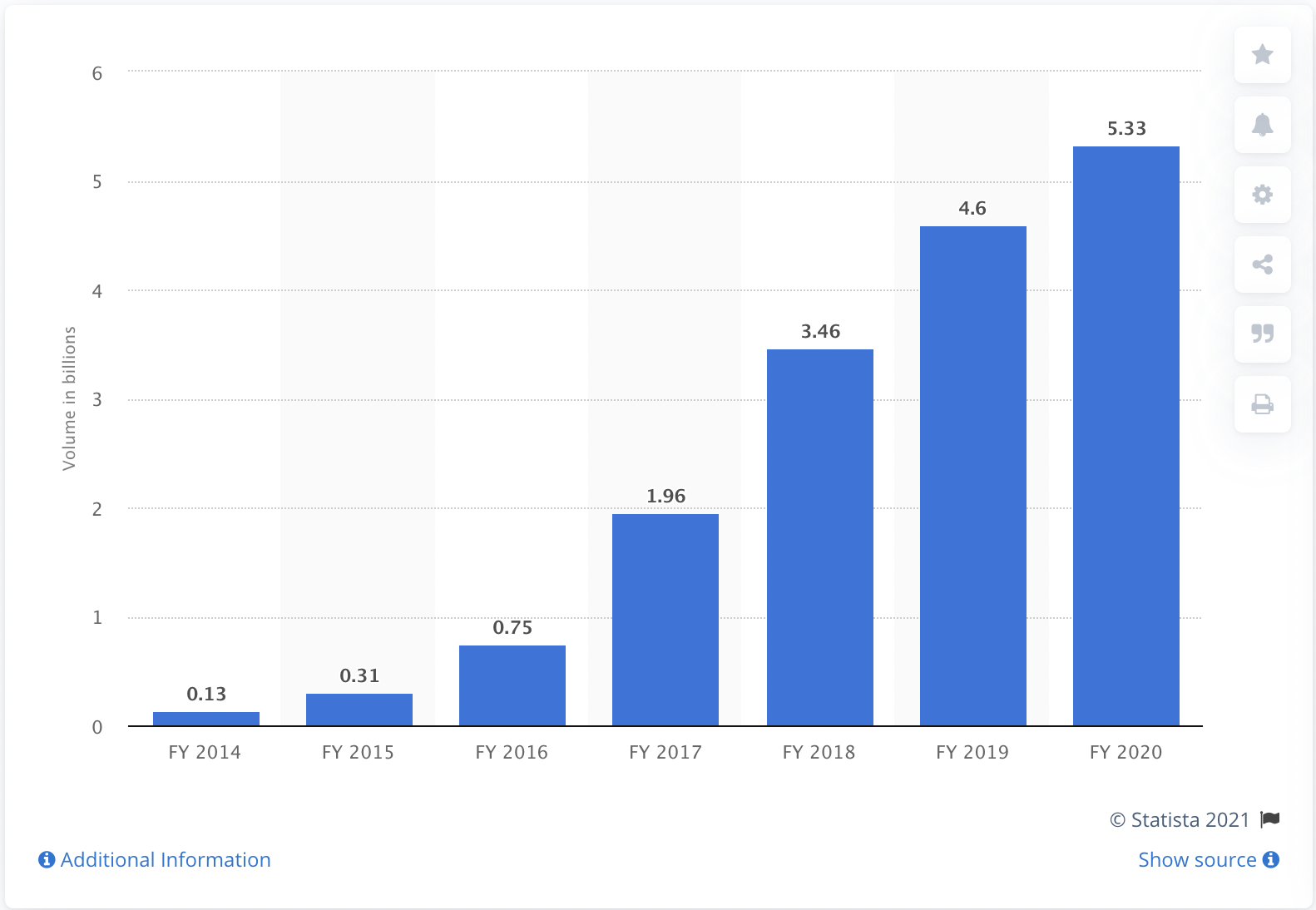

The growth of PPI in India has been incredible over the years. According to Statista, the volume of payments, in billions, made through Prepaid Payment Instruments in India from FY 2014-20 looked something like this.

The PPI payments volume in India in 2020 accounted for over 5 billion! Woah.

RBI has outlined in detail about prepaid instruments under the Payment and Settlement Act, 2005, and sees it as pivotal to enabling a cashless & digital India. According to RBI guidelines, a PPI facilitates:

- Goods/services purchase & avail financial services

- Smooth remittances

- Fund transfers

Who can Issue a PPI?

According to RBI guidelines, any company that is incorporated in India and is registered officially under the Companies Act, 1956 / Companies Act, 2013 has the permit to issue PPI to either an individual or organization. All this is, of course, after getting authorized by the RBI as a license holder, or you can utilize Decentro’s API suite to ride on top of underlying banks as the license holders.

What are the Types of PPIs?

We can broadly categorize prepaid instruments into three categories.

- Closed PPIs

- Semi-closed PPIs

- Open PPIs

Closed PPIs

The PPI user (or holder) can only use it for making purchases on the same platform that issued the instrument in the first place. In any other entity, the prepaid card would appear invalid. For example, they were receiving a gift voucher or coupon card from a specific e-commerce website or swiping a smart card at the metro or parking lots.

- A holder of a closed PPI cannot withdraw cash from an instrument that’s already loaded with money.

- Since this category nor the purchase falls under an interoperable payment system as seen by RBI, the organization/individual who issues the prepaid instrument doesn’t require any prior RBI approval.

Semi-closed PPIs

A bank or non-bank approved and authorized by the RBI can issue semi-closed PPIs for transacting goods & services, remittance, etc. The instrument can be used only for separate merchant locations or entities with a contract with the issuer, bank or non-bank, to accept PPI as a payment method. In some instances, a payment gateway or aggregator steps in for this contract, and the issuer and the holder needn’t have a direct relationship. A good example of semi-closed includes the PayTM wallet.

- Cash withdrawals aren’t permitted here either.

- In addition, this is interoperable so it can be used across merchants and terminals that accept this particular wallet.

- However, unlike closed instruments, to function, the issuer needs a license from RBI to run the instrument or can ride on top of an existing bank’s license as the provider.

Open PPIs

Only a bank that RBI authorizes has the permit to issue the open prepaid instruments. One of the best examples of the same is credit and debit cards.

KYC-based PPI Limits in India

There are limits set for the usage of PPI based on background checks & verification via KYC. Each time, a certain amount of money can be loaded into the instrument and used. For a semi-closed PPI, the various limits are:

- Min KYC

- e-KYC

- Full KYC

| Min KYC | e-KYC | Full KYC | |

|---|---|---|---|

| Balance Limit(₹) | 10,000 | 100,000 | 200,000 |

| Monthly Transaction Limit(₹) | 10,000 | 100,000 | Depends on PPI Issuer |

| Yearly Transaction Limit (₹) | 120,000 | 200,000 | Depends on PPI Issuer |

| Verification Method | Mobile OTP verification | Aadhar-based or PAN-based OTP | Biometric or Video KYC |

| Validity | Lifetime | 12 months | Lifetime |

Min KYC Lifetime validity is as per the new PPIs issued by RBI in December 2019

Aadhaar OTP KYC Validity: Must be converted to Full KYC after 12 months

How can Prepaid Instruments Help Your Business?

PPI comes with a host of benefits for a business that can help them:

- Simplify operations

- Elevate customer experience

- Add additional streams of revenue

- Scale & grow

Here are some of the key features of a prepaid instrument to look out for.

Diversity of PPI Options

Prepaid payment instruments can come in different forms to the end-user. It could be a digital wallet, a smart card, a magnetic strip physical card, or a virtual one, for that matter. This enables the PPI issuer to choose what’s best suited and for the user to go cash-free.

Ease of Loading Money

The ease of adding money to a PPI is definitely one of its USPs. A simple bank transfer (RTGS, NEFT, IMPS) or the latest UPI would do the job. The issuer gets much flexibility to load the PPI on their own or enable the user to do so.

Ability for Online/Offline Purchases

A PPI can be used to make purchases both online and offline. A user can pay at a local grocery store using a digital wallet like PayTM. Likewise, a business can shop online for their favorite tools using a virtual card linked to a prepaid wallet or UPI.

Safety from Theft

The instrument brings enhanced security for a user in case of theft. Unlike currency, the users can block the card if it goes missing or raise a concern to the issuer during the time. Since some preloaded co-branded cards have no bank accounts tied to them, the scare theft or misplacement is removed from the picture.

Facility to Customize & Limit the Spends

Companies have the flexibility to customize the instrument from user to user. For example, a business can issue a card to their customers or partners that allow certain purchases such as food or clothing. Or, a fleet operator can customize the card for fuel & food alone. For categories outside the tailored ones, the instrument will be invalid.

Decentro & PPIs

We’ve curated some of the must-know factoids about prepaid payment instruments. Now, let’s tell you how we can help your business.

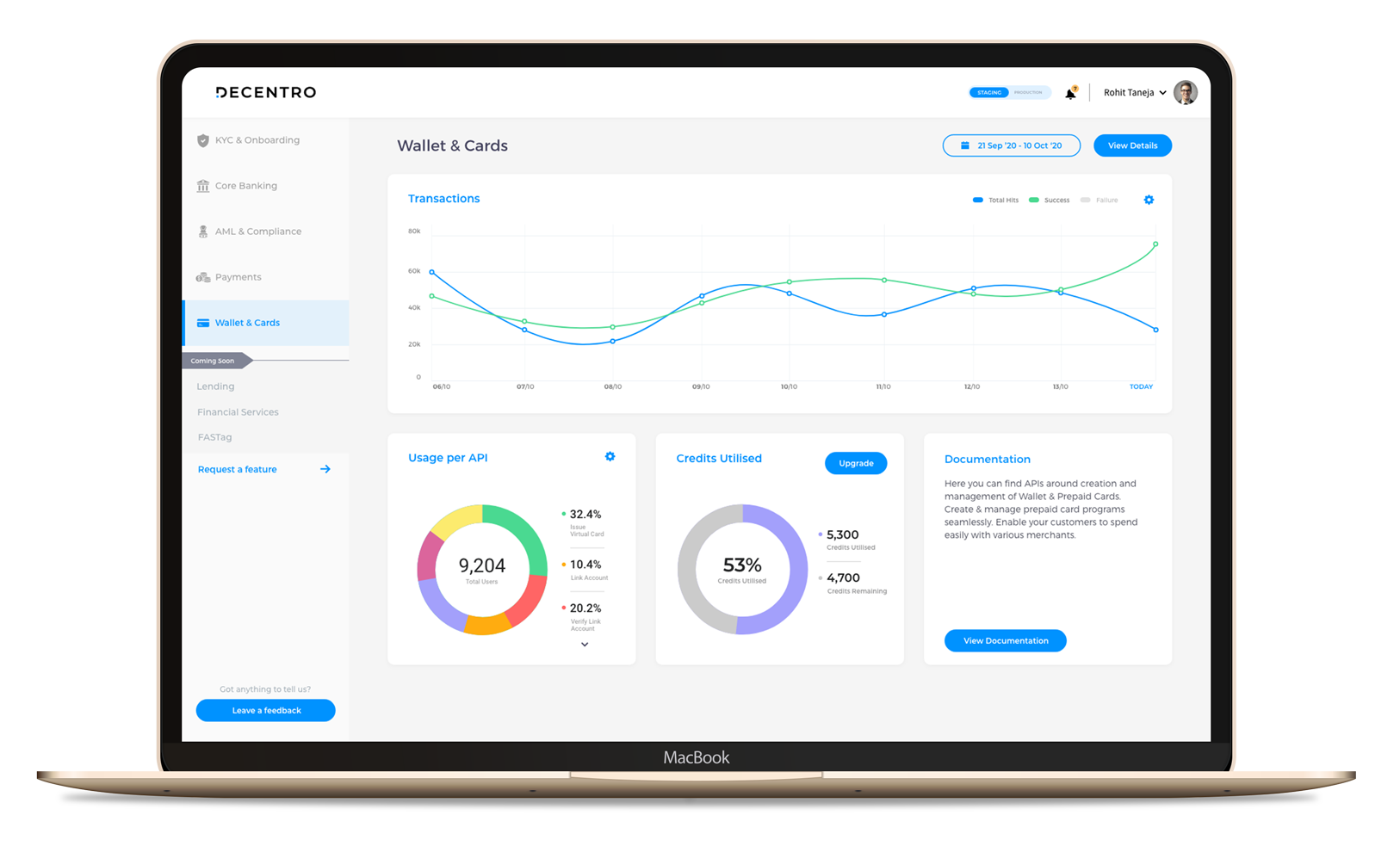

Decentro’s recently launched co-branded cards & wallets by partnering with Yes Bank. Our cards module offers physical & virtual cards for companies to issue to their customers, partners, merchants, or even employees.

Some of the key things you can do with our cards module include:

- Go live with your cards program in a matter of weeks. No more waiting around for months to issue your own PPI.

- Co-branded cards can either be virtual or physical giving the ultimate convenience to your customers.

- Easy to load payment options via NEFT, RTGS, IMPS, or UPI.

- Track all the spend through the cards via a dedicated dashboard for your business. Furthermore, monitor the purchases and limit the spends as and when needed.

What’s More?

- Reconcile all card transactions in real-time—even the failed ones. Our virtual accounts will enable this. Please don’t worry about wasting hours and resources running behind the source & destination of each transaction. We’ll take care of that for your business.

- Customize the categories for which your audience can use the card for. Like we’d mentioned earlier, be it food, fuel, shopping online.

- Issue new cards when required, deactivate old ones or the cards your users no longer need.

- In case of theft, halt the card purchases and elevate the safety standards.

- Run efficient loyalty programs that actually work and bring back your customers for recurring purchases. Besides, set up an incentive program for your employees to boost morale, help them out when in need, and reduce the attrition rates.

How about if we say your cards can be a source of an additional revenue stream? If your customers can be cost-savers and not cost-centers?

- Earn revenue every time a transaction happens through the prepaid payment instrument you have issued.

- In addition, offer lending services to your customers or partners as & when needed. Consequently, earn an income from the interest paid during a payout.

- Earn more revenue from existing products & customers!

Prepaid payment instruments help simplify business operations for you and scale & grow your venture. If this sounds like something you want to invest your time in, be sure that we’re just a chat or call away.

We’d be happy to customize the best solution for you and help take your business to the next aspiring level.

Drop us a ‘Hey’ at hello@decentro.tech. If you think this will help someone in your network, do share it across!

Cheers!