What is a payment gateway? Your guide to how they work, why they matter, and how you can get started with Decentro’s payment gateway.

What Is a Payment Gateway? Everything You Need to Know

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

The rise of digital commerce and digital payments has been nothing short of transformative.

As global e-commerce is projected to surge to a staggering $6.35 trillion by 2027, the backbone of this growth lies in seamless, secure, and efficient online payments.

In India, the story is no different. The Unified Payments Interface (UPI) continues to set new benchmarks, clocking an incredible 16.58 billion transactions worth ₹23.50 lakh crore in October 2024 alone. This meteoric rise underscores the pivotal role payment gateways and payment processors play in powering online payments and enabling businesses to thrive in a hyper-connected world.

From facilitating online shopping sprees to streamlining subscription services, payment gateways are the unsung heroes of today’s digital economy. In this blog, we’ll demystify the concept of payment gateways, explore how they work in combination with payment processors to facilitate online payments, and why they are indispensable for any business venturing into online payments.

Let’s dive into the essentials of Payments Gateways 101!

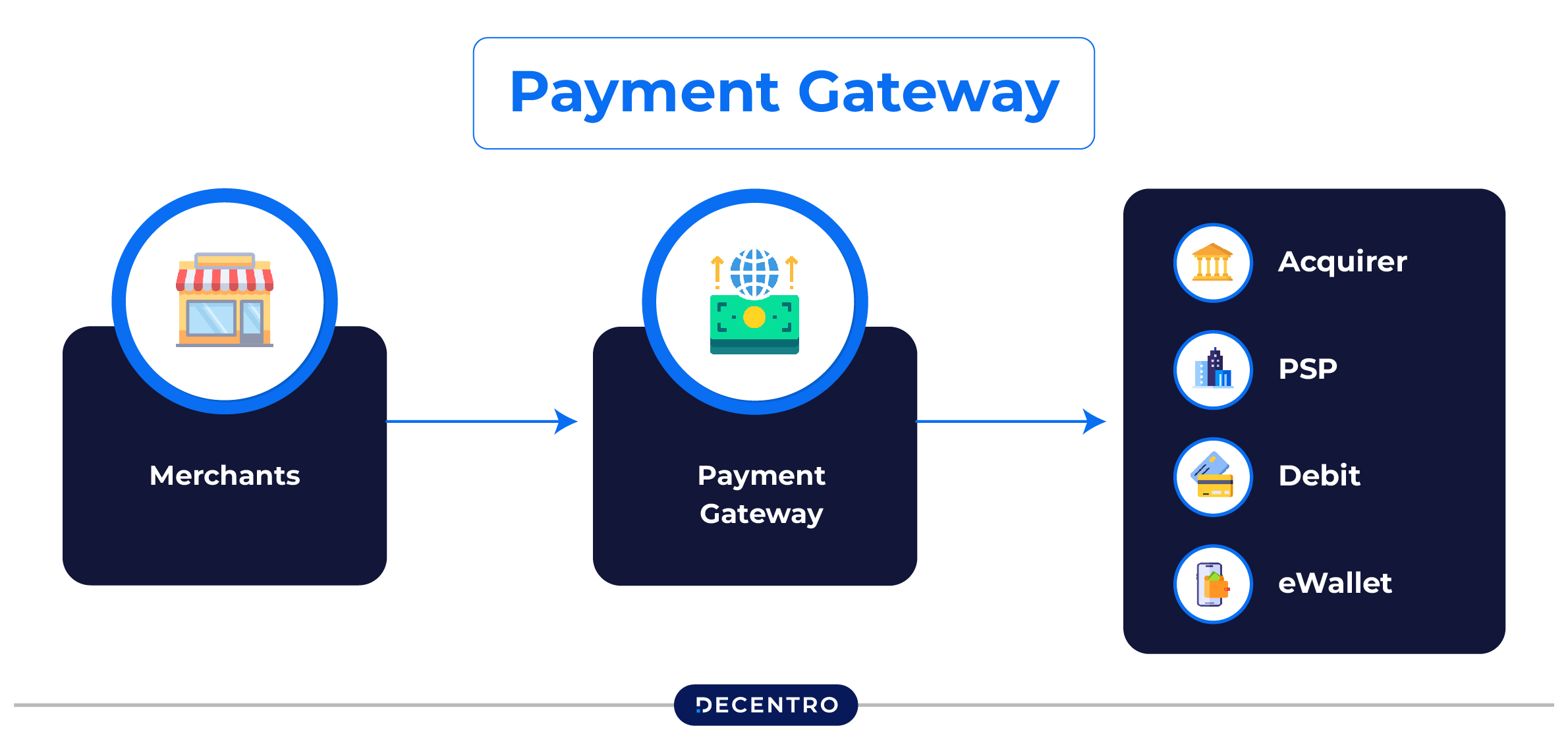

What are Payment Gateways?

A payment gateway is like the middleman that makes electronic payments simple and secure. Whether you’re running an online store needing online payments or a physical business, it helps you accept and process payments like credit cards, debit cards, and digital wallets. Think of it as a bridge connecting your customers, your business, and their banks—all on one platform. And for every transaction it handles, the gateway typically charges a small fee for its service.

How does a Payment Gateway work? A day in its life

When you buy something online, there’s a little behind-the-scenes team making it all happen. Here’s who’s involved:

- The Customer: That’s you—browsing, adding things to your cart, and clicking “Buy” because, well, you’ve decided it’s worth your hard-earned money.

- The Merchant (a.k.a. the Seller): The genius (hopefully) behind the product you’re eyeing.

- The Online Store: The digital display case showcasing everything the merchant is selling.

- The Merchant’s Bank: Where the money from your purchase eventually lands.

- The Acquiring Bank: This bank works with the merchant to handle the payment processing.

- The Issuing Bank: The issuing bank is the one that issued your credit/debit card or facilitates your non-card payment.

- Your Bank Account: The treasure chest the money is coming from.

- The Payment Gateway: The MVP here—this tech makes sure everyone in this list communicates smoothly and securely.

- The Payment Processor: The payment processor plays a complementary role alongside the payment gateway by acting as an intermediary between the acquiring bank and the issuing bank to ensure the payment is processed securely and money movement happens without any glitches.

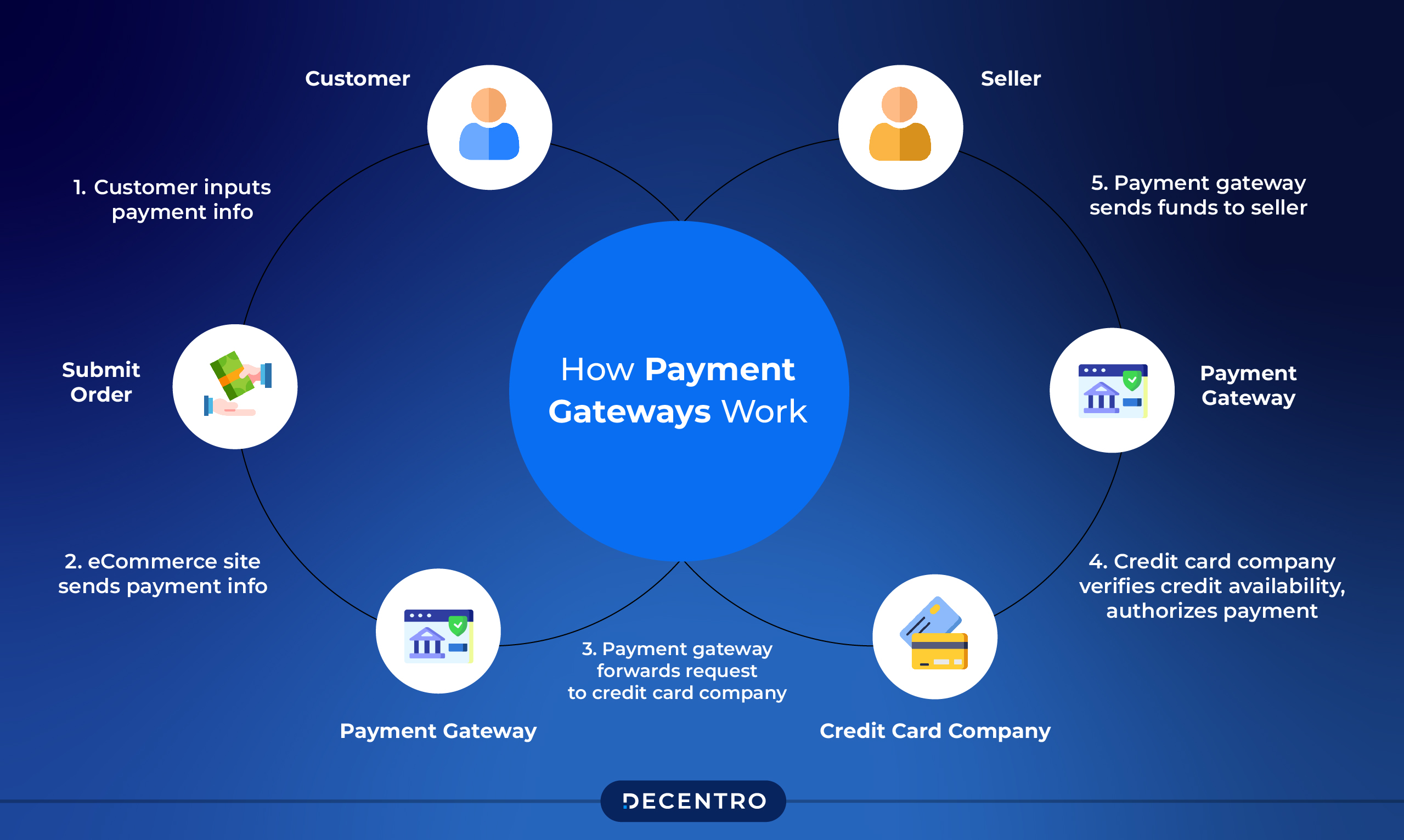

Here’s how it all goes down:

- You hit “Buy”: After finding the perfect item, you confirm the purchase.

- Your browser works its magic: It securely encrypts your payment info and sends it to the online store.

- The online store packages the details: It is wrapping up your payment data with a neat “identity certificate” and shipping it off to the payment gateway.

- The payment gateway takes over: It verifies the online store’s identity and shows you a payment screen with options like cards or wallets.

- You pick a payment method: The gateway sends your choice to the right bank—either the acquiring bank (for card payments) or directly to the merchant’s bank (for other payment methods).

- Banks talk it out: The issuing bank checks (with the help of the payment processor) with the acquiring bank if you’ve got enough funds or credit to cover the payment and gives either a thumbs-up or a rejection.

- The response comes back: The gateway lets you and the merchant know whether the transaction was approved or declined (with reasons if it’s declined).

- The online payments are processed!

All of this? Lightning fast: This entire process typically takes just 2-3 seconds!

The next steps:

- The issuing bank doesn’t immediately transfer the money if the transaction is approved. There’s a “settlement” step where the funds move from the customer’s bank to the merchant’s account. For card payments, this can take 2-4 business days. Merchants usually batch all transactions at the end of the day, submit them to their acquiring bank, and wait for the funds to clear.

So, the next time you click “Buy,” know there’s a lot of teamwork behind that instant confirmation and successful online payments! And the beauty? You barely notice it happening.

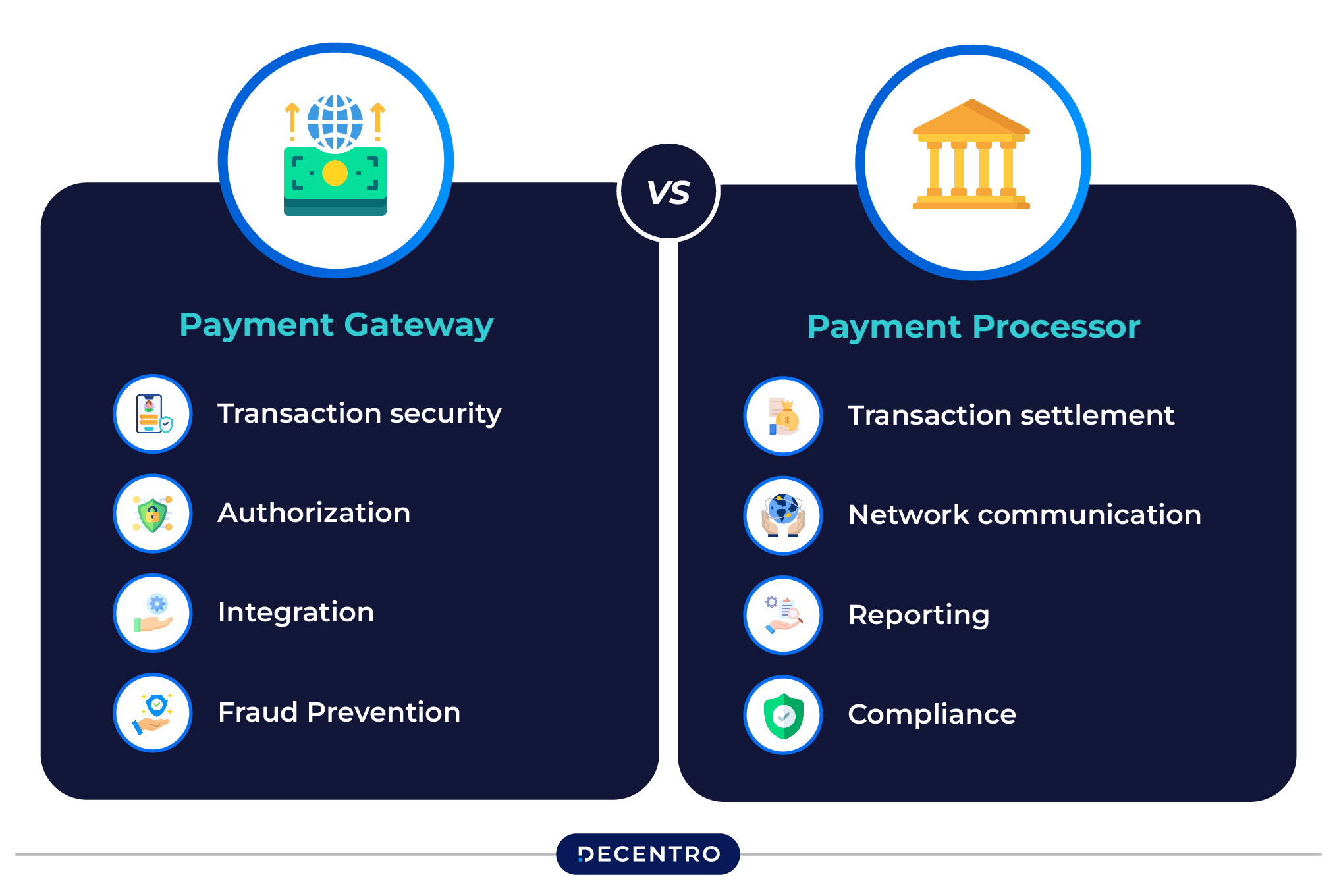

Payment Gateway vs. Payment Processor: What’s the Difference?

Let’s clear up some confusion because these two terms often get mixed up—but they play very different roles in making payments happen.

- The Payment Gateway: Think of this as the digital bouncer. It securely collects your payment details (like credit card info) and checks if everything looks good to proceed. The link connects you (the customer) to the merchant, ensuring your payment method is valid and ready to go.

- The Payment Processor: Now, this is the behind-the-scenes transporter. Once the gateway gives the green light, the payment processor moves your payment information between the customer’s bank and the merchant’s bank. It’s like the middleman who ensures the money gets from point A to point B smoothly.

The Big Picture

While the gateway is all about making sure the payment can happen, the processor is what makes o possible. Both work together to ensure your transactions are fast, secure, and seamless!

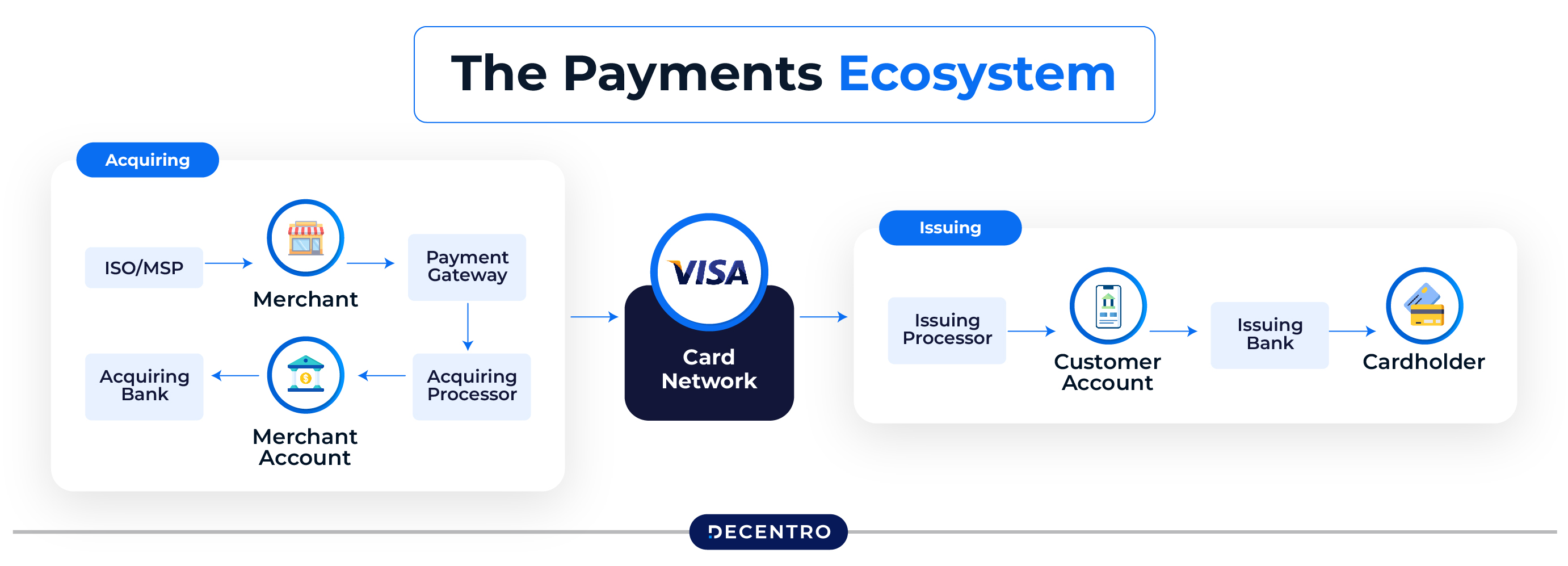

Players in the Payment Gateway Ecosystem

Behind every smooth online transaction is a well-coordinated team of key players, each with a specific role to ensure everything works seamlessly. Let’s meet them:

- Merchant or Seller: The merchant is the star of the show—selling goods or services online. To accept payments digitally, they need a merchant account, which is like a special bank account designed to receive funds from online transactions. This account works hand-in-hand with the payment gateway to securely process payments and deposit the money into the merchant’s bank after settlement. Choosing the right provider for a merchant account is crucial to keep transactions smooth and secure.

- Customer: No customers, no transactions! Customers are the lifeblood of the ecosystem. They’re the ones buying products or services using payment methods like debit/credit cards, net banking, UPI, or digital wallets. Their payment kicks off the whole process and sets the other players into motion.

- Acquirer and Issuer Banks: Here’s where the banking magic happens:

- Acquiring Bank: The merchant’s partner manages their merchant account and receives payments on their behalf. Essentially, it’s the bank that “acquires” the payment.

- Issuing Bank: This bank represents the customer—it’s the one that issued their credit or debit card or manages their payment account. It validates the transaction and authorizes the funds to be sent to the acquiring bank.

- Payment Gateway: The payment gateway is the communication hub. It securely bridges the gap between the merchant’s platform and the banks (both acquirer and issuer). When you hit “Pay Now,” the payment gateway ensures your details are securely transferred, checks for authorisation, and facilitates the settlement process. It’s the tech backbone of the ecosystem.

- Payment Processor: The payment processor is the technical workhorse. It connects the dots between the payment gateway, acquirer, and issuing banks. Its job is to validate transactions, route payment information, and ensure the funds flow exactly where they’re supposed to. Without the processor, the whole system would grind to a halt.

These players might seem like background characters, but together, they’re what make online payments safe, fast, and reliable. Every time you complete a purchase, you’re witnessing a finely-tuned ecosystem in action!

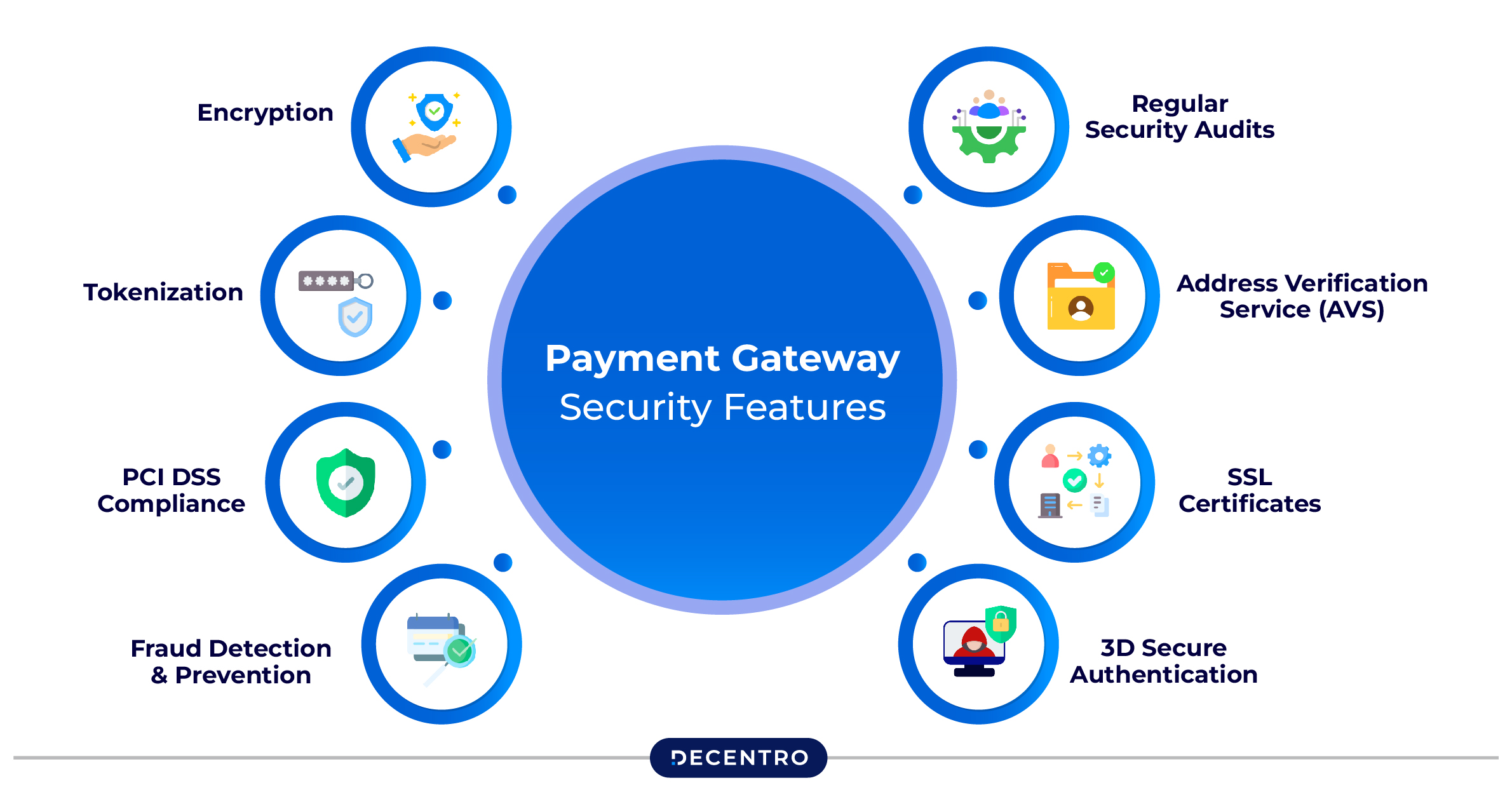

Payment Gateway Security Features

When it comes to online payments, security is the backbone of trust. Payment gateways deploy advanced security features to ensure your payment details are safe, your transactions are secure, and the whole process runs smoothly. Here’s what makes it all tick:

- Encryption

- Think of encryption as a digital lockbox. Payment gateways encrypt sensitive data like card details, ensuring it’s securely transmitted between the customer, the merchant, and the banks. Even if intercepted, the data would be indecipherable without the encryption keys. Decentro follows industry-best encryption standards like AES256 and RSA4096 for the utmost security.

- Tokenization

- Instead of transmitting actual card details, payment gateways replace them with unique tokens. These tokens are useless outside the payment environment, making sensitive information much harder to steal.

- PCI DSS Compliance

- Payment gateways must adhere to PCI DSS (Payment Card Industry Data Security Standard) guidelines, a global benchmark for secure handling of cardholder data. Compliance ensures that gateways meet strict security protocols and regularly update their defences. Decentro is fully compliant with ISO 27001 guidelines across all the products.

- Fraud Detection and Prevention

- Payment gateways integrate AI-driven fraud detection tools to monitor and analyze transactions in real-time. These tools flag unusual activity, like inconsistent IP addresses or mismatched billing details, helping to prevent fraud before it happens.

- 3D Secure Authentication

- Ever seen an OTP request before completing a transaction? That’s 3D Secure, an extra layer of verification required by many payment gateways to ensure the customer is the rightful owner of the card or payment method.

- SSL Certificates

- Payment gateways use SSL (Secure Sockets Layer) certificates to establish a secure connection between the customer’s browser and the gateway. This ensures that sensitive information stays protected during transmission.

- Address Verification Service (AVS)

- AVS is a tool that matches the billing address provided by the customer with the address on file with their card issuer. It adds an extra check to reduce fraudulent transactions.

- Regular Security Audits

- To stay ahead of emerging threats, payment gateways perform routine security audits and vulnerability assessments. These proactive measures keep their systems robust and up-to-date. Decentro undertakes frequent internal vulnerability assessments and undergoes periodic internal audits to ensure industry best practices are being followed.

With these features working in tandem, payment gateways ensure every transaction is seamless and fortified against potential threats. It’s like having a digital fortress protecting every payment you make!

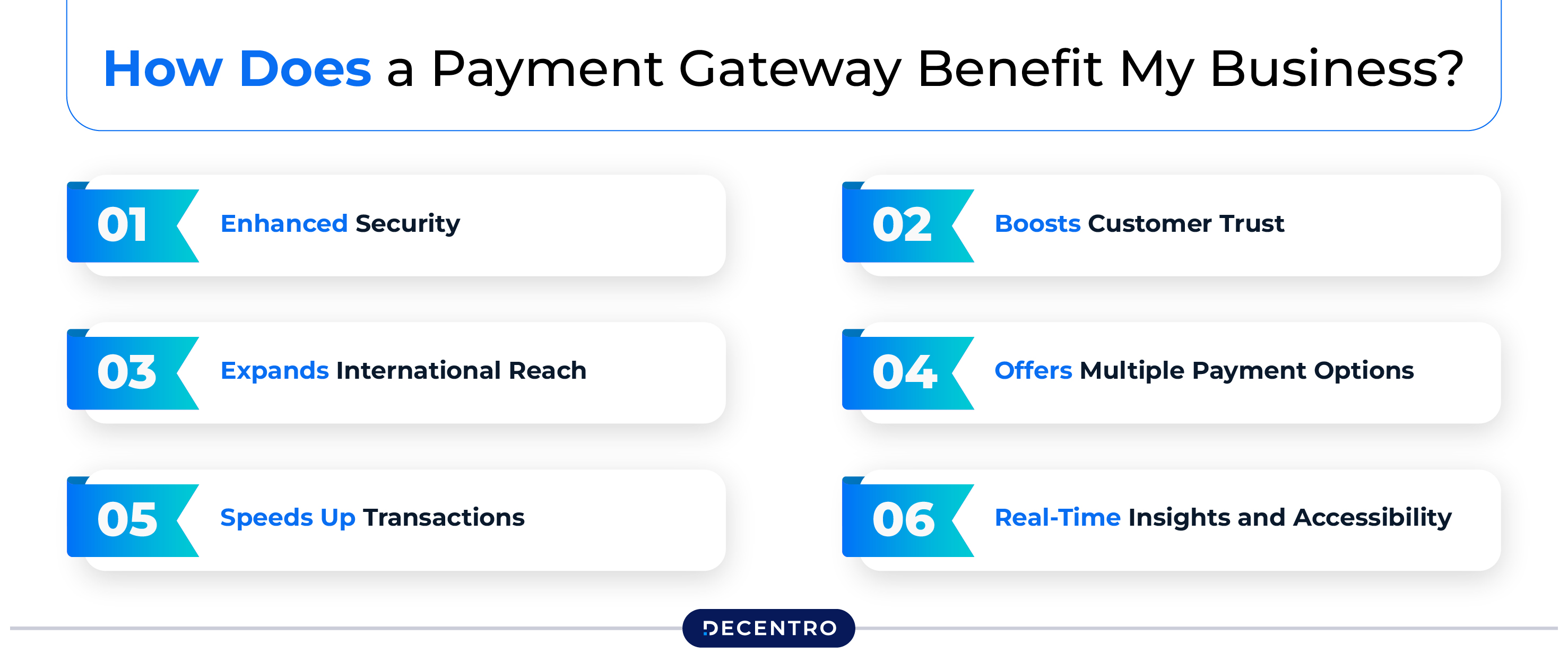

How Does a Payment Gateway Benefit My Business?

Integrating a payment gateway into your online payments isn’t just about accepting payments—it’s about streamlining operations, building trust, and unlocking new opportunities. Here’s how it can help:

1. Enhanced Security

Payment gateways ensure secure transactions by using advanced encryption and fraud detection tools. This protects sensitive customer data and safeguards your business from potential cyber threats.

2. Boosts Customer Trust

When customers see a trusted payment gateway during checkout, they feel more confident purchasing. A well-known gateway provider can act as a seal of approval, reassuring customers that their data is safe.

3. Expands International Reach

With a payment gateway, borders are no longer barriers. Many gateways support multi-currency payments, allowing you to accept payments from customers around the globe. Features like real-time currency conversion and T+1 settlements in your local currency (like INR) make global transactions hassle-free.

4. Offers Multiple Payment Options

From credit and debit cards to UPI, net banking, and digital wallets, a payment gateway gives your customers plenty of ways to pay. The more options you provide, your chances of completing a sale increase.

5. Speeds Up Transactions

Nobody likes waiting, especially during checkout. Payment gateways enable lightning-fast authorizations and settlements, reducing cart abandonment and boosting conversions.

6. Real-Time Insights and Accessibility

Payment gateways often come with feature-rich dashboards, giving you access to real-time transaction data. This lets you monitor sales, identify trends, and address potential issues immediately. For example:

- If a product is flying off the shelves, you can restock it before it runs out.

- If customers frequently abandon their carts at a specific step, it might be time to optimise that product page.

A payment gateway doesn’t just process payments—it elevates your entire business by creating a secure, seamless, and efficient customer experience.

Smoother, Simpler Payments with Decentro

India’s leading payment gateway provider, Decentro, simplifies complex tasks, offering banking APIs for streamlined transactions. Reconcile payments in real-time, saving business hours. Diversify payment options like RTGS and UPI, reinforcing branding. Launch Buy Now Pay Later products swiftly. Decentro’s payment gateway powers 1000+ enterprise payments including names like Pickrr, Volopay, Tramo, OwnDays, and NewTap Finance (By Cred).

Digitally onboard merchants with comprehensive KYC verification. Provide neobanking services for seamless transactions. Operate quickly with Decentro’s multi-bank architecture, handling volume spikes effortlessly. Supercharge your online payments with Decentro’s innovative solutions backed by top banks like ICICI.

Seems like a deal you would like to make ?

Frequently Asked Questions

Absolutely! Most payment gateways offer developer-friendly APIs and SDKs to seamlessly integrate with websites and mobile apps. Some providers even offer no-code or low-code options for quick setup. See the detailed guide here.

Payment gateways typically support multiple methods, including credit/debit cards, UPI, net banking, digital wallets, and even Buy Now, Pay Later (BNPL) options, depending on the provider.

Yes, a merchant account is usually required, as it serves as the intermediary account where funds are deposited before settling into your business account. Some payment gateways also offer bundled solutions that include a merchant account.

Payment gateways prioritize security by implementing features like encryption, tokenization, 3D Secure, and PCI DSS compliance. These measures ensure that transactions are protected against fraud and data breaches.

Payment gateways typically charge transaction fees, which may include a flat fee or a percentage of each transaction. Additional fees might apply for setup, monthly subscriptions, or certain advanced features, so it’s important to review the pricing structure.