Here’s a curated list of the best Non-banking Financial Companies (NBFCs) in India for 2025!

20 Top & Upcoming NBFCs In India In 2025

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Name of Application | Value Proposition |

| LendingKart | The loan application process is entirely online, and disbursals happen as swiftly as within 24 hours. |

| U Gro Capital | U Gro has disbursed loans worth over ₹1700 Crore |

| NeoGrowth | According to the Social Impact Report published by NeoGrowth, the NBFC stated it has catered & extended loans to over 1197 women, i.e., 16.4% of total borrowers. |

| FlexiLoans | The NBFC currently has roots in over 1000+ cities across India, has disbursed 10,000+ loans worth ₹2,30,01,25,000, and with over 100 partners. |

| Saraloan | To credit micro-business retailers to pay their vendors. |

| Oxyzo Financial Services | Oxyzo’s cumulative disbursements stand at over $2 billion now. |

| Recapita Finance | Recapita is a member institute of Equifax, Experian, TRIF, and Trans Union. |

| Ziploan | An RBI-registered NBFC, ZipLoan operates across 6 cities in the country. |

| InCred | The NBFC has garnered notable awards such as LinkedIn Top Startups 2018, The Economic Times Best Brands 2019, Super StartUps Asia 2019, and The Economic Times Best Brands 2020. |

| Home Credit | It offers flexible repayment options via online payments, payment apps, or any authorized centres. |

| PayU | PayU Finance facilitates Buy Now Pay Later via Lazypay, and it has PaySense as the Digital Lending Partner. |

| WeRize | WeRize is India’s 1st socially distributed, full-stack financial services platform that caters to middle-income groups, a whopping population of 300 million. |

| LoanTap | LoanTap provides a 24-hour disbursement window once a loan application is processed & approved. |

| Navi | Navi offers loan amounts up to ₹5 Crores with Interest rates from 6.4%. |

| Axio | Axio has a presence in over 300+ cities and has served over 2 million customers, disbursed over 9000+ Crores loans, and financed 7.5+ million purchases. |

| TapStart | TapStart’s digital lending partner is MoneyTap, one of the country’s largest consumer lending platforms. |

| LiquiLoans | It charges a service fee from the consumers for facilitating the credit. |

| RupeeCircle | The P2P lending platform is an alternative to traditional loans and lucrative investing options. |

| LenDenClub | It has registered loan disbursements close to ₹600 Crores in FY21, along with a YoY growth of 1000%. |

9507!

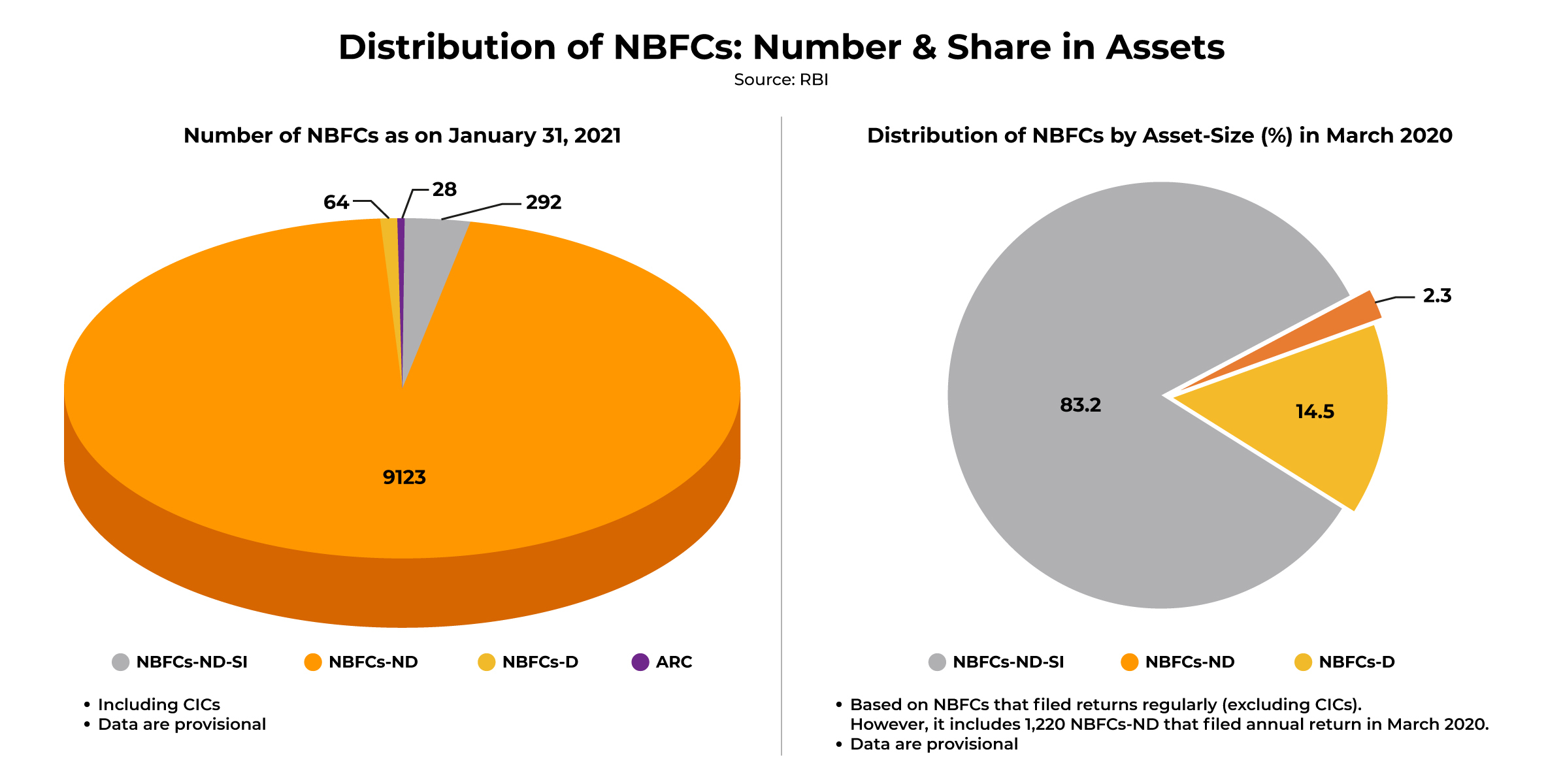

As of January 2022, the number of Non-banking financial companies (NBFCs) registered with the RBI was a staggering 9000+, according to Statista!

The majority of these belonged to the non-deposit category, and out of these, nearly 300 companies manage more than 80% of the total NBFC asset volume!

Today, let’s take a look at the Top NBFC platforms in India for 2025. Oh, did we mention we’ve segmented these non-banking financial companies as SME-focussed, consumer-centric, and peer-to-peer platforms!

Along with the well-known names in the NBFC space for a very long time, such as:

- Fullerton India Credit Company

- Aditya Birla Finance Limited

- Mahindra Finance

- Ujjivan Small Finance Bank

- Bajaj Finserv

- HDFC Ltd: Housing Finance

- Clix Capital

- LIC HFC

… we are giving a loud shoutout to many of the promising players who are already disrupting the NBFC space for good!

As always, here’s a quick note from our end.

Note: We aren’t ranking these NBFCs; merely curating the list for you! 🙂 And we know this isn’t an exhaustive list of the finest NBFCs in India. That is the very reason why you should keep a watch on the listicle for regular updates.

Top SME-focussed NBFCs in India in 2025

Without further ado, let’s see the top Non-Banking Financial Companies that cater to SMEs and empower them.

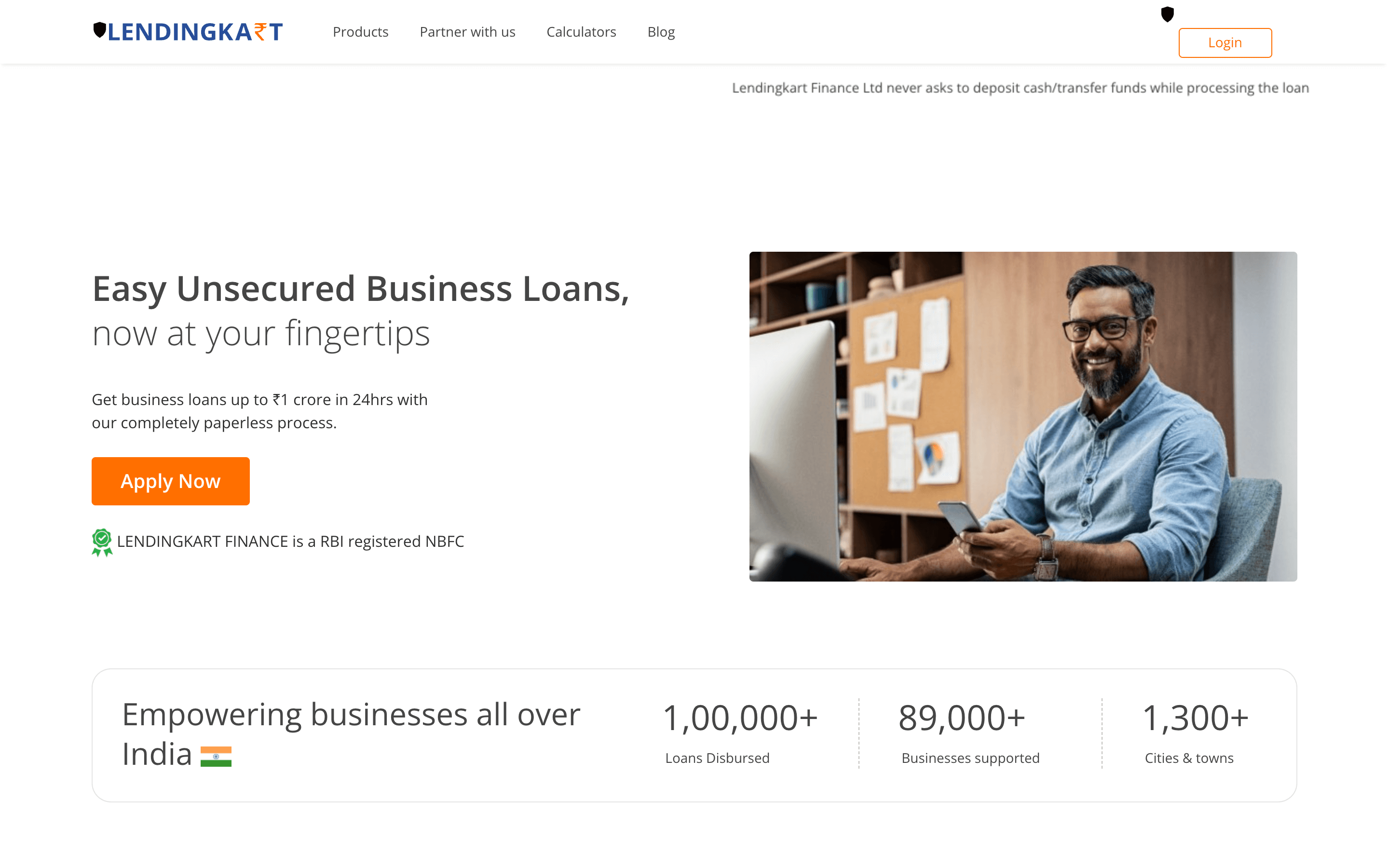

Lendingkart

Lendingkart Finance is an RBI-registered NBFC that provides unsecured business loans to small and medium enterprises. The loan application process is entirely online, and disbursals happen as swiftly as within 24 hours.

Getting business loans via Lendingkart is very simple.

- Enter business details to know about eligibility

- Complete KYC verification and register

- Choose repayment options and get swift disbursals.

Currently, the NBFC has extended over 1 Lakh+ loan, served more than 89,000 businesses, and has spread wings over 1,300 cities & towns along the length and breadth of the country.

U Gro Capital

U Gro Capital is a BSE-listed, tech-driven NBFC that provides working capital loans laser-focused on MSMEs to power their growth in India. This end-to-end digital lending platform aims to empower MSMEs with sector-specific loans, both secured & unsecured, with the mission to ‘Solve the Unsolved’ – the US $600 billion Small Business Credit Need. U Gro has disbursed loans worth over ₹1700 Crore.

U Gro operates across 8 select categories. These include:

- Healthcare

- Education

- Chemicals

- Food Processing / FMCG

- Hospitality

- Electrical Equipment and Components

- Auto Components

- Light Engineering

The NBFC has sought patent rights for its scorecard-based underwriting model that forecasts superior credit defaults and improves GNPA & NNPA levels. Further, it has partnered with banking institutions like the Bank of Baroda to facilitate co-lending for the MSME sector.

NeoGrowth

NeoGrowth is a digital lending platform that offers micro, small, and medium enterprises credit facilities and extends a range of secured and unsecured lending products.

Initially, the NBFC focussed heavily on underserved women entrepreneurs along with first-time borrowers. Soon enough, the horizon expanded, and the platform saw an influx of first-time entrepreneurs, business owners, retailers, restaurants, apparel shop owners, pharmacies, clinics, and more!

According to the Social Impact Report published by NeoGrowth, the NBFC stated it has catered & extended loans to over 1197 women, i.e., 16.4% of total borrowers.

The key products of this NBFC include:

- Vendor Finance

- Purchase Finance

- Finance for online sellers & e-commerce owners

- Neocash: Offline retailers & Point-of-sale purchases

FlexiLoans

FlexiLoans is an online lending platform that provides business loans to MSMEs. The platform aims to address one of the long-standing problems that MSMEs face- easy access to credit.

Did you know? Financial institutions reject over 80% of loan applications from SMEs due to a lack of sturdy credit history or stable collaterals.

FlexiLoans help MSMEs avail easy and instant loans via its various products and services such as:

- Term Loans

- Line of Credit

- Loan against POS

- Vendor Financing

- Value-Added Services

The NBFC currently has roots in over 1000+ cities across India, has disbursed 10,000+ loans worth ₹2,30,01,25,000, and with over 100 partners.

Further, FlexiLoans announced its partnership with Google Pay to serve its ever-growing merchant base. Above all, this makes it the first platform to go live on Google Pay to serve & extend loan services to 50,000+ businesses.

Saraloan

Saraloan is an NBFC that caters specifically to the supply chain domain and helps micro-businesses and their vendors with various financial needs. It has an automated tech platform that allows to manage the supply chain and navigate & ensure a smooth cash flow for businesses.

The key offerings of Saraloan include:

- Buy Now Pay Later: To credit micro-business retailers to pay their vendors.

- Vendor Financing: Helps business owners to prevent inventory stock-outs and pay vendors with an easy credit line.

- Receivable Financing: Enables business owners to get paid for any stuck receivables upfront.

- Cash Advance: Provides short-term loans for their working capital requirements.

Oxyzo Financial Services

OfBusiness is a tech-powered platform that enables SMEs in the manufacturing & infrastructure sectors to procure raw materials and provide credit facilities. The platform offers SMEs cash-flow-based financing to purchase raw materials via its NBFC ‘Oxyzo Financial Services.’

Oxyzo, now a pioneering fintech unicorn, emerges as a notable Non-Banking Financial Company (NBFC) at the forefront of facilitating digital lending solutions such as working capital finance tailored for Small and Medium Enterprises (SMEs). At the core of its operations lies a commitment to harnessing the power of technology to provide swift and efficient lending experiences. Oxyzo stands out by diligently adhering to online security measures and advanced digital protocols, including Vulnerability Assessment and Penetration Testing (VAPT), to ensure the utmost data privacy during all interactions within its information system.

Key Features:

- Robust Online Security: Oxyzo places paramount importance on safeguarding data privacy. The company meticulously follows the OWASP Top 10 2024 guidelines, exemplifying its proactive approach to mitigating cyber threats and vulnerabilities through VAPT.

- Roles & Permissions Framework: Oxyzo employs a meticulous Roles & Permissions framework to establish precise access controls within its systems, following the 4-Eyes principle. This stringent approach guarantees secure data management, restricting access solely to authorized personnel. By doing so, Oxyzo significantly reduces the risk of unauthorized data breaches.

- Maker & Checker System with PA/PT Data Security: Oxyzo adopts a Maker & Checker framework to heighten the precision and dependability of its operations. Additionally, Oxyzo reinforces its commitment to seamless, secure, and prompt lending experiences for SMEs by implementing Penetration Testing (PT) and Vulnerability Assessment (PA) measures for data security.

Oxyzo’s cumulative disbursements stand at over $2 billion now. This includes the amount being lent, which circulates back after the loan is paid, typically within 90 days.

Recapita Finance

Recapita Finance is an NBFC registered with RBI that provides gold, business, and personal loans. The platform enables you to apply online for the loan, customize the loan as per your needs, proceed to document verification, and get same-day approval & disbursals.

Recapita offers the following products:

- Gold Loan

- Personal Loan

- Working Capital Loan

- Small Business Loan

- Corporate HR Loan

- Mortgage Loan

- Industrial Property

- Financial Advisory

- Corporate Advisory

- Invoice Financing

Recapita is also a member institute of Equifax, Experian, TRIF, and Trans Union.

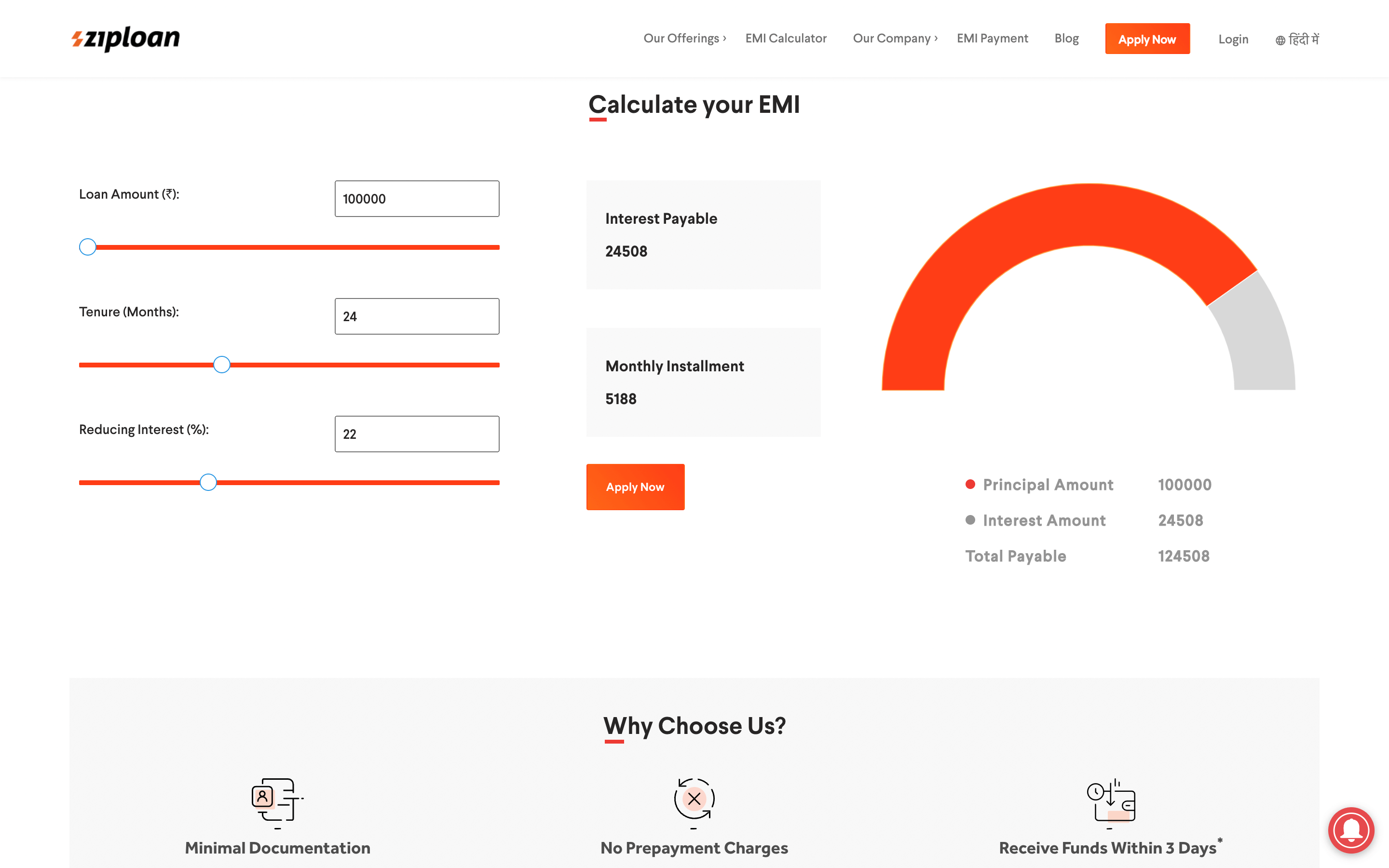

ZipLoan

Even after many strides in fintech, lending, and banking, easy credit access to small & medium businesses remains a significant hurdle. ZipLoan is a lending platform that caters to SMEs and provides micro-business loans. It aims to resolve this once and for all with a tech-backed lending platform.

An RBI-registered NBFC, ZipLoan operates across 6 cities in the country. It offers business loans of up to ₹1-7.5 Lakhs with minimal documentation, essential eligibility criteria, and minus any prepayment charges. In addition, the loan disbursal timelines happen within 3 days, making it easy for SMEs who are in immediate need of funds.

Top Consumer-focussed NBFCs in India in 2025

Now that we’re wrapped up the SME-driven NBFCs, let’s look at the top Non-Banking Financial Companies catering to consumers and individuals.

InCred

InCred is an NBFC personal, education, SME business, and two-wheeler loan and caters to individuals and companies.

The NBFC has garnered notable awards such as LinkedIn Top Startups 2018, The Economic Times Best Brands 2019, Super StartUps Asia 2019, The Economic Times Best Brands 2020.

Getting started with a loan with Incred can be done in 4 simple steps:

- Loan details

- Personal Information

- Verification Details

- Loan Offer after evaluation

With some notable partnerships, this NBFC strives to democratize lending and provide credit to both businesses and consumers, both underserved and catered. For instance, InCred has tied up with Amazon to address & resolve financial constraints Indian e-tailers face. In addition, Incred has also partnered with Zomato to provide easy credit to restaurant partners, especially to combat the drought brought by the pandemic.

Home Credit

Home Credit is an international NBFC with a global presence across more than 9 countries. It offers various products such as loans, insurance, and financial services.

The key offerings from Home Credit include:

Loans

- Mobile Phone on EMIs

- Home Appliances on EMIs

- Personal Loan

- Home Credit Ujjwal (EMI) Card

- Two-Wheeler Loan

- Home Loan

Insurance

- Health Insurance

- Pocket Insurance

- Two Wheeler Insurance

Services

- ScreenGuard

- Extended Warranty

- Mobile Protect

- Safe Pay

- Wallet Security

- Health Services

- Home Appliance Protection

- Credit Score Check

- Care360° Protection

- Digital Gold

Even if you don’t have a borrower/credit history, Home Credit still offers loans and welcomes first-time applicants. Furthermore, it also offers flexible repayment options via online payments, payment apps, or any authorized centers.

PayU

PayU is a global fintech firm focusing on Payments, Credit, and Investments. Spread across 50+ markets, the firm processes 10 Million financial transactions daily, $55B payments in FY21, has disbursed $130+ Million consumer loans, and invested over $1B in fintech.

The Indian entity is a payment gateway service provider that aims to help build a developer-friendly financial integration for payments and allow businesses to transact easily. Its lending counterpart, PayU Finance India, moved on to become an independent entity, after receiving the license from RBI.

The key offerings by PayU Finance include:

- Instant Personal Loans

- Shop Now, Pay Later

- Shop in Installments

PayU Finance facilitates Buy Now Pay Later via Lazypay, and it has PaySense as the Digital Lending Partner.

WeRize (MoneyOnClick)

The world is moving towards a DIY approach for any service or product. However, the small towns in the country, yet to tap into the tech-savvy progress, often falls behind. WeRize aims to serve these communities with their unique social distribution tech platform ‘Finance ki Online Dukaan‘ to provide high-touch sales/after-sales services. Be it customized credit, or group insurance, or savings products!

WeRize is India’s 1st socially distributed, full-stack financial services platform that caters to middle-income groups, a whopping population of 300 million. This growing market is worth $200 billion and requires a distribution model that traditional financial & banking institutions can’t stretch to serve.

LoanTap

LoanTap is an NBFC that provides customized loans to individuals, especially millennials, for diverse purposes. It extends to swift & flexible consumer loans to salaried professionals and business owners.

This fintech provides an array of products and services such as:

- Personal Loans

- EMI Free Loans

- Personal Overdraft Facility

- Credit Card Takeover Loans

- Rental Security Deposit Loans

- Advance Salary Loans

- House Owner Loans

LoanTap provides a 24-hour disbursement window once a loan application is processed & approved. In addition, it also offers financial products like Limitless Cards along with BNPL services to users that can convert outstanding amounts to EMI.

Navi

Navi is a digital lending app that provides users with easy credit and loan options. A user can apply for swift loans using Aadhaar/PAN and choose any EMI repayment duration and terms via a fully digital KYC verification process.

Navi aims to build financial services and products that are simple, affordable, and accessible to all. It provides home loans, personal loans, and insurance to consumers within a couple of clicks and has a custom app for tracking the same.

Navi offers loan amounts up to ₹5 Crores with Interest rates from 6.4%. Further, you can choose EMI tenure periods up to 25 years!

Axio

Axio is a top NBFC that provides Buy Now Pay Later and credit facilities to salaried and self-employed individuals for personal or professional needs. The platform has partnered with some of the top brands and offers lending services for consumers that shop online.

Founded in 2013, Axio has a presence in over 300+ cities and has served over 2 million customers, disbursed over 9000+ Crores loans, and financed 7.5+ million purchases.

Axio provides unsecured digital credit for up to ₹10 lakhs to help individuals with their business needs. This short-term credit facility has an online application process, requires no collateral, and has 72-hour loan disbursement.

The eligibility criteria for this NBFC to provide loans include the following:

- Income: Salaried or Self-employed individuals

- KYC: Documents like PAN card, Savings Account, and address proof are mandatory

- Residency: Applicant must reside in India

- Coverage: Across Axio’s operational cities

TapStart

TapStart is an RBI-licensed NBFC that aims to simplify credit for consumers in India. TapStart provides consumer credit via digital channels and pursues, making the credit experience the most convenient for the retail segment in India.

TapStart’s digital lending partner is MoneyTap, one of the country’s largest consumer lending platforms. This NBFC helps users with any need- be it loan for wedding expenses, education fees, or, medical emergencies.

Top P2P-focussed NBFCs in India in 2025

LiquiLoans

LiquiLoans is a peer-to-peer lending platform that connects fintech lenders and borrowers and enables them to provide & receive loans.

The P2P NBFC employs tech to match these lenders & borrowers and removes the margin fees that traditional financial institutions & banks otherwise levied. Further, it charges a service fee from the consumers for facilitating the credit.

LiquiLoans provides loans for a variety of uses such as:

- Free Credit Score

- Deposit Financing

- Wedding Loan

- Vacation Loan

- Credit Card Payment

- Debt Consolidation

- Vehicle Loan

- Education Loan

This P2P lending NBFC requires the following eligibility criteria for a user to either lend or borrow:

- Minimum age of 18

- A valid address with proof

- Bank account

- Regular income

RupeeCircle

RupeeCircle is a P2P NBFC that connects creditworthy borrowers with lenders and aims to provide last-mile credit facilities to users across India and amplify financial inclusion. The P2P lending platform is an alternative to traditional loans and lucrative investing options.

Moreover, it eliminates any middlemen and provides a common arena for borrowers to meet lenders.

If you are wondering about the instances of fraud on this P2P NBFC, RupeeCircle takes care of the heavy lifting- background checks, profile verification, risk assessment, loan collections, and more!

The different types of P2P loans curated by RupeeCircle include:

- Debt Consolidation Loans

- Vacation Loans

- Medical Bill/Emergency Loans

- Auto Loans

- Small Business Loans

- Life event Loans

- Education Loans

- Consumer Loans

LenDenClub

LenDenClub is India’s first P2P lending platform that has touched profitability. It has registered loan disbursements close to ₹600 Crores in FY21, along with a YoY growth of 1000%.

To get started with this P2P NBFC as a lender:

- You need to register on the platform, undergo the KYC verification process, and pay a one-time fee of ₹500

- Peruse verified borrowers and invest as needed

- Receive monthly returns from the borrower and choose to reinvest, if needed

The criteria to be a borrow with LenDenClub are:

- Age at time of disbursement: 21 to 55 years

- Net monthly income: At least ₹12000

- Residence: With family, rented home, or own home

- Bank Default: No loans or credit cards with default, written-off, or settled status after 2012

- Location: Mumbai, Pune, or Bangalore

- Employment: Salaried individuals

Wrapping Things Up!

With that, we’ve seen the top upcoming NBFCs in India for 2025! We’re thrilled to empower our dear customers, such as CreditFair, CashE and more in their mission to decentralize and democratize lending and credit.

How has Decentro’s banking API stack empowered these non-banking financial companies to serve their customers better? Stay tuned, for their case studies are en route! Not only that, we are gearing up to enable many more NBFCs in the coming months!

Are you an NBFC or fintech lender looking to amp up your financial offerings and provide a seamless lending experience to your customers, partners, and vendors? Decentro’s API banking platform provides easy-to-consume financial APIs to help businesses like yours.

How?

- Fully-digital KYC onboarding for your customers & partners.

- End-to-end customizable conversational banking workflows on chat-based social media apps like WhatsApp for your consumers, agents, businesses. or partners.

- Real-time transaction reconciliation via virtual accounts.

- Real-time, instant repayments using UPI & NACH Mandates.

Sounds like something you’d like to invest in?

Frequently Asked Questions

NBFC is a company registered under the Companies Act 1956 or 2013. NBFC is a company with the primary business of receiving deposits. It raises funds from the public (Directly or indirectly) and lends them to small enterprises. NBFCs provide credit facilities and are preferred more than banks. They cannot run their business without getting a license from RBI.

NBFCs are an important source of financing for Indian small-scale industries.

The NBFCs registered with RBI have been classified as:

Asset Finance Company (AFC)

These companies primary business is financing the physical assets (like automobiles, generator sets etc) that support production and other economic activities.

AFCs are of two types:

1. AFC’s accepting deposits

2. AFC’s not accepting deposits

Investment Company (IC)

Loan Company (LC)

Residuary Non-Banking Companies

In section 45-IA of the RBI Act, 1934, every NBFC must be registered with RBI to commence or carry on any business of a non-banking financial institution as defined in clause (a) of section 45-I of the RBI Act, 1934.

NBFCs cannot accept demand deposits as it falls within the realm of activity of commercial banks. An NBFC is not a part of the payment and settlement system, so an NBFC cannot issue cheques drawn on itself. Unlike in the case of banks, a deposit insurance facility is not available for NBFC depositors.