Here’s an in-depth guide to unlocking the potential of QR codes for secure & contactless payments. Elevate customer experience, save on fees, and go live in 2 weeks with Decentro’s Banking APIs.

How Does a QR Code Payment Work?

Chai & Fintech Addict at Decentro. Venture Capitalist in my previous life. Namesake Engineer before that.

Table of Contents

A visit to the nearby Kirana store, riding a taxi (after an eternity of cancellations & praying), booking movie tickets, shopping at your favorite outlets… the pre-pandemic era had us on our feet much more.

At the same time, it brought a way of change- how people consumed goods & services, both online & offline. A couple of years ago, could we imagine any mode of payment other than cash or cards which an offline store would accept?

While UPI payments have disrupted the universe of transactions, yet another payment methodology is gaining traction equally, perhaps more in the future.

Let’s talk about the Robin to the UPI-Batman, QR Codes!

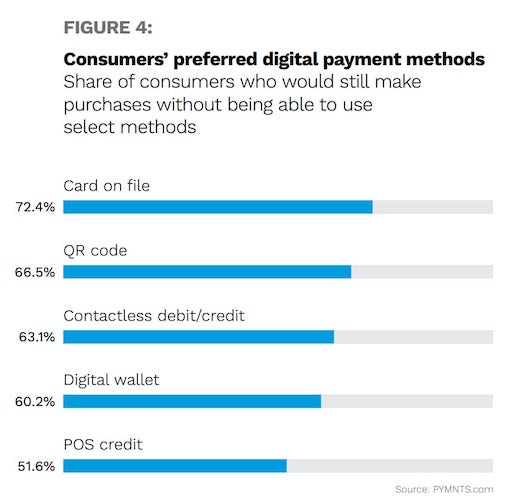

A study conducted by PYMNTS and American Express shows how customers globally have moved on from contact-based payments, such as cash, since the wake of the pandemic.

The study also found that brick-and-mortar business owners are moving towards creating a contactless payment system to provide the utmost convenience to both customers & employees!

Needless to say, QR code payments have an increasing presence in offline businesses, but before that.

What Are QR Codes? How Do They Work?

In 1994, the Japanese automotive company Denso Wave developed an alternative to barcodes that could be scanned in any direction and had vertical and horizontal patterns. This simple pattern of black barcodes arranged in a square grid can be easily scanned by a compatible code scanner/reader or a smartphone with an in-built camera reader.

QR code, or Quick Response Code, is a machine-readable, easy-to-scan optical label that is similar to a barcode and helps a user perform a variety of tasks such as make a payment, navigate to a particular location such as an online website, or access data in the form of an image or PDF, among others!

A QR code can hold 100X times more info than a barcode. Moreover, it can store up to 7,089 digits or 4,296 characters, including punctuation marks and special characters, making it a lucrative option for business owners for various uses, payments, for instance!

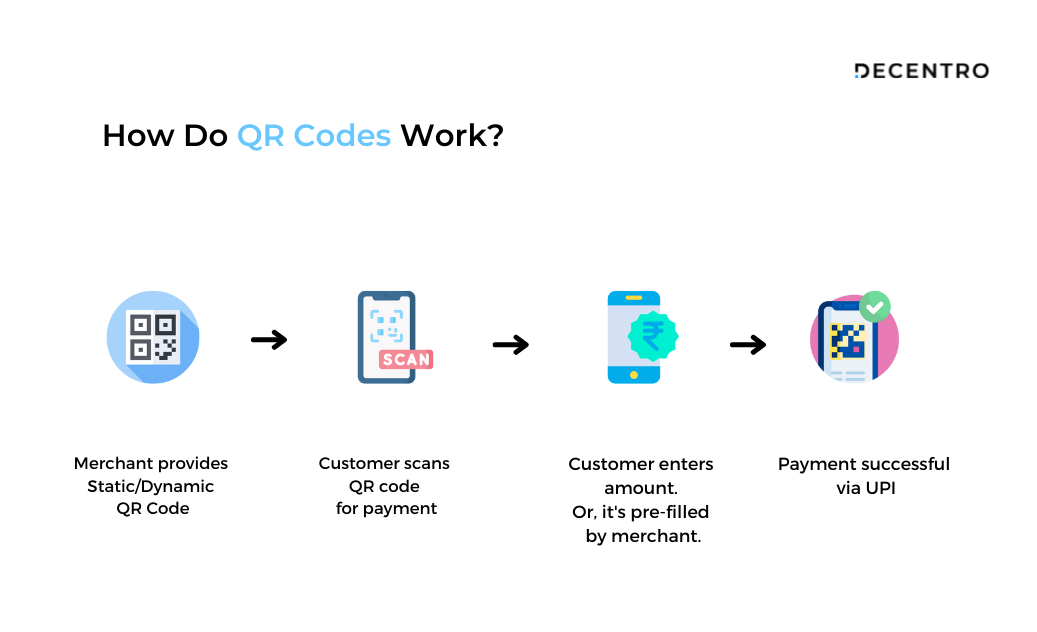

As we know, QR is a barcode-like image consisting of information about both a merchant and their payment provider. QR payments function like a standard Point of Sale (POS) terminal: customers use their smartphone to scan the QR code; once the camera detects the QR code, a push notification leads them to a screen to input their payment details and complete the purchase instantly.

Types of QR Codes

We can broadly classify the types of QR codes as follows:

- Static Codes

- Dynamic QR Codes

The information that’s encoded in static QR codes is complete and final. By this, we mean that once the QR code is created, it isn’t possible to change the data within and in turn, the data it points to. If there is an error, the entire QR code will be obsolete. The information is directly encoded in a static QR code, making the pattern denser. What are some familiar places where a static QR code finds use?

- A small store owner who accepts payments from customers

- Any crucial information that must not be changed, such as an ID card or employee details

On the other hand, dynamic QR codes have a short URL placed within them. This provides the creator the flexibility to change the destination/data of the QR code any number of times. What are some examples of dynamic QR codes in use?

- Scanning a menu at a restaurant

- A business sharing product catalog, website details, and more!

- Payments at shops or outlets with more than one point of purchase are all directed to the same payment destination.

What are Some Key Use-cases of QR Code Payments?

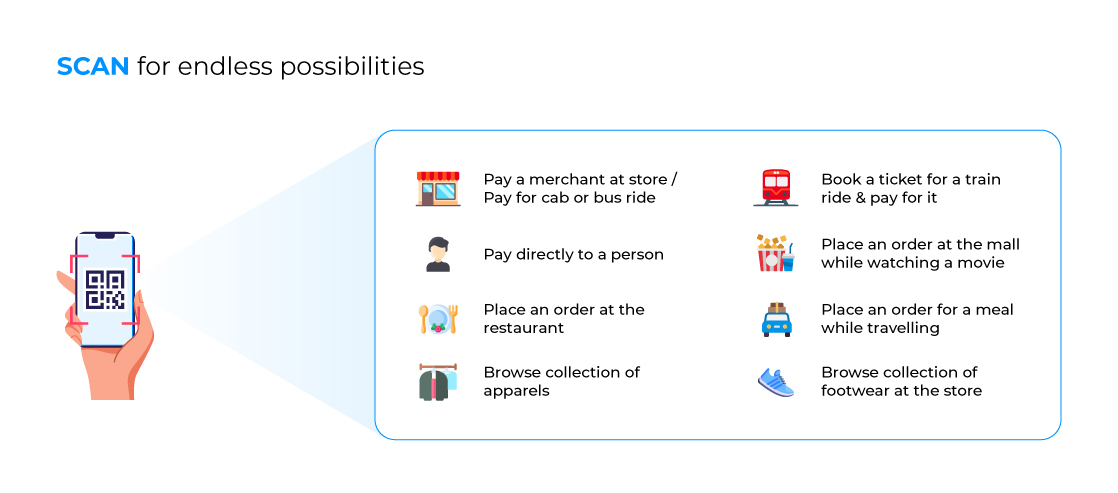

As we’ve seen, QR code payments can find use in umpteen ways in the everyday functioning of offline businesses. Let’s take a look at some of the popular use cases.

Kirana Stores & Retail Outlets

Many Kirana Stores are moving to QR codes to accept customer payments. Retail outlets also station scannable static or dynamic QR codes at PoS(point of sale) machines to enable easy customer checkout. The retailer can enter the amount, generate the QR code, and the amount automatically reflects in the UPI app of the user, who can proceed to transact in just 2 clicks. Alternatively, the user can also enter the amount and pay the shop owner. Talk about smooth payments for offline businesses!

Business Correspondents

Business correspondents are agents who provide banking & financial services to users at locations other than official branches or ATMs. The BCA network constitutes 91% of the total banking outlets in India. A BC can use QR codes to facilitate payment collections from customers at the comfort of their homes and enjoy any financial or banking services easily.

Vendors, Small Merchants, SMEs

QR code payments also make life easier for vendors, small merchants, and SMEs. While vendors enjoy instant payments via QR codes & UPI, small merchants can save on the money they must spend as a commission or transaction fees to a payment service provider like payment gateways. Similarly, B2B payments that are high in volume would require SMEs to pay a hefty amount as processing fees, which can be avoided using QR code payments.

Utility Bill Providers

A utility bill service provider offering services such as water, cooking gas, or electricity can use multiple QR codes to collect customer payments. All they need to do is embed the QR code along with the bill- the customer can easily scan it via the physical invoice.

Pay & Park Businesses

Pay ‘n Park service providers can ensure an uninterrupted and quick checkout process by using QR code payments. They can either embed the same in the parking ticket or provide the same at the collection point.

How do QR Code Payments Benefit Merchants, Shop Owners, and Vendors?

QR code payments benefit offline business owners, small-time shop owners, and retailers with multiple outlets. Some of these include:

- Real-time, instant payments

- Contactless and a more secure payment alternative

- Convenience with interoperability feature

- Easy bookkeeping & transaction reconciliation

- Improved customer experience

Mimosa pudica, or the touch-me-not plant – That’s how our transactions are becoming.

Given our preferences for touchless menus and contactless transactions in the last two years, QR codes have made huge inroads – a 750% rise in QR Code downloads ever since the pandemic occurred. The global QR Code Market is projected to grow to $1.2 billion by 2026 from $0.9 billion in 2020.

Local Kirana stores, restaurants, fintech players, retailers, FMCG companies, travel and hospitality businesses, healthcare businesses, and even donation platforms have started using Quick Response, or QR codes with varying degrees of need.

RBI announces UPI and credit card linking

With the new announcement, users can now link their credit cards to popular UPI apps like Google Pay, Paytm, and PhonePe. Users can then scan the QR code and choose a credit card as the mode of payment, making it an additional layer of convenience.

So, how are these developments in QR codes impacting business revenues and customer growth?

QR codes – The connector between us and the physical world

QR codes – The key benefits

- Convenient and contactless, and real-time

QR codes can be placed anywhere: outside a payment counter or shop, on websites, or in emails. Customers can complete payments instantly from a safe distance. - Improved customer experience

QR codes for payments eliminate the need for cards or payment terminals – a smartphone can do the job. - A secure payment alternative

QR codes are more secure than card payments: all data is encrypted, and if paid through a website QR code, customers need not fill in any bank details. - Payment Reconciliation

Every payment is reconciled in real-time, and the ledgers are updated. While it is convenient for customers, virtual accounts APIs make it easier for businesses. - Saving on commissions and processing fees

While vendors can get payments instantly via QR codes & UPI, small merchants get to save the commission or transaction fees to payment gateways. With high-volume B2B payments, SMEs can save big by using QR code payments and avoiding paying hefty processing fees.

How can Decentro empower businesses with QR codes for payment?

Get Static or Dynamic QR Payment Codes

Decentro’s Payments APIs help you create static or dynamic QR codes based on your business needs. Be it neobanks, fintech lenders, gig economy platforms, or NBFCs, Decentro’s payment stack supports multiple modes of transfers including bank transfers, UPI, and QR code payments. With virtual accounts created exclusively for your business, you can receive payments in real-time!

Branded or White-labeled UPI IDs

Branded UPI IDs instill confidence in customers. Decentro can help you brand the UPI IDs in the name of your business, making way for a better customer experience!

Simplified Split Payments & Commission Settlements

Keeping track of the money flow can be a hassle for businesses with more than one branch. Decentro’s split payments feature helps a business with real-time bookkeeping, irrespective of which outlet the money flows from!

Payment Reconciliation

Offline businesses often face trouble figuring out missed payments, reversed transactions, etc.. Decentro’s real-time payment reconciliation via virtual accounts APIs keeps your ledgers updated, and you can create multiple accounts too!

Speed of Integration

You perhaps liked all the features which fit well with your business needs. Suppose you are wondering how soon you get started with the integration. In that case, Decentro’s financial & banking APIs are built to enable you to go live in about two weeks, compared to the months traditional financial institutions typically take. This also means reduced expenses of up to 90%!

Drop us a message at hello@decentro.tech if you think now’s the time you want to get the best of QR code payments and make your customer transactions straightforward and secure.

We can help!

By the way, You also even scan the QR code below to reach us.

Just for the feel of it, cheers!