Learn how secure data sharing in open banking drives innovative, personalized financial solutions and customer satisfaction. Leverage Decentro’s APIs and get started.

Leveraging Online Open Banking for Enhanced Financial Services Personalization

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Financial leaders face a growing challenge: delivering truly personalized financial solutions. Traditional services, often impersonal and inefficient, struggle to meet today’s sophisticated clientele. Open banking offers a powerful solution. It allows secure data sharing between institutions, enabling the creation of highly customized financial tools and services. Imagine tailoring loan offers or building automated budgeting apps based on real client data–with their consent. This article explores how open banking can be your strategic advantage, driving customer satisfaction, innovation, and new revenue streams.

The Power of Personalization in Finance

The Problem

Traditional financial services often fail to deliver personalized solutions. Banks and financial institutions typically offer generic products and one-size-fits-all approaches, failing to address their clients’ distinct needs.

This lack of personalization results in inefficiencies and lost opportunities for both institutions and their clients. The 2024 State of CX Personalization Report reveals that 76% of consumers expect companies to understand their unique needs and expectations.

Why Personalization Matters

For businesses, personalized financial services can significantly enhance customer satisfaction and loyalty. Tailored financial products and advice allow clients to achieve better financial outcomes, optimize budgeting, increase savings, and provide more relevant investment and loan options. For instance, a customized budgeting tool aligned with specific spending habits can help businesses manage finances more effectively, while personalized loan offers can deliver better interest rates based on detailed financial profiles.

The same personalization report indicates that 63% of consumers are likelier to engage with companies offering personalized experiences. For financial institutions, this means a clear competitive edge through enhanced client loyalty and satisfaction.

Data Drives Personalization

The cornerstone of effective personalization is data. By leveraging data analytics to understand spending habits, income patterns, and financial goals, financial institutions can craft solutions specifically designed for each client. This data-driven approach ensures that clients receive pertinent and timely advice, aiding them in making informed financial decisions. For example, if a bank understands a client’s income and expenditure patterns, it can recommend suitable savings plans or investment options that align with their financial goals and risk tolerance.

This targeted approach benefits clients by providing tailored financial advice and helps institutions build stronger, trust-based relationships with their clients, ultimately enhancing loyalty and long-term engagement.

Open Banking: The Key to Personalized Services

How Open Banking Works

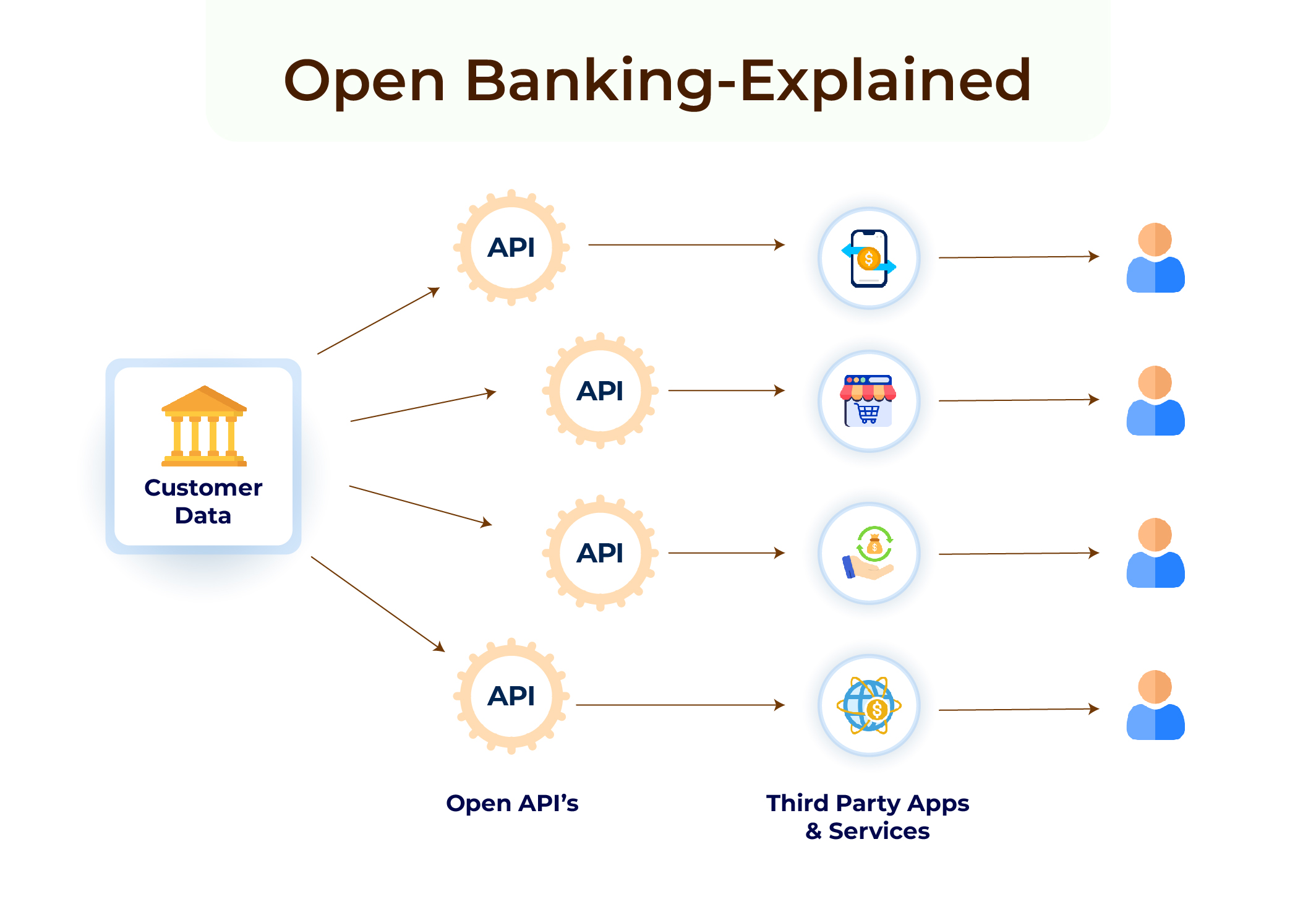

Open banking enables financial institutions to share customer financial data with third-party providers securely, contingent on customer consent. This process utilizes open banking APIs (application programming interfaces), which facilitate seamless communication between different software systems.

When customers authorize data sharing, third-party providers can harness this data to develop bespoke financial services. This system ensures secure data exchange while safeguarding customer privacy.

To distinguish between open banking and platform banking: open banking focuses on sharing financial data between banks and third-party providers to craft personalized services. Conversely, platform banking consolidates various financial services, such as banking, investments, and insurance, within a single application, streamlining the user experience by offering multiple services in one place.

Both methodologies aim to enhance customer satisfaction but differ in approach: open banking prioritizes data sharing, while platform banking focuses on service integration.

Benefits for Financial Institutions

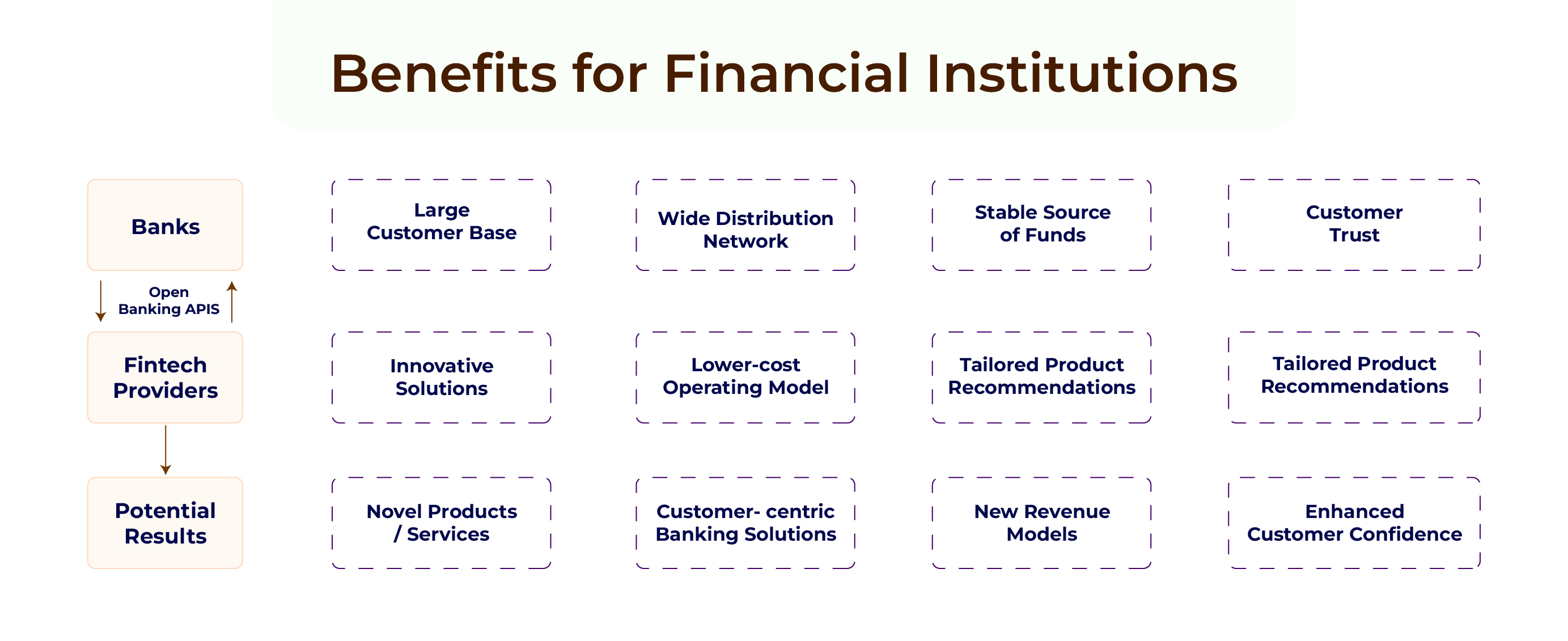

For banks and other financial entities, open banking presents substantial advantages.

Access to comprehensive customer financial data allows institutions to gain deeper insights into customer behaviors and needs. This understanding enables the creation of products that closely align with individual preferences, significantly enhancing customer satisfaction.

Furthermore, open banking fosters innovation, enabling financial institutions to maintain a competitive edge in a rapidly evolving market.

A recent Accenture report indicates that 76% of banking executives believe that embracing open banking will enable them to develop superior, more personalized customer services.

Transforming the User Experience

Open banking is revolutionizing how financial services are personalized and delivered, enhancing efficiency and customization in several key areas:

Tailored Product Recommendations

Financial institutions can leverage open banking data to offer highly personalized product recommendations. Analyzing comprehensive financial information allows banks to provide tailored loan offers, investment advice, and insurance plans that align precisely with a client’s financial profile.

This targeted approach ensures that businesses receive relevant and advantageous financial solutions.

Automated Budgeting and Goal Setting

Using data obtained through open banking, financial applications can analyze spending patterns and automatically allocate funds toward specific financial goals. This automation simplifies financial management, enabling businesses to save and invest more efficiently without the need for manual intervention.

Streamlined Loan Applications

The traditional loan application process can be cumbersome and time-consuming. Open banking addresses this by providing lenders with comprehensive financial data, expediting the approval process and enabling better loan terms.

For instance, students typically endure a lengthy and stressful process when applying for loans. Open banking can significantly streamline this by offering lenders a complete view of the applicant’s financial situation, including income, expenses, and credit history. This detailed data allows for faster and more accurate decision-making, resulting in quicker approvals and potentially lower interest rates.

As students navigate their educational journeys, making informed decisions about their future can significantly impact their career trajectories. Understanding the implications of their choices, particularly when selecting college majors, is essential for long-term success.

Moreover, when students select the best college majors they want, open banking can provide tailored financial advice and loan options that align with their chosen field of study. For example, if a student chooses a major with high earning potential, lenders might offer more favorable loan terms based on projected future income. This personalization level ensures students receive financial products that best suit their needs and career plans.

Additionally, students can benefit from data-driven insights highlighting job market trends related to their majors, enabling them to make even more strategic decisions about their education and future employment opportunities. By aligning their studies with lucrative career paths, students can better position themselves for success in a competitive job market.

Alternative Data Assessment for Credit Underwriting

Open banking also facilitates the use of alternative data in credit underwriting. By providing access to diverse data points, it enables lenders to assess creditworthiness more comprehensively.

This interoperability helps extend credit access to a broader range of clients, including those who may not have traditional credit histories but exhibit reliable financial behavior through other metrics. This approach enhances inclusivity and supports better-informed lending decisions.

Security, Privacy, and the Future of Open Banking

Addressing User Concerns

While the advantages of open banking are substantial, addressing data security and privacy concerns is paramount to gaining the trust of stakeholders. For company executives, lenders, and fintech leaders, ensuring robust security measures and transparent data usage policies is critical.

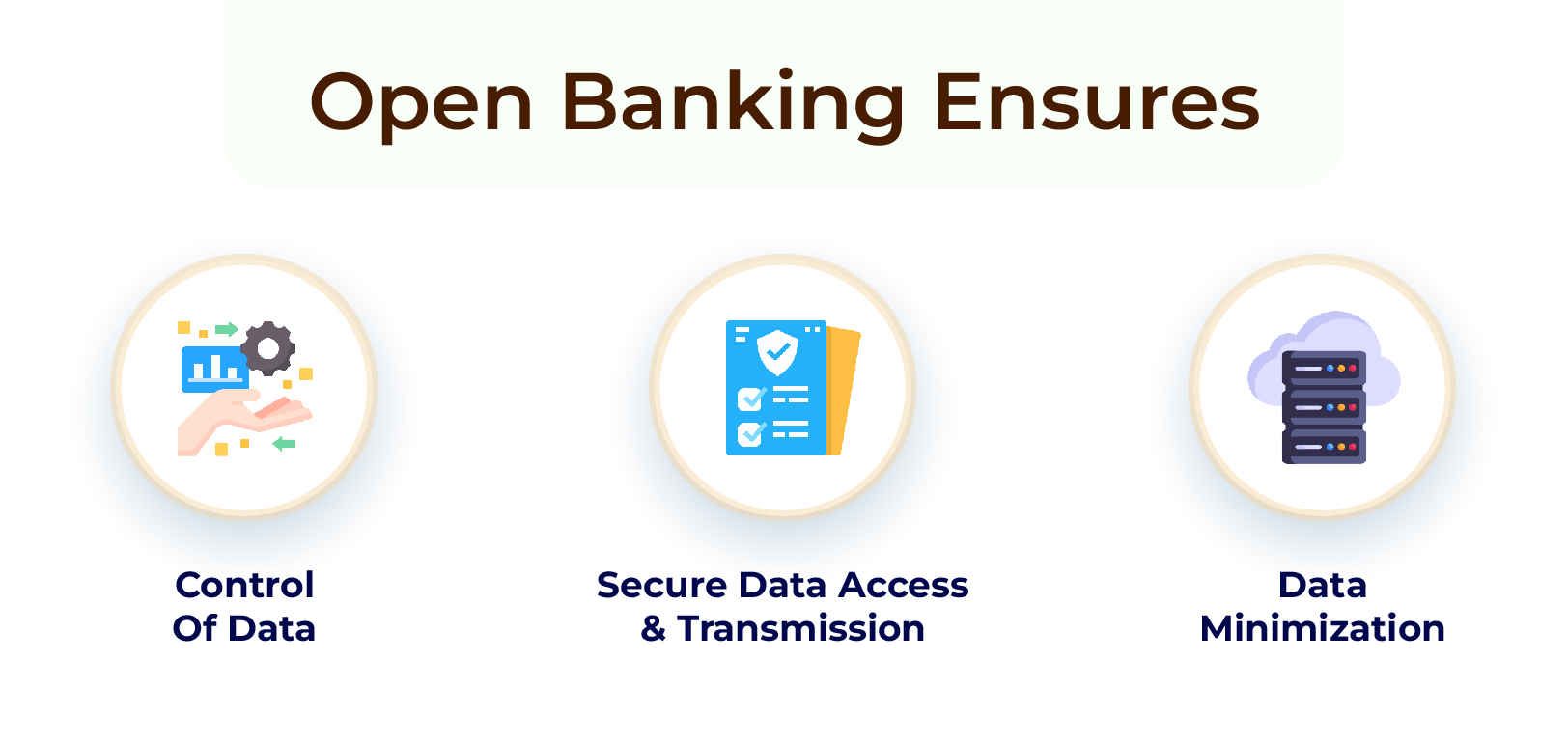

Open banking systems are engineered with stringent security protocols to safeguard customer data. These systems employ advanced encryption techniques and secure communication channels to prevent unauthorized access.

Moreover, they empower customers by giving them control over their data, allowing them to decide what information to share and with whom.

A Deloitte survey underscores the importance of this transparency, with 54% of consumers indicating that companies need to be more transparent about their data usage. For business leaders, this statistic highlights the necessity of fostering trust through clear communication and rigorous data protection practices within the open banking ecosystem.

Adherence to Regulatory Compliance

Trust is crucial for the success of open banking. Financial institutions and third-party providers must prioritize transparency and security to earn and maintain customer trust. Ensuring adherence to regulatory compliance is key to building this trust within the open banking ecosystem.

Open banking systems are designed with robust security measures to protect customer data, including advanced encryption and secure communication channels. Furthermore, compliance with regulations such as GDPR and PSD2 ensures that financial institutions handle data responsibly and transparently.

Clear communication about data usage and protection is essential. Customers should be informed about how their data will be used and the security measures in place to safeguard it.

For business leaders, adhering to these regulatory requirements enhances data security and fosters a trustworthy environment where customers feel confident in how their data is managed. This compliance is fundamental to maintaining the integrity and success of the open banking model.

The Future of Open Banking Personalization

The future of open banking is poised for significant advancements with the integration of emerging technologies. Artificial intelligence (AI) is at the forefront of these innovations, offering unparalleled opportunities for personalization. AI can analyze extensive datasets to deliver highly customized financial advice, enabling clients to make more informed financial decisions.

AI also plays a crucial role in automating financial tasks such as budgeting and saving, streamlining financial management for users. This automation not only enhances efficiency but also ensures that financial institutions can offer proactive and tailored financial solutions to their clients

Collaboration is Key

For the full potential of open banking to be realized, collaboration between traditional financial institutions and FinTech companies is essential. This partnership leverages the strengths of both sectors, fostering a more dynamic and responsive financial services landscape.

By working together, banks and FinTech firms can innovate more effectively, developing cutting-edge financial products that address individual needs more precisely. This collaborative approach drives the evolution of financial services and enhances the overall user experience, ensuring that clients receive personalized and efficient financial solutions.

Conclusion

Open banking is revolutionizing the financial industry by enabling highly personalized financial services. Secure data sharing facilitates tailored product recommendations, automated budgeting, and streamlined loan applications, all of which can significantly enhance the customer experience and operational efficiency.

For company executives, lenders, and fintech business leaders, embracing open banking offers a strategic advantage. By leveraging the opportunities it presents, organizations can provide superior financial services that are closely aligned with client needs and preferences. Open banking is not just the future of finance; it’s a pathway to a more personalized and efficient financial ecosystem, driving growth and innovation in the industry.

As we advance toward a more personalized financial landscape, it is crucial for business leaders to explore and integrate open banking solutions to stay competitive and achieve strategic financial objectives effectively.

How can Decentro Help your Business?

At Decentro, we’re firm believers in the Banking-as-a-Service (BaaS) innovation and wish to extend banking workflows to all kinds of customers. In a hyper-personalized world, companies have started differentiating themselves by building their personalized user workflows using APIs. Besides absorbing the complex banking workflows, our platform takes care of the underlying regulations while dealing with each banking product.

Our KYC module is one small step towards open banking, and we plan to add more innovation and leverage the underlying government and regulatory stacks. Most importantly, we take care of both kinds of downtimes and outages in an automated and streamlined fashion—when a bank provider goes down intermittently or even permanently.