What has been buzzing in the fintech industry over the past year? What can we expect going forward? Let’s recap & evaluate!

Fintech Trends For 2022: What To Expect In Tandem With 2021

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

Food for thought: Do we realize the extent of penetration fintech has in our everyday lives?

How about when you pay later from Amazon after buying that resistance band? Or scan a QR code to pay for your electricity bill? Setting up autopay, be it for investment or your monthly Netflix subscription?

There was a time when cash payments alone ruled the world. Sending money over the internet was considered foolhardy. However, now, anyone can move around without cash freely, as long as they have a smartphone with an active internet connection.

According to ResearchAndMarkets, the fintech market was valued at ₹2.30 Trillion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of ~24.56% between 2021 & 2026 to reach ~₹8.35 Trillion by 2026.

Not just that, as of 2020, India accounted for the highest fintech adoption rate (87%) and is the biggest destination for investment deals worldwide.

ResearchAndMarkets

Today, let’s recap some of the significant things that happened in 2021 in fintech and see the trends to expect for 2022!

9 Fintech Trends to Watch for 2022

Along with the trends and their key impacts, let’s also see the new regulations, compliance requirements, and guidelines issued across diverse spaces in the fintech & banking industry.

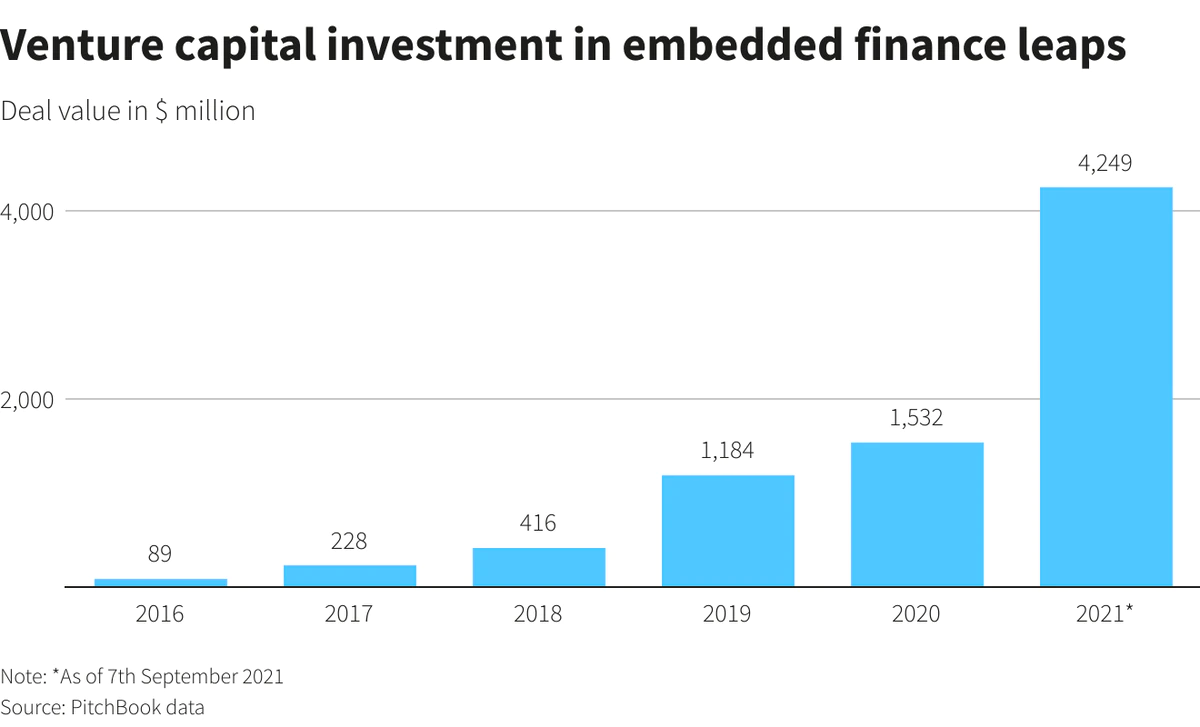

#1 Embedded Finance & Lending

As we’d mentioned at the start of this blog, embedded finance & lending has seamlessly integrated money, credit, & more into our lives seamlessly. Getting insurance for our travels, seller financing, invoicing, paying for the cab rides later, are some of the examples that illustrate this.

For instance, our customer Jumbotail has made life easy for Kirana store owners with simplified payments and instant settlements for suppliers & agents using embedded finance & lending within their platform.

Key Impacts

- Tech giants such as Amazon have already absorbed this wave to provide credit within their applications avoiding the need for consumers to visit traditional banks for loans.

- The financial inclusion index is sure to increase since access to basic financial services such as loans is much easier.

- Spending patterns will increase driving more economic activity & growth since people have access to credit via services like BNPL from non-fintechs, as opposed to getting in the queue to get a credit card.

- Increased customers satisfaction and happiness due to elevated experience.

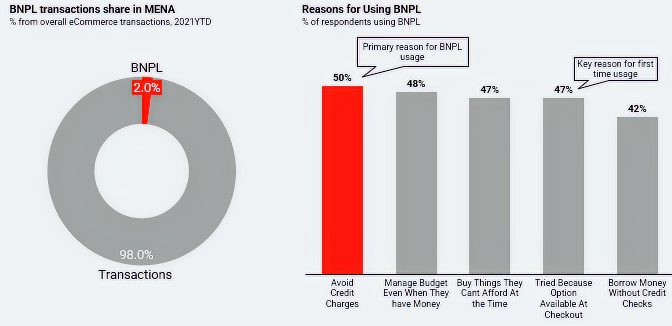

#2 Buy Now Pay Later

One of the hottest buzzwords in the fintech and banking world would be BNPL. I mean, can we even write a blog on Fintech trends in 2022 without mentioning pay later in it?

As people have adjusted & embraced digital payments, especially since the pandemic, BNPL has seen an increased adoption rate.

Redseer research says India’s BNPL market will touch $45-50 billion by 2026, from the existing $3-3.5 billion. What are some noteworthy trends in this sector?

Key Impacts

- Mastercard is of the view that BNPL could lead to a 45% increase in average sales from previous customers and a 35% reduction in cart abandonment.

- This could pave the way for non-fintech companies, especially in the e-commerce domain, to join hands with fintech players to provide credit via BNPL.

- BNPL is very likely to replace credit cards in various sectors due to its ease of use and credit availability.

This space is seeing a lot of growth & traction and some super cool turn of events!

- Visa and Mastercard are reportedly exploring options to launch their respective Buy Now Pay Later (BNPL) platforms in India by the end of FY22.

- As per ET’s reports, Visa and Mastercard are on the lookout for integrating with partners to provide retail business & merchants BNPL services via a direct tie-up with lenders.

- E-commerce giant Flipkart has seen 2x year-on-year growth for Flipkart Pay Later users to encourage purchases, especially during festive seasons.

- Paytm spokesperson reported that the loans disbursed grew to touch 2.8 Million, a 714% year-on-year growth, in Q2 FY22.

#3 UPI Number – Interoperability

@ybl, @paytm, @sbi

We juggle multiple IDs daily while processing UPI payments for a multitude of purchases. However, with NPCI’s[National Payments Corporation Of India] latest mandate, a single UPI ID that is interoperable across any application is in the pilot program. A single ID available for uniform use across different UPI apps. The ID can be an 8-10 digit number. If it’s a 10 digit number, the ID must be the user’s mobile number. Easy to remember, share, and pay!

Can you imagine the convenience that will come with it?

Key Impacts

- We can expect an increase in the UPI adoption rates since this further simplifies the usage.

- The UPI number could accentuate the financial inclusion index since signing up and using it as simple as remembering your phone number.

What are the essential points of the UPI interoperability update?

- By 1st December 2021, all the UPI apps(TPAPs & PSPs) will need to be compliant-ready.

- These apps are not allowed to incentivize users for this. The pilot allows apps to run with less than 5 million users.

More about UPI Numbers can be found here!

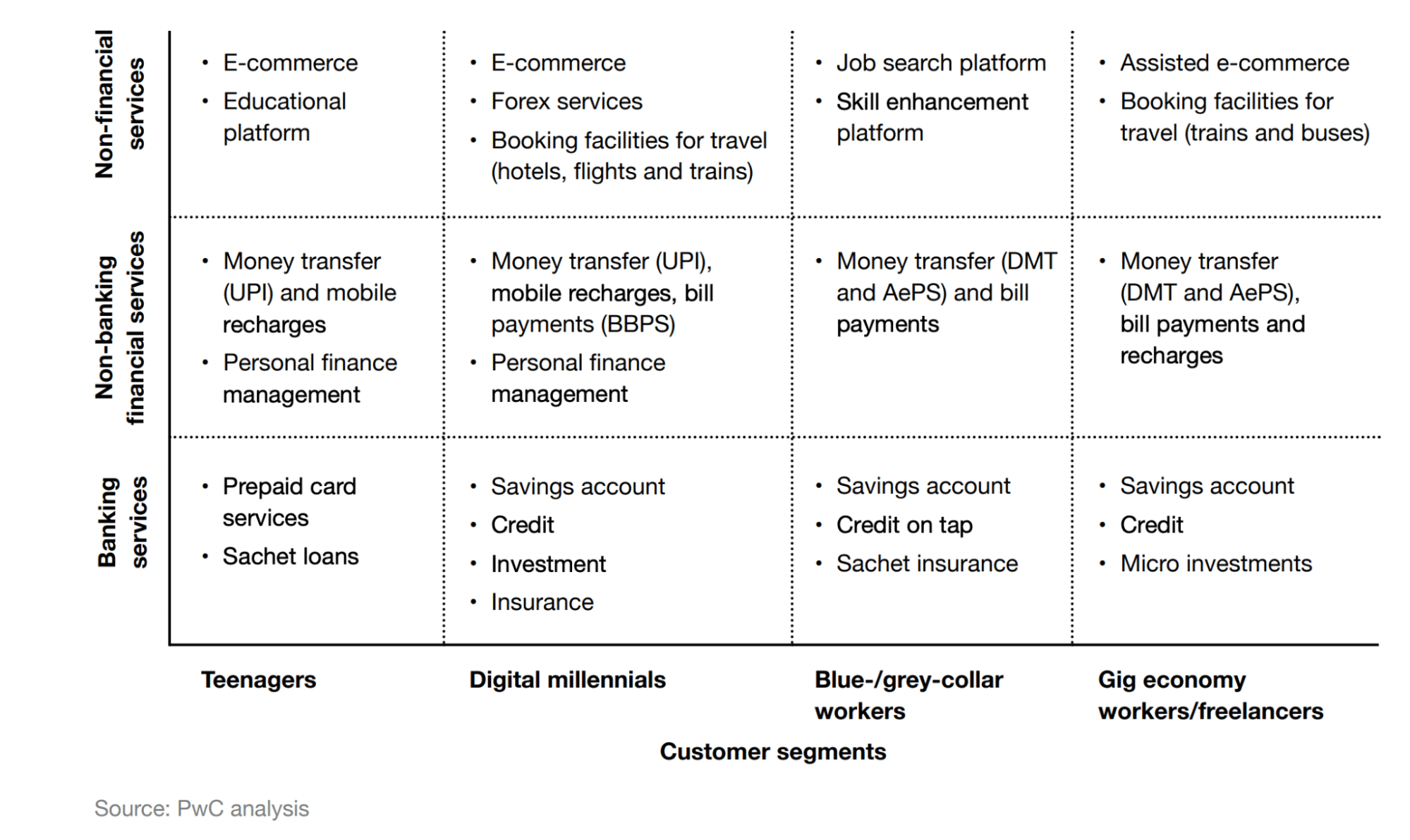

#4 Neobanks in India

Recently, we curated the list of the top and upcoming neobanks in India– it’s a regularly updated list and we’ve so far covered 23 neobanking apps with more en route.

Such is the kind of disruption we’re witnessing in the challenger banking space. More and more neobanks are coming up to refine the banking experience and set a competitive battleground to win customers over both the consumer segment and the MSME sector.

- Indian neobanks are yet to operate with autonomy since they don’t have licenses, guidelines to function, or regulatory approvals.

- As a result, they function via partnerships with banking institutions licensed under RBI, making this one of the stark differences with global neobanking platforms.

- Neobanks are capturing market share in the MSME sector, a largely ignored section by traditional banking institutions due to high cost of acquisition and collections.

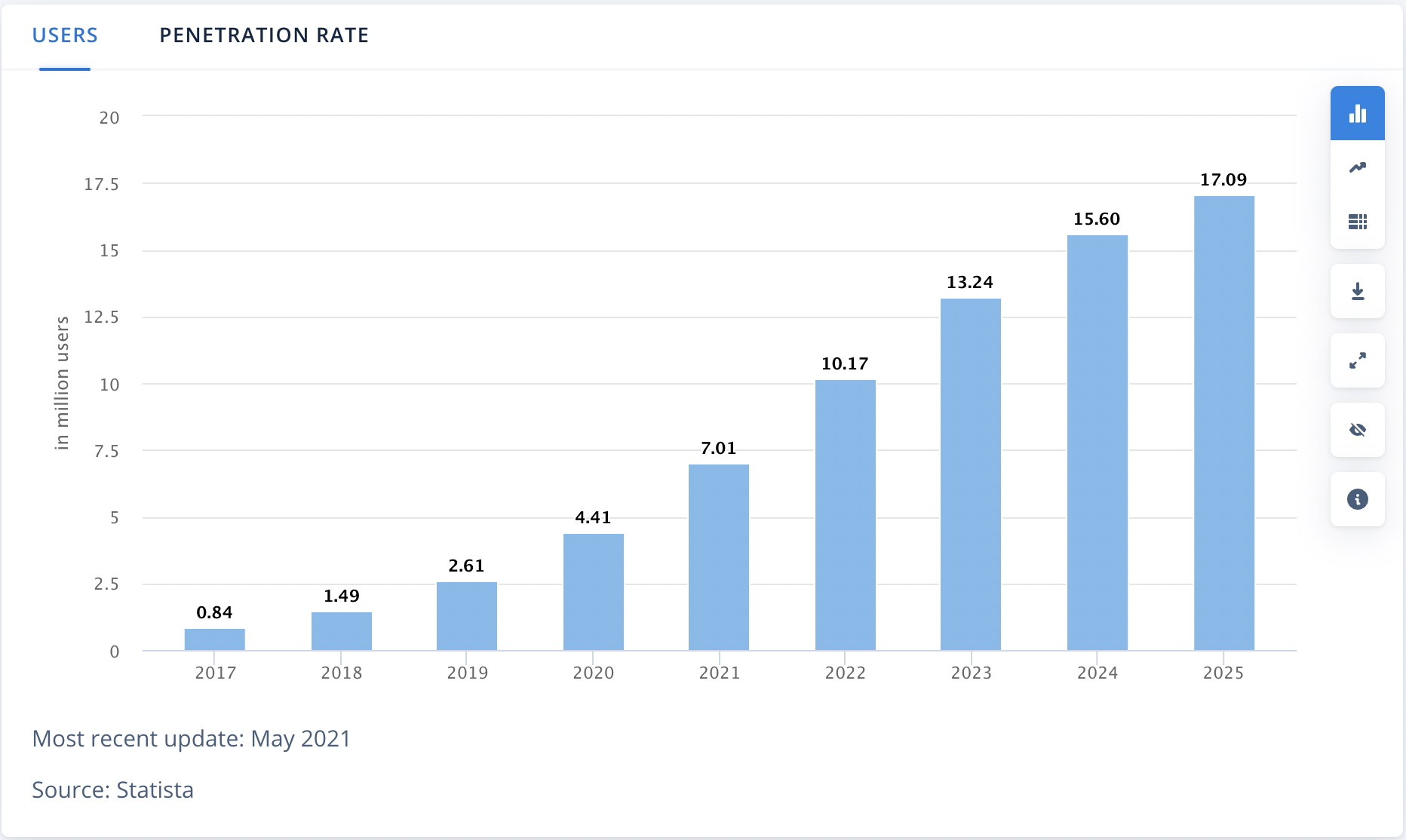

According to Statista, the number of neobanking users in India in 2021 is 7.01 million. It is expected to touch 17 million in 2025 with a market penetration rate of 1.2%.

In 2021, the transaction volume that neobanks processed included a whopping $30.5 billion and is expected to touch $96.6 Billion in 2026.

This sure is an exciting fintech trend to keep our eyes glued to!

#5 Retail Offline Digital Payments

It’s not just online payments that witness one stride after another in the country. Thanks to RBI’s latest guidelines, offline digital payments are also coming to the forefront.

Key Impacts

- Higher adoption for digital payments via cards, wallets, mobile devices. Especially in rural areas where the population is still dependent on cash.

- Retail businesses can target a broader category of users and provide an equally enriching experience for them via agents or directly with the user.

- Greater penetration numbers for financial inclusion index in the country.

The absence of the internet entirely or the erratic nature of connection in remote areas hinders digital payments adoption. To combat this, the govt has developed a scheme to allow payments even in the absence of the internet. The pilot was undertaken till 31st March, 2021 from August 2020.

More about the pilot here!

#6 QR Code Payments Domination

It’s highly improbable to find a store, even a Kirana one for that matter, in all major metros without a QR code pinned near the checkout counter. There’s no doubt that QR code payments are on the rise, and will continue to be so.

According to PYMNTS, 40% of India’s population uses QR codes. The use of QR codes in conjunction with UPI makes it even more lucrative for businesses, big or small, to provide a faster and seamless checkout process.

What are the trends we see in the QR payments space?

Key Impacts

- Retailers, small business owners, Kirana stores, and the likes can easily be a part of the digital payments world using simple to use QR codes.

- QR code interoperability reduces the hassle of managing multiple codes for multiple applications and running behind the reconciliation at the end of the month.

- With this, businesses can offer a superior checkout experience to consumers, thereby spiking the sales figures.

In October 2020, RBI had outlined a couple of pointers for QR codes, which still holds good.

- The two interoperable QR codes, UPI QR & Bharat QR, will continue operations for users across India

- Payment System Operators (PSOs) can no longer launch their own proprietary QR codes and instead need to shift one of the two mentioned above.

#7 Data Storage Guidelines

In accordance with RBI’s latest data storage guidelines, all e-commerce platforms are not allowed to store any customer’s payment details on their servers, including even the 16-digit lengthy card number. This has come as a fierce effort to protect users from highly sophisticated cybercrimes, which have increased even more since the pandemic.

Businesses will have to be compliant with this guideline before January 2022.

Key Impacts

- Customers will Need to Memorize Card Details to Transact.

- This could have a major impact on card transactions that could drastically dip owing to users moving to alternative payment methods. The one-tap checkout will no longer be a value proposition these platforms offer users.

- Recurring Transactions will be Harder

- Subscription-based systems will find it hard to process recurring payments for users. The do-once-forget-it method will no longer work, which could majorly impact user experience.

- Obvious Shift to UPI

- If you are in India, this mandate needn’t worry you greatly- UPI will take care of smooth payments for you. If a user hesitates to transfer large amounts of money via UPI, this is the definite point where it ceases (UPI easily facilitates transactions up to ₹2 Lakhs).

- Improved Seller Payments & Reduced Delays

- E-commerce seller settlements take their own sweet time. With the new guidelines, merchant settlements will be faster and they no longer need to wait for days together to collect funds.

- Adieu Card-related Cashback

- The personalized cashbacks for users would get tricky for companies since they can no longer save the card details.

#8 Card-on-File Tokenization

When you were about to make the payment on your food delivery app, did you receive a message asking you to ‘tokenize’ your credit/debit card details?

This can be seen across all the e-commerce platforms where we have saved our cards details for a smooth & swift shopping experience. This follows RBI’s mandate that allows e-commerce companies to tokenize the credit & debit cards of users.

Before that, what is tokenization?

A user’s card details are replaced with a ‘token‘ or a unique set of characters that becomes the replacement and masks the sensitive data.

Key Impacts

- Enhanced security for a customer’s card data(aka Card-on-File (CoF))

- The identity of 2 Crore Indians was compromised with a potential data breach on BigBasket’s online supermarket platform, in November 2020. Any such data leaks of the CoF data is serious- frauds & hacking would become common & highly probable. Tokenization will strongly thwart such instances since it’s extremely hard to reverse-engineer & generate the actual card data from the token.

- This mandate will help Card aggregators & networks positively since it reduces a merchant’s efforts to implement PCI DSS (Payment Card Industry Data Security Standard) guidelines.

- Card issuers are permitted to offer tokenization services as Token Service Providers (TSPs) and require explicit consent from customers via Additional Factor of Authentication (AFA).

- The extent of tokenization has moved to laptops, desktops, & more from mobile phones.

What are the key aspects of the tokenization mandate?

- When a debit/credit card is used for a transaction, the details(card number) are dispatched to a tokenization service system/provider.

- A unique 16-digit ‘token’ is generated that replaces the original card number. This is then used & stored by the e-commerce business under the customer’s name.

Note: While the original deadline for card tokenization was January 2022, the deadline has now been extended to 30th June 2022. Post this date, all stored data will be purged. More details can be found here.

#9 Updated PPI Guidelines

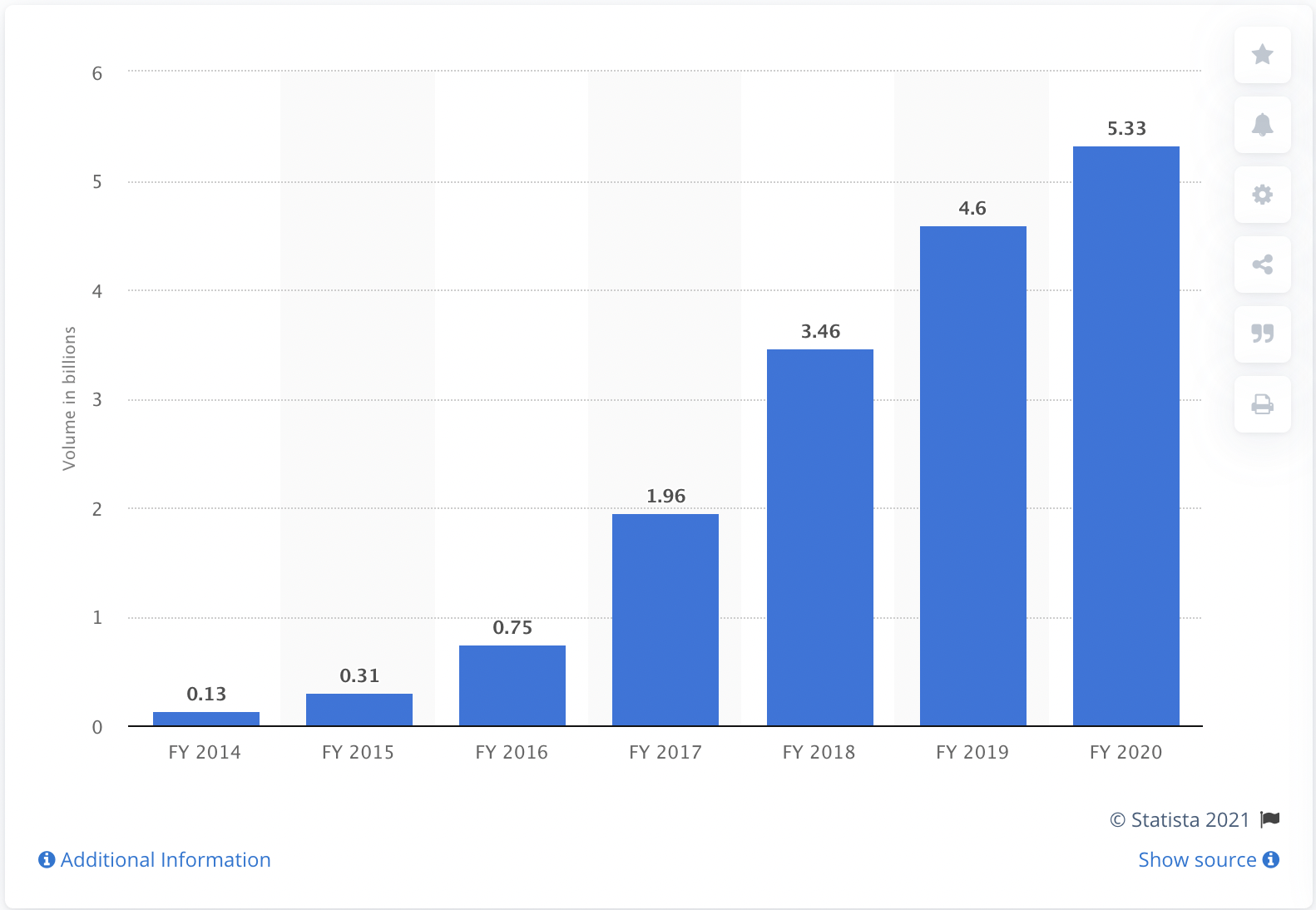

The volume of PPI payments in India in the fiscal year 2021 accounted for approximately 4.9 billion.

Statista

The Govt & RBI has now mandated PPI Interoperability, increased the limit to ₹2 lakh for Full-KYC PPIs, and permitted Cash Withdrawal from Full-KYC PPIs of Non-Bank PPI Issuers.

Key Impacts

- Increased adoption of prepaid instruments such as prepaid cards and wallets. The interoperability makes it easy for consumers to use the instrument for diverse purposes driving more numbers. Cash withdrawals will also contribute to this!

- Increased limits will enable more users to complete full KYC, thereby reducing fraud instances and offering higher security for consumers.

There’s no doubt that fintech & banking is a compelling space to be in currently. We’re happy to do our part in empowering hundreds of businesses and in turn, hundreds of thousands of their customers, enjoying a better financial journey.

Be it with:

- Simple APIs for UPIs,

- White-labeled virtual wallets

- Plug & play banking APIs to launch a custom BNPL product for your business in weeks.

- Instant QR codes, tied to unique virtual UPI IDs that make payments smooth for your business & customers,+ reconciliation is no longer a headache with virtual accounts!

- A host of banking products such as Savings accounts, business BaaS, and more for your neobank!

We hope this blog on the upcoming trends in fintech was an insightful read for you. Did we miss out on anything? Drop a comment below and get featured in our blog.

Got any questions? We’re always here to help: hello@decentro.tech!

Cheers!

Comments are closed.