How are so many new neo-banks and credit cards hitting the market?

What’s the buzz behind BaaS? Here’s a primer on Banking-as-a-Service. Read on!

Banking as a Service (BaaS) – Everything You Need to Know

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

“Wherever you go, go with all your heart,” said Confucious.

“Wherever you go, go with TripMoney Global Credit Card,” thought Make My Trip.

MakeMyTrip’s fintech arm TripMoney has joined hands with SBM Bank India to launch a rupee-denominated secure credit card. Visa powers the value-loaded credit card with several money management features and can be used across 150 countries, helping international travelers, including students.

Next, Amazon and Flipkart thought, “Empty shopping bags don’t make noise,” and launched their credit cards with rewards to make buying more affordable, targeting over 50 million customers.

IndMoney, more like the dad in the house, thought, “If you are shopping and traveling so much, you may well keep track of what you spend and save.” They have developed a super finance app that can be the “one-stop shop” for people to keep tabs on savings and expenses.

How are all these made possible?

How can non-banks embed financial services into their experience and quickly take it to the market?

Who is bridging this collaboration between regulated financial institutions & any company that wants to partner with them and build fintech products?

Many such questions. One answer – Banking-as-a-Service, or BaaS providers.

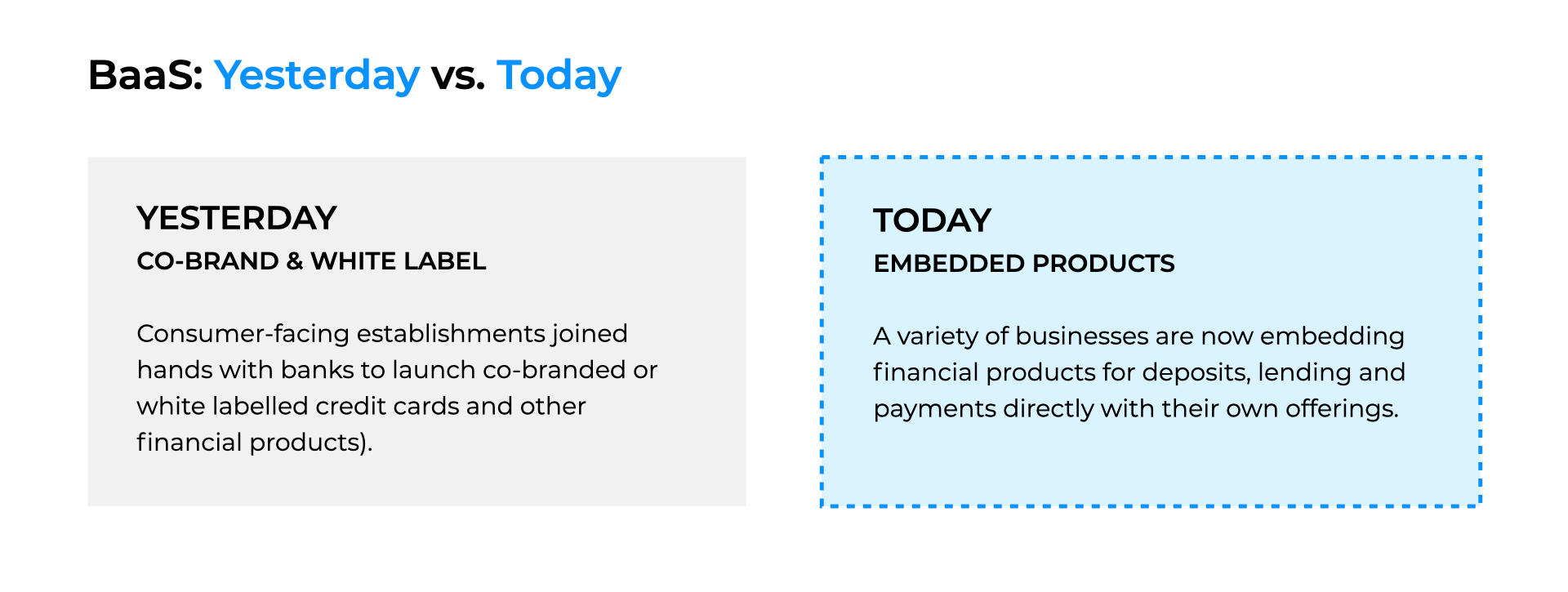

What is BaaS?

So imagine you have a business.

A model that thrives on elevating customer experiences. So you think of extending services such as coupons, referrals, or even customer loyalty points that can be used on your platform.

As the perks are monetary, you have to involve a bank.

Banks hold money, remittance, and payment processing. Banks need tons of investment to create the required infrastructure to enable these functions. The processes and the complex infrastructure often create gridlocks.

These gridlocks called for a bridge for fintech companies and non-bank organizations to partner with banks instead of building these financial services from the ground up.

And that bridge is your BaaS provider.

BaaS is an end-to-end approach that enables fintech companies and other third-party organizations to connect with a bank’s system using APIs. This helps businesses build modern financial services on the provider bank’s regulated infrastructure while facilitating open banking services.

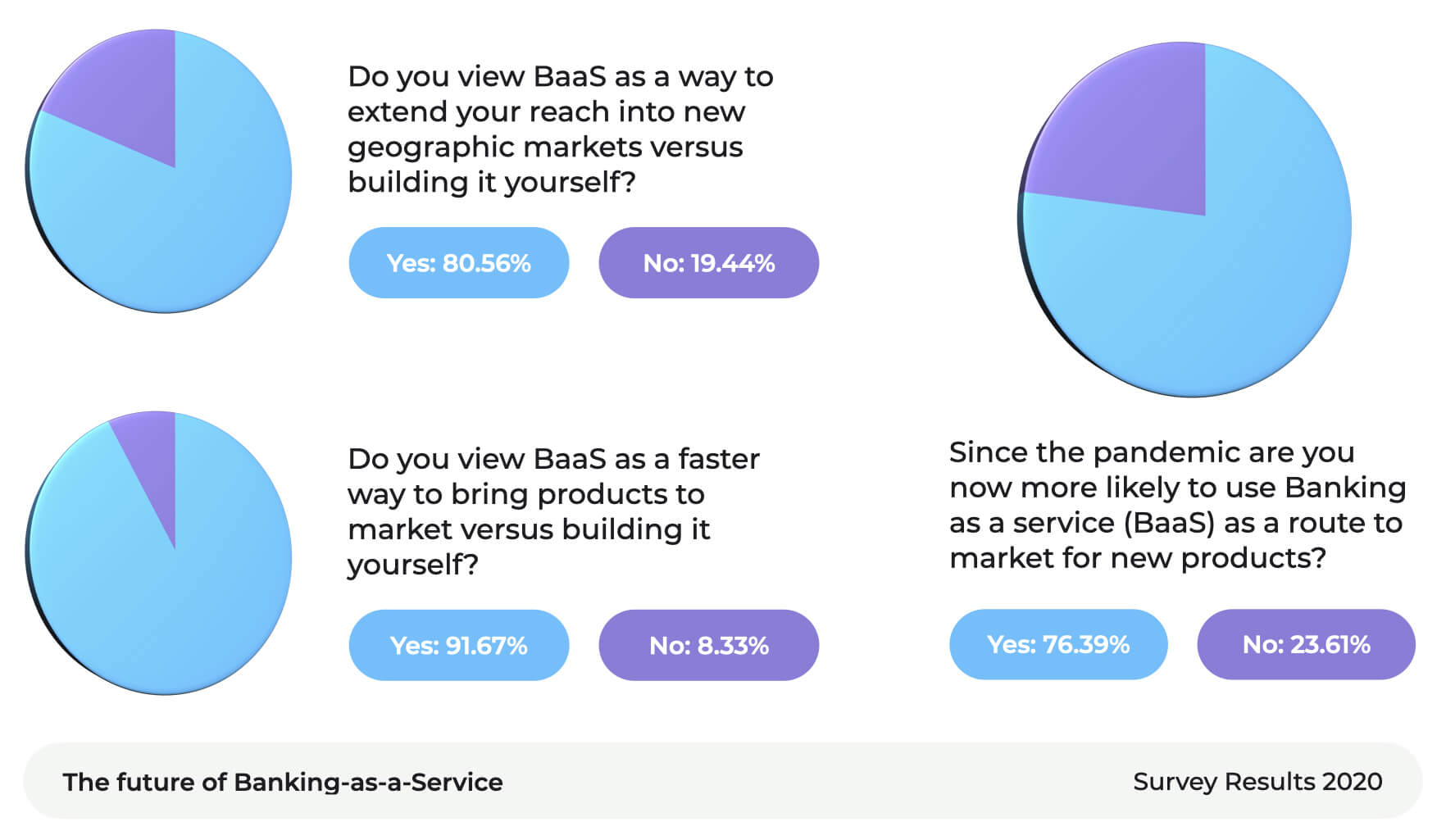

Let’s look at Equinix’s recent reports on BaaS to see how businesses perceive the wave of BaaS.

Banking as a service has enabled new players, both fintech and otherwise, to launch products within half the time, keeping compliance issues at bay. Let’s discover how your business can catalyze growth with business banking as a service today.

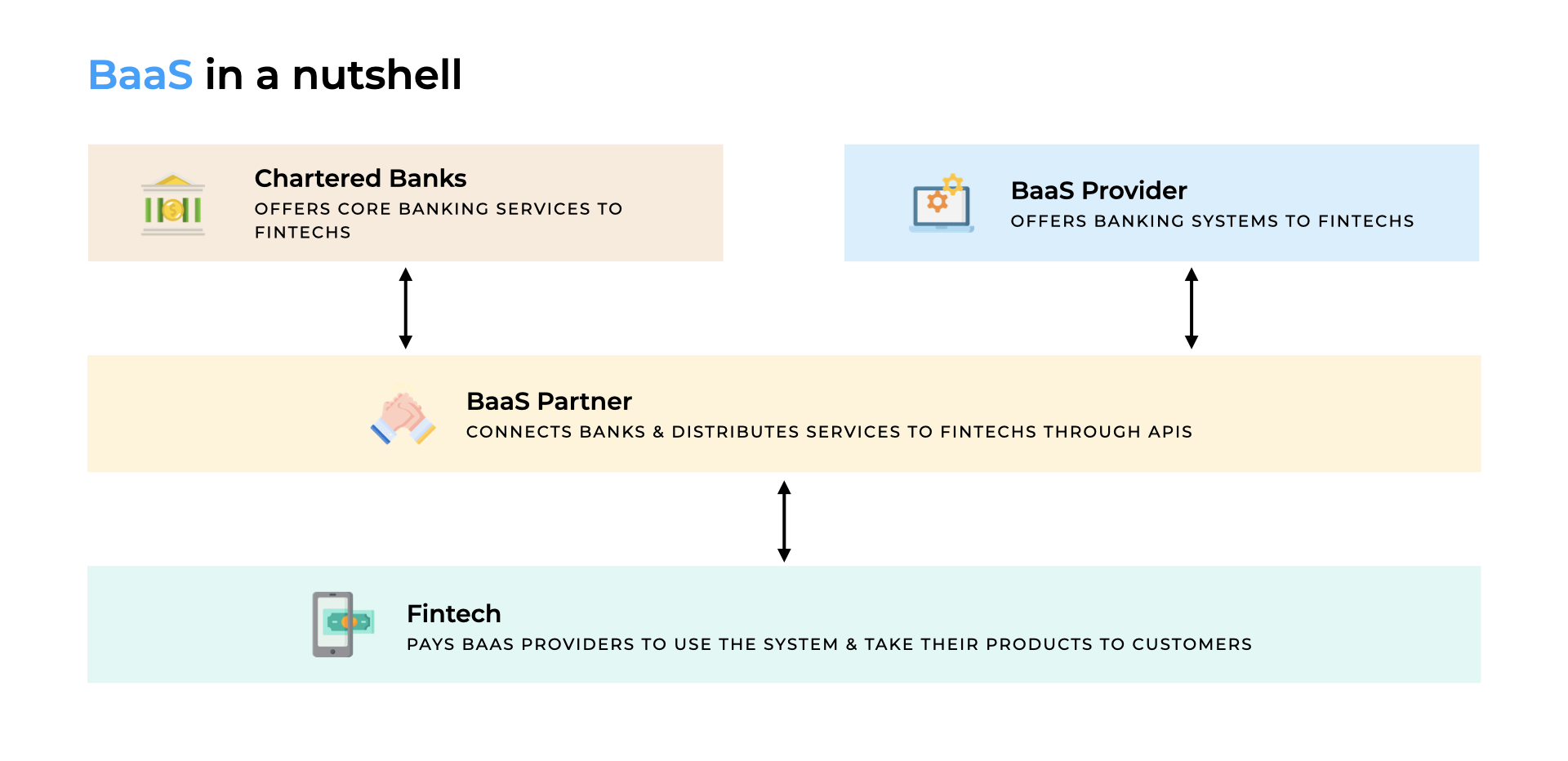

Who are BaaS providers?

Banks help fintech companies connect their products and services to the broader financial system. BaaS providers act as a bridge between a bank and a company – they integrate the bank’s financial infrastructure into a company’s app or website.

Start-ups and businesses can create a fintech product without setting up their financial infrastructure. With BaaS providers, businesses don’t need licensing or compliance with many financial regulations because they never “touch” the money. All financial operations are driven through the BaaS provider’s system.

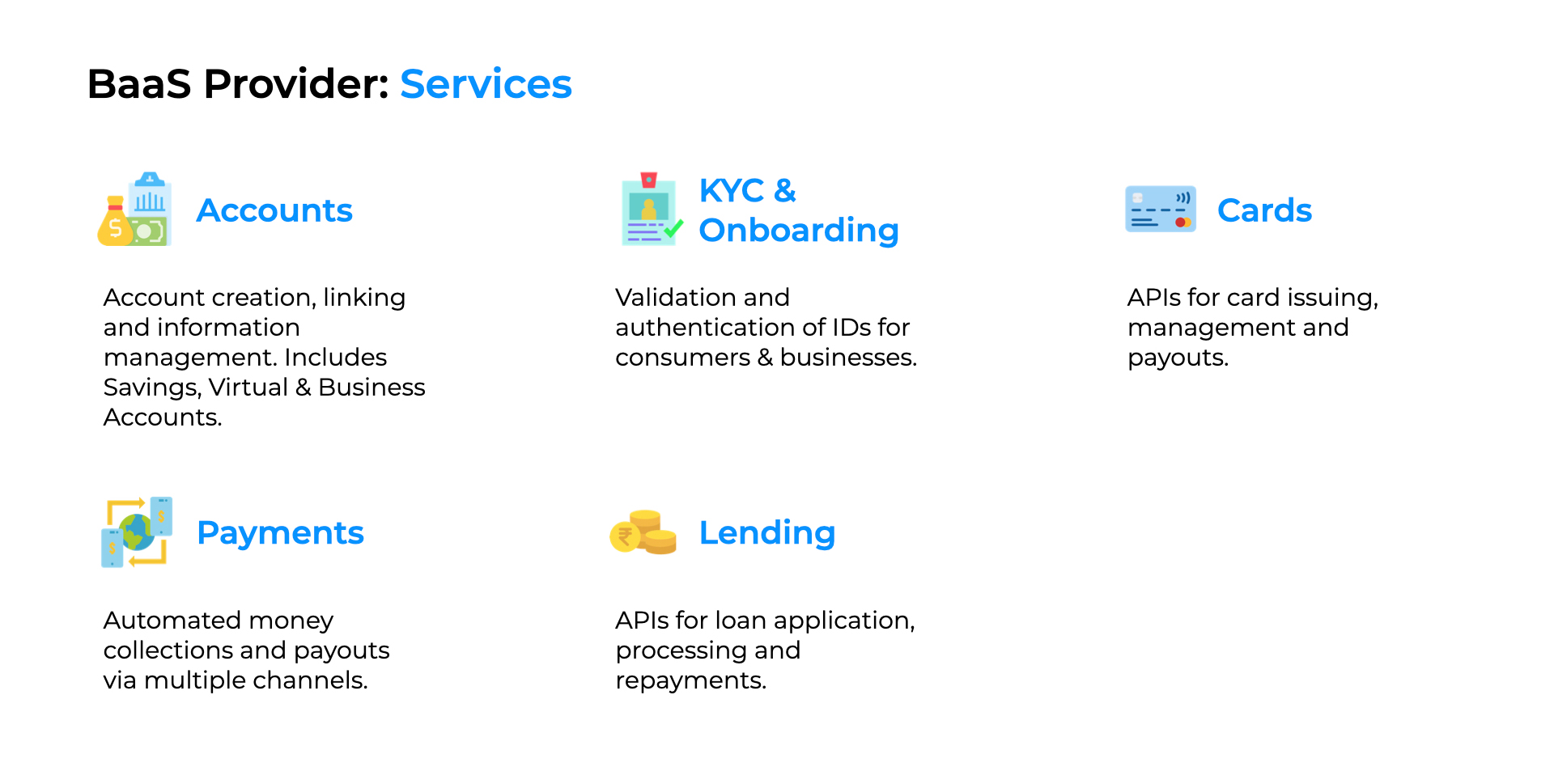

BaaS partners offer various business needs, including issuing cards, KYC, credit scoring, currency exchange, and core banking elements like payments, accounts, loans, mortgages, etc. This dramatically reduces the costs and complexities of taking financial services and products to the end customer.

How does Banking-as-a-Service work?

Banking as a Service allows businesses to draw from existing banking services through APIs that communicate between them and banks. This enables building their features as a layer on their existing banking services.

In simple words,

- Fintech companies pay to use BaaS

- Bank opens its APIs, and BaaS connects them to the fintech companies

- Fintech companies build innovative financial services using these APIs

BaaS Provider Services Offering

BaaS providers can help businesses with the most crucial factors — think KYC and onboarding, opening an account – be it a virtual, savings, or business, fintech payments, debit cards, and your BNPL product. The important thing, after all is companies want the BaaS provider to help them grow and support their fintech innovation.

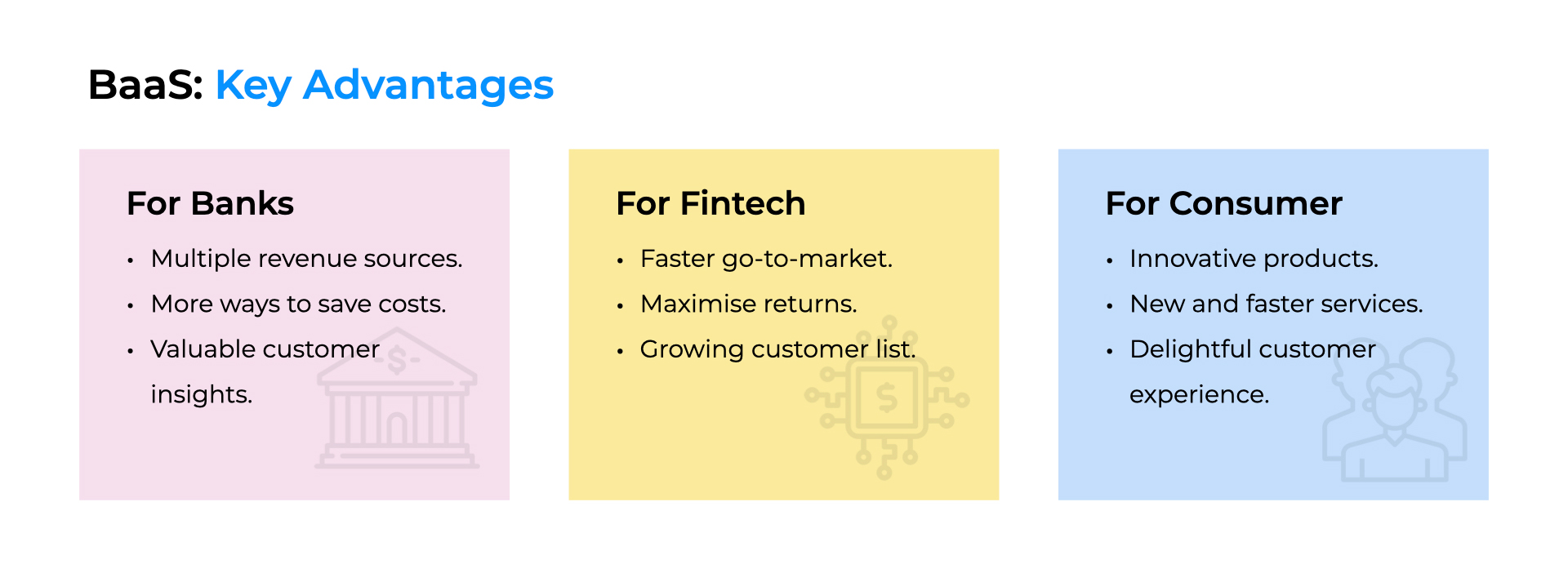

How do businesses benefit from BaaS?

- With API-driven facilities, BaaS partners help create new revenue sources for businesses by enabling cross-selling capabilities.

The API-driven facilities have immense potential to operate on the osmosis theory. Tapping into the trusted network of banks while capitalizing on the innovation that comes with new businesses is a sure-shot way of exploring new revenue streams for both parties.

For instance, Amazon earned over $1 billion in 2019 by integrating BaaS into consumer and merchant financing. Closer to home, health tech startup Saveo a B2B e-commerce platform for pharmacies, embraced embedded banking to offer credit to its retailers, which, in turn, helps pharmacies collect working capital.

The motto, You [Business] scratch my bank, and I [Banking as a service] will scratch yours.

- With BaaS, businesses can reduce the time to build and ship apps, taking products to the market faster.

Time is of the essence when it comes to an ecosystem that is so dynamic with new product launches in this space. As a business/ service provider, it is only fair that you get the early bird advantage. Not to toot our horns, the product suite at Decentro can be leveraged to help businesses go live within a matter of 6 weeks, as opposed to grueling 6 – 8 months, making it an ideal route for businesses to soft launch.

- Businesses innovate more by capitalizing on their own APIs and third parties.

With banking, there is a constant struggle when it comes to innovation due to the regulation which is so apparent across the sector. With BaaS providers taking on the workload of licensing on the business’s behalf, there is one less thing for the businesses to worry about. This regulatory bypass accelerates product launch and enables a single mind to focus on the problem statement, paving the way for efficient solutions.

- Building products and services using API ecosystems drastically increases the customer base.

This is a direct by-product of leveraging the customer and trust network that comes with Baas in Banking. Banks are a gold mine for unbridled loyalty in the customer base. This trust is leveraged to deliver efficient solutions, which convert to large customer bases.

- BaaS providers basically become the company’s extended tech team, helping them solve last-mile challenges and keep up with changing regulations.

The differentiator for any business boils down to how superior is the customer experience. Efficient banking as a service provider fulfills this expectation by customizing an offering for your business that caters to customer satisfaction, whether around-the-clock support, string data protection, or effective compliance measure.

- Consolidate Banking at One Place

Fetch all the banking information about your company from a consolidated source. For instance, pull the latest account balance and monitor all transactions in your accounts. All this without having to log in to your corporate bank portal.

Are you a seller on marketplaces like Flipkart and Amazon? Would you like to see your consolidated bank account information on your seller platform rather than logging into your Bank’s Internet banking portal each time? Your business can enable all of this through connected banking.

- Transfer Payments Easily & Instantly 24×7

Bypass all the time wasted as the cooling period when you add a new beneficiary using business BaaS. In this manner, add any number of payees at once and transfer payments easily using RTGS, IMPS, NEFT, or UPI payments. This, in turn, completely removes the complexity of B2B payments. For instance, invoice payments or any recurring subscriptions.

- Reconcile Payments in Real-time

Most businesses waste tonnes of time and resources running behind reconciling transactions. With business BaaS, this happens in real-time and is fully automated. Track the path of each transaction, even failed ones, without lifting a finger using virtual accounts!

- Streamline Payouts using APIs

If you are a fintech lender offering lending services to customers, two of the primary workflows you’ll wish to optimize are disbursals & repayments. Business banking offers API solutions that streamline payouts for your business- even bulk fund transfers.

- Incorporate Embedded Banking as an Offering

Business banking as a service can be the first step for your business to leverage embedded finance. For instance, provide credit services to your customers or partners, or build your own Buy Now Pay Later product, diversifying your payment options. In this manner, you can open up new revenue streams for your business in a short period.

- Integrate ERP or CRM & Manage Payrolls

Imagine if your ERP or accounting tool is intelligent enough to fetch transactions from your bank account and reconcile the payments automatically.

Above all, these banking API solutions help integrate your ERP and solve challenges in streamlining financials- simplifying & automating payroll management, for instance.

What makes choosing the right BaaS partner important?

Partnering with the right BaaS provider is crucial for two reasons – not all BaaS providers are the same, and it is not easy to switch BaaS providers midway because all your customer interactions will be linked to that particular provider’s financial infrastructure.

Be it a fintech product that centers around core banking or a service that embeds financial features as an add-on for customers, the BaaS provider you choose will determine the bank you can partner with. Some BaaS providers may build on one bank’s systems or many; their range of services may differ and not suit your business. These are other critical factors that make sense while evaluating a BaaS provider.

What should you look for in a BaaS provider?

- Easy-to-use APIs

Look for APIs that allow you to integrate the platform into your existing systems. Chunky, expensive, or hard-to-maintain customization should be avoided at all costs.

- Partnership Model

Partnership with banks & regulated institutions is the most critical factor for any fintech service. The fintech company must control the relationship to grow if the BaaS provider enables a direct relationship with your fintech business and the bank, great. BaaS providers also do the heavy lifting when it comes to preventing fraud, payments not going through, offering credit to customers through the bank, etc.

- Account-Centric Approach

An account-centric approach to BaaS is ideal because all bank processes revolve around accounts. This approach by the provider makes way for deeper integration with bank cores, allowing you to use the needed banking tools to build more products and services as you grow. Bank accounts support multiple forms of lending & payment transfers.

- Layered Partnerships and Services

The BaaS provider becomes a good fit if they can integrate with more than one bank partner to handle all your company needs. An ideal BaaS partner supports neobanks, NBFCs, BNPL players, commercial and retail fintech, and embedded banking for non-finance businesses. The provider’s services offering, implementation, and support, as the provider’s customers, are all crucial factors to be considered.

For instance, we at Decentro have joined hands with some of the best banks, lenders, and government institutes in the country to help you kick-start BaaS to help your business.

Looking to leverage banking as a service?

We are just a buzz away at hello@decentro.tech! Drop us a message. We’re all ears!