Explore how Alt DRX simplified real estate investing using Decentro’s APIs—achieving 99.8% uptime and automating KYC, UPI Collections, and Autopay flows.

How Alt DRX Boosted Recurring Investments by 65% with Decentro?

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

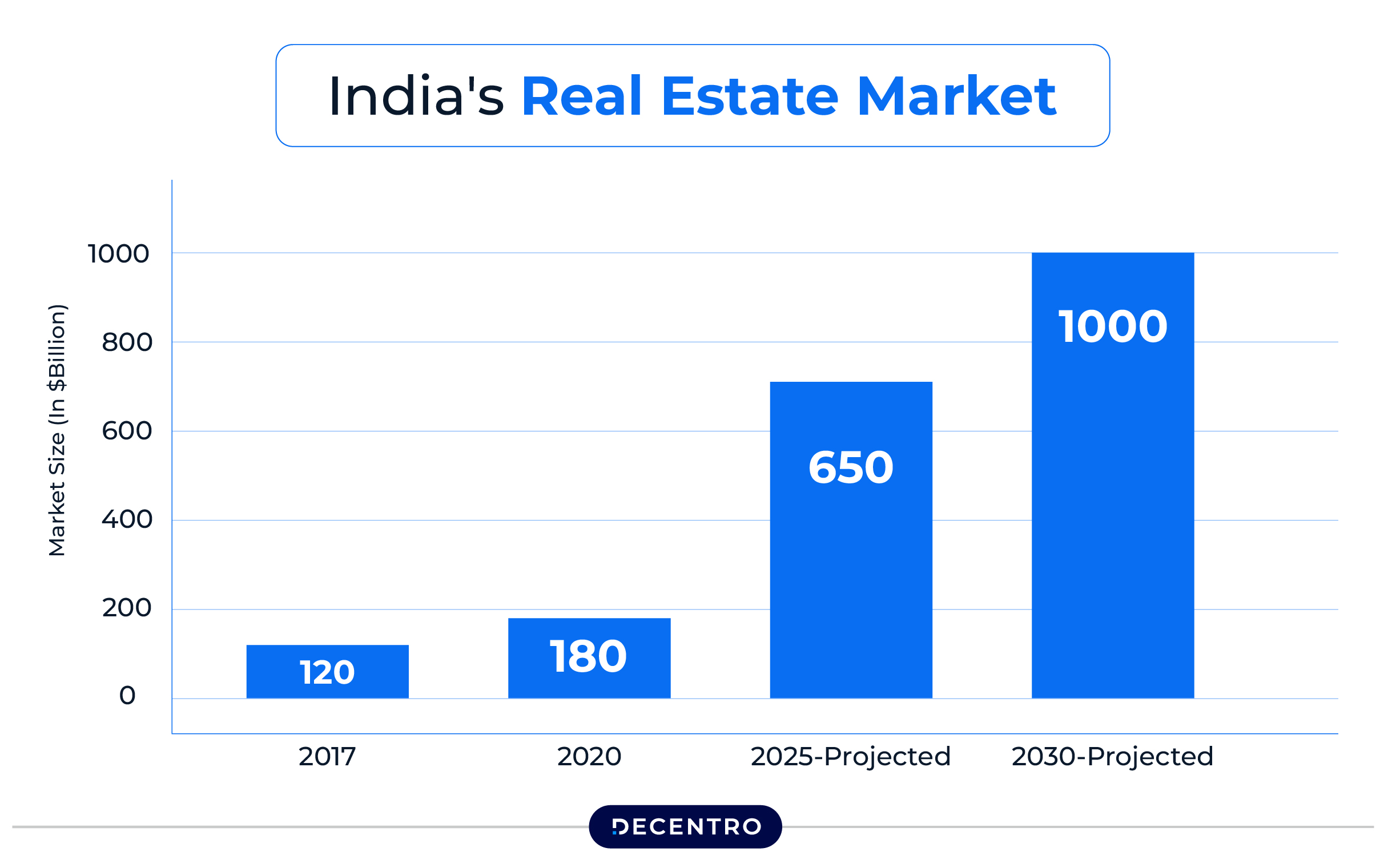

The Indian real estate market, valued at approximately $200 billion, has historically been accessible only to the wealthy and institutional investors. With minimum entry points often in crores, retail investors have remained locked out of this lucrative asset class—until now.

Alt DRX emerged with a bold vision: to transform real estate investment by making it accessible one square foot at a time. In a country where real estate accounts for 7% of GDP and is expected to reach $1 trillion by 2030, this democratisation represents a business opportunity and a fundamental shift in how Indians can build wealth.

However, enabling thousands of retail investors to participate in real estate markets comes with enormous regulatory, operational, and technical challenges. Our partnership has been transformative in this area.

The Evolution of Our Partnership

Our initial collaboration with Alt DRX established the foundations: streamlined KYC processes and virtual accounts for fund management. Today, we’re proud to share how this partnership has evolved to support Alt DRX’s complete investor journey, handling everything from identity verification to recurring investments, creating a seamless experience that makes fractional real estate investment as easy as mutual funds.

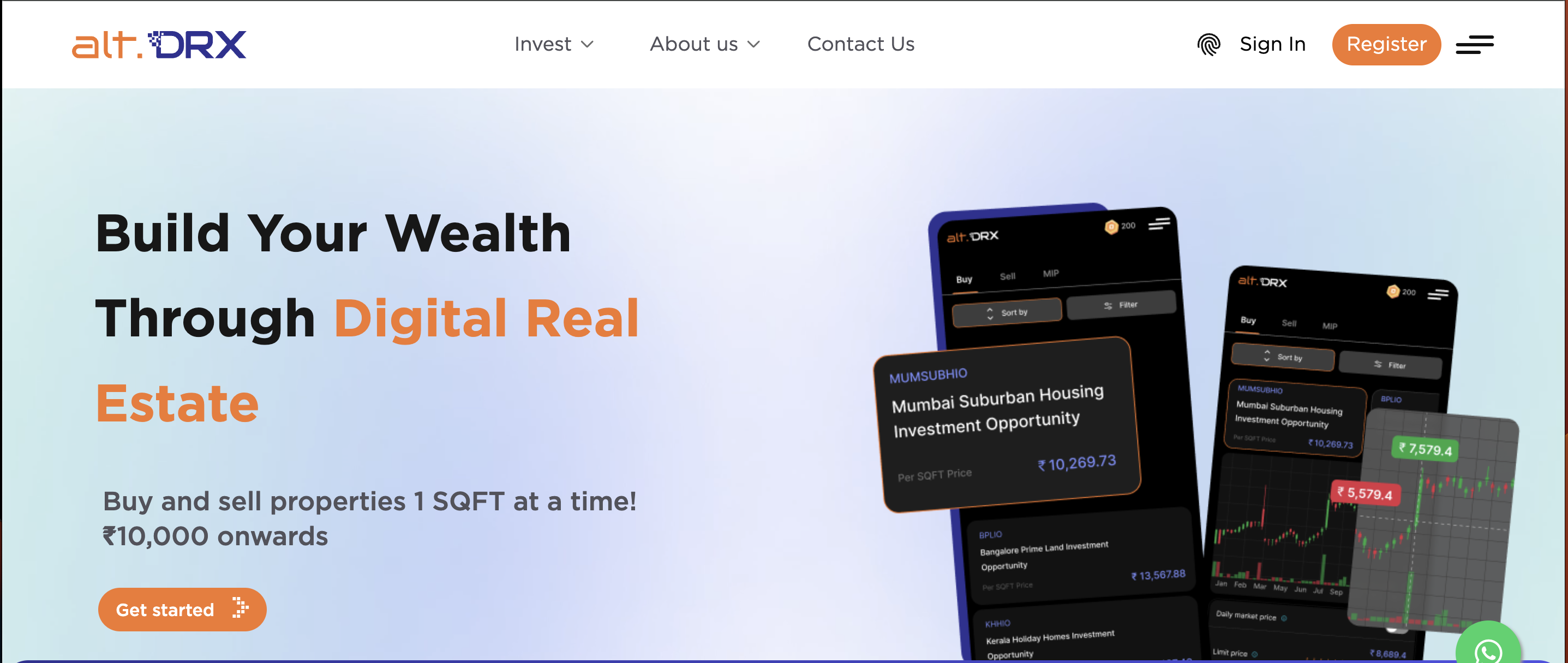

A Quick Recap: What is Alt DRX?

Alt DRX is a Digital Real Estate Marketplace for middle India to buy & sell tokenized residential properties 1 SQFT at a time, powered by algorithmic pricing, instant settlements and blockchain ledgers.

The Complete Investor Journey: Powered by Decentro

Building on our early wins with KYC and Virtual Accounts, Alt DRX has now fully integrated Decentro’s comprehensive product suite to power every stage of the investor journey-from onboarding to automated investing.

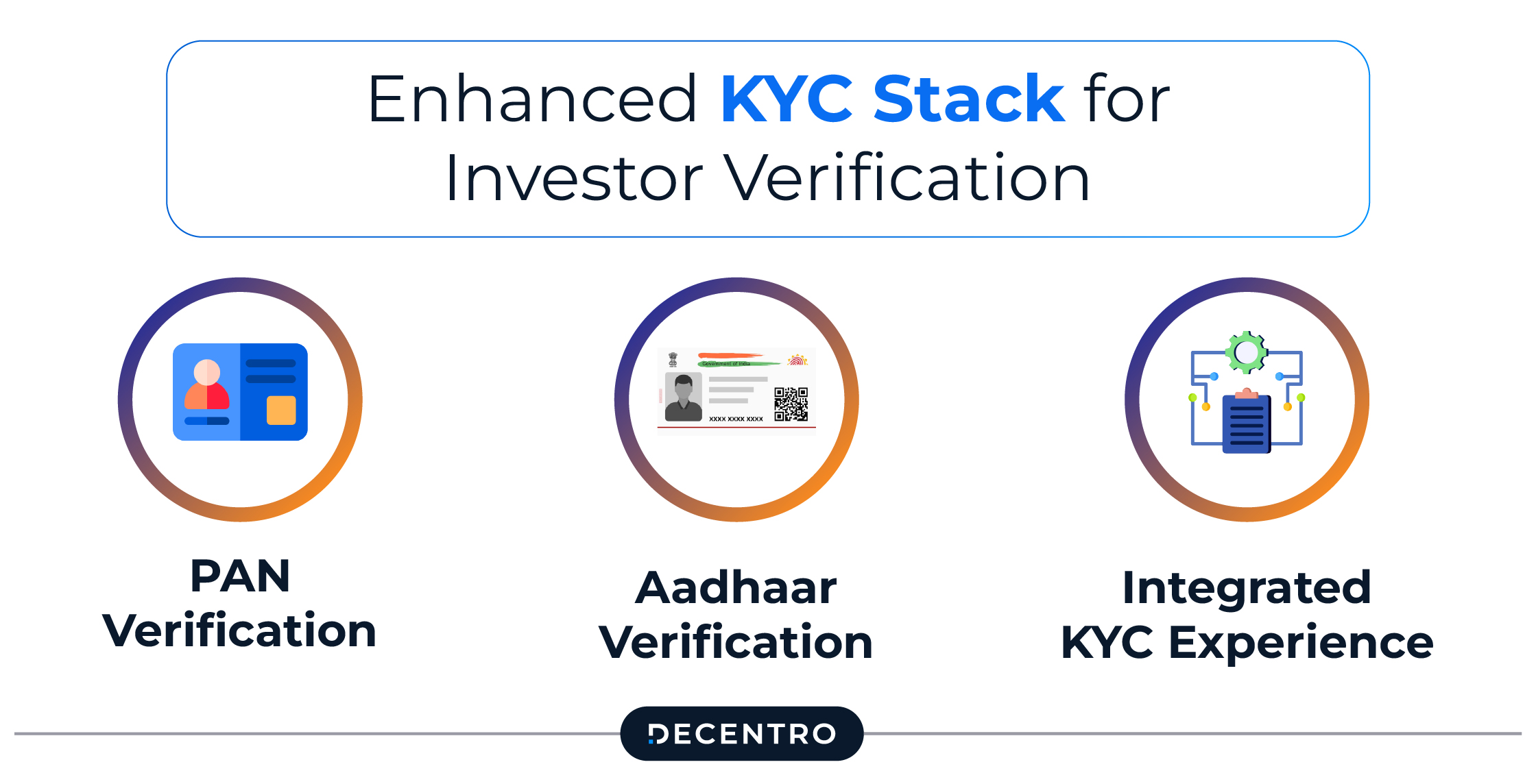

Enhanced KYC Stack for Investor Verification

We have expanded our user of Decentro’s KYC stack to streamline and secure investor verification:

- PAN Verification: Instant validation of investor identity through PAN card verification

- Aadhaar Verification: Instant validation of Aadhar details

- Integrated KYC Experience: A unified verification process that completes within minutes, significantly reducing drop-offs

Daily Savings Plan UPI Auto Pay

Alt DRX has launched India’s first Daily Saving Plan, empowering individuals to save every day and build their real estate investment portfolio effortlessly. This innovative approach makes investment more accessible, allowing users to build wealth gradually through small, consistent contributions with the convenience of Decentro’s UPI Auto Pay.

Decentro’s UPI AutoPay enables flexible investment schedules for Alt DRX:-

- Recurring Investment Options:-Investors can now set up automatic investments on daily,weekly or monthly schedules

- Mandate Management :-Seamless creation, modification and cancellation of investment mandates

- Automated Collections :- Scheduled collections that work silently in the background, ensuring consistent investment without manual invernation

Unified UPI Collection Stack

For one-time investments and other transactions, Alt DRX has implemented Decentro’s UPI collection infrastructure:

- Instant Payments: Investors can quickly fund their accounts using any UPI app

- Real-time Confirmations: Instant verification of successful payments, allowing immediate investment allocation

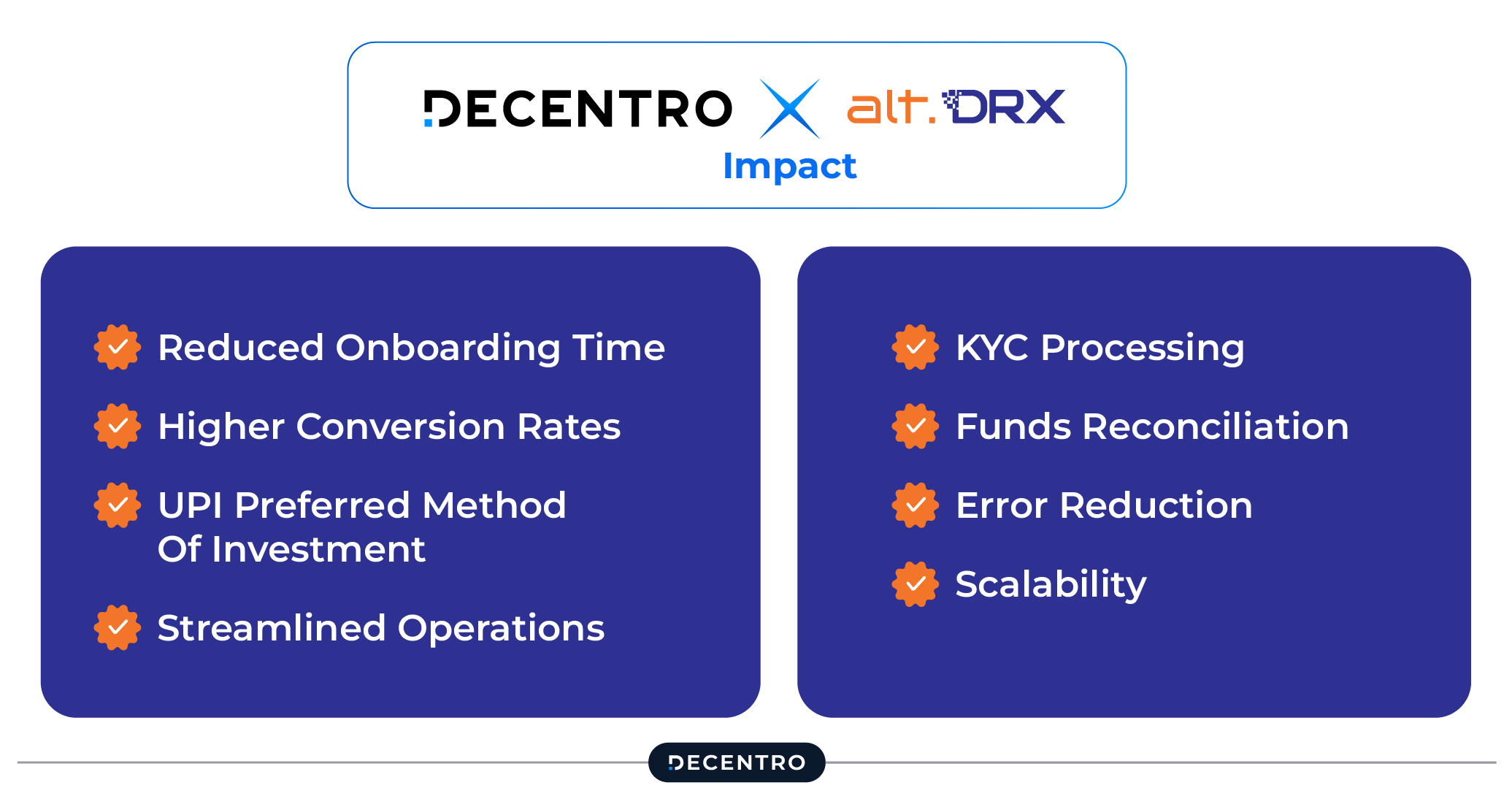

Impact: Creating a Frictionless Investment Experience

This expanded integration has transformed Alt DRX’s user experience and has yielded impressive results in terms of transaction voluments and operational efficiency

- Reduced Onboarding Time: Complete investor registration and verification in under 3 minutes

- Higher Conversion Rates: 40% increase in successful account completions

- UPI Preferred Method of investment :-65% rise in UPI payments

- Streamlined Operations: Automated reconciliation and reporting have reduced operational costs by 35%

Volume Impact: Scaling with Confidence

The partnership has yielded impressive results in terms of transaction volumes and operational efficiency:

- KYC Processing: The platform now processes a significantly higher volume of verifications monthly, representing a substantial increase from previous capacity, with near-perfect uptime reliability

- Funds Reconciliation: Handling a considerable volume of monthly transactions with zero manual reconciliation required

- Error Reduction: Manual reconciliation errors have been completely eliminated, with transaction matching accuracy at near-perfect levels

- Scalability: The system has successfully handled multiple volume spikes during peak business periods without any degradation in performance

Client Testimonial

“Our partnership with Decentro has grown from strength to strength. After seeing the impact of our initial integration, expanding to their complete suite was a natural progression. The UPI Payment Collection functionality for our key features, like TradeX, Daily Saving Plans, has been transformative, allowing our investors to ‘set and forget’ their real estate investment strategy. Decentro’s unified API approach means we can focus on our core mission of democratising real estate while they handle the financial infrastructure seamlessly.”

Sachin Joshi, Co-Founder and CTO of Alt DRX

In Conclusion

Decentro’s expanded partnership with Alt DRX demonstrates how comprehensive banking APIs can enable innovation at every step of the customer journey. From initial verification to recurring investments, our solutions provide the infrastructure that allows Alt DRX to focus on their core mission of democratising real estate investment.

This case study shows that the right financial technology partner doesn’t just solve individual problems—it enables complete customer journeys and unlocks new business models.

Are you looking to streamline your financial processes or enable new investment models? We would love to help you figure this out. Together.