This guide contains everything you need to know about Vendor Payments. It also dives into why they are important, and how to enable them for your business.

Vendor Payments: All You Need To Know

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Vendors, also known as suppliers, are the backbone of businesses across multiple sectors. Your network of vendors ensures that your business’ supply chain stays active, helping you build a sustainable business over time. As companies scale and the number of vendors increases, managing the accounts payable (AP) of the company’s vendors becomes a challenge.

With the widespread adoption of digital payment as the preferred transaction method across businesses and sectors, the real impact of the need to standardize the payment process becomes more evident during the festive season. Adopting an efficient solution acts as an asset during the exponential rise of the transaction volume during this focused time, largely due to its convenience and added benefits in the form of cashback and exclusive discounts. To put things into perspective, in terms of volume, from the day of the first Navratri in 2023 on September 26 till October 23, the business of more than 1.25 lakh crore had already taken place in the country, according to the Confederation of All India Traders (CAIT). The total business of Diwali sales was expected to cross 1.50 lakh crore, which was be a significant boon to India’s retail trade and open the playing field for effective solutions to facilitate such numbers.

In this blog, we will backtrack and learn more about vendor payments, how they work, and the benefits of automating the process.

What are vendor payments, and who needs them?

AP is one of the most important pillars of any company’s financial management system. It represents the short-term debt owed by the business to its vendors and suppliers in exchange for products and services. Vendor payment clears this debt by processing the payments to vendors and suppliers. The types of vendors can vary based on the kind of business and sector of the company.

Here are some examples:

- A supermarket chain would purchase products from wholesale vendors.

- A B2B business producing individual car parts must purchase raw materials from its suppliers.

- A D2C pet care business will source its products from a mix of pet food producers

- Marketplaces have a wide network of eCommerce merchants who market their products on the platform

- A gig work platform may need to settle payments to a large fleet of skilled workers providing services to customers

As we can see, almost every business has its unique network of vendors with whom they need to build relationships and honor the payment of their debt with an efficient vendor payment process.

Why are Vendor payments important?

To build a sustainable and profitable business, companies not only need to expand their network of vendors, but they also need to have a plan to retain them. An essential aspect of the relationship-building process is to be able to clear vendor payments in a timely and efficient manner. In earlier decades, companies would require a team of accountants to manage this process efficiently through physical books or spreadsheets.

However, in today’s times, additional complexities make it impossible to sustain efficient vendor payments through manual efforts. Here are some of the challenges that are addressed when companies invest in state-of-the-art vendor payments automation software:

- The number of vendors is growing exponentially, reaching hundreds, thousands, lakhs, etc. Manually managing them can result in errors, delays, duplications, and lack of compliance.

- Vendors can be seamlessly paid in multiple currencies.

- Intuitive cash flow monitoring is required with the same vendor sells and purchases products within your ecosystem

- Vendor payments may need to be processed from multiple company verticals, which brings more complexity to the process.

- Vendor payments need to be compliant with various requirements such as TDS (tax deducted at source) and GST (goods and services tax)

- The credit period can change, and various vendors may also have unique credit periods, making it difficult to track and incorporate such changes manually.

How do vendor payments work?

The vendor payments process may vary from organization to organization based on the business model and the business scale, but the basics remain the same. Here is the snapshot of the process of how vendors typically get paid:

- The vendors send their invoices to your business. If they forget, you may need to remind them several times.

- Once you receive an invoice, check for the accuracy of the invoice

- Next, your records must be entered into your accounting system. You’ll need to calculate and apply any taxes to purchase TDS for GST if required

- Any TDS owed to the government must be deposited within the correct time frame.

- You must also file a Form GSTR-3B to report any GST paid and discharge this liability.

- Get an authorized signatory to approve the invoice payment on time to process the payment on the due date.

- Once the vendor payment is completed using the payment mode of choice, you must record the transaction in your accounting system for future reference.

What are the Challenges with Vendor Payments?

If your business operates with multiple vendors with varying payment cycles, timely settlements can be challenging. Having various outlets for your business would require a master consolidation of all the payments & invoices to ensure the reconciliation process is not disturbed.

Instances of Error

Most businesses are yet to tap into automation to streamline their financial processes. Especially when it comes to reconciliation and invoice entries, we all know the problems tied to manual processes, no matter how carefully done.

At the same time, it’s an equally time-consuming process that drains a team’s time.

Delayed Settlements & Chunky Payment Processing

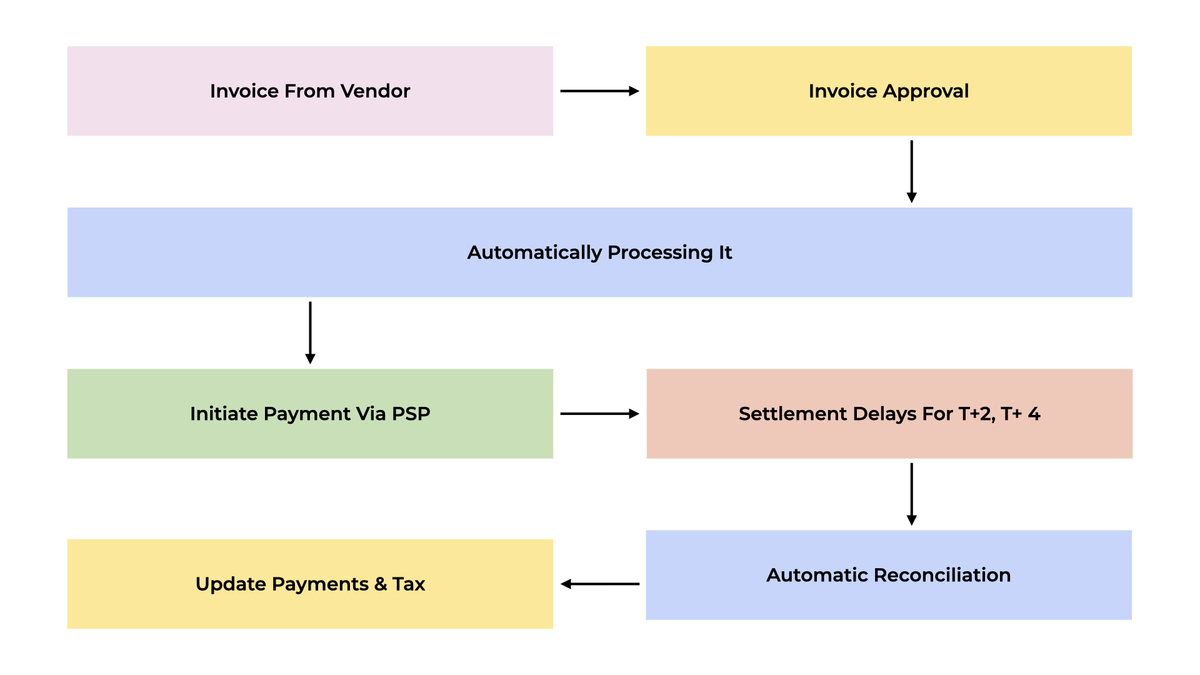

Initiating payments for invoices is no easy task. Multi-department approvals and transferring money via banks or any external payment processor take their sweet time. For instance, if you opt for wire transfers, cooling periods for beneficiaries are a default time-taker. Additionally, if you employ a payment service provider, the settlement delays are between T+2 and T+ 4.

Processing Taxes & Bills

Tax Deducted at Source or TDS is money a business needs to pay before settling the amount with a vendor. Based on the nature of products/services availed, many vendors will have varying TDS amounts, making the process even more excruciating. Moreover, filing GST for your business after showing the cumulative expenses made is necessary to comply with tax regimes in the country.

Security Concerns

Ensuring sensitive information such as bank details is necessary for your accounts payable process. While processing payments, ensuring you don’t expose any data or transfer improper payments to a different vendor is all the more important.

Vendor Payments: A Comparison

Let’s break this down into three parts:

- A manual process set up by your business

- A vendor payment process via any payment service provider[PSP].

- Building your custom, automated process via an API banking platform

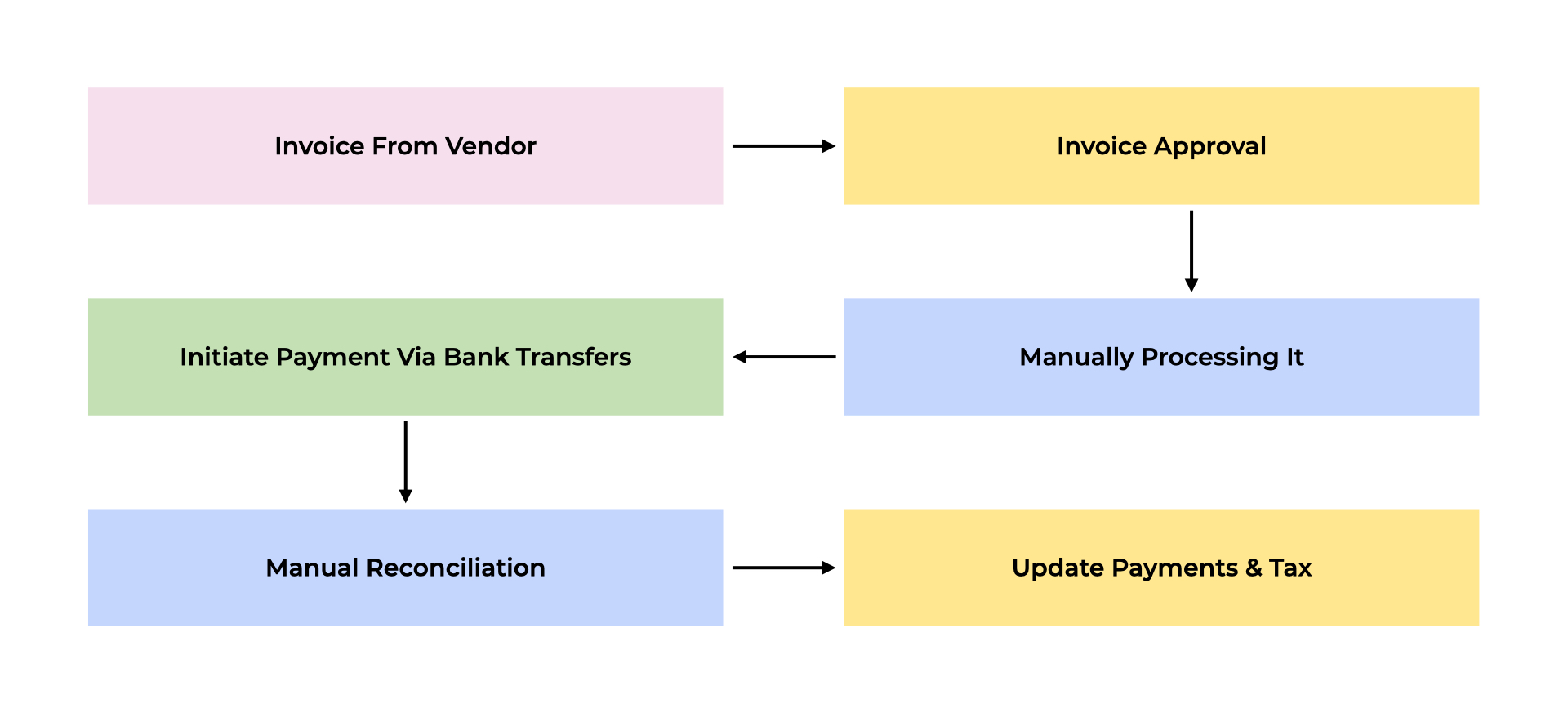

Manual Process

As we saw previously, the chances of error are high, and the entire process is effort-intensive and time-draining.

Using A PSP

Using a payment service provider will let off some steam and help you move faster. But is it a foolproof method? Perhaps not always!

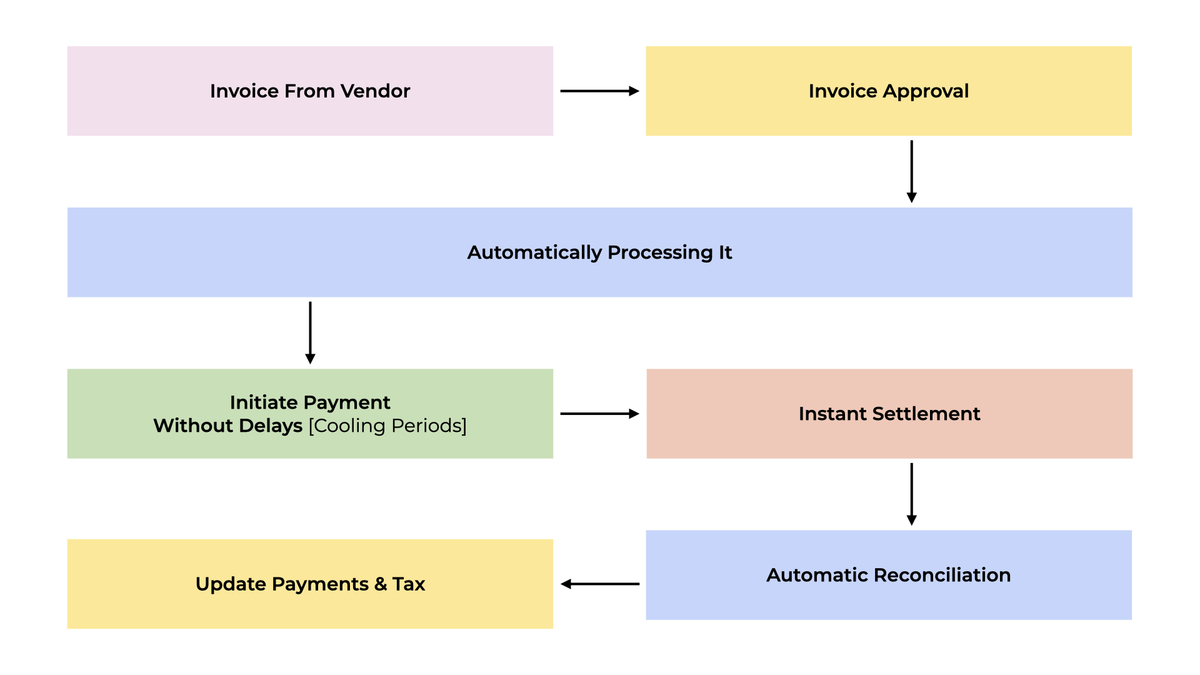

Building Custom Workflows Via API Banking Platform

Are you willing to make your vendors wait for days together? Or do you want to move faster? Banking & financial APIs can help you build a custom internal process within your business to manage vendor financing. You decide how the money flows and when!

How to make vendor payments seamless?

Today, many businesses are adopting cloud-based vendor payments software solutions to address the challenges of scale, evolving tax regulations, and other unique vendor needs. Here’s a rundown of the potential advantages of adopting a superior tech-enabled solution to speed up and transform the vendor payments management function:

- Whitelist and verify your vendors digitally via KYC & KYB stack.

- Onboard new vendor bank accounts with ease and skip the cooling period

- Facilitate instant API-based payments via your preferred payment mode, such as NEFT, RTGS, IMPS, or UPI

- Automate reconciliations in real-time via ledgers, to ensure there are no inconsistencies with your double or even triple-entry accounting process

Long-term impact on businesses

The impact of leveraging technology to solve the challenges of vendor payments is multifold. Companies are in a position to

- Enhance the relationship with your network of vendors by ensuring timely payments.

- Eliminate the instance of error by verifying and validating automated data entry.

- Enhance data security of sensitive vendor information with adequate security safeguards.

- Keep up with the evolving nature of tax regulations through a dynamic compliance system.

Enable efficient vendor payments for your product

Businesses investing early in automated vendor payment solutions will have a competitive edge. They will be able to cultivate long-lasting relationships with their vendor networks and onboard new vendors quickly, thus enhancing the potential to emerge as market leaders. This is where the Decentro API stack integrates with your existing process while allowing you to customize your vendor payment journey. Link your current accounts and simplify your banking experience by bringing them to one place. Decentro’s connected banking module helps with precisely that.

How Can Decentro Empower Your Vendor Payments?

You don’t need to create brand-new accounts to process vendor payments. Link your current accounts and simplify your banking experience by bringing it to one place.

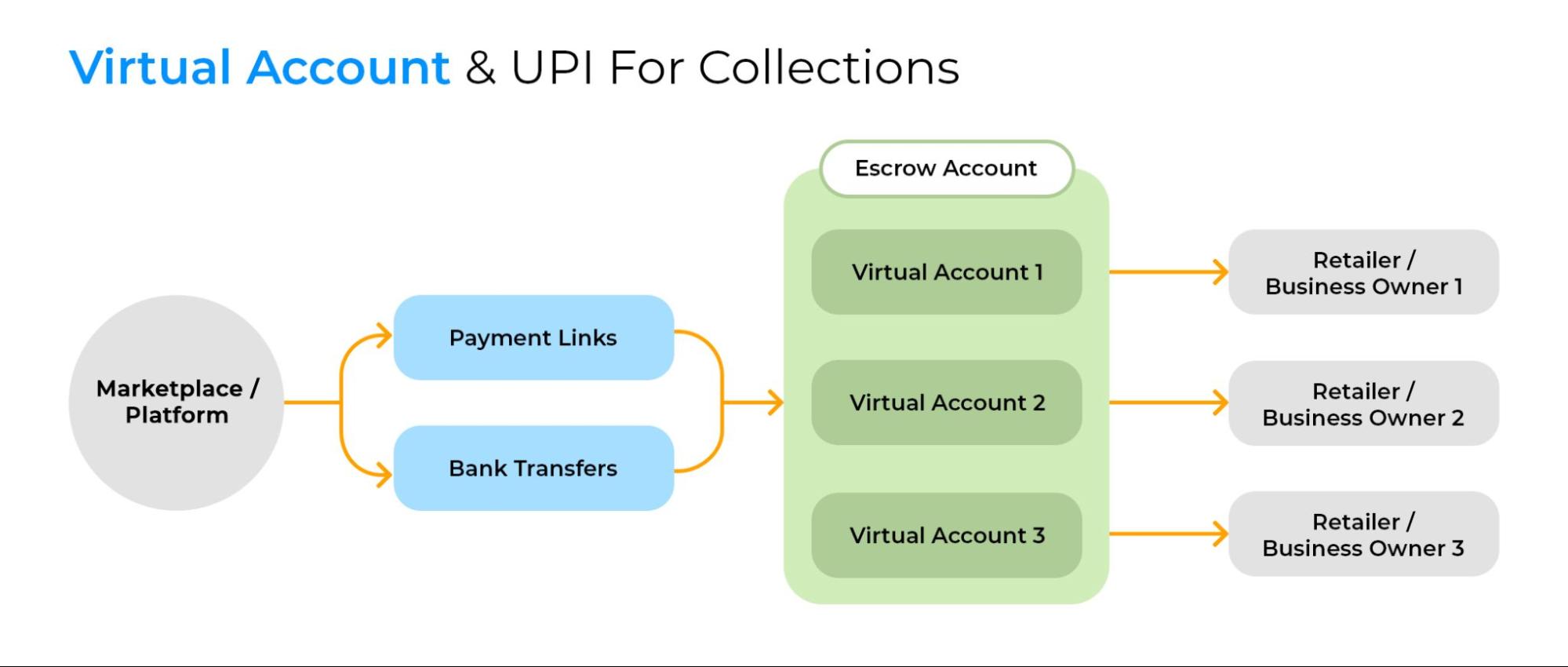

Reconcile Easily With Virtual Accounts

You can create custom virtual accounts for each vendor to track and reconcile all real-time payments. It takes just a few minutes, and you can create as many accounts as needed. A master virtual account and vendor accounts will help you move funds quickly without losing track of payments.

Track even failed transactions and keep your ledgers up-to-date. In addition, you can move funds from individual accounts to your master account at any time and in one go!

Initiate Instant Payouts (NEFT/IMPS/UPI/RTGS)

Transfer payments to your vendors without any beneficiary cooling periods or settlement delays. You can employ diverse methods such as NEFT, IMPS, UPI, and RTGS. Utilize our APIs for UPI, skip paying transaction charges to PSPs, and utilize the zero MDR on high-volume transactions.

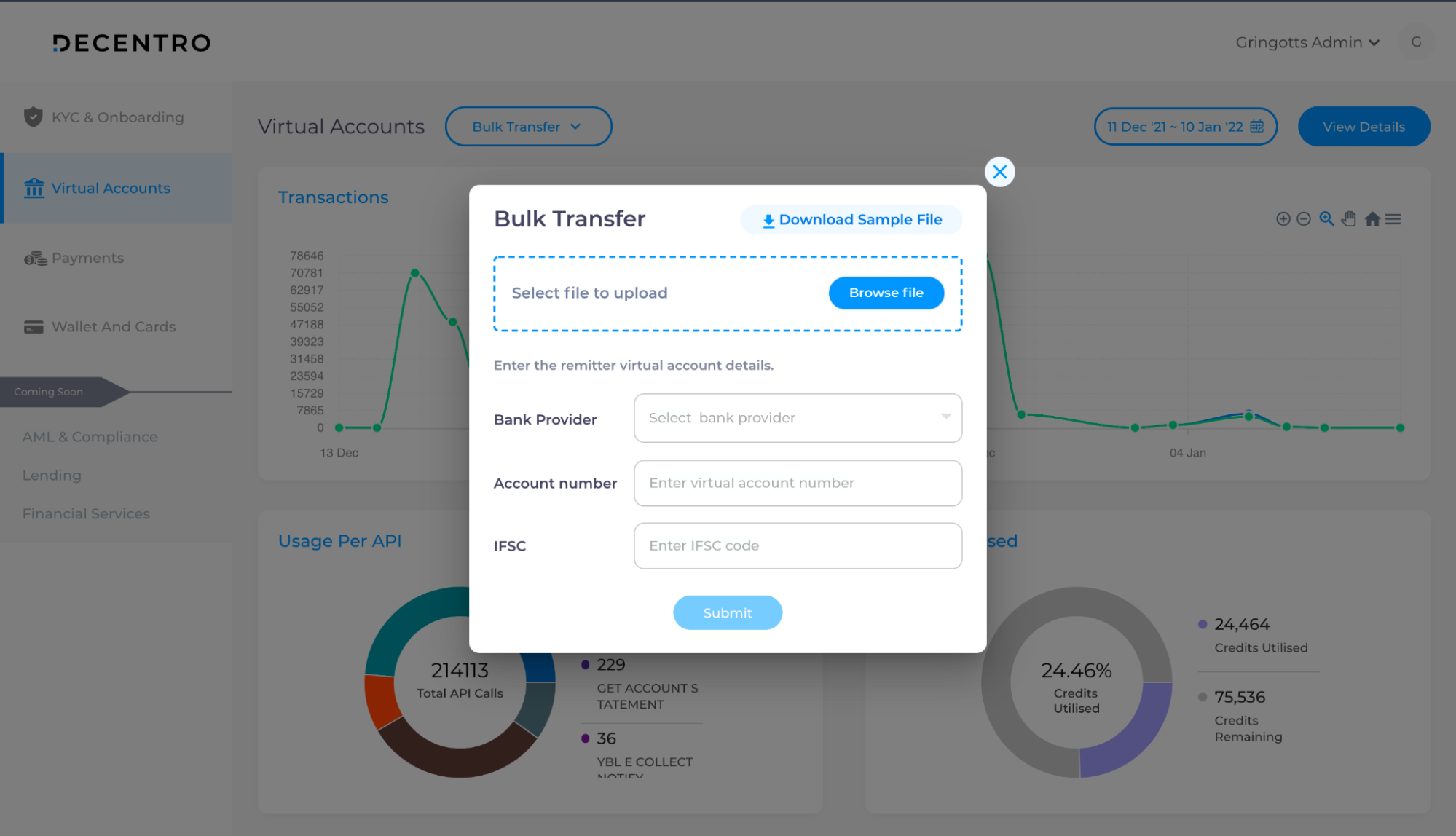

Process Bulk Payments

Settle payments with multiple vendors at one go using bulk payouts. Simply enter the invoice and beneficiary details, and leave the rest to us. With a simple API call, get high-volume bulk settlements done instantly, along with the reconciliation.

Manage Invoices Easily

Manage invoices easily with Decentro’s API banking platform. Upload CSV files containing all required details, such as due date, payment amount, and beneficiary bank account details, and process invoices automatically. Once settlements are successful, get notified! Analyze the status of your invoices at any time.

GST Data In One Fetch

Our GST APIs fetch all crucial data to optimize vendor financing & bill discounting. Leverage a single API Integration to access multiple GST data points and resources. Validate the GSTIN of your vendors, collect e-way bills for transporting goods, and analyze GST returns by accessing filling information spanning GSTR1, GSTR3B, and GSTR2A, with just a click.

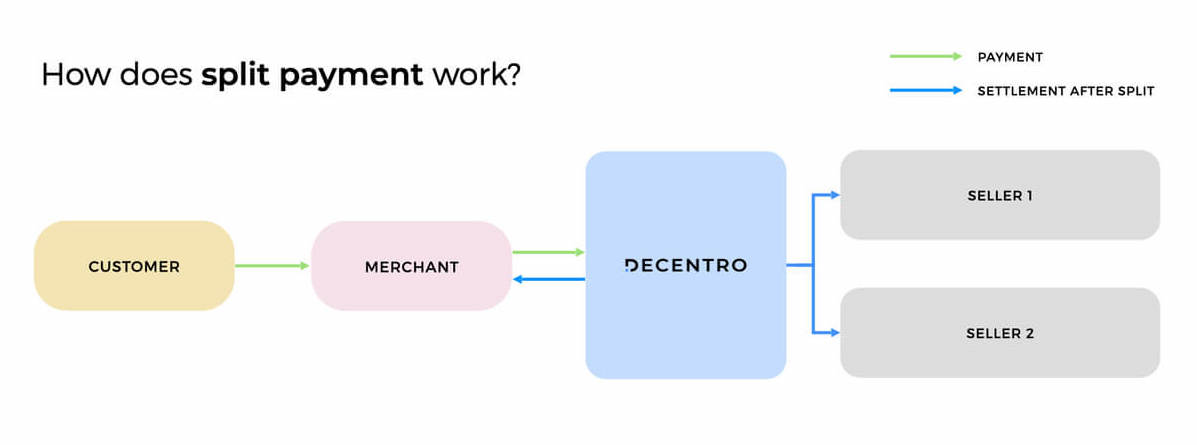

Enable Split Payments & Commissions

Don’t worry about the bookkeeping process if your business has multiple outlets and requires funds to be routed to multiple vendors simultaneously. We’ve got you covered with split payments APIs. No matter how many destinations your money circulates, it is a cakewalk now to bookkeep them efficiently in real-time without compromising the cash flow cycle!

Collect Payments With Ease

Simplify the collection process just like settling invoices with your vendors. Generate a payment link, or collection request to facilitate one-tap payments from your vendors/customers. Leverage conversational banking via social platforms like WhatsApp, and make it simple for your vendors even further.

If your business seeks to optimize your vendor payments flow, drop us at hello@decentro.tech to start a conversation. We can help you access a customized solution for your vendor payment challenges.