How is Saraloan reshaping supply chain finance with 10X optimized operations, & at 90% reduced expenses? Let’s find out!

Reinventing Supply Chain Finance With BlackSoil & Saraloan

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

When we walk into a supermarket for the monthly grocery shopping (yep, adulting is no child’s play, pun intended!), does it ever occur that almost all the things sitting on the counter have gone through multiple, fairly organized processes?

This is quite a simple example we’ve cited. Supply chain management spans across any consumer goods or products and, over the years, has turned into a well-oiled machine to optimize production and bridge the demand-supply gaps.

The MSME(micro, small and medium enterprise) sector in India has a crucial role in the economy’s growth.

According to studies, this sector accounts for 29% of the country’s gross domestic product (GDP) and 49% of exports.

Today, let’s examine how one such platform, which focuses laser-like on MSMEs and is located in the supply chain space, has streamlined its operations to become 10X more efficient.

What Is BlackSoil Capital & Saraloan?

BlackSoil Capital is a non-banking financial company(NBFC) and an alternate credit platform that extends lending & custom credit options to SMEs, high-growth companies, startups, and similar businesses.

In addition to being an alternative NBFC, BlackSoil is also an AIF Fund platform that provides custom lending solutions to businesses via a comprehensive underwriting framework, customized debt structures, and calibrated monitoring system.

As of March 2021, the NBFC has shown a YoY growth of 1.2X and cumulatively disbursed over ₹160 Crore along with ₹1120 Crore gross disbursements.

The key offerings of BlackSoil, among others, include:

- Alternate Credit

- Alternate Real Estate Debt

Saraloan, a child product of BlackSoil, is a fintech player that predominantly focuses on the supply chain financing space. The tech-driven lending platform enables micro-enterprise business owners & their vendors with financial services & products.

Saraloan offers products like:

- Buy Now Pay Later,

- Receivables Financing,

- Vendor Financing,

- and, Cash Advance!

Saraloan’s automated platform helps retailers, vendors, distributors, and the entire supply chain cycle boost sales access credit lines with ease and efficiently meet their financial needs.

How Did Saraloan Leverage Decentro’s Banking APIs?

We’ve already seen the 4 pillar offerings by Saraloan. With the multitude of customers under their umbrella, Saraloan needs to track payments, reconcile transactions, streamline lending & credit processes, verify the creditworthiness of each user that onboards the platform, and ensure smooth payment collections.

Streamlining Receivable Financing

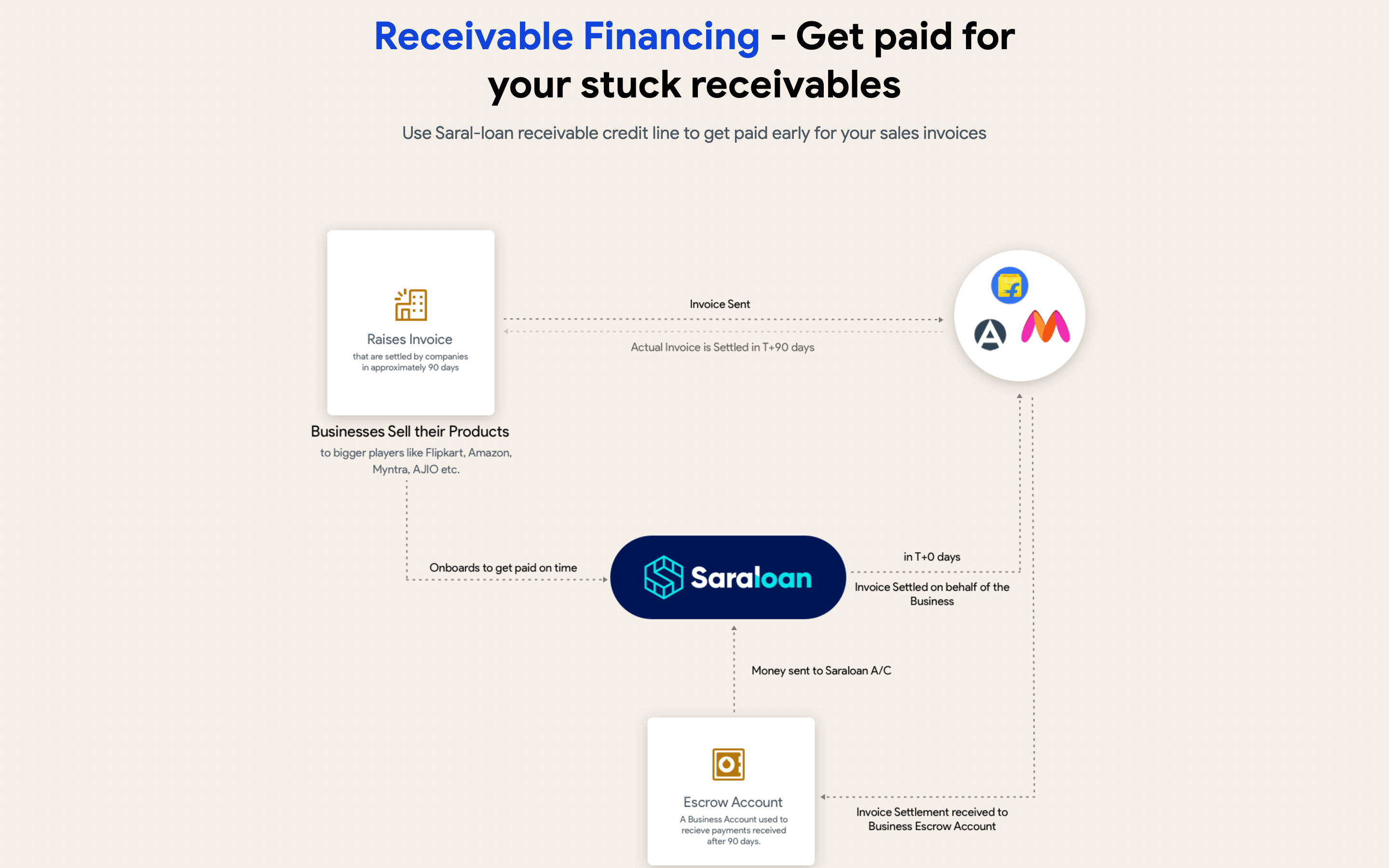

Receivable Financing helps a business to collect payment advances for their invoices. This, in turn, means that they get access to locked funds that are otherwise stuck in invoicing & billing cycles.

Thanks to Receivables Credit, the T+90 days that typically takes for an invoice settlement drastically reduces to T+0 days. Saraloan pays the business/retailer a percentage of the invoice amount as and when the marketplace/platform such as Flipkart or Myntra pays it.

In this entire process, tracking & reconciling the source of each transaction can get quite tricky, when there are umpteen vendors, distributors, retailers, marketplace platforms, and more in the ecosystem.

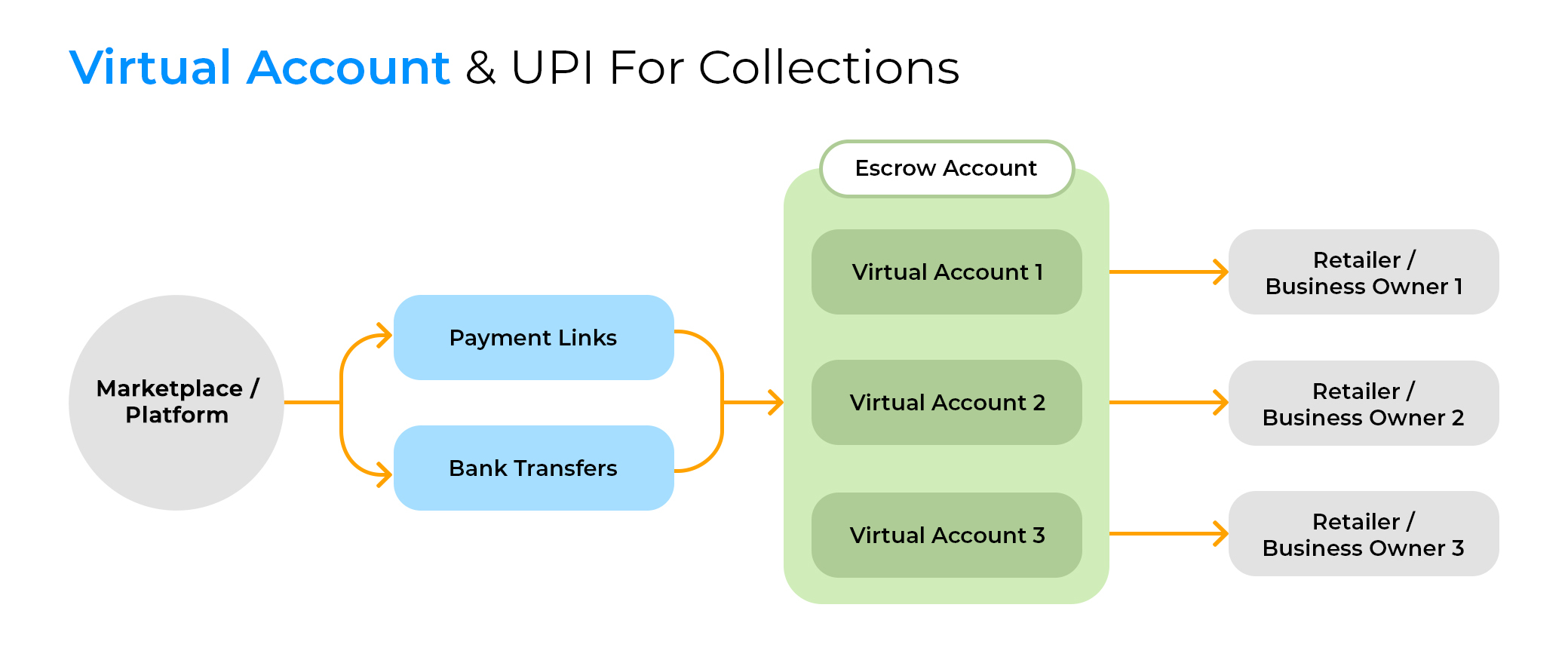

With Decentro’s virtual accounts, Saraloan resolves this issue easily.

A virtual account is set up for each business owner or retailer. As the marketplace/platform shares the invoice amount to the Escrow account, after the stipulated time frame, the same is transferred to each retailer via virtual account APIs after an interest deduction.

Facilitating Vendor Financing

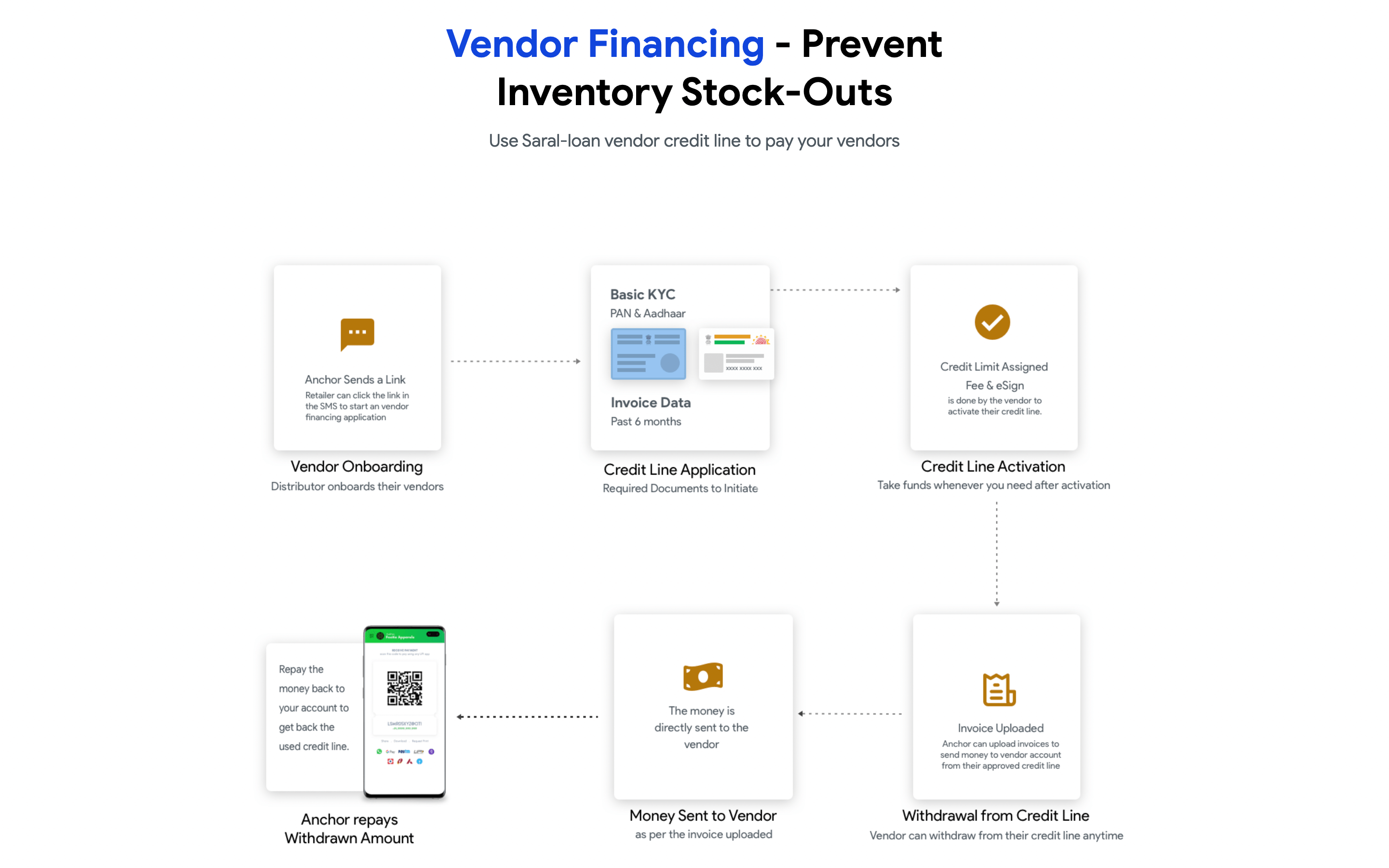

Vendor Financing helps distributors to access credit to pay their vendors. With this offering, distributors can run their operations uninterrupted, even if there is a shortage of capital.

The distributor onboards the vendor to Saraloan, following which Saraloan checks the creditworthiness of the vendor with extensive KYC & background checks. After approval, the vendor can activate their credit line and withdraw funds to their accounts. The distributor then proceeds to repay Saraloan within the stipulated time.

Like we’ve seen previously, payment tracking & reconciliation is vital in vendor financing to monitor & analyze which loans have been closed by distributors. In the same manner, Saraloan assigns virtual accounts to each vendor via Decentro’s APIs.

Consequently, when a distributor repays the credit, the funds are transferred to the specific vendor. Thus, the lending cycle is complete! Not just reconciliation, Decentro helps Saraloan with seamless payment collections.

What are the Key Outcomes?

Saraloan utilized financial & banking APIs to create even smoother supply chain business workflows. What are some of the outcomes of integrating with Decentro?

- Simplified payments collection process by over 5X!

- Real-time payment reconciliation.

- Processed transactions worth more than ₹13 Crores via Decentro’s APIs in a few months. Further, the daily transactions of Saraloan average in Lakhs!

- Saraloan has so far had thousands of API hits to facilitate Receivable Financing and Vendor Financing for their customers.

- Leveraging Decentro’s API stack has helped Saraloan launch Virtual Accounts & Payments Collections 10X faster and at over 90% reduced overheads.

In an exclusive Decentro Talkies series, we chatted with Saraloan’s CTO, Daman Kohli, who discussed how Saraloan is leveraging Decentro’s APIs to streamline cashflow lending and optimize collections without increasing its workforce.

Just like Saraloan, we’ve enabled many NBFCs, fintech lenders, neobanks, and businesses to overcome the challenges posed by legacy financial institutions. Is your business struggling with the same?

We can understand!

While you are here, do feel free to take a look at our modular API suite- be it enabling neobanking via Savings Accounts, offering credit to your customers via your custom BNPL product, simplifying B2B payments for your business; We can help!

Feel free to drop us a message at hello@decentro.tech! Let us explore your business’s use case, together!

Until then,

Cheers!