How about a free-trial virtual card that lets you try out various subscriptions without the fear of getting charged unnecessarily? Meet ZeroBalance!

How Spac Instantly Generates Free-trial Virtual Cards Without Breaking A Sweat

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

Disclaimer: At the time of drafting the case study, the organization was named as ZeroBalanace and has now re-branded as spac, hence the case study reads as ZeroBalance across.

A couple of months ago, Decentro launched India’s first Fintech Fellowship. The program saw thousands of entries where young, aspiring entrepreneurs put forward an acute pain point they saw in the fintech & banking domain and their idea of a solution.

The winners of the fellowship were Parth Shah & Yaagni Raolji, with the vision to build a product brimming with innovation and with much relevance in today’s subscription-based economy.

Netflix, Amazon, Hotstar, HealthifyMe, Spotify, LinkedIn… the list of platforms and apps in our phones, laptops, and TVs are numerous! The subscriptions for them? Well, that too.

Most platforms offer a free trial to experience and make a judgment call later on. Easy peasy. Or is it really?

Quite a lot of apps require us to enter our card details for payment and auto-debits after the trial is over. What if we forget to cancel the subscription? Ouch!

Incidentally, the founder of ZeroBalance, Parth Shah, faced something similar in his family. His brother was a die-hard Fortnite fan who wanted to purchase things within the game. And, his father was skeptical about giving his credit card; this got Parth wondering. The Eureka-light-bulb moment happened soon after and, ZeroBalance was born!

What is ZeroBalance?

- Do you end up getting charged for all those free trials you took happily but forgot to cancel?

- Do you find it hard to manage multiple free trials using your debit/credit cards?

- Always wanted to cancel that one recurring subscription but never got to it, actually?

- Or do you want to take a free trial but don’t want to be charged post the period?

When it’s said the trial is free, it should be genuinely FREE! This is what ZeroBalance aims to achieve.

ZeroBalance offers Ultimate Free Trial Cards to users to help manage trials & subscriptions and makes online & in-app payments easy to track & manage.

These virtual cards enable you to control every aspect of your expenses- who can charge you what and how frequently. You can instantly get started with more than 100 free trials via this app.

Subscription Cells

ZeroBalance provides users with Subscription Cells to have a comprehensive view of how subscription services are managed. If the funds are low, the renewal process halts, eliminating the chances of getting charged for something you don’t want to in the first place!

One time Cards

The platform also provides virtual cards that expire after one-time use. In case you wish to avail any services that don’t require a renewal, this is the place for you!

Crossing Paths With Fintech Fellowship

While the idea for free-trial subscription cards was under heavy brainstorming sessions, Parth came across Decentro’s Fintech Fellowship that was just the opportune moment to kickstart the journey. Parth had been following Decentro, especially over social media channels, for a long while, and the offering of virtual cards, in particular, spiked his interest. These cards can either be white-labeled or co-branded, as per the need of the business issuing them.

Over the course of the fellowship, the team learned about the Payments ecosystem in detail- the regulations, compliances, and the thought process behind building a fintech product. Interactions with Decentro’s team helped ZeroBalance to tap & leverage the diverse backgrounds of the team to understand more about products, how they are built, the tech layer that goes behind, and scaling it strongly.

How Can You Get Started With ZeroBalance?

To get started with hassle-free trial experiences, ZeroBalance has a simple 3 step onboarding process for users.

- Sign up: Via email or directly Google accounts.

- Verify identity using PAN card to complete the KYC process

- Enter mobile number and verify it via OTP.

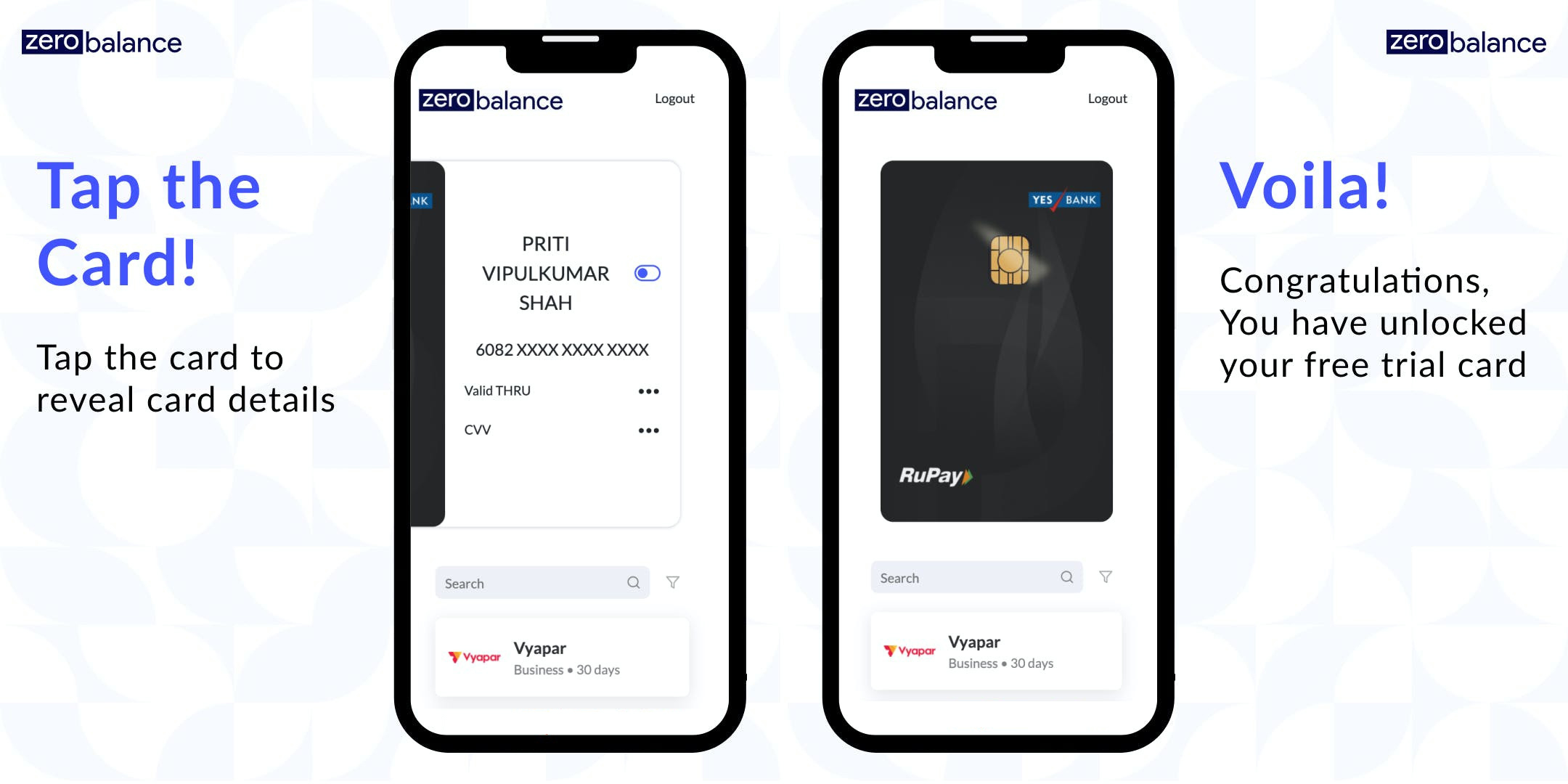

With this, you can get your virtual card instantly powered by Yes Bank & Rupay network with Decentro as the TSP and the program manager.

Why was ZeroBalance looking for Banking & Financial APIs?

When we asked Parth why was ZeroBalance looking for an API banking platform such as Decentro, he summarized his need and let’s see what they are!

“Everything in the payments space needs to be backed and integrated with a banking platform. Connecting with a bank to build out an MVP is difficult as there is an extremely high cost of integrations, complex APIs, complex security mechanisms, and a low level of support. Decentro solves all of these at one go for fintechs that are just starting out and scaling.”

Parth Shah, Co-founder, ZeroBalance

There are umpteen tools that will do the post-analysis for users. However, this only gives them an idea about where the money went rather than enabling them to budget & save. ZeroBalance aims to resolve the pre & post-part of expense management down the lane.

How Is Decentro Empowering ZeroBalance?

ZeroBalance resolves the headache related to trial charges once and for all using Decentro’s banking APIs. Here’s how!

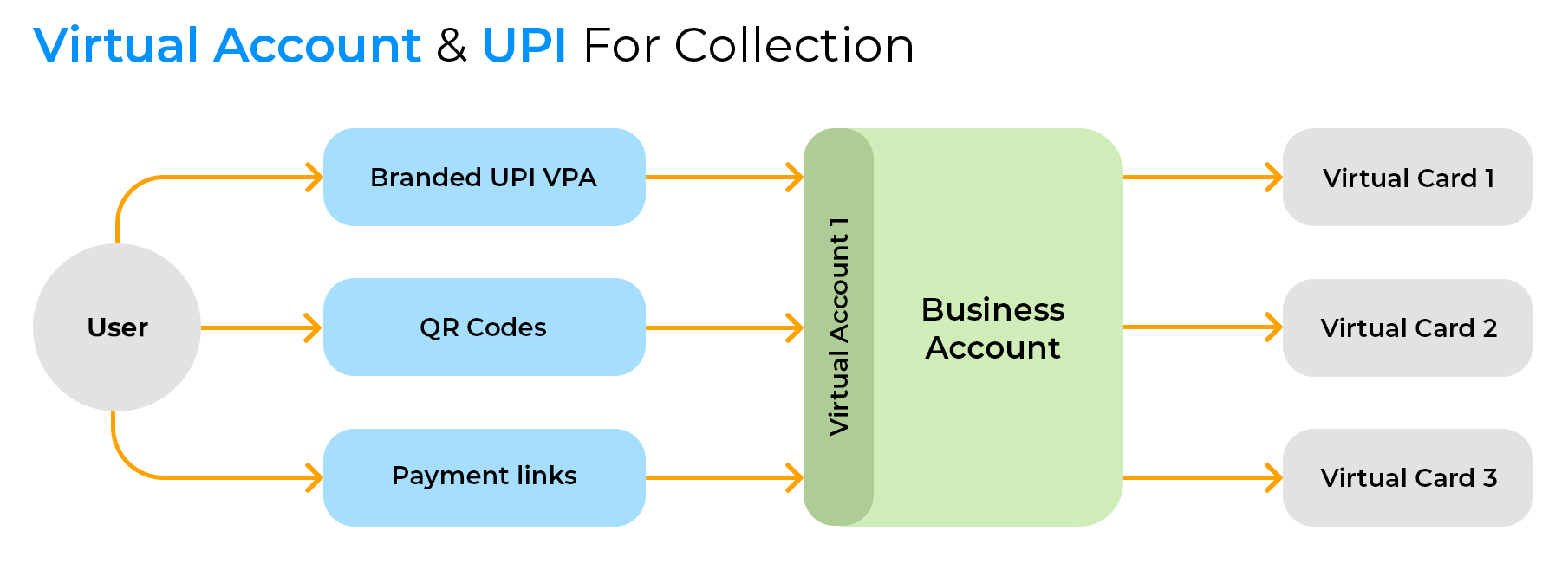

Virtual Accounts to Track & Reconcile Transactions

Users can generate multiple virtual cards under a single roof along with dedicated virtual accounts linked to each card. These accounts come with the immense benefit of not having to expose your bank details to any third-party subscription platform. Moreover, sending money to these linked virtual accounts is as simple as making a simple bank transfer or UPI payment.

In addition, with Decentro’s virtual accounts & payments APIs, each user can track all transactions from multiple cards for expense management, in real-time & automatically.

Further, ZeroBalance bypasses the requirement of integrating with a payment gateway and paying a hefty charge on the same- Decentro’s Payments stack takes care of it!

What are Some of the Outcomes?

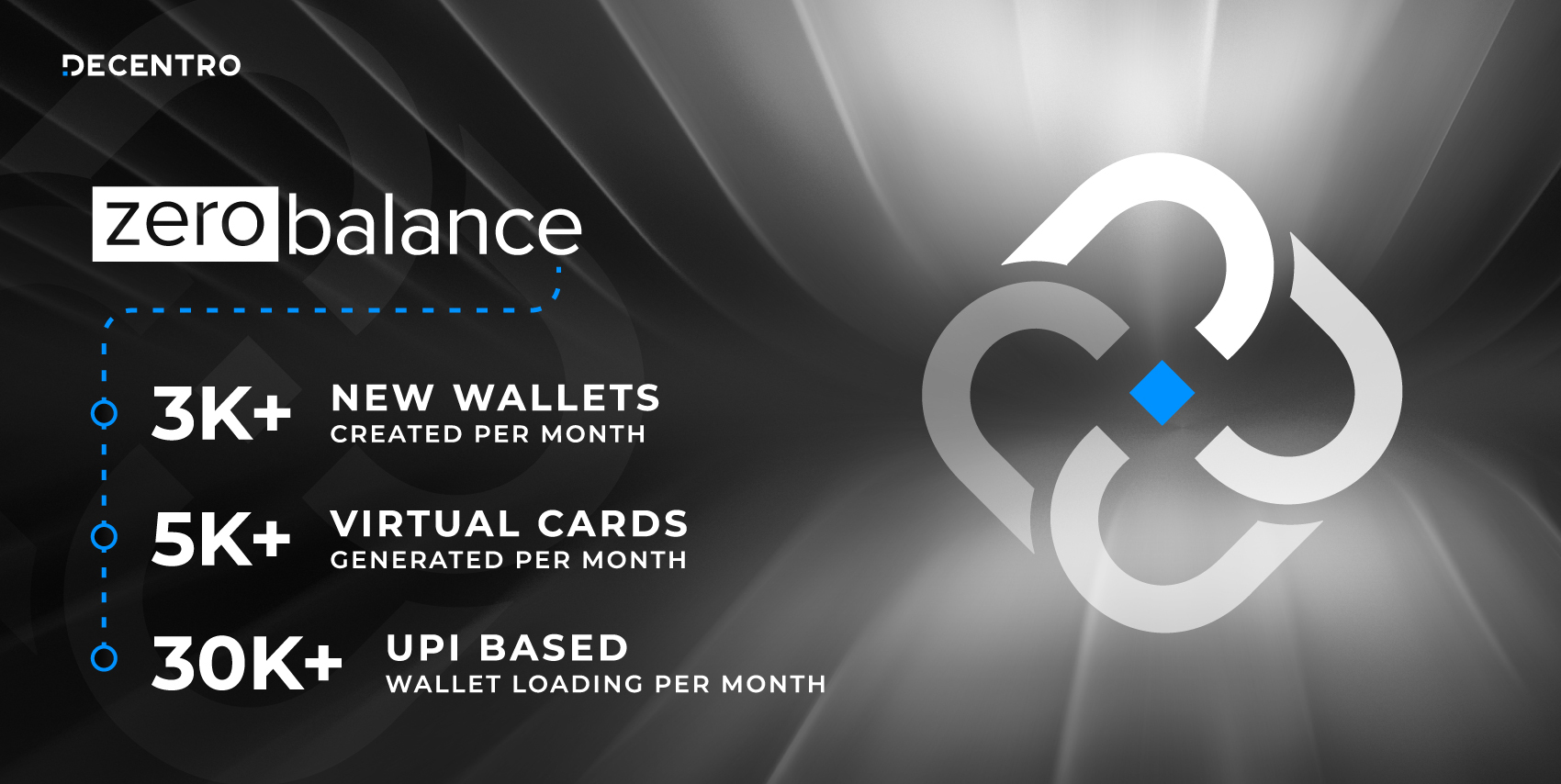

ZeroBalance has been able to leverage the Fintech fellowship to enable its operations and furnish phenomenal numbers such as

- With Decentro’s banking APIs, ZeroBalance rolled out their MVP[Minimum Viable Product] within a matter of 3 weeks, reducing capital expenditure by more than 90% and focusing on user journeys and the product itself.

- As of October, ZeroBalance has onboarded over 3000 users on a monthly basis, since its induction into the Fellowship program.

- Decentro’s infrastructure layer has enabled ZeroBalance 20,000 virtual cards to users, with an average of 5K+ virtual cards generated per month, all trackable with a unique virtual account linked to each card.

- On average, Decentro has enabled 30K+ UPI-based wallet loading through its secure infrastructure deployed for ZeroBalance.

The Road Ahead for ZeroBalance

ZeroBalance ranked #1 on ProductHunt upon launch garnering attention from India and abroad. The platform is currently free for the first 500 users.

ZeroBalance is looking to build a sub-wallet layer to the existing product and bring Budgeting features to customers.

If you wish to hop on board this expense management ship, now’s the time!!

A Word from the Founders

Before we wrap up, here’s a word from Rohit Taneja, Founder & CEO, Decentro, and Parth Shah, Co-founder, ZeroBalance.

Being a repeat fintech founder, I have a lot of empathy for early stage ventures since I have been in those shoes both from a B2C as well as a B2B perspective. Banking & finance are probably one of the hardest areas where someone can startup since the domain tends to be complex, and more important trust is a prerequisite here. Hence, making the job of these new founders 10X easier gives us immense happiness and satisfaction. Ultimately, the idea is that you should focus on the problem you want to solve and your user experience. Leave the backend complexity, plumbing and compliance to us without a worry.

Rohit Taneja, Founder & CEO, Decentro

“Pratik and Rohit have been phenomenal mentors, we always had access to them, and their feedback has been critical in building out our first version.“

Parth Shah, Co-founder, ZeroBalance

With innovative products such as ZeroBalance entering the arena and new RBI guidelines, such as PPI Interoperability, fueling the growth, we can only expect prepaid instruments to disrupt the payments space further.

We’re happy to enable hundreds of businesses, like this, in their ambitious journey for financial inclusion and do our bit to democratize fintech for all.

While you are here, feel free to explore how we empower neobanks, fintech lenders, gig economy platforms, NBFCs, and more with a modular API suite. Whether extending credit with custom Buy Now Pay Later, making life simple for merchants & vendors with split payments & commissions, zooming ahead with the new-age conversational banking, or ensuring thorough verifications via CKYC before credit underwriting, we’ve got you!

Cheers!