How can your business generate additional streams of revenue just by integrating financial services to existing products? Let’s find out!

Embedded Banking – A Complete Guide for 2024

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Remember the time when the latest smartphone launched with jaw-dropping specifications & features? And, got everyone talking?

11 10 of us would have made a willful decision to open our pockets and get it, sooner or later.

Even if the numbers on the price tag gave us a mini-heartache.

Popular e-commerce sites, like Amazon, offer EMI loan options and buy now pay later features on thousands of products to make the purchases easy on the customer and give them power over it.

Likewise, there is a myriad of products & services that have incorporated this approach. As a result, customers can use financial services or banking products without moving out of the platform.

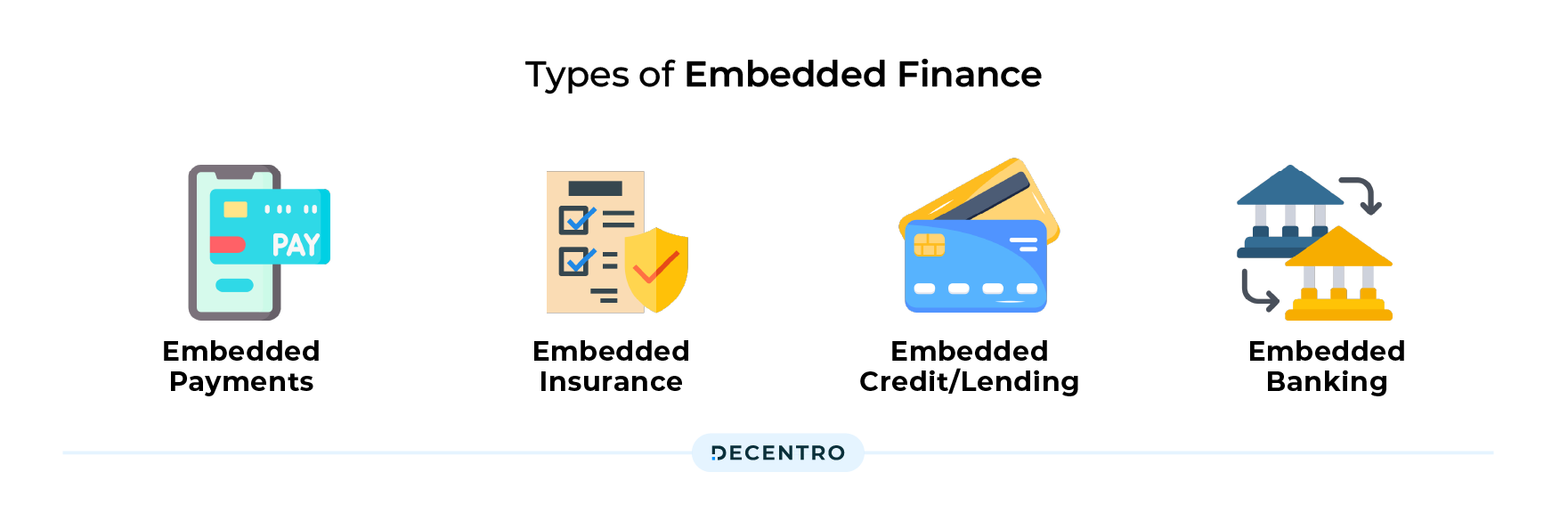

Types of Embedded Finance

Broadly, embedded financial offerings can be divided into the following types. Their examples are as follows-:

- Embedded Payments: With Embedded Payments, consumers make payments with the touch of a button. It allows them to make payments without switching between apps, which speeds up the checkout and payment settlement processes, thus offering an excellent user experience.

- Embedded Insurance: Embedded insurance offers customers affordable, relevant, and customized insurance when needed.

- Embedded Credit/Lending: Embedded lending is embedding a financing application to a website that isn’t run by a finance company (like an online store). The likes of the BNPL option are usually placed at checkout, though the best practice is to ensure that the financing options are advertised throughout the customer journey.

- Embedded banking: Embedded banking is integrating financial solutions with a business platform or app through APIs. It works as an umbrella term, encompassing different types of financial services, including payments, lending, wearables, contactless payments, card issuing, vIBANs, and bank transfers.

This brings us to our topic today.

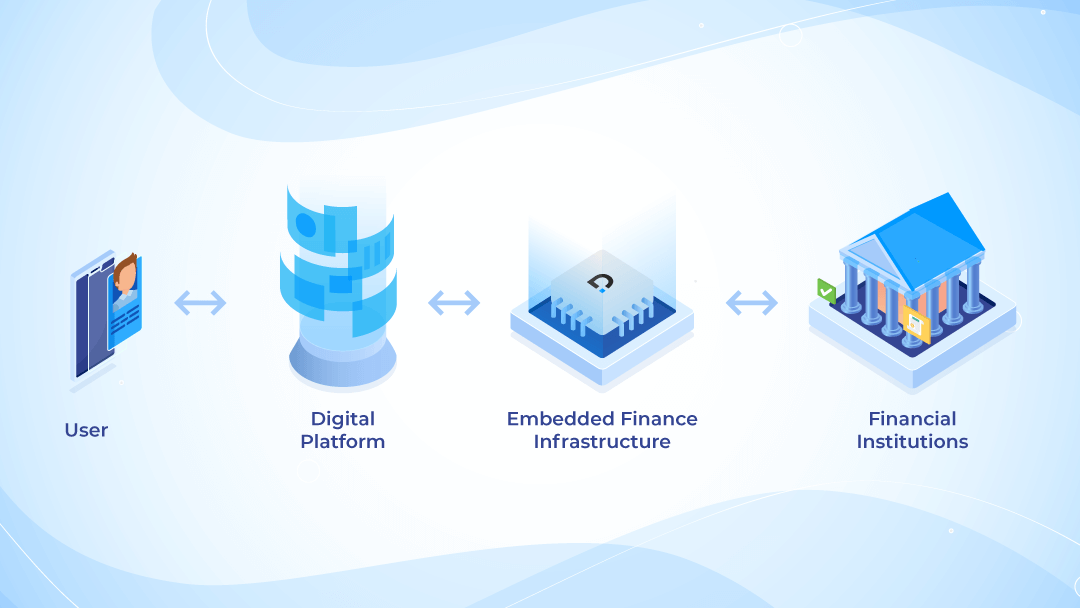

What’s Embedded Banking?

Embedded banking is not merely a term that’s flying around in recent times.

Embedded banking is the process of adding banking solutions into a third-party platform, using APIs.

These applications do so to serve customers better, and also to add a new revenue stream. Inherently, such platforms needn’t have a financial background, per se.

Embedded finance may sound like embedded fintech. While the former focuses on blending a tightly integrated lending solution into an existing product, embedded fintech deals with helping banking institutions step up their services & offerings with the latest financial technology.

“By 2030, embedded finance companies, even those who pivot into this trend, will reach a market capitalization of $7.2 trillion globally.”

Business Insider

Embedded banking offers the ultimate convenience to the end customer, be it an individual or a business, to avail of a desired financial service within their favorite app or platform.

Stakeholders of Embedded Banking

Before understanding the back-end process of embedded finance, it is essential to know the stakeholders involved. There are primarily three major stakeholders-:

- Consumer: This is the person buying the non-financial product and, thus, becomes a potential customer for the embedded financial offering. Although in some cases, due to the latency involved, one may need to be explicitly able to identify themselves as a customer.

- Business: The company which is selling you a non-financial product or service.

- Financial Institution (banks, non-banking financial companies or NBFCs, fintechs, etc.): The companies/institutions selling/backing the embedded financing products. These companies do not directly sell the financial offerings but indirectly do so – through the businesses.

Let’s take a look at a couple of examples of embedded banking to understand its scope better.

What are Some Examples of Embedded Banking?

In December 2020, Zomato announced partnering with Incred, an NBFC, to offer lending services to its restaurant partners and delivery executives. This was to manage their financials uninterrupted better.

This initiative will remove the burden of many business owners’ shoulders who could be struggling during this crisis. Indeed thoughtful, no doubts there! Incred will enable Zomato, not inherently a company with a financial backdrop, to offer risk-free credit options.

From Zomato’s perspective, these are brilliant ways to lock in customers and restaurant partners even further into a loop of increased loyalty and benefits.

At the same time, Zomato generates extra revenue on both channels. As a quick exercise, can you think of their revenue share/model in each of these? If yes, let us know in the comments below, and you may get a surprise gift in your inbox!

Similarly, health tech startup Saveo is a B2B e-commerce platform for pharmacies. The platform is a single point to get medical supplies & services- surgical, over-the-counter medicines, specialty, allopathy, & ayurvedic.

Saveo embraces embedded banking to offer credit to its retailers, which, in turn, helps pharmacies collect working capital. As a result, pharmacies can improve their business flows rather than waiting for regular settlements.

Likewise, the Gig Economy platform Workflexi is another example. It helps hirers and workers (consultants, contractors, freelancers) connect and get a ‘gig’ done. Payment for these gigs happens right within the platform.

And, the best part is where Workflexi has eliminated the payment settlement delays brought by a payment gateway. In short, the workers get their money instantly instead of 5-6 days of waiting around. Ubercool, isn’t it? Thanks to embedded banking!

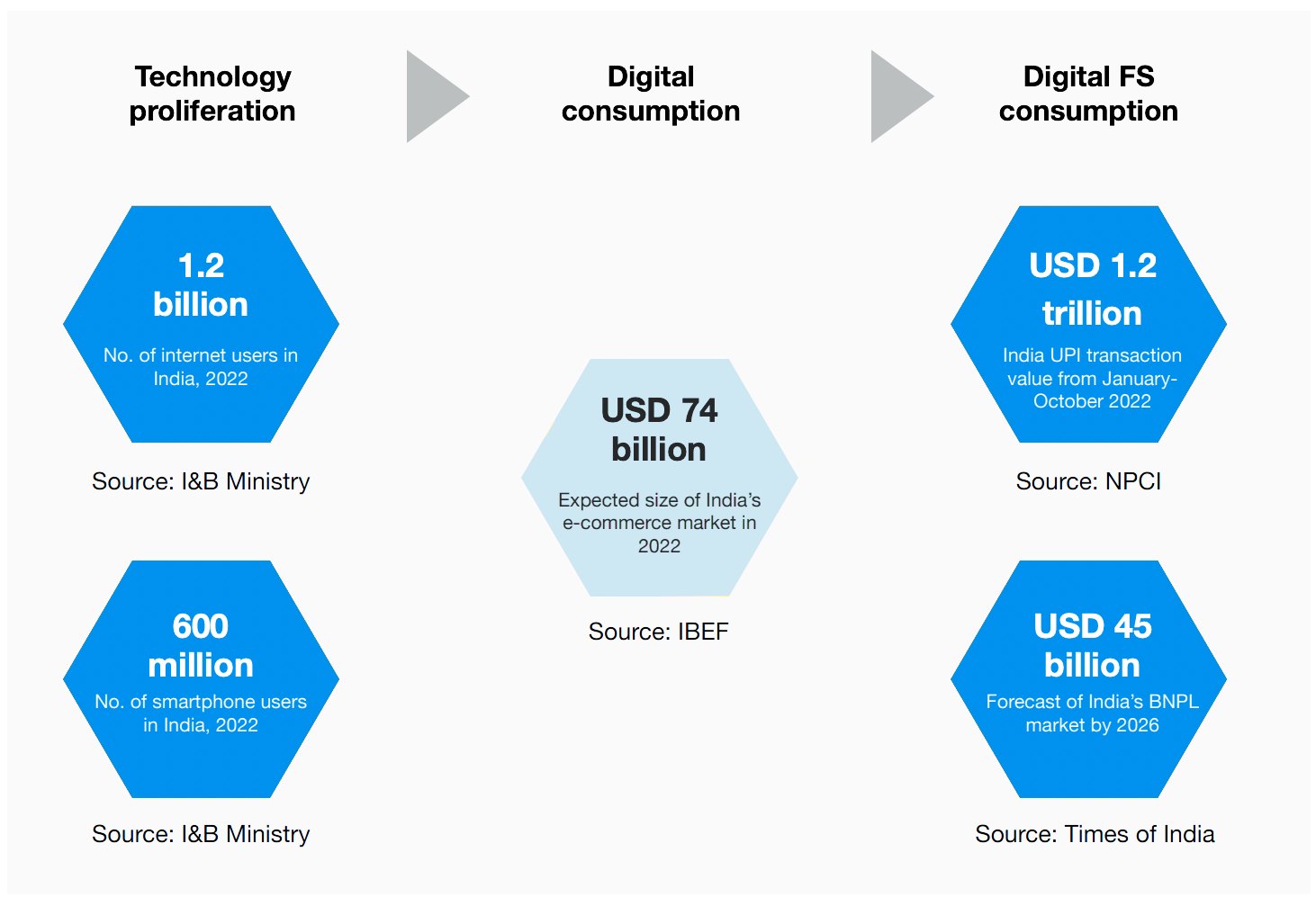

Why is Embedded Banking Crucial to Economic Growth?

It wouldn’t be wrong to say that embedded banking has the power to catalyze economic growth & prosperity at its true potential.

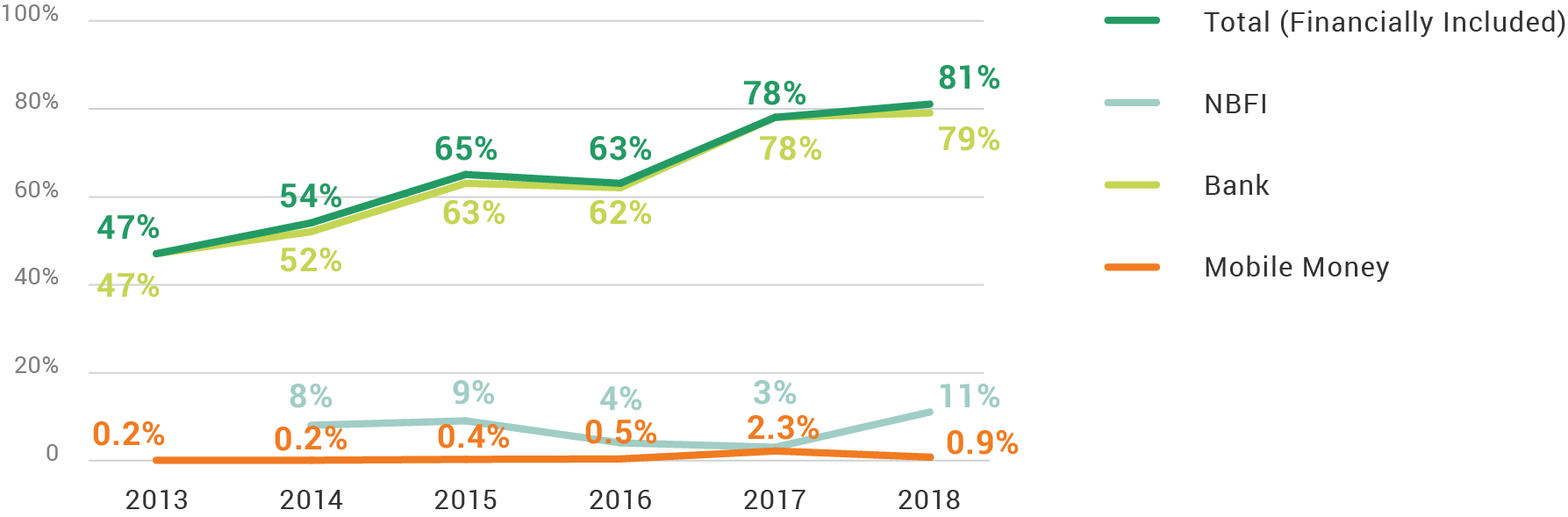

In 2008, only 1 in 4 persons had a bank account. Needless to say, financial inclusion was a struggle back then. Now, we have taken a colossal leap where 80% of Indians are proud owners of at least one bank account.

This tells us that we’ve come a long way to provide the essential financial necessities to the underserved Indian population. Revolutions such as open banking, banking as a service(BaaS), UPI, have played instrumental roles for it. There’s still a long way to go, yes. But we’re off to a great start already.

It doesn’t stop there. When a company sets out to incorporate financial services into its product, it’s not an easy task. Definitely not a quick one, either! These financial integrations often take months due to compliance issues & regulations. The legacy infrastructure of existing financial institutions and the broken documentation don’t make it any easier.

Embedded banking is an important catalyst for these transformations to progress.

How does Embedded Banking Span Across Domains?

As the saying goes,

It comes as no surprise that embedded banking finds a spot across diverse domains. Let’s see what they are!

SMEs & Startups

Businesses can launch co-branded cards and wallets for their partners, vendors, and customers as an additional revenue stream. They can earn money on the interchange of each and every transaction on the prepaid card. By offering lending services, SMEs and startups can get a small percentage from interest when a lender disburses. Besides, while maintaining bank accounts, businesses can levy a maintenance fee from customers.

Marketplaces & Aggregators

Marketplaces and aggregators that deal with thousands of businesses on a daily basis can earnestly enjoy embedded banking. These platforms can enable instant payment settlements for their merchants, thereby improving customer experience and earning recurring revenue.

Moreover, marketplaces can save a ton of money, using embedded banking API solutions, that are otherwise spent as transaction fees to payment service providers. Furthermore, they can offer loan/credit facilities by connecting to the right lender & borrower and opening up a new revenue stream.

E-commerce Platforms

Both B2B(such as Saveo) & B2C platforms(such as Amazon) can integrate with embedded banking API platforms to offer credit for their customers, retailers, & partners. During collections, they can earn a nominal percentage as income. For each new account that’s opened, e-commerce platforms can derive revenue from the float of the deposit account.

Trade & Logistics

Earn an interchange commission whenever your agents, drivers, or transporters spend using the card you issue. Also, offer lending services through these cards and generate revenue streams via interest. Furthermore, you can provide insurance for your drivers, & insure the goods & trip. This not only offers security but gets you an income from its premium.

Healthcare

Provide cards & wallets which doctors, nurses, and other medical staff can avail. While they go cash-free, you can develop a revenue stream from interchange fees. In addition, extend a helping hand to patients for surgeries & treatment with loans; allow them to pay it down the lane.

Automotive Industry

Let’s take the instance of KUWY, a digital platform for instant automotive loans & the resale of second-hand cars. The platform facilitates the sale while also offering lending services by connecting the right buyer with a lender. Consequently, earn recurring revenue from the interest. In addition, embedded banking can enable similar platforms to offer vehicle insurance as a part of their offerings, and a percentage of the premium could be a good source of revenue for the business.

The Key Benefits of Embedded Banking

Embedded banking brings many benefits to a multitude of domains. What are they?

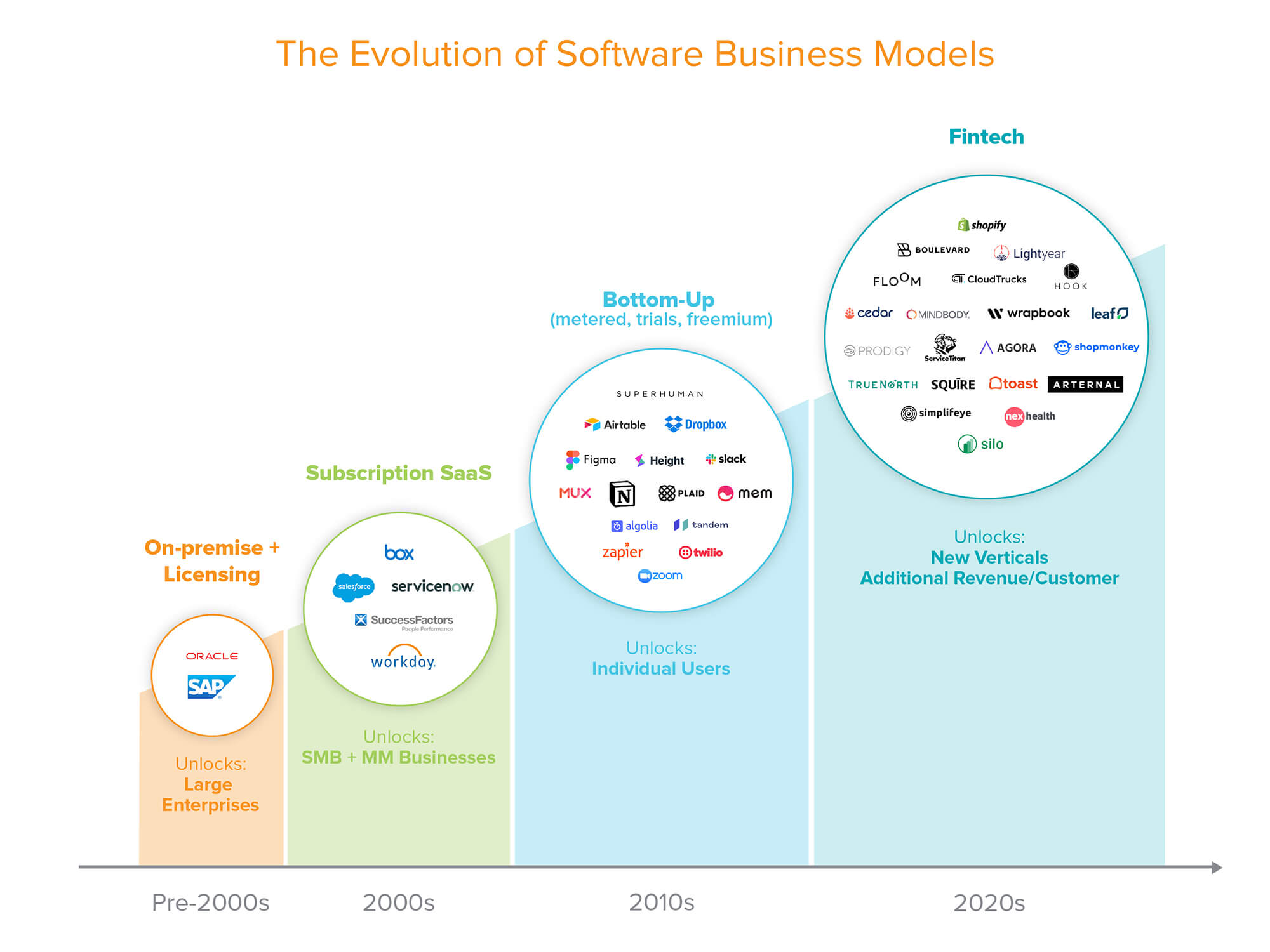

According to Andreessen Horowitz, a renowned Silicon Valley VC,

Companies can earn up to 5X higher revenue from embedded banking models, as compared to their usual subscription revenue models.

Let’s delve into it.

Opening an Additional Revenue Stream

Monetize the spend of your customers, partners, or vendors with embedded banking. Adding a layer of fintech allows companies to incur additional income. For instance, offering credit cards can help companies earn a nominal annual fee from each customer.

Lending services, as Buy Now Pay Later, can help them earn revenue in the form of interest payments. For payments happening within the platform, the company could charge a very nominal transaction fee.

Enter New Verticals & Markets

An extension of what we saw above. While incorporating financial services, companies can venture into new markets and test waters. With their existing customer base, it becomes easy and the scope of risk is comparatively reduced.

Consequently, acquiring new customers becomes easy and more streamlined.

Improving Convenience Manifold

The quotient of convenience which you can offer your customers with embedded banking is truly commendable. For instance, Google Maps allows users to pay the parking fees as they find a slot, getting BNPL options during online shipping, or EMI on your next flight for a holiday. Embedded banking enables customers to avail the desired financial service without having to leave your platform at all!

Financial inclusion goals

Traditional financial institutions frequently need help to reach out to specific populations, such as low-income individuals, rural areas, and small businesses. Embedded finance, in the form of embedded banking, can provide new channels for delivering financial services to those underserved by integrating financial services into non-financial products and services. Additionally, it could increase competition in the financial services market, resulting in better products and services for customers. Customers, for example, can easily compare and choose from a wide range of financial products and services, resulting in better deals and improved customer outcomes.

Decentro and Embedded Banking

We at Decentro are embracing the wave of embedded banking in all its might. With robust APIs and foolproof documentation and powered by leading bank partners in India, our plug-and-play API modules are intricately designed for businesses of all sizes to consume instantly.

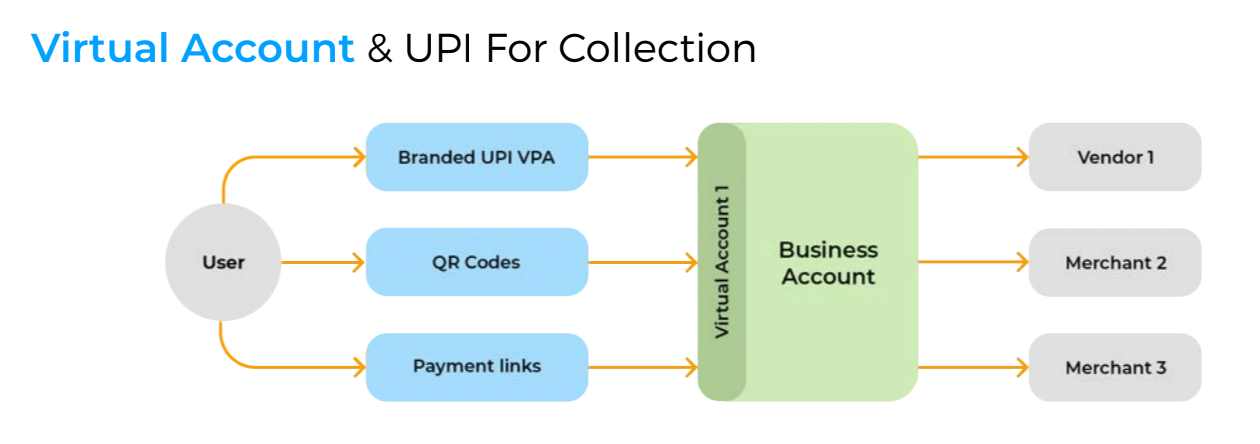

Payments & UPI

Don’t make your customers, partners, or lenders wait- initiate instant payments and settlements via our payments module & virtual accounts. Choose from RTGS, IMPS, NEFT, QR code-based, and UPI payment methods. Establish your brand identity from the get-go by white-labeling UPI IDs in your company name while sharing it with the world.

Are you ready to take your business to the next vertical? Don’t be behind to make the most of embedded banking. We’re here to help!

Drop us an email at hello@decentro.tech!

Until next time,

Cheers!