A detailed case study on 1Bridge, a last-mile platform, overcame collections & reconciliations hurdles in their pursuit for financial inclusion for rural India.

How 1Bridge Streamlined Collections & Reconciliation With Decentro

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

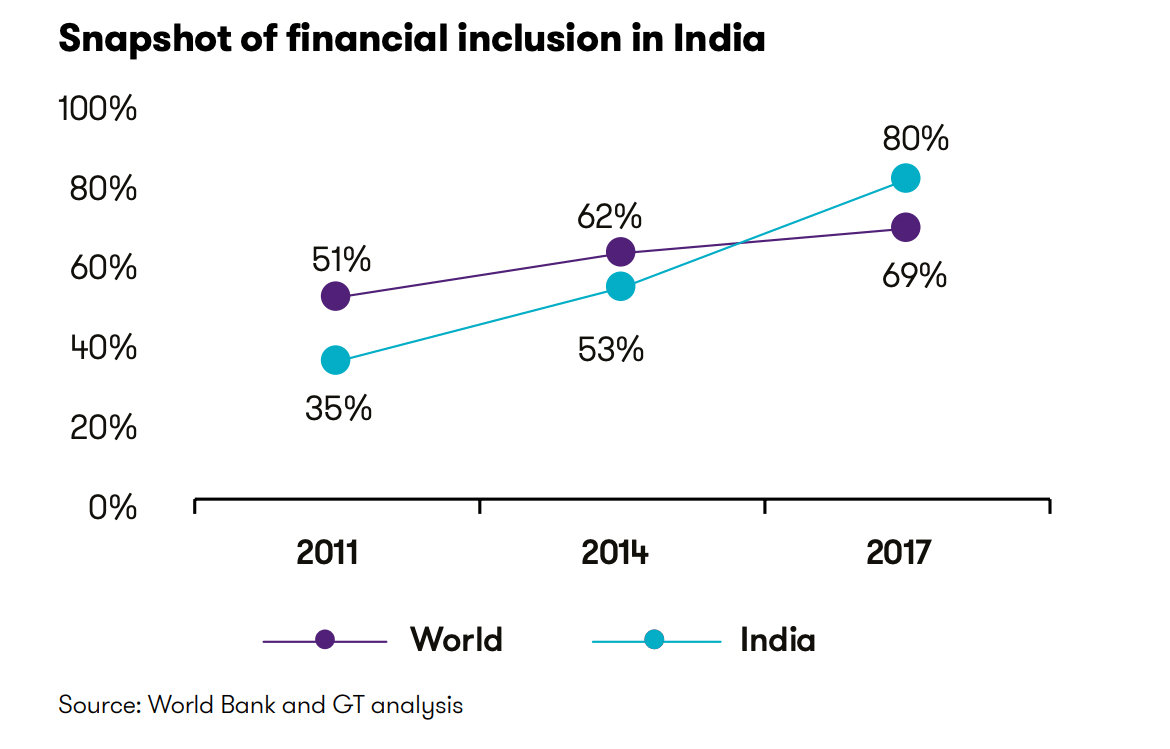

Financial inclusion is the simple yet powerful concept of ensuring that every citizen across the country has the capability to access and avail of basic financial services.

India has been steadily marching for a financially included and literate population over the years.

In 2017, over 80% of Indians (aged 15+ years) had account ownership at a financial institution or with a mobile-money service provider, a massive increase from 35% in 2011.

World Bank

However, we could go on a limb here and say that a good section of rural India is only beginning to be a part of these crucial growth & development schemes.

As a part of the financial inclusion strategy, RBI outlines the following:

- providing banking access to every village

- strengthening digital services for a cashless society by March 2022

- ensuring that every adult has access to a financial service provider through a mobile device by March 2024

Bridging the gap between rural and urban India is a platform that helps people to connect, order, and avail products and digital services.

What is 1Bridge?

1Bridge is a last-mile platform connecting rural customers with other rural and urban suppliers through an assisted commerce platform.

Through a network of local entrepreneurs & product/service partners, their mobile, intuitive platform plans to cater to the untapped rural population, which constitutes about half of the Indian population.

In addition, 1Bridge also provides last-mile delivery services for leading e-commerce players in the market.

What were the Main Challenges of 1Bridge?

The local entrepreneurs or 1Bridge Advisors get employment opportunities in their village, empower the residents with digital services, and help bring a host of revenue-generating activities to the village.

While this promised significant progress to digitize a village or hamlet, there were some challenges which 1Bridge faced.

Placing Orders & Payment Flows

The 1Bridge advisors collect requirements from rural customers and place the order on the platform. However, the agents should load their wallets with funds before placing any order.

This was to ensure a seamless payment flow.

Collections & Reconciliation

With orders pouring in from the length & breadth of the country, collections & reconciliation were tough. Most importantly, facilitating easy collections was necessary for a great experience for customers. In addition, the platform will need to dedicate valuable hours and resources to keep track of these transactions.

How did Decentro Empower 1Bridge?

Decentro’s API product suite enabled 1Bridge to offer a smooth payment flow and extinguish any reconciliation hassle.

How?

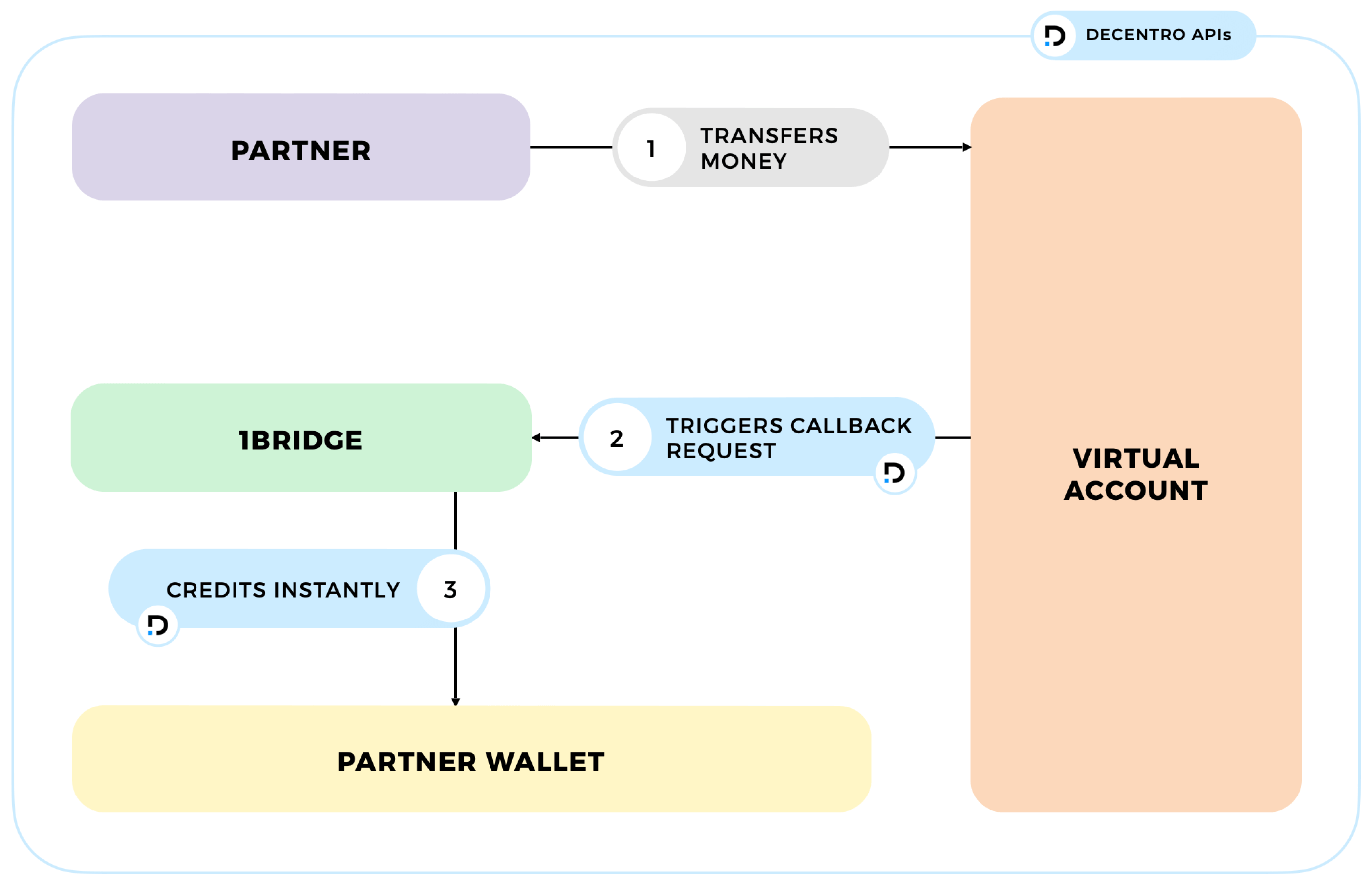

With the virtual account solution!

1Bridge can open any number of virtual accounts on its platform for each of their rural partners using Decentro’s APIs.

The advisors transfer the funds into their virtual accounts using:

- Bank transfers via NEFT, IMPS, RTGS

- UPI or payment links

- Static or dynamic QR codes

The UPI links are associated with a virtual account. These can be white-labeled for branding purposes and can be used across popular UPI apps such as GooglePay or PhonePe using deep linking. In addition, this payment method comes with instant settlements without any delays and minus the MDR(Merchant Discount Rate).

Moreover, with simple Account Statement API calls, the reconciliation of all transactions happens in real-time and is fully automated.

What were the Key Wins for 1Bridge?

After 1Bridge resolved these knots and smoothened things out with Decentro, let’s see the outcomes.

10X Faster Integration Timelines

1Bridge’s integration timelines were reduced by 10X from an integration perspective on the banking front. Instead of spending a few months with a bank to get a streamlined API-driven solution, they could integrate and go live with us in just a matter of 2 weeks!

Uninterrupted Wallet Loading

Above all, Decentro’s Account Balance callback ensures instant alerts to 1Bridge’s system, thus helping 1Bridge to credit the wallets instantaneously and automatically. At the same time, they didn’t have to worry about bank downtimes or any upgrades on the API front as we handle those in the backend.

80%+ Cost Reduction & Instant Settlements

Direct bank transfers ensured an 80%+ reduction in cost as compared to traditional payment gateways. In addition, 1Bridge removed delayed settlements from the equation completely by controlling their money flow directly and having visibility in real-time on the status.

Similar to 1Bridge, we’ve enabled our customers, such as Zoozle & Gromo, to simplify their operations and elevate the customer experience. In addition, you can find more such detailed case studies in the sections below!

While you’re here, please feel free to explore our API suite that helps business across various financial services such as:

To put things into perspective, in just a matter of two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

In conclusion, go live in a matter of weeks, enrich your customers’ experience, and fuel the growth of your business without any compromise. Let us help you achieve that.

Until we see you next time with another exciting story.

Cheers!