Dive into the step-by-step process of using PayNow for secure and seamless transactions. From setup to your first transfer, we’ve got you covered at Decentro.

PayNow Explained: A Guide to Seamless Transactions in Singapore

Table of Contents

The PayNow payment system is doing the same thing for Singapore that UPI has done for India, revolutionizing how financial transactions are conducted.

Starting in 2017, PayNow has become one of Singapore’s most popular payment methods, with more than a 7.6 Billion Monthly Transaction Value (as of the end of 2021).

Read our in-depth guide to understand how to send and receive money securely using PayNow.

What is PayNow?

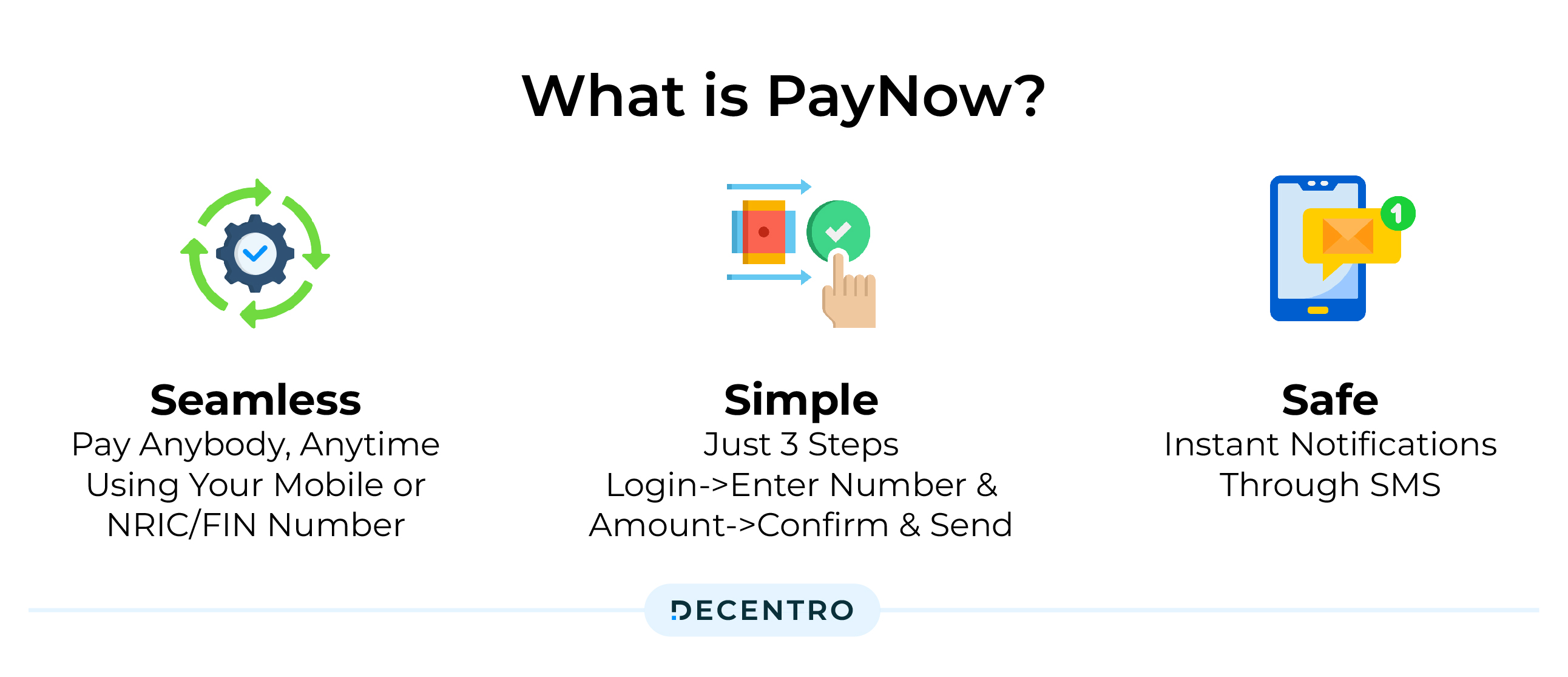

PayNow is a secure payment system that lets you pay individuals and businesses using your mobile number. You can send money to your friends, pay your bills, or make online purchases using only your mobile number, NRIC/FIN number, VPA (Virtual Payments Address), or UEN (Unique Entity Number) for business payments.

This powerful platform ensures 24/7 availability, allowing for almost real-time transactions without needing to obtain recipients’ account numbers. Whether settling bills, making online purchases, or transferring funds to friends, PayNow provides a seamless and secure financial solution.

What is PayNow Corporate?

PayNow has evolved beyond its initial scope, now catering to individual consumers and extending its functionality to encompass corporate entities, businesses, Singapore Government agencies, associations, and societies—collectively referred to as ‘Entities.’ This expansion, known as PayNow Corporate and facilitated through participating banks, enables these entities to execute swift SGD transactions effortlessly by associating their Unique Entity Number (UEN) with their respective Singapore bank accounts. This eliminates the intricacies associated with navigating through bank and account numbers during fund transfers.

Entities desiring to receive funds are encouraged to complete their online registration via their respective bank’s digital banking platform or to contact their bank for dedicated assistance. Notably, this service also streamlines fund transfers between retail customers of participating banks and Entities, ensuring a seamless financial transaction experience.

PayNow can be an excellent boon for e-commerce businesses. With 4.9 million users, over 80% of Singapore residents and businesses use PayNow, making it a straightforward and cost-effective solution for accepting customer payments with lower fees than credit card transactions.

PayNow also offers a number of methods so that customers can pay through multiple channels.

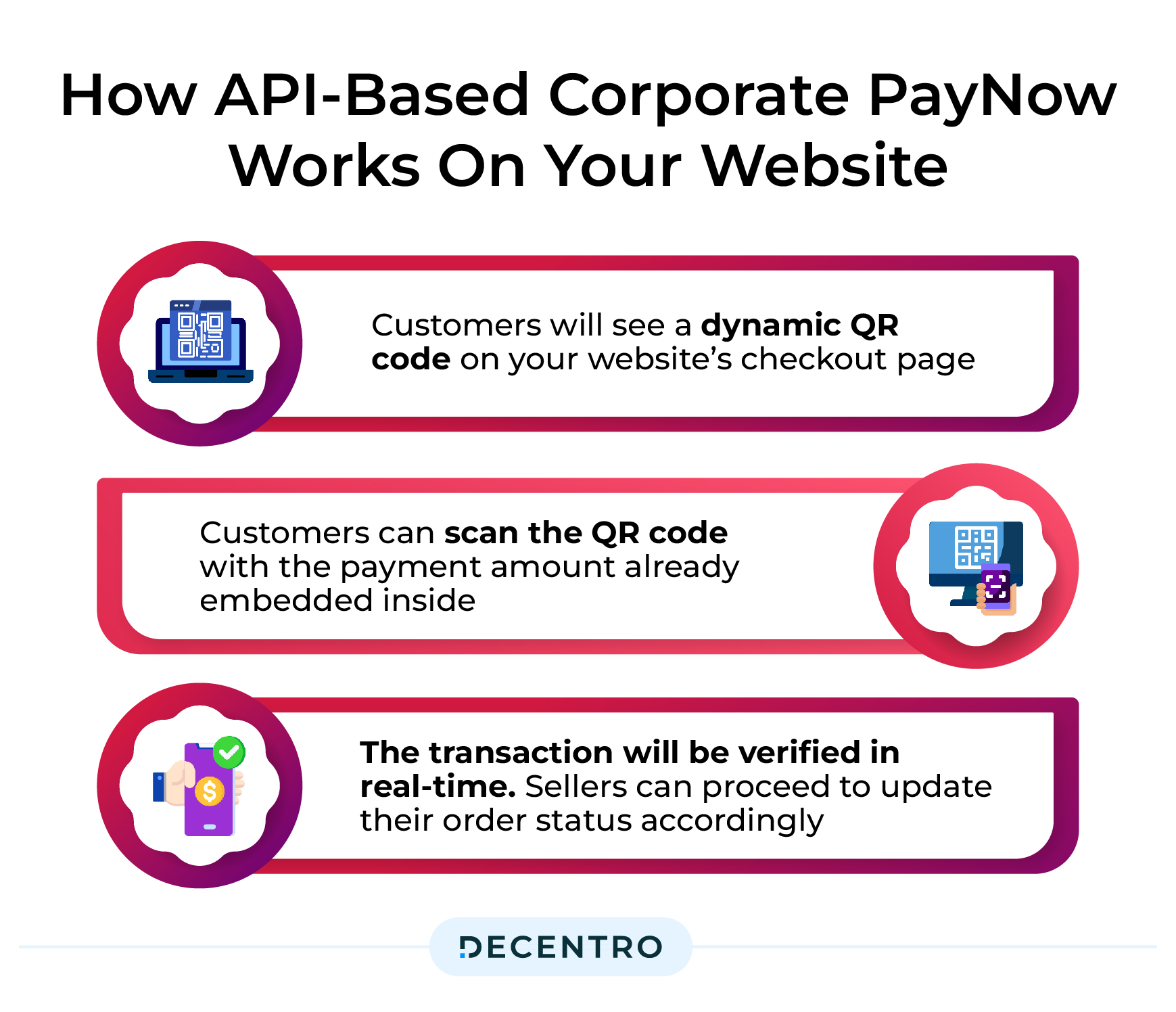

- API-based PayNow Corporate Integration – API-based PayNow Corporate Integration is a real-time online payment method where merchants can sign up with the bank to enable API-based PayNow Corporate. Your customers will see a dynamic QR code at your website’s checkout page with your product amount and reference ID information embedded inside.

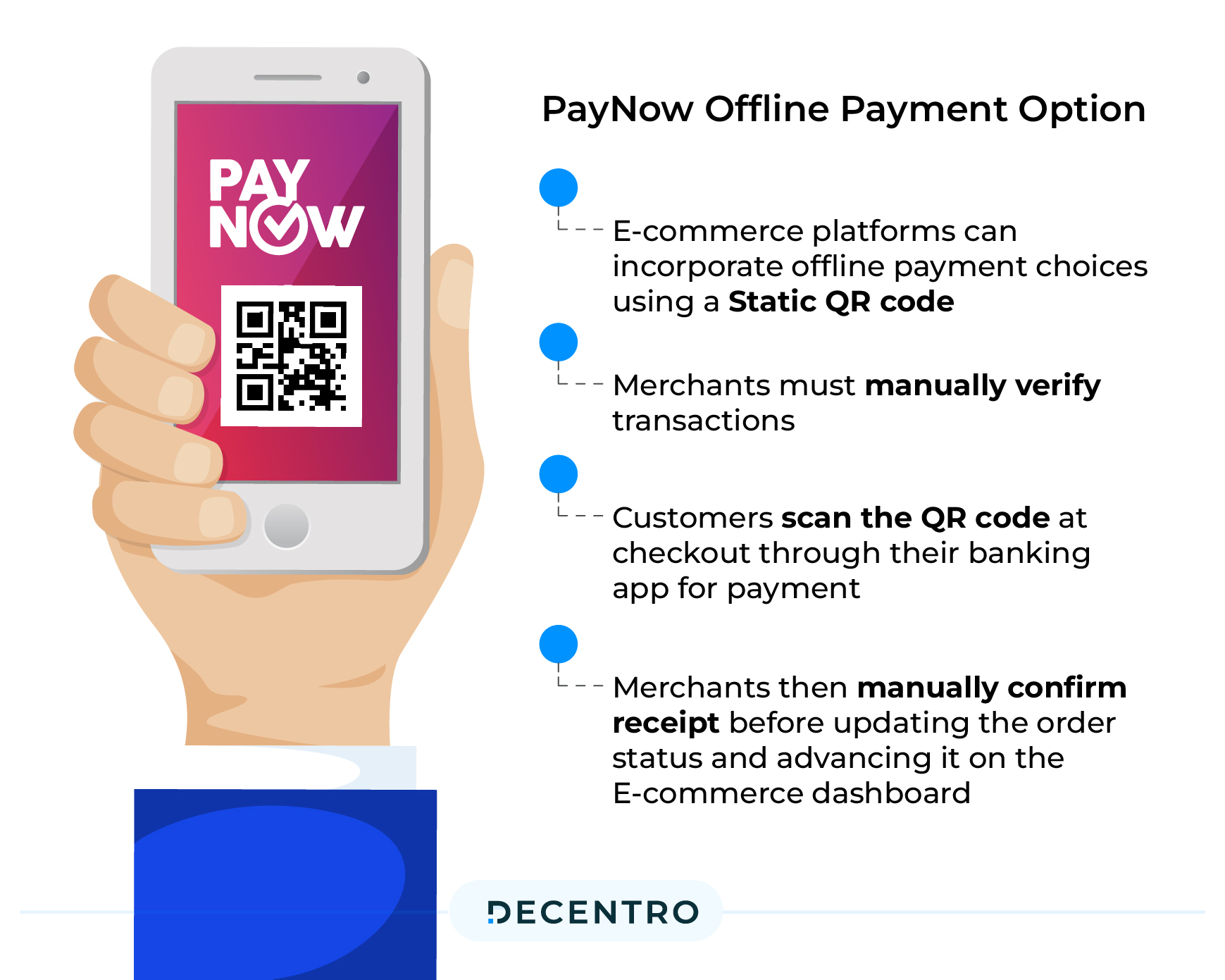

- PayNow Offline Payment Option: E-commerce platforms can incorporate offline payment choices using a static QR code. Yet merchants must manually verify transactions. Customers scan the QR code at checkout through their banking app for payment. Merchants then manually confirm receipts before updating the order status and advancing it on the e-commerce dashboard.

- Third-party Payment Gateway – Third-party payment gateways integrate PayNow’s gateway into their systems, offering plugins and extensions for developers to install on E-commerce shops. Typically, these gateways charge some transaction fee.

With PayNow, you and your customers can enjoy a seamless payment experience, allowing you to focus on business growth.

Which banks support PayNow?

PayNow is readily available through the majority of Singapore’s major banks. These include:

| Bank Name | Incoming | Outgoing |

| DBS | All fees waived till 31st Dec 2025 or subsequent notice | GIRO – S$0.20 per transaction*FAST – S$0.50 per transaction for commercial payments**until subsequent notice |

| OCBC | All fees waived till 31st Dec 2025 or subsequent notice | GIRO – S$0.20 per item*FAST – S$0.50 per transaction**until subsequent notice |

| UOB | All fees are waived till 31st Dec 2025 or subsequent notice | GIRO – $0.40 per item*FAST – Up to 50 free outgoing transactions per month from 1 August 2020 to 31st January 2021.The subsequent charge will be S$0.50 per transaction until 31st December 2021.*until subsequent notice |

| Maybank | All fees waived till 31st Dec 2025 or subsequent notice | All fees waived till 31st Dec 2020 or subsequent notice |

| Standard Chartered | All fees waived for a limited time only*As reflected on their website | GIRO – S$0.50 per transaction*FAST – Free 30 transfers per month. Subsequent charge at $1 per transaction.*until subsequent notice |

| Citibank | GIRO – No charge*FAST – S$0.40 per transaction**until subsequent notice | GIRO – No charge*FAST – S$0.40 per transaction**until subsequent notice |

| HSBC | Information not available | GIRO – S$0.50 per item*FAST – S$1 per transaction**until subsequent notice |

| Bank of China | All fees waived until subsequent notice | All fees waived until subsequent notice |

If you’re an existing customer of any of these banks, PayNow payment options may have already been integrated into your online banking system.

How safe is PayNow?

PayNow is a highly secure funds transfer service that adheres to the stringent security protocols established by the Singapore banking industry for fund transfers, mirroring the standards in systems like FAST and GIRO.

How to set up PayNow?

As mentioned before, if you’re a customer of any of the above banks, you can register for PayNow by linking your mobile number, National Registration Identity Card (NRIC) number (in case you’re a Singapore citizen) or Foreign Identification Number (FIN) (in case you’re a foreign national working in Singapore) to your bank account. Once registered, you can use PayNow by logging into your online or smartphone banking system.

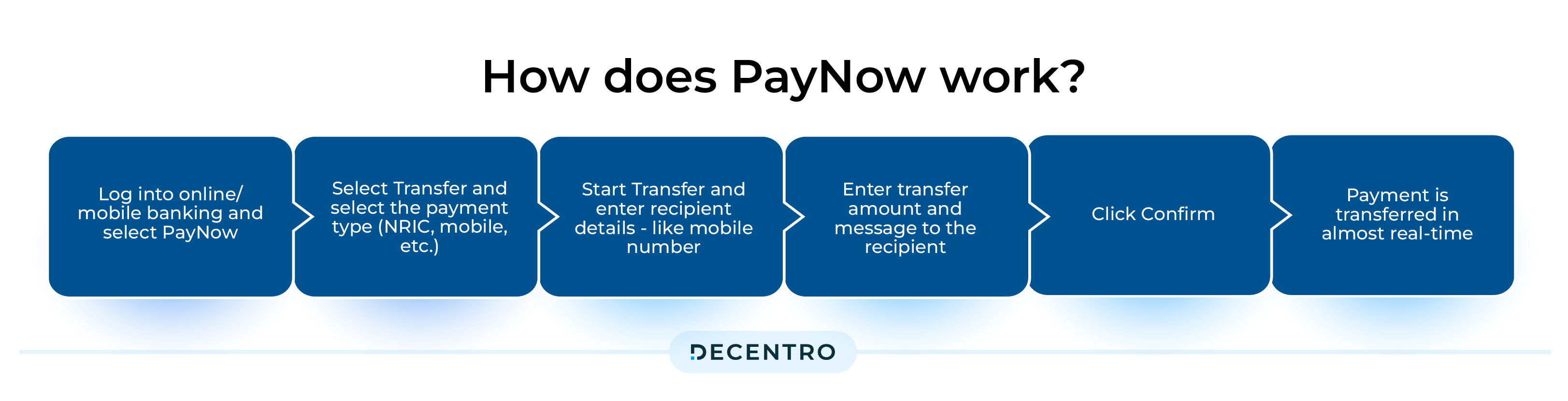

How does PayNow work?

- Log into online/mobile banking and select PayNow

- Select Transfer and select the payment type (NRIC, mobile, etc.)

- Start Transfer and enter recipient details – like mobile number

- Enter transfer amount and message to the recipient

- Click Confirm

- Payment is transferred in almost real-time

How is PayNow different from FAST?

To initiate a fund transfer via the FAST system, a customer or business is traditionally required to have the account number and the name of the intended payee. Conversely, with PayNow, a proxy mechanism replaces the necessity for an account number in fund transfers. This proxy can be a Mobile Number, NRIC/FIN, or a VPA (Virtual Payments Address) issued by National Banking Institutions (NFIs).

Also, PayNow allows transfers of SGD 5,000 per transaction if recipients are not added, while FAST transfers are subject to limits set by the user’s bank.

Making your first transaction through PayNow

You can make your first transaction on PayNow in three different ways:

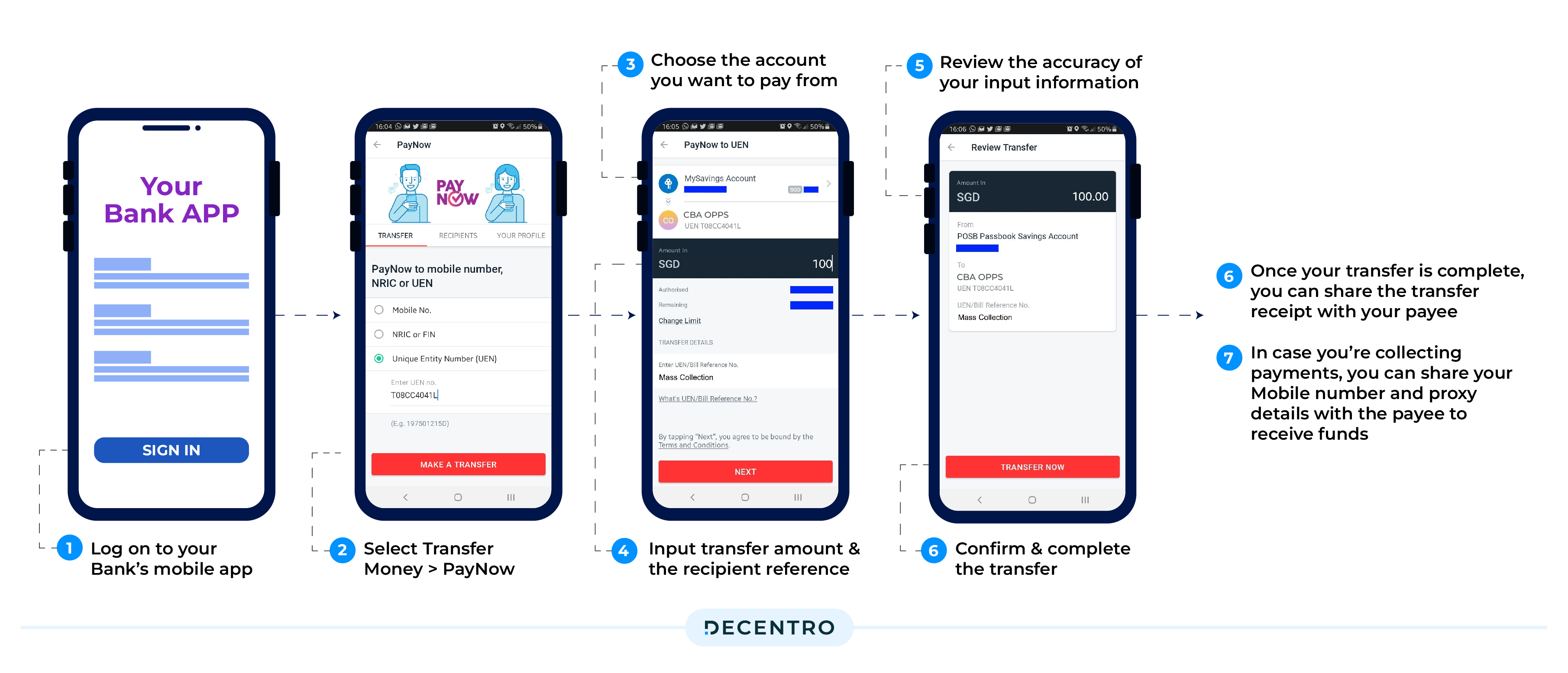

Using mobile number, NRIC, UEN or VPA

- Log on to your Bank’s mobile app

- Select Transfer Money > PayNow

- Choose the account you want to pay from

- Choose from your list of saved payees or create a one-time transfer using your payee’s mobile number, NRIC, Unique Entity Number or Virtual Payment Address

- Input the transfer amount and the recipient reference

- Review the accuracy of the information

- Click Confirm to complete the transfer

- Once your transfer is complete, you can share the transfer receipt with your payee

- In case you’re collecting payments, you can share your Mobile number and proxy details with the payee to receive funds.

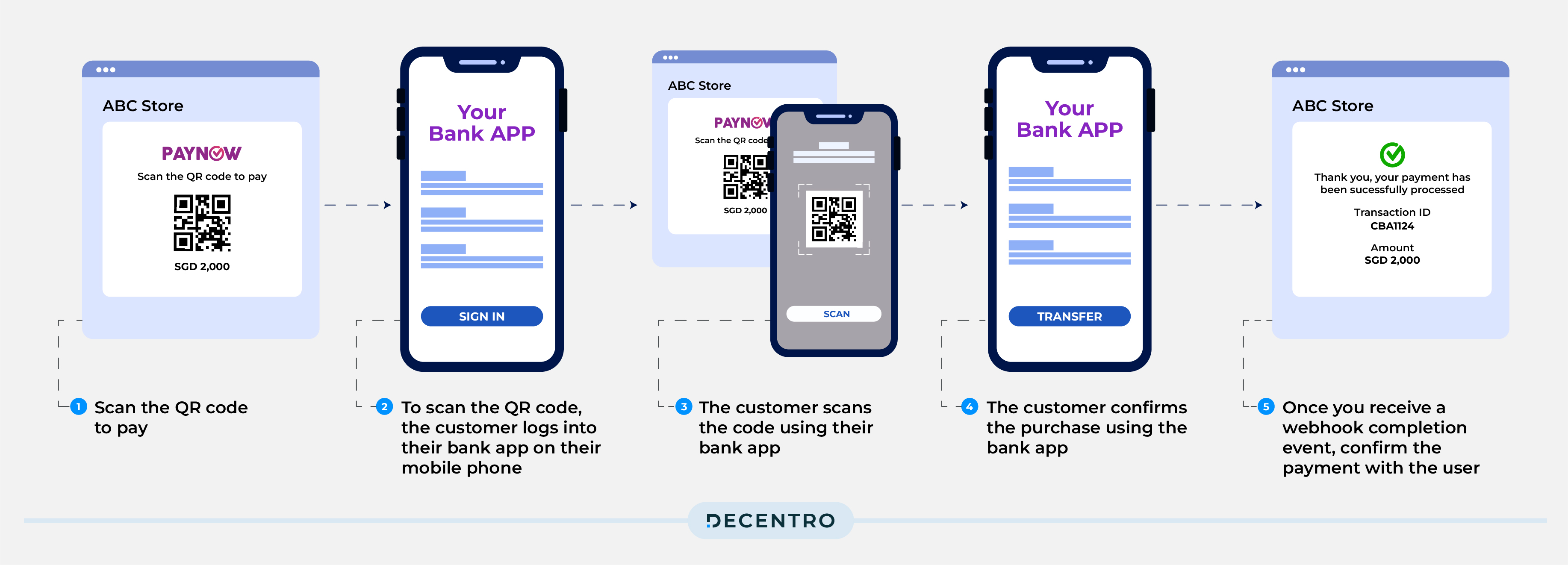

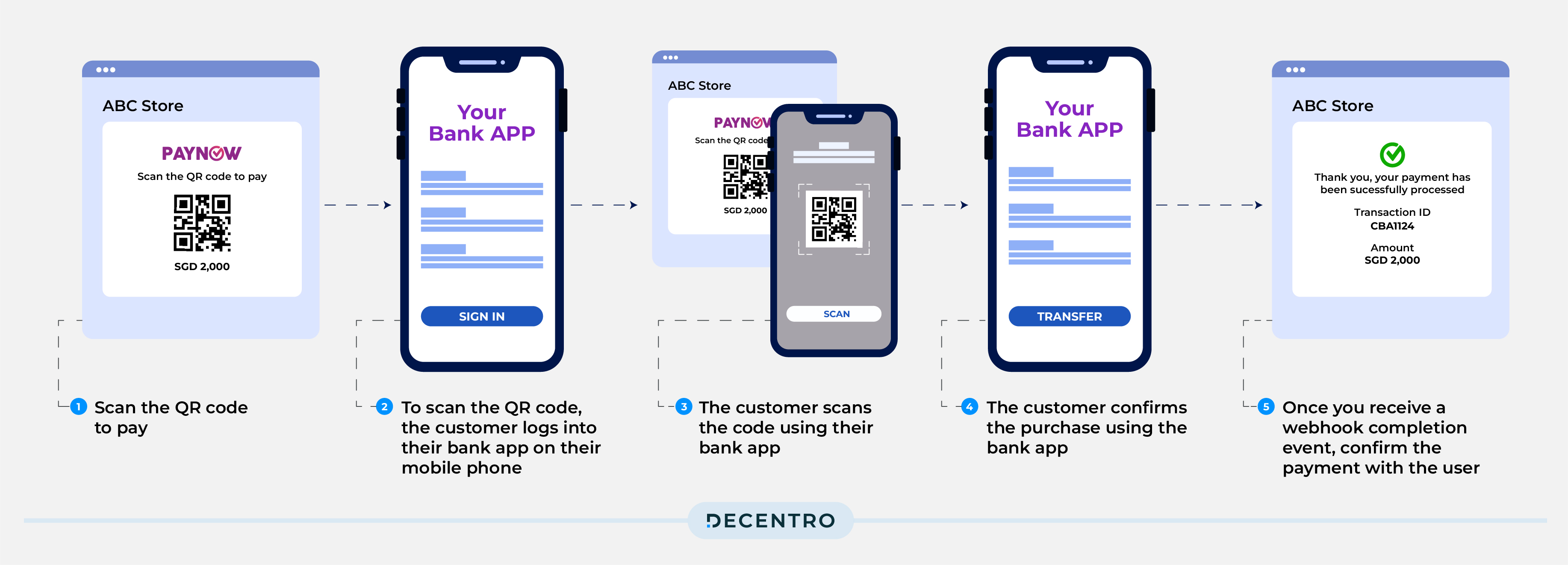

Using QR Code

- Select the Scan and Pay option > Scan the QR code

- Log on to the Bank app on your phone

- Input the transfer amount, select the debiting account and click continue

- Review the accuracy of the information

- Click Confirm to complete the transfer

- In case you’re collecting payments, you can generate your QR code on your banking app and download your QR code or select copy details to use the UEN and your reference.

Using Online Banking

- Log on to the Online Banking portal of your bank

- Select PayNow from the menu

- Select Transfer via PayNow and the payment account

- Input the beneficiary details and transfer amount

- Review the accuracy of the information

- Click Confirm to complete the transfer

Once the transaction is complete, you can check the PayNow transaction by logging onto your banking app and retrieving your transaction receipt.

How to increase the PayNow limit?

Generally, different banks will have slightly different methods to increase your PayNow limit. Primarily, the method is similar across all the supporting banks.

- Log into your Online Banking portal or Mobile Banking portal.

- Go to transfer settings.

- Select other banks.

- Set your new transfer limit and proceed.

- A new limit will be saved.

Benefits of PayNow

We have established the significant benefits of PayNow, such as speed and convenience.

However, apart from these, PayNow also offers other benefits:

- 24X7 availability with high security

- Transfer of larger amounts of up to SGD200,000 possible

- An extensive network of banks and NFIs support PayNow

- Easy access transfers are enabled of up to S$1,000 daily without the need of a Digital Secure Key/Security Device

Why Decentro APIs for PayNow?

Decentro’s robust and easily integrable APIs can help you grow 10X faster with a wide range of benefits, including:

- Elevate the customer experience with a wide range of faster and more convenient payment options, like PayNow.

- Enable quicker go-lives by integrating our stack and go-live within a matter of days.

- Get instant real-time payment-related reports, insights, and notifications on your dashboard.

- Drive lower operational costs by cutting your expenditure on heavy integrations and relationships.

The road ahead

PayNow is a fast and powerful method to enable payment transactions at scale in Singapore. Carrying cash or obtaining bank details is no longer a requirement to make fast and secure payments. Individuals and businesses can now drive transactions through all the participating banks using only mobile numbers with proxy.

India and Singapore have officially connected their digital payment systems, UPI and PayNow, allowing instant and cost-effective fund transfers. This move seeks to disrupt the annual cross-border money flow exceeding $1 billion between the two nations. The linkage is now live, involving banks like DBS, Liquid Group, Axis Bank, and State Bank of India. Citizens can use their local payment systems for real-time transfers to the foreign land. An Indian user can remit up to 1,000 SGD daily, as per the Reserve Bank of India.

This collaboration is a critical element of a broader regional initiative to simplify cross-border payments, aiming to cut operational costs for individuals and merchants.

With more and more capabilities (including payment modes and cross-border payment capabilities) being added to PayNow, it’s a no-brainer for individuals and businesses to start using PayNow for simple, fast, and safe payments.

Elevate your customer experience in Singapore with seamless payments.

Drop a Comment