Here’s a detailed case study on how Workflexi, a gig economy platform, overcame the challenges of delayed payment settlements & transaction reconciliation with Decentro.

How Workflexi Fast-tracked Gig Economy Payments & Settlements

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

Year 2008.

On a chilly December evening two entrepreneurs, Travis Kalanick and Garrett Camp, found themselves unable to find a cab while attending a prestigious tech conference. ‘What if booking a cab could be as simple as tapping your mobile?’ they wondered. Soon enough, this idea soon shaped into a reality.

12 years later, Uber functions across 65 countries, providing cab riding services in 600+ cities, and generating revenue in billions.

I could go on a limb here and say that Uber is one of the popular synonyms of Gig Economy with many others such as Airbnb and Upwork.

A gig is defined as any job taken up on a temporary basis- right from a simple cab sharing to a complicated web application development. The world is seeing a visible shift towards the gig economy where workers are hired temporarily to perform a task.

The size of Gig Economy transactions is projected to grow by a 17% CAGR; the gross volume is expected to touch ~$455 billion by 2023, from $204 billion in 2018.

Mastercard

Making gig economy a familiar term in the everyday dictionary is Workflexi, a platform for gig workers to find a job, gig hirers to get the right talent.

What exactly does Workflexi do?

Workflexi is an online platform to find gig jobs and make revenue. It is the only platform in the country to offer gigs across various verticals, contractual or freelance. You can signup with the platform and use it as an individual gig-worker, a company gig-seeker, an individual hirer, or a company hirer.

Above all, Workflexi has facilitated more than 1000 gigs via peer-to-peer, employer-to-employee, or business-to-business collaborations. They currently function across India and some parts of the world.

What were Workflexi’s Key Challenges?

One of the essentials for Workflexi to ensure is that the right hirer and worker get connected and the payment for the same happens without delays or hiccups.

One of the major challenges faced by Workflexi was payment settlement timelines. Employing a payment gateway for the same delayed the settlements by up to 6 days. Furthermore, this cascaded to a delay in settling the dues of gig workers.

As Workflexi onboarded more users and companies, the volume of transactions increased rapidly, reconciling transactions became tricky. It was harder to track which payment came from whom. Subsequently, as the platform scale further, this issue is bound to worsen.

How Decentro Empowered Workflexi

Decentro’s API product suite helped Workflexi to speed up the payment settlement process.

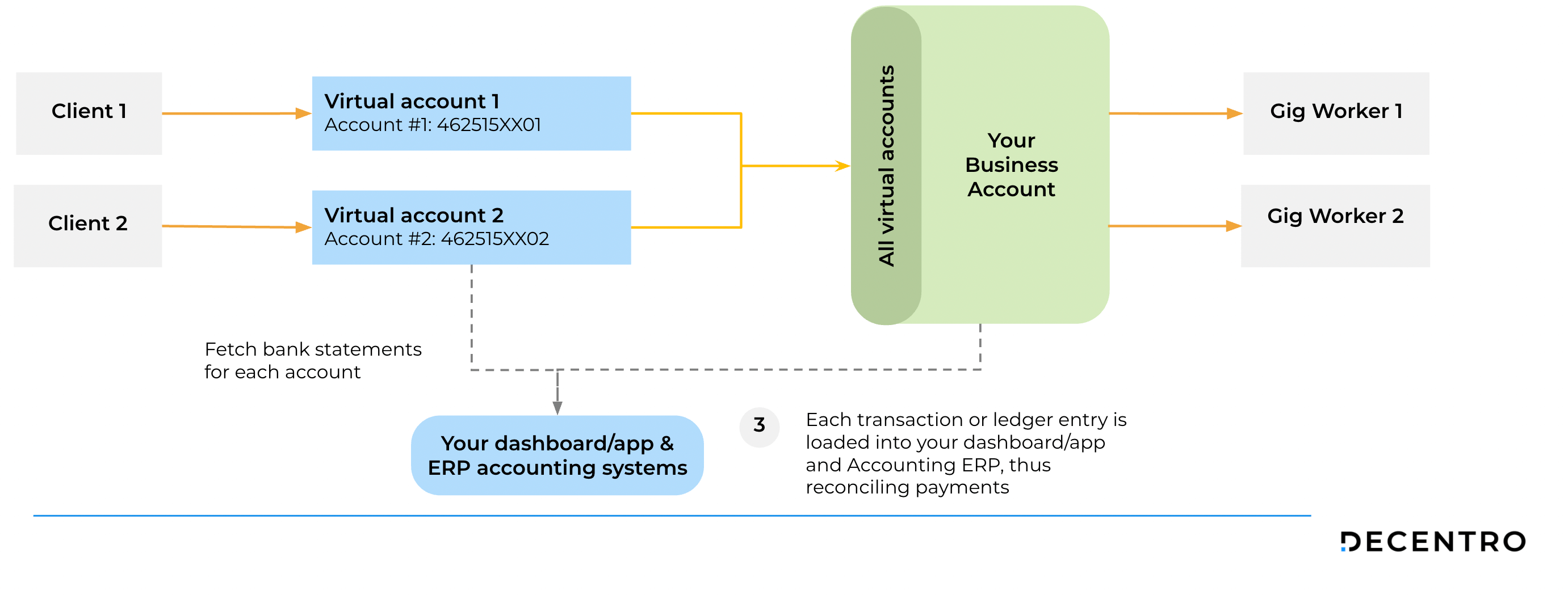

Workflexi set up multiple virtual accounts for their customers with our accounts module to track and reconcile payments, fully automated and in real-time.

The payment settlement timelines now became real-time and instant, drastically reducing from the usual 4-6 days.

Besides, each virtual account has an associated UPI ID which you can customize & white-label, and share easily across multiple channels such as WhatsApp; the latter being one of the finest use of conversational banking!

Some of the best outcomes after Workflexi joined hands with Decentro includes:

- Instant payment settlements. Reduced the delay from T+6 to T+0

- Real-time and automated payment reconciliation

- Single endpoint for multiple integrations

- Supported Multi-channel payment collections via UPI, QR codes, RTGS, IMPS, NEFT

- Fastest API response times within a few hundred milliseconds

- Customer support across multiple channels

We wanted a payment process that is instant for our gig workers and couldn’t find a payment gateway that could do that for us. We also wanted companies to transfer money from their current account to the wallet, and with Decentro that’s possible.

Sandesh Kangod, Founder & CEO at Workflexi

It’s not just the reconciliation, management, and settlement of payments alone. Our host of products, from bank account validation to payments and debt collection, helps your business simply integrate financial and smooth workflows. Here’s a case study on how we enabled the country’s first neobanking platform for teenagers, FamPay, to strengthen their KYC process.

In just a matter of two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

If you have a business challenge you’re locking horns with, we’d be happy to get you onboard and solve it. Together.

We’re just a chat or email away. hello@decentro.tech.

Until we see you next time with yet another success story.

Cheers!