There are many challenges faced by B2B companies when it comes to money flow & payments. Here’s how you can solve it.

Identify & Overcome These 7 Acute Challenges of B2B Payments

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

Are you a business owner?

Yes? Let’s start with a small quiz, shall we?

- Have you spent restless hours related to payments for your buyers, sellers, suppliers, or partners?

- Do you see your admin & finance teams struggling to tally the transactions and reconcile them periodically?

- Have you found it difficult to accept or receive payments from your customers, merchants, or send money to your vendors, leading to deal-breaking moments?

- Is smooth cash flow cycles a myth in your business?

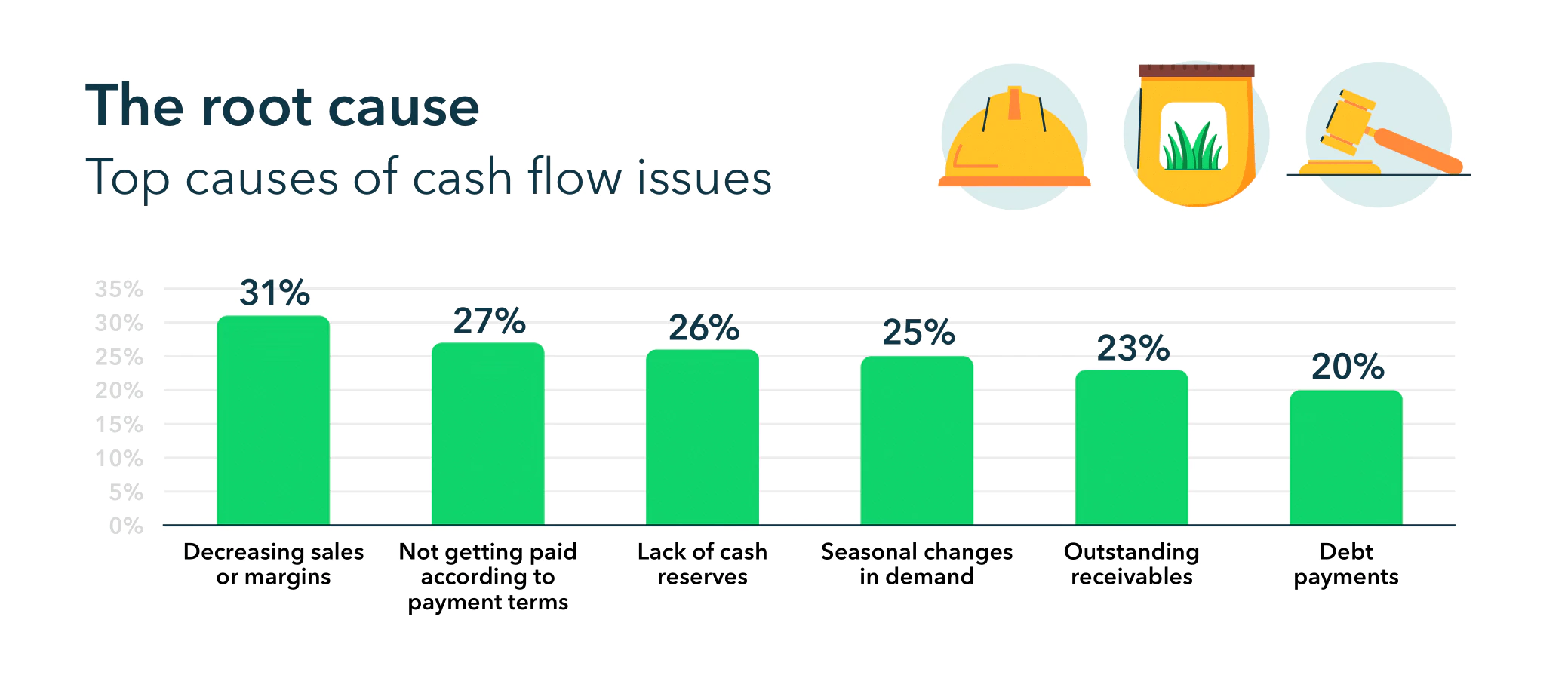

If you answered yes to these questions, then these numbers by Intuit QuickBooks might be relatable.

In 2021, faced with cash flow problems, 79% of small businesses have struggled to pay a supplier, up from 71% pre-pandemic.

What were the impacts of these payments & cash flow hurdles?

- Reduced business growth (40%)

- Missed opportunities to close new projects(31%), hire(19%), and invest in capital (25%)

This blog is aimed to help your business navigate far away from the acute challenges and facilitate easy business payments and online money transfers for your customers & merchants.

What are B2B Payments?

Platforms like Zoho & Udaan are fine examples of B2B companies that work with and empower thousands of businesses of all sizes, to function better and reduce hassles. The transactions that occur between them, therefore, are termed as B2B payments.

In simple terms, B2B payments are the transactions that happen between two businesses to avail a product or service. A business-to-business commercial payment does not involve an end customer and is typically applied to MNCs, startups, retailers, merchants, wholesalers, vendors, and more!

A B2B payment can be a recurring subscription or even a one-time purchase. In addition, B2B payments are different & slightly complex compared to B2C payments, due to the string of approvals & settlements involved.

What are some of the common B2B payment methods? Let’s find out!

Cash or Cheque

The paper payment method is gradually turning obsolete, especially in the wake of the pandemic. UK Finance study has recorded a 35% reduction in cash transactions in 2020 and the increasing adoption of digital money transfers.

Wire Transfer

Also known as bank transfer & online money transfer, this method involves making payments online through banks via RTGS, IMPS, NEFT.

- Immediate Payment Service(IMPS) allows a business to transfer money instantly, round the clock.

- However, unlike IMPS, National Electronic Funds Transfer (NEFT) takes longer to process, although it can be availed the same way.

- Furthermore, for high-volume business transactions tied to approvals & clearance, Real-Time Gross Settlement (RTGS) is the best choice, available during select hours of the operating banks.

Credit or Debit Cards

A business can avail either physical or virtual cards, both credit, and debit, to go cashless. The cards are tied to your business banking accounts and adds to the list of expenditures. In addition to usage, your business can also issue these prepaid cards to your customers, partners, or merchants to enable them to swipe and use them on categories of your choice.

Payment Gateways

Payment gateways, a subset of payment service providers, helps businesses to accept or make payments after integrating with their platform. The payment gateway collects money securely from the buyer and deposits it to the seller’s account. Some of the prominent payment gateways are Razorpay and Stripe.

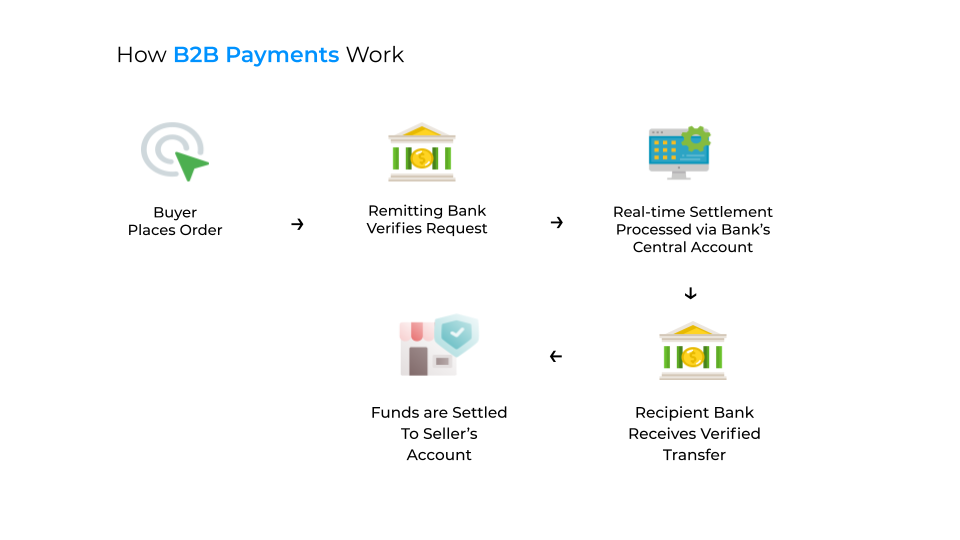

How Does Business-to-Business Money Transfer Typically Work?

Unlike paper transactions, an online money transfer saves much time & effort for businesses to share & receive payments and bookkeep it easily.

Let’s take the example of a simple business-to-business money transfer using RTGS.

In the RTGS mode of transaction, the verification is carried out via the banks’ central accounts. Very often, B2B payments may not settle instantly since there would be a fixed period in the payment terms set by the two transacting businesses. For instance, a 30-day term period.

How Are B2B Payments Different from B2C?

While B2C typically has low transaction amounts, B2B money transfers could end up in hundreds of thousands of rupees. As a result, it’s comparatively tougher to process instant payments since there are multiple levels of verification involved.

While B2C payments are instantaneous like we’d mentioned, the same can’t be generalized in the case of B2B. In contrast, B2B money transfers often follow a synchronous payment agreed upon by both parties. In addition, a B2C purchase decision doesn’t require multiple steps and is solely up to a customer to decide. On the other hand, B2B involves many stakeholders that could take much time!

What are the Challenges for B2B Payments?

Even with much potential, B2B payments still pose major challenges for companies all over. Let’s see what they are.

1. Interoperability Between Businesses

Very often, the transacting businesses have contrasting natures, right from payment terms, the preferred choice of payments, and the rounds of decision making. For instance, your seller may prefer a bank transfer, but your business needn’t due to the high transaction fee. Consequently, this could create a dent in the smooth flow of payments.

2. Security Concerns & Breaches

Since B2B payments involve high-volume transactions, the stakes are high, and so are the security concerns. Furthermore, it’s critical to ensure no confidential information about your business gets leaked, and even that of your customers, partners, or merchants.

In a shocking incident, The Washington Post reported a ransomware strike that has impacted 800-1500 SMBs in July 2021. Hailed as one of the worst-hit attacks, the breach on IT service provider company Kaseya left thousands of their customers exposed, vulnerable, and hacked.

Threats such as business email compromise (BEC) wreak havoc on B2B payments and it’s all the more crucial for companies to double-triple ensure safety & compliance.

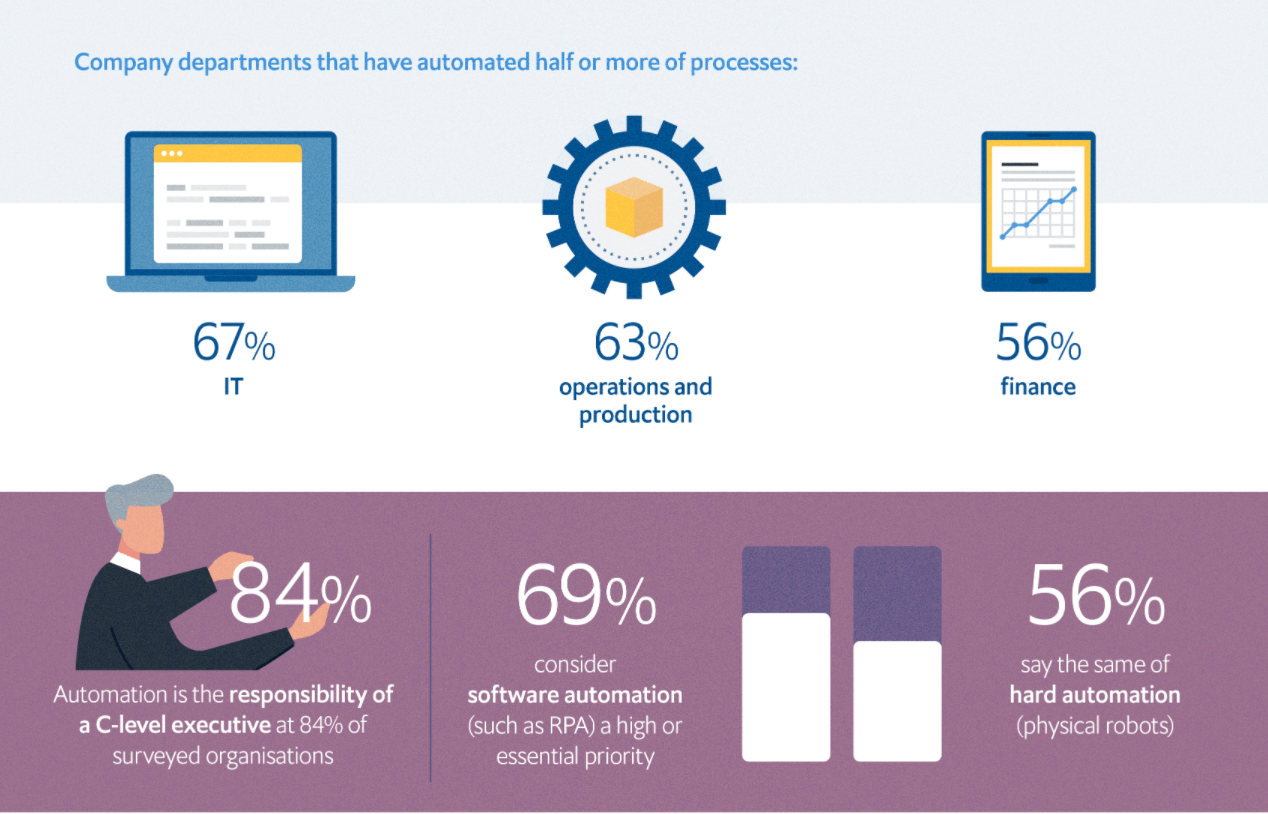

3. Broken Financial Workflows

Even after advancements in automation tools, many businesses, especially small ventures, are yet to adopt these to automate their financial workflows and payments. More than often, a business can get caught in the whirlpool of manual tracking, cross-team communication, and back & forths with transacting business leading to loss of revenue and wastage of resources.

Are your salespeople also acting as payment collectors while they should be closing the next deal? Food for thought!

4. Lack of Money Flow Transparency & Tracking

Tracking the money flow is crucial for any business to reconcile easily and improve profitability. However, if not done properly, there’s a lack of visibility in tracking the transactions between two companies that pave the way for errors, from pillar-to-post communication between teams and companies that drains time and resources, to name a few repercussions.

5. Fund Settlement Delays

The payment terms period as such could add a window for settlements to happen. Furthermore, the online transfers modes for B2B payments delay the settlement periods again. For example, a payment gateway facilitates transactions; however, a merchant would have to wait to get their funds at least for 2-5 days.

6. Higher Overhead Expenditure

Most payment methods require a business to pay a percentage of the value as the transaction fees. This is particularly a burden for SMBs due to the sheer volume of transactions that happen daily. Similarly, any payment processor like payment gateways also comes with this added cost, around 2-5%, which adds to the overheads.

7. Lack of Digitization

While there are businesses that don’t adopt automation tools for their financial cycles, there exist businesses that rely on pen & paper to tally, checkout, and reconcile. Above all, frequent trips to banks, the safety of the huge amount of cash in possession, manual tracking & bookkeeping, makes this a classic nightmare case of B2B payments. Ergo, misappropriation of money is inevitable.

Cross-border Limitations for Expansion: Your business may have clients overseas or wish to expand to new territories. However, payments between countries still pose a major challenge to companies across the globe. International payments are a costly affair altogether, with expenses coming in the form of bank fees, cross-border fees, currency change and the exchange rates, and the taxes in the country.

How Can Decentro Power-up Your B2B Payments By 10X?

At Decentro, we meet businesses that struggle with smooth payments, settlement delays, and chaotic bookkeeping & reconciliation.

Thus, it’s with earnest efforts that we’ve built our banking API modules, such as Payments and Virtual Accounts, to help businesses like yours to slingshot past these challenges.

Here’s how you can overcome the key challenges of B2B online money transfers.

Settle Funds Instantly

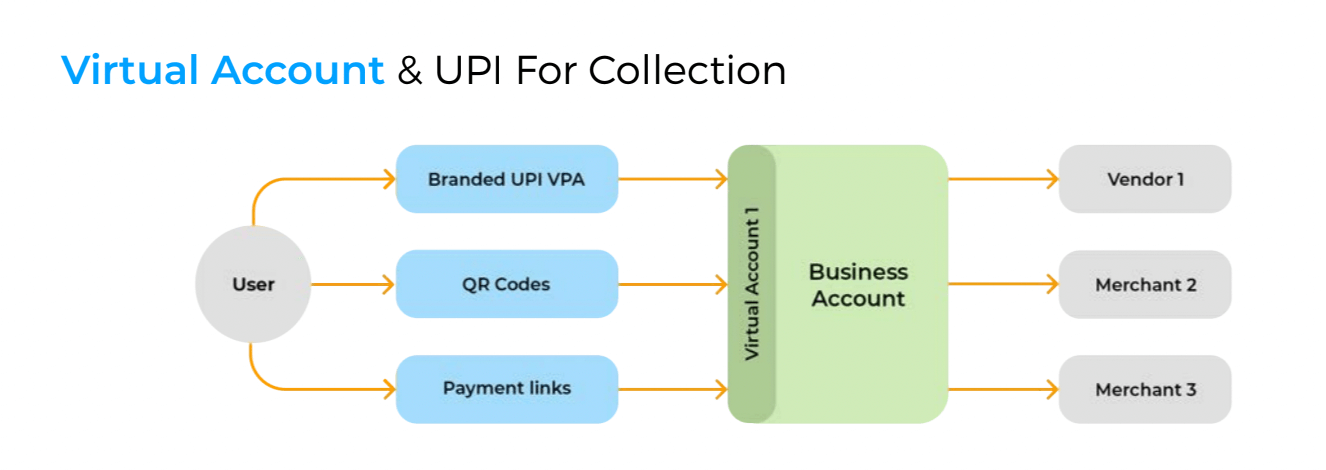

Employ multiple payment options such as RTGS, IMPS, NEFT, static/dynamic QR codes, and UPI payment links. Furthermore, you can white-label the UPI IDs to reflect branding naturally and establish trust with customers, right from the start. Most importantly, UPI helps your business to transact & settle funds instantly. Why keep your merchants & customers waiting for days together when you can provide an exceptional service with instant fund transfers!

Reduce Payment Collection Costs by 5X

Automate B2B payment collections once and for all and reduce the expenditure by up to 5X. Create payment links and share them with your customers, partners, and merchants via multiple channels. Add beneficiaries without any cooling periods and start transacting immediately. Track all your transactions in a dedicated dashboard for your business. Got recurring payments? Automate it too!

Reconcile Transactions in Real-time

Bid farewell to manual payment reconciliation or spending hours together tracking the origin of each transaction. With our virtual accounts module, all your transactions can be tracked and automated in real-time. Enable the same for your customers too!

Decrease Overhead Expenditure by 80%

With Decentro’s APIs, you can go live within weeks compared to the months-long delay posed by legacy institutions. Set up your payments flow on top of your desired bank partner or choose from our list of partners. Bypass the massive transaction fees that you otherwise incur, especially via payment service providers.

Evade Risks & Security Threats

Reduce fraud and security risks that could drastically strike your business. Onboard all customers after KYC checks and run your business with complete compliance. The best part? All of these are baked into the product by default.

To put things into perspective, in just a matter of two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

Oh, it doesn’t end there! If you build a cards program for your business, it unlocks additional revenue streams by helping you earn interchange revenue for every transaction on the card!

According to Acumen Research & Consulting, the global B2B Payments market is expected to set foot on ~ US$ 63,084 billion by 2026 with a CAGR of 6% over the forecast period 2019 to 2026. It’s about time to make B2B payments how they should be simple, swift, and secure!

If you’d like to set up the same for your business, reduce payment collection & other expenditures by 80%, and go live 10X faster, let us help! In addition, diversify your payment options & extend credit to customers by introducing your custom Buy Now Pay Later product in weeks. We empower many of our customers, such as 1Bridge, Saveo, MoneyTap, Gromo, and many more, to simplify their financial workflows and make transactions breezy.

We’re always available at hello@decentro.tech!

Cheers!