A case study on how OcareNeo, digital health bank, simplified payments & collections using Decentro.

OcareNeo – Simplifying Banking for the Healthcare Sector

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

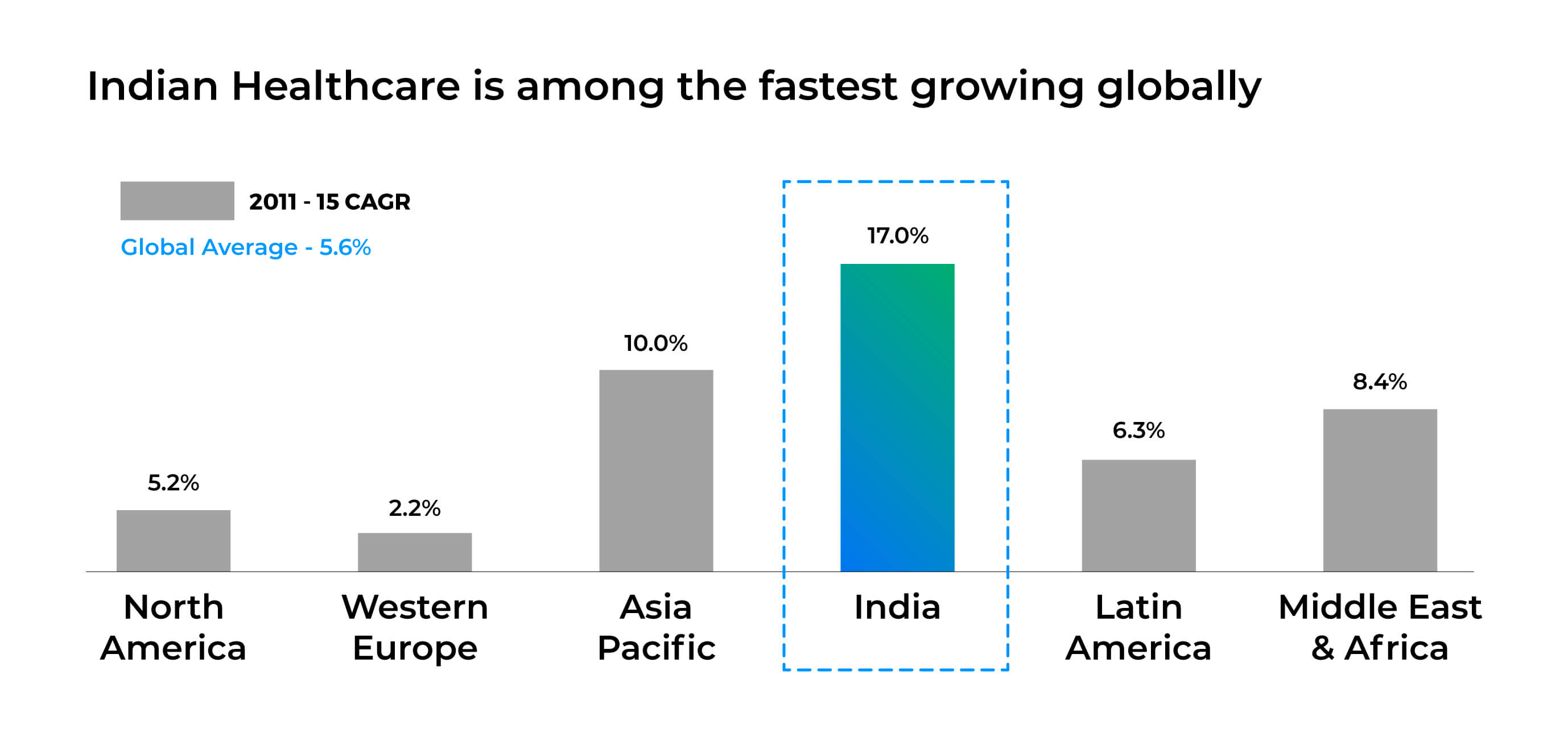

Healthcare in India is experiencing an overhaul. This has only been catalyzed further by the pandemic that has encouraged technology adoption to offer better facilities and services to both healthcare providers & receivers.

The difficulty in availing the primary healthcare services is still a major barricade for a large volume of the population in the country. Yes. However, it’s not all bad news; the government plans to expand public health spending to 2.5% of the country’s GDP by 2025.

In addition, according to India Brand Equity Foundation,

The Healthcare sector in India is expected to jump from ₹4 Trillion in FY17 to ₹8.6 Trillion in FY22.

Joining this vision to make healthcare accessible to all and with the utmost convenience offered by technology is OcareNeo, a digital health bank.

What is OcareNeo?

OcareNeo is India’s first digital health & banking platform that aspires to amalgamate two diverse domains- banking & healthcare, and in the process, elevate the overall experience that each stakeholder gets.

OcareNeo’s mission is to amplify the ease of adopting healthtech systems globally; by bridging the gap that’s prevailing today in healthcare financing through fintech solutions. The platform comes with many features that equip a user to have a smooth digital healthcare experience. For instance:

- QR-codes to access medical history with a quick scan,

- Digital or virtual cards that take care of all healthcare expenses,

- And, digital piggy banks to save capital for future expenditure.

How does OcareNeo Benefit from Decentro’s API Banking Platform

To bring together health and wealth management, OcareNeo was on the lookout for an API platform for banking and financial integrations. In many healthtech platforms, combining financial services with medical billing automations helps practices manage patient charges and reimbursements more efficiently. Furthermore, one of their top focus items is facilitating smooth payments between patients & healthcare professionals and tracking the flow of money seamlessly.

Here’s how Decentro’s banking APIs enabled OcareNeo’s digital health bank.

Instant & Seamless Payouts

OcareNeo facilitated instant payments for the users registered on their platform using Decentro’s UPI Payment links. Subsequently, after a consultation, the platform triggers a payment link to patients who click, authenticate, and complete the transaction.

While the traditional payment system took at least 2-4 days to settle the funds, Decentro’s bank to bank payments enabled OcareNeo to instantly transfer the funds to a healthcare professional’s account. Consequently, this leads to a much more streamlined and richer user experience across the platform.

Moreover, the possibility of white-labeling the UPI IDs tied to each virtual account helps OcareNeo to reinforce branding effortlessly and establish trust with users right from the get-go.

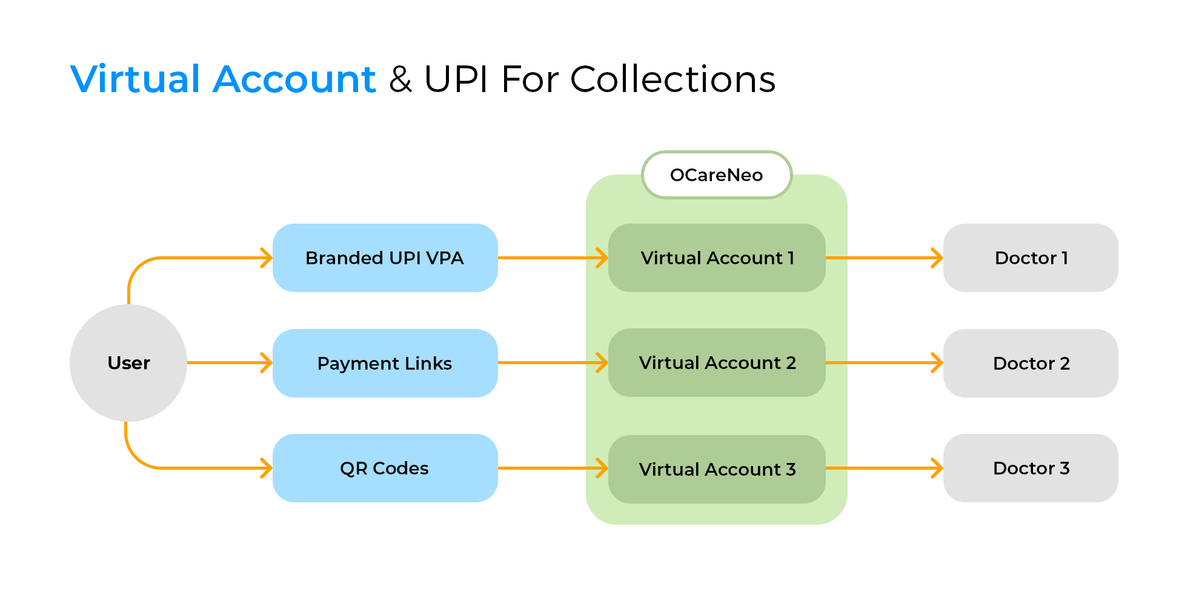

Real-time Transaction Reconciliation

One of the major challenges most businesses face is tracking the source of transactions and bookkeeping them. However, with virtual accounts, OcareNeo steered clear from expending time, effort, and capital for payment reconciliation.

Therefore, after a patient pays, the funds get transferred to the virtual accounts created for each user, making it easy to trace & reconcile before settling them to the users externally.

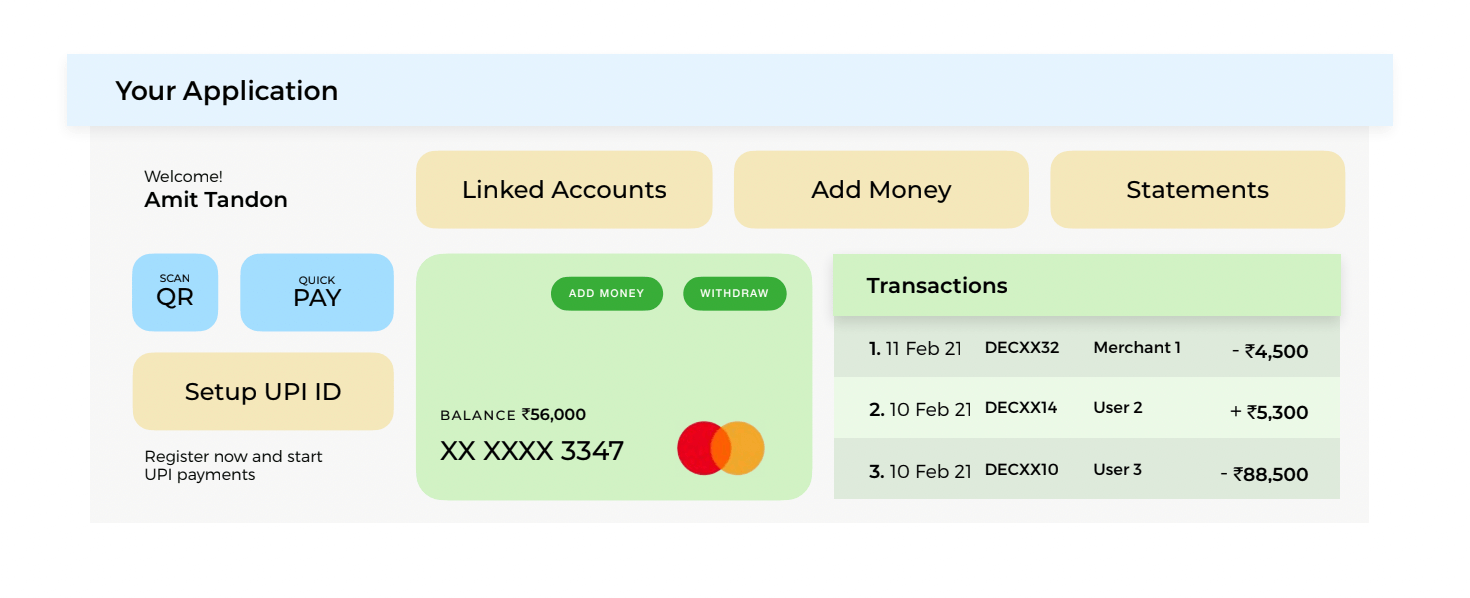

Virtual Cards For Expense Management

OcareNeo makes spending hassle-free by issuing digital cards that users can use anywhere & anytime. With prepaid cards & wallets, OcareNeo can enable users to streamline card payments, reconcile all purchases made on the card in real time, and load money into it instantly. In addition, all card transactions can be tracked on a dedicated dashboard.

Above all, a business can go live with its own cards & wallets program (powered by Yes Bank and many more bank partners en route like ICICI) within weeks instead of months.

What are the Key Outcomes for OcareNeo?

Here are some of the key benefits for OcareNeo after using Decentro’s banking APIs.

- Instant and real-time settlements instead of waiting around for 2-4 days.

- Cost reduction for money collection and reconciliation by 5x.

- Multiple banking providers to re-route traffic in case one faces downtime

- APIs with a few hundred milliseconds response times, and 99.9% uptime.

- Load balancing that handles spikes in volume

- Multi-channel customer support

- And, unlocking an additional stream of revenue from virtual cards through interchange fees.

… to name a few!

We wanted to go live with a customer SB account for basic banking needs for statements, add beneficiaries, funds, and enable payments via IMPS, NEFT, RTGS, and UPI. However, we faced a roadblock with the slow pace of the banking partnership. We then worked with Decentro to provide a stable and mature stack to extend the same features on ICICI Bank virtual accounts, which has helped us to reach our early customers and validate our offerings. Decentro has low initial and recurring costs for fintech companies like us to quickly go to market.

OcareNeo Team

Similarly, we’ve enabled many of our customers, such as FamPay, MoneyTap, and KUWY to overcome challenges related to KYC user onboarding, banking, instant B2C & B2B payments, and more! In just a matter of two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

If your business has a financial hurdle looming, let’s catch up and solve it today! Drop us a ‘Hey‘ at hello@decentro.tech.

While you’re here, feel free to scroll down and explore our other case studies.

Cheers!