Thinking of adding financial products to your business? Here’s how bank account APIs can help you!

How to Propel Your Product’s Financial Journey With Bank Accounts

Chai & Fintech Addict at Decentro. Venture Capitalist in my previous life. Namesake Engineer before that.

Table of Contents

Fintech Explosion!

There isn’t another way to describe it. What was once imagined impossible is a cakewalk now- going cashless, QR code payments by just waving your phone, NFC payments, if I were to give some of the many instances.

We live in a world now where the lines that once existed between a fintech & non-fintech player have blurred, and almost every company out there has backpacked to join the world of fintech & banking. Rightly, so!

But when a company sets out on this journey, planning for the long run is crucial. To build a sustainable and scalable fintech product that comes with a competitive advantage and adheres to compliance & regulations would require your business to start from the basics.

Wondering what I mean by basics? Bank Accounts!

7 Reasons To Begin With Bank Account APIs

Well, a lot can be done with bank accounts. You can tap into payment rails via bank accounts and, in the process, open doors to more financial products & services for the roadmap ahead.

According to IBEF, as of November 03, 2021, the number of bank accounts opened under the government’s flagship financial inclusion drive reached 43.81 crores, and deposits in the Jan Dhan bank accounts were more than Rs. 1.48 trillion (US$ 19.89 billion).

Source: SoleBlogger

In short, every company that wishes to venture into this space would require a financial instrument, be it a bank account or a prepaid wallet, that acts as a core to propel the creation of new products.

With that said, let’s take a look at some of the doors a bank account would open for your business.

- Lending: Easy loan disbursement and collections

- Payments: Via Physical & virtual cards, wire transfers, and UPI payments

- Investments

- Interest accrued in savings accounts

- Access to Fixed Deposits

- Autopay/NACH for recurring payments

- More flexibility on account balances, interest payments, and the likes.

Now you must be wondering, what about a prepaid payment instrument like a wallet? Can they replace bank accounts?

The same that we’ve mentioned is also possible using prepaid wallets. Some of the key points to consider while evaluating prepaid wallets are:

- PPI Interoperability: RBI has mandated the interoperability feature of prepaid instruments to go live. Thus, payment methods will be the same & convenient for your customers with wallets that will be linked to UPI rails.

- Lending is possible using real-time funding of the wallet.

- The only caveat is the lack of interest and account balance limit of ₹2 Lakhs.

- Easier to crack partnerships with PPI issuers and go live

Now, let’s dive deeper into the different types of accounts and how each can favor your business.

Types of Bank Accounts & How They Can Be Utilized

Savings Accounts

We all have one savings account in our names. But, what exactly is a savings account? How are they beneficial to your consumers?

A savings account is a Store of Value financial instrument regulated by the RBI and managed by a financial institution such as a bank. With a savings account, a user can avail interest on the amount deposited and is a secure & non-binding option to meet short-term cash needs.

A user can spend money via multiple payment methods such as bank transfers, UPI, and credit/debit cards using a savings account.

Further, as we’d seen, savings accounts open a portal to a whole new bunch of financial services. Some of them include:

- Enabling Payments using cards & UPI; this helps businesses like yours to configure any UPI app (GPay, PhonePe) and enable swift payments for customers.

- Purchasing insurance & investments(mutual funds, stocks, alternative investments) and making it super easy by setting up recurring NACH/eNACH mandates.

- Providing an overdraft limit

- Getting visibility on expense management if this is the core account

- Leveraging Neobanking: With savings accounts under your wing, users will have a solid proposition to switch from their existing bank account to your neobanking services.

What are some notable examples?

- Jupiter + Epifi has partnered with Federal

- Niyo has partnered with Equitas & SBM

- Freo has partnered with Equitas

NOTE: While savings accounts are one of the perfect financial instruments to get started on, it could be challenging to crack the partnership with banks. In such a case, a BaaS [Banking as a Service] player can come as a handy intermediary to make the API integration easier & faster.

Current Bank Accounts

If savings accounts point more towards consumers, a current account caters to businesses of all sizes, irrespective of their industries. In the simplest sense,

Current Accounts are bank accounts to operate & run a business. It is typically a non-interest-bearing financial instrument that requires the business owner to maintain a minimum balance at all times & even levies charges for short-term quick withdrawals.

The bank/financial institution runs a comprehensive check on the business via KYC [KYB & CKYC] to ensure that the business is not a shady corporation tied to anything illegal or involved in any terrorist-funded activities.

Current accounts are typically to facilitate smooth business operations rather than savings. White-labeled current accounts provide businesses with many features such as:

- Statement fetching

- Balance fetching

- Transaction initiation(merchant payouts)

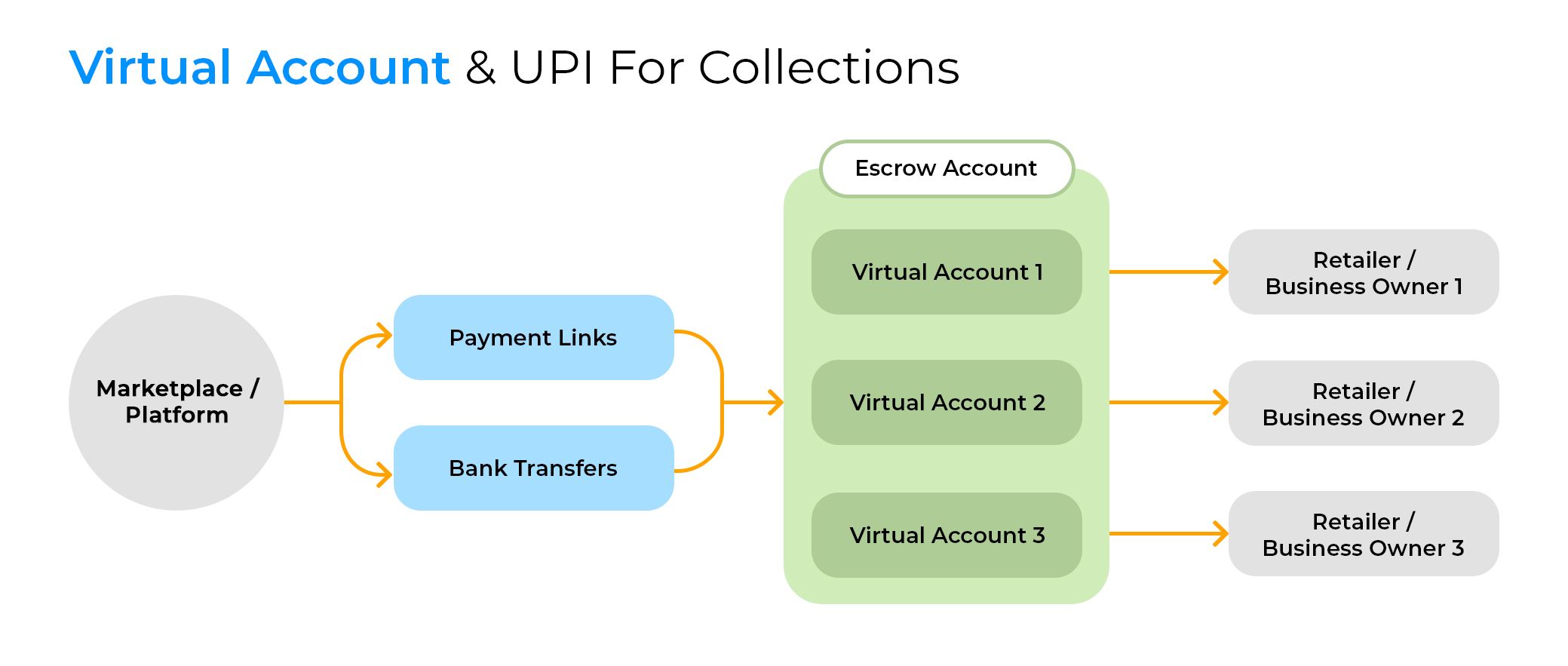

Furthermore, companies can create any number of ‘virtual accounts’ tied to a current account to identify the source & destination of money flow, removing the nightmare of reconciliation, and amplifying the ease of identifying collections.

Escrow Bank Accounts

Let’s take the example of OLX, which facilitates a sale between two parties. The buyer likes a product, negotiates with the seller, and the deal closes. The buyer transfers the fund to OLX, which transfers it to the seller.

This is the classic example of escrow accounts in use via an online marketplace.

An escrow account is a financial instrument that acts as the temporary storage for funds by a 3rd party/entity for payment transactions between two parties. RBI regulates escrow assets, and these accounts can hold money, securities, funds, and more.

Decentro’s Bank Account APIs To Empower Your Pursuit

Remember the section where we said it could be difficult to form partnerships with banks if your business wishes to enter the fintech sector?

We can help you right there!

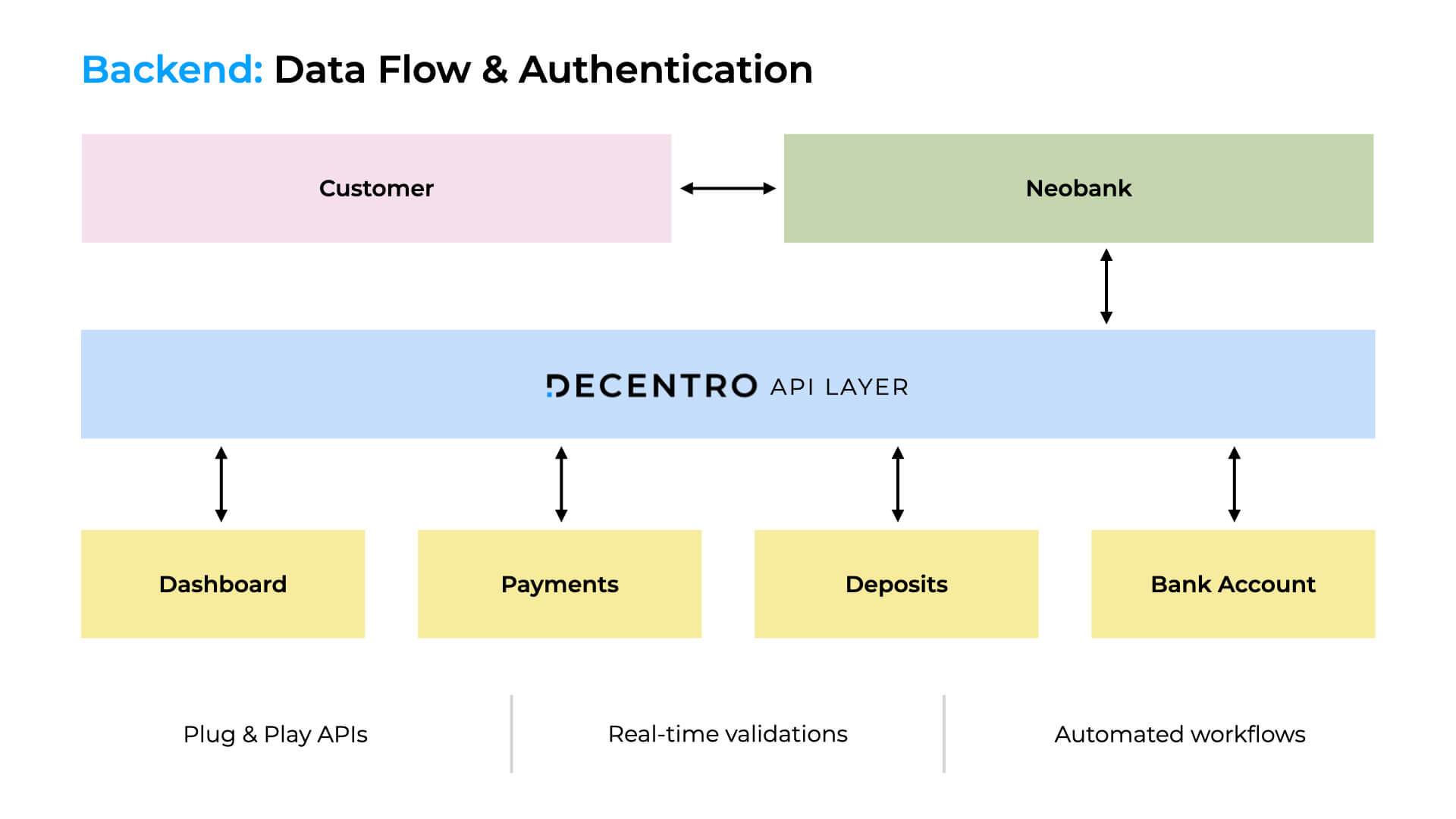

Decentro Banking APIs come in a simple plug-n-play fashion helping your team to integrate with multiple banking partners for various financial & banking modules without expending bandwidth or resources.

To be precise, we help you launch your fintech product within weeks and at 90% reduced OPEX & CAPEX.

- Multi-provider facility in the backend: Our system automatically switches to a functioning provider during any unexpected downtimes or black swan events. What does it mean for you? More than one provider supports your business flows so that you operate uninterrupted and without any dependency.

- Consolidate Banking in one place- accept Deposits, check balances & history, and create/link accounts.

- Vendor payments, payrolls, split payments & commissions, real-time payment reconciliations. Further, if you are a business-facing firm, enable B2B payments without burning a hole through your wallet with chunky transaction charges.

- Neobanking, business banking as a service… we’ve got you covered if your business is consumer-facing or business-facing.

- Embedded banking & finance to help your business scale and branch into diverse markets with innovative financial products.

- Fully digital account opening with Video KYC, Provide Integrated Deposits, Extend Multi-bank Support.

- Entire banking experience of account maintenance on a platter via our API collection

What’s More?

- Key Products:

- Accounts [Savings, Business, Virtual]

- Payments[Wire transfers, UPI, QR codes, wire transfers]. Without beneficiary cooling periods, instant, secure, and real-time payment transfers to anyone in the country.

- Conversational banking & lending: Onboard & provide banking services to your customers with chatbots and WhatsApp journeys. Leverage any social/chat-based platform to embed these workflows.

Got an exciting idea that you wish to turn into a reality? Let us help!

We’re always a chat away at hello@decentro.tech!