Two keywords that are fairly popular in fintech these days, yet, confusing to many. Let’s decode it today.

Open Banking Vs. Platform Banking

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

Making payments online with just a click of a button.

Transferring funds from one bank to another.

Managing your finances like a pro using budgeting apps.

How things have changed, isn’t it?

Open Banking Vs. Platform Banking is a highly discussed topic in Fintech today. Banking & finance keeps getting better- more efficient & secure. Thanks to regulations and policies.

There was a time when getting things done, for example, acquiring a loan or getting a mortgage, involved a very elaborate procedure that took significant time and effort. Submitting & getting verified many documents such as credit statements, salary slips, utility & maintenance bills to authenticate your financial stability and capacity to repay. Back & forth between account statements and mortgage providers. You get the picture right.

Companies such as Plaid and Yodlee started screen scraping to extract banking data such as bank balances and transactions. Banks did not have APIs back then, and replicating the internet banking portal seemed like the only option. After consumers logged into their banking portals, they extracted their financial data & shared it with other companies or regulated entities.

Thanks to open banking, any third-party financial institution, such as your mortgage providers, can be given selective access to your financial information very securely and use it for granting you a loan or mortgage in a matter of hours. As opposed to days or weeks.

Sounds amazing, doesn’t it?

What is Open Banking?

Let’s understand what the two terms mean before we move on to dissect the difference between the two.

Open banking is a system where banks open their Application Programming Interfaces (APIs) and allow third-party institutions to access certain financial information. This information includes but is not limited to transactions & banking information of account holders or clients.

Customers decide what information must be shared and what’s to be hidden securely, giving them higher financial transparency and control over their financial data. This will help the third-party institutions improve services and the banks to improve the customer experience.

Where did Open Banking Originate?

The European Union first introduced open banking policies, and the United Kingdom has been hailed as the global leader of open banking.

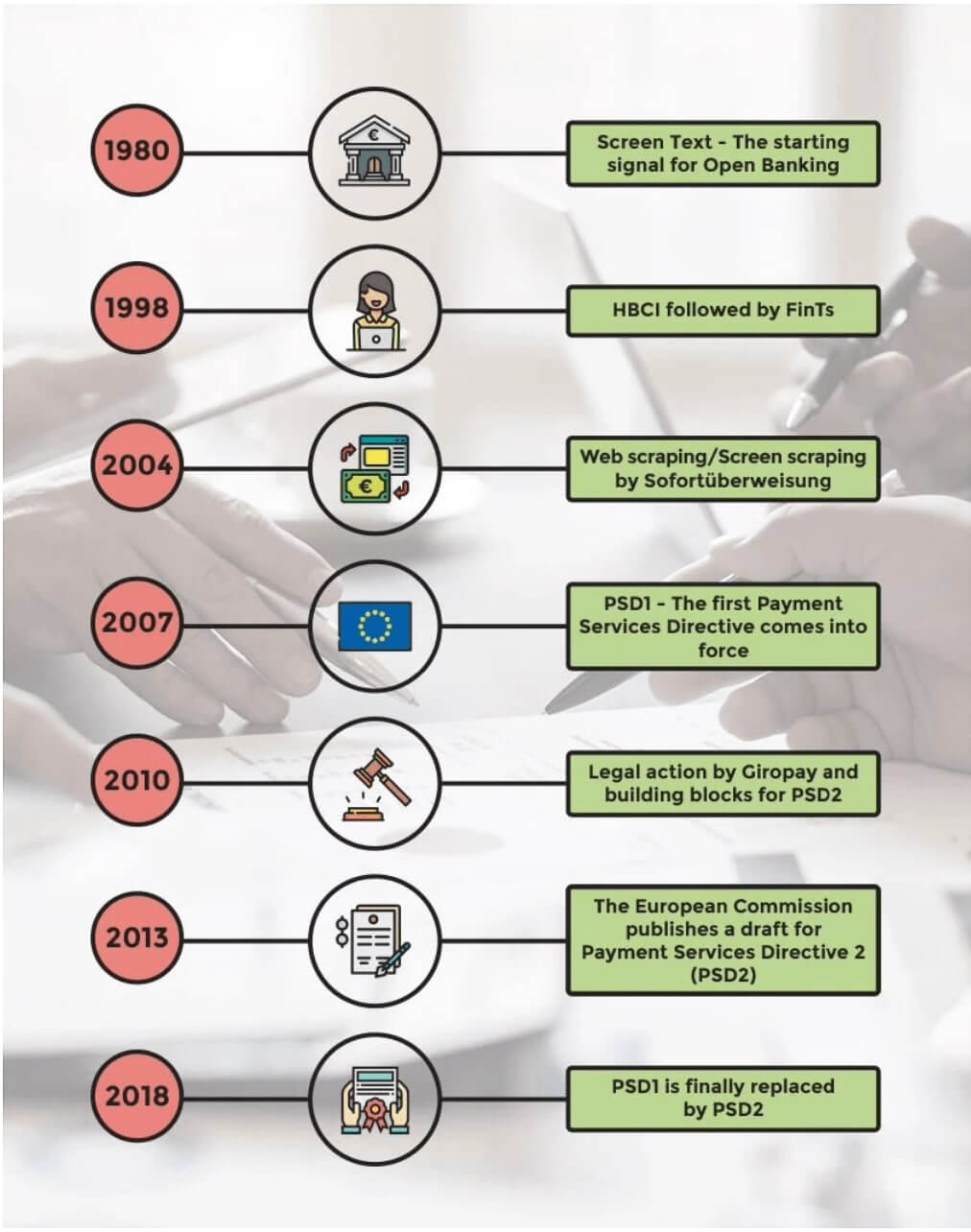

PSD1, or Payment Services Directive, was devised by The European Commission in 2007, but it was only until its successor PSD2 was enforced in January 2018 when open banking came into full throttle.

PSD2 made open banking mandatory in Europe – all banks had to furnish their APIs to third-parties, thereby giving customers higher control over their financials.

Although the European countries lead the scenario, others like the US, India, Australia, and Singapore are catching up quickly and being an essential part of the open banking system narrative.

What is Platform Banking?

Platform Banking or Banking-as-a-Service (BaaS) is something that is even bigger and more impactful.

Platform Banking enables companies and fintechs to offer banking products and services via API banking platforms. A great example would be a neobank building its services on top of a BaaS player that runs on top of regulated banks.

Software vendors or the bank’s in-house teams develop the necessary applications and workflows to publish APIs. The banks then try to offer this platform to enrich customer experience and make banking smooth.

For example, Bank Open, India’s first SME-focused neobank, has built its infrastructure on top of ICICI Bank and enabled workflows around bank accounts, and payments.

Open Banking Vs Platform Banking: The Whys’

Let’s move on to the million-dollar question- How’s Open Banking different from Platform Banking? Both have the same end goal- to improve the banking experience for customers and the overall efficiency. However, why do we think these are the biggest trends of the decade?

Open banking involves sharing financial data with third parties upon due consent by clients. On the other hand, platform banking involves either setting up the infrastructure for a better banking model or improving the existing one using technology-centered companies.

Let’s find out.

According to a report by PwC, around 39% of clients are willing to share their data with third-party companies if that meant benefits and a better experience.

With open banking:

You get Better Financial Transparency

Access all your financial data in one place; find better deals, open the right accounts, opt for the better loan options, plan better for your expenditures. The app you choose to share the details with is entirely your choice.

Quick & Efficient Payments

It becomes effortless to transfer payments from one bank to another or a third-party app. Wish to recharge your phone bill? Cable bill? No worries there!

Improved Banking Experience

Open banking benefits customers with a better operating experience and helps the bank to amp up its offerings and expand the customer base.

Increased Referrals

The collaboration from open banking brings in referrals easily—both for the third party and the bank.

The Other Side

While open banking merits make a strong case, we must not forget the added burden it brings alongside- security & compliance. The threat posed by malicious applications is real- for the client’s financial privacy & data.

The alternative screen scraping approach is highly prone to errors and frauds, and hence governments are cautious before regulating these activities.

On the other hand, platform banking can help resolve all these issues since the APIs are open for a deeply integrated use case. BaaS companies go through an integration process that lasts for at least a few months. This exhaustive onboarding process is critical as the bank should get enough comfort on the platform concerning trust, privacy, and client satisfaction. The BaaS company is then able to onboard its customers within a few weeks.

Examples & Use-cases of Open Banking & Platform Banking

Open Banking

A Small & Medium Enterprise(SME) can use open banking to share alternate data with lenders and avail loans. This data includes(but is not limited to) transaction history and tax invoices. While the underlying bank provider fetches the bank statements, the tax invoices are taken from government authorities.

Platform Banking

A marketplace with a network of multiple SMEs can use platform banking to optimize its payment, banking, and lending workflows. The platform can offer financial services to its SMEs. This includes faster and cheaper bank payments, connecting bank accounts (for transaction analysis), issuing prepaid or expense cards for the SMEs’ employees, and offering multiple loan options in case of a working capital crunch. Thus, platform banking enables any company to provide native banking and financial services.

Open Banking Vs Platform Banking – Geographic Variations

In 2016, the RBI approved the construct of Account Aggregators or AA. With this policy, a Non-Banking Financial Company– Account Aggregator (NBFC-AA) gives the ability to share banking details with any company- A significant step in India’s financial blueprint towards open banking.

Indian banks such as RBL Bank and Yes Bank have taken the new route long back, 2013 to be precise, to open their APIs to partner companies to build better financial models. These banking APIs fuelled the early innovation in payments across industries such as food delivery, e-commerce, and investments. However, as expected, the integration quality and times have been 10X behind, to say the least, creating a space for BaaS players to solve this massive challenge.

Moving on to the APAC

Singapore recently launched its own version of Account Aggregation called Singapore Financial Data Exchange (SGFinDex) in December 2020. With this protocol, Singaporean consumers and businesses can easily share their financial data with regulated financial and government institutions.

In 2016, the Monetary Authority of Singapore [MAS] released 12 APIs to enable third parties to bring up innovative solutions that improve banking. Some, but not all, of the use-cases that get implemented with ease include:

- Companies filing tax returns after calculating exchange rates

- Extracting the credit statistics of a demographic

How can Decentro Help your Business?

At Decentro, we’re firm believers in the Banking-as-a-Service (BaaS) innovation and wish to extend banking workflows to all kinds of customers. In a hyper-personalized world, companies have started differentiating themselves by building their personalized user workflows using APIs. Besides absorbing the complex banking workflows, our platform takes care of the underlying regulations while dealing with each banking product.

Our KYC module is one small step towards open banking and we plan to add more innovation and leverage the underlying government and regulatory stacks. And most importantly, we take care of both kinds of downtimes and outages in an automated and streamlined fashion – when a bank provider goes down intermittently or even permanently.

Hit us up to learn more! We’re just a chat or email away: hello@decentro.tech

Until we see you next time,

Cheers!

P.S. If you wish to be a part of this revolution, we’re hiring! Please apply on AngelList to find your next challenge.