Virtual Accounts have an instrumental role in aiding a business’s growth. How? Let’s find out.

All Things Virtual Accounts: How They Work & Why We Need One

Once a Clueless Engineer, and now a Chuffed Marketer. Learning the trades of Fintech currently and making it great with Decentro.

Table of Contents

A Quick Glance

| Managing company expenses and payment reconciliation can be daunting, leading to reduced productivity and an unpleasant customer experience. | Virtual account numbers (VANs) are unique and mask the associated physical account, providing an extra layer of security for transactions. | With virtual accounts, businesses can enhance the customer experience, reducing the risk of losing customers due to payment-related issues. |

| Virtual accounts offer an innovative solution to this problem for businesses, from startups to established enterprises. These accounts are like regular bank accounts but have no physical existence and are temporary, transacting on behalf of a real account. | Depending on the transaction requirements, virtual accounts can be set as single-usage or multiple-usage. Payments can be made to virtual accounts using traditional bank transfer methods or UPI, providing businesses with an efficient and secure payment solution. | Decentro’s APIs offer innovative solutions for various use cases, from automating money movement to offline collections and finance management. |

Every month-end comes with its own set of nightmares, and the credit card bills generally tend to take the cake. And, the sight when most of us open our wallets could be this.

The strive to track the expenditure and take a vow to do better next month. This puts us down the vicious cycle of cross-checking the expenses and ensuring our pockets have been transacted correctly.

Of course, expense-tracking apps can help out when we’re talking about day-to-day chores.

But.

Ever thought about how companies or multinational corporations with thousands of daily transactions take care of this bit?

Whenever a business receives a payment, it would contain all the required information to help its accounting team just ‘tick-mark’ the transaction, right?

Or, so we thought.

Companies are often caught in the endless loop of open invoices and guessing who made which transaction.

This:

- Increases the time spent on payment reconciliation

- Increases DSO or Day Sales Outstanding

- Takes a significant hit on the team’s productivity

In other words, companies must spend hours scanning bank statements with a fine-toothed comb to ensure the expenses, credits, and debits all match up. This bookkeeping, called payment reconciliation, drains time, demands effort, and produces inaccurate records.

This snowballing further worsens when the company has to send payment reminders to clients, many of whom would have paid already, leading to an abysmal customer experience.

Is there a way out of this? Luckily for companies, be it a budding startup to a fully-fledged enterprise, virtual accounts solve the problem in a jiffy.

First things first.

What are Virtual Accounts?

I recall my first encounter with a virtual account. I passed a few inputs (name and basic details), and a virtual account was created in seconds, like making your Facebook/Instagram account! Memories of visiting the bank branch and opening an account flashed.

How is this possible? How could I open a bank account in seconds without KYC? My curiosity crossed the zenith. As I dug further, I learned more about how virtual accounts work.

Virtual accounts are bank accounts that have no physical existence, are temporary, and transact on behalf of a real, physical account.

Also known as a shadow account, a virtual account has a unique account number that makes it easy to trace the funds coming through it and helps to identify the source or the payer.

What are Virtual Account Numbers (VANs)?

Virtual account numbers or VANs are system-generated, unique numbers associated with a single virtual account and mask the physical account it is associated with. They are generally generated in place of the card’s actual account number and act as an extra layer of protection for your card details.

This number is used when you use the virtual account service provider to make a payment (or receive a refund) so that your card account number is not shared with the retailer and does not appear on the receipt. The payment app generates a new virtual account number each time you add a card.

Virtual account numbers greatly increase consumer security and privacy, ease reconciliation worries, and save time and effort. But how is it so different if a virtual account can transact just like a standard account?

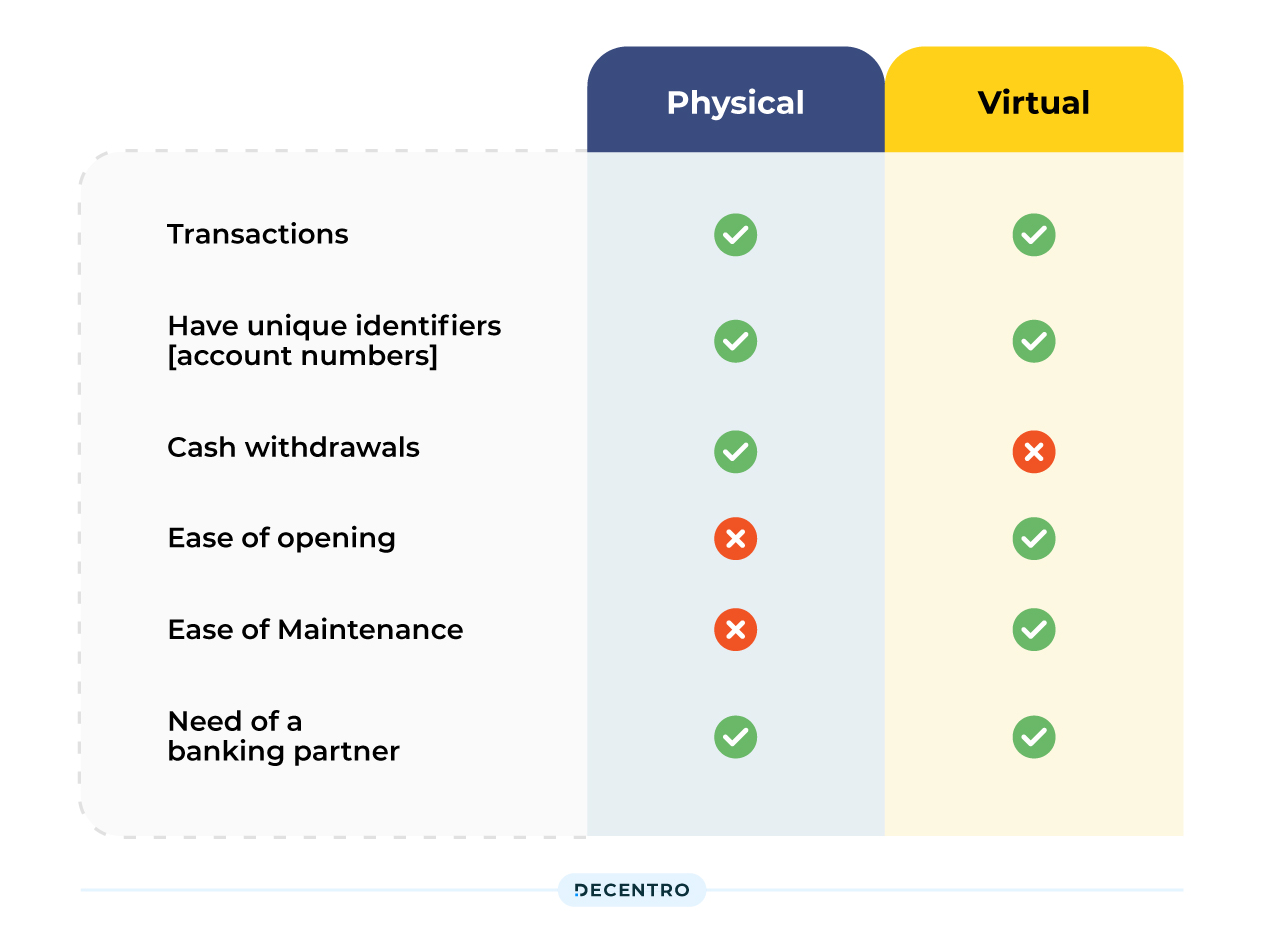

Virtual Account Vs. Physical Account

Now that we know virtual accounts, it is only fair to see how they compare to physical accounts.

Virtual accounts function just like physical accounts. They have an account number of their own and can transact payments smoothly.

But. That’s just not it.

A virtual account’s operating and maintenance costs are significantly lower than their physical counterpart.

Moreover, it’s easy for a business to open hundreds to thousands of virtual accounts, while doing the same for physical accounts would be nothing short of a nightmare.

Virtual accounts come with flexibility and self-service, a breath of fresh air to struggling teams running behind payment reconciliation.

How do Virtual Accounts Work?

There are two types of virtual accounts:

- Created on top of a nodal or escrow account

- Created on top of a business or current account

Don’t worry. We’ll explain each using an example.

Top of a Nodal or Escrow Account

Virtual accounts on top of nodal/escrow accounts are temporary. By temporary, we mean that the funds stay within the account only for a short period until it’s transferred to the payee.

The RBI has rolled out Payment Aggregator Regulations, similar to payment gateways, where customers can accept any payments through many methods, such as debit/credit cards, net banking, or UPI.

When you pay, the fund goes to a nodal/escrow payment gateway account (e.g., PayU, Razorpay). These gateways have a master nodal/escrow account and various virtual accounts (if required for collections).

Example: When your local business purchases goods from a wholesaler using NEFT/RTGS/IMPS, the funds can be transferred to a virtual account serviced by a payment service provider. It stays there temporarily until it finally reaches the wholesaler on settlement.

Top of a Business or Current Account

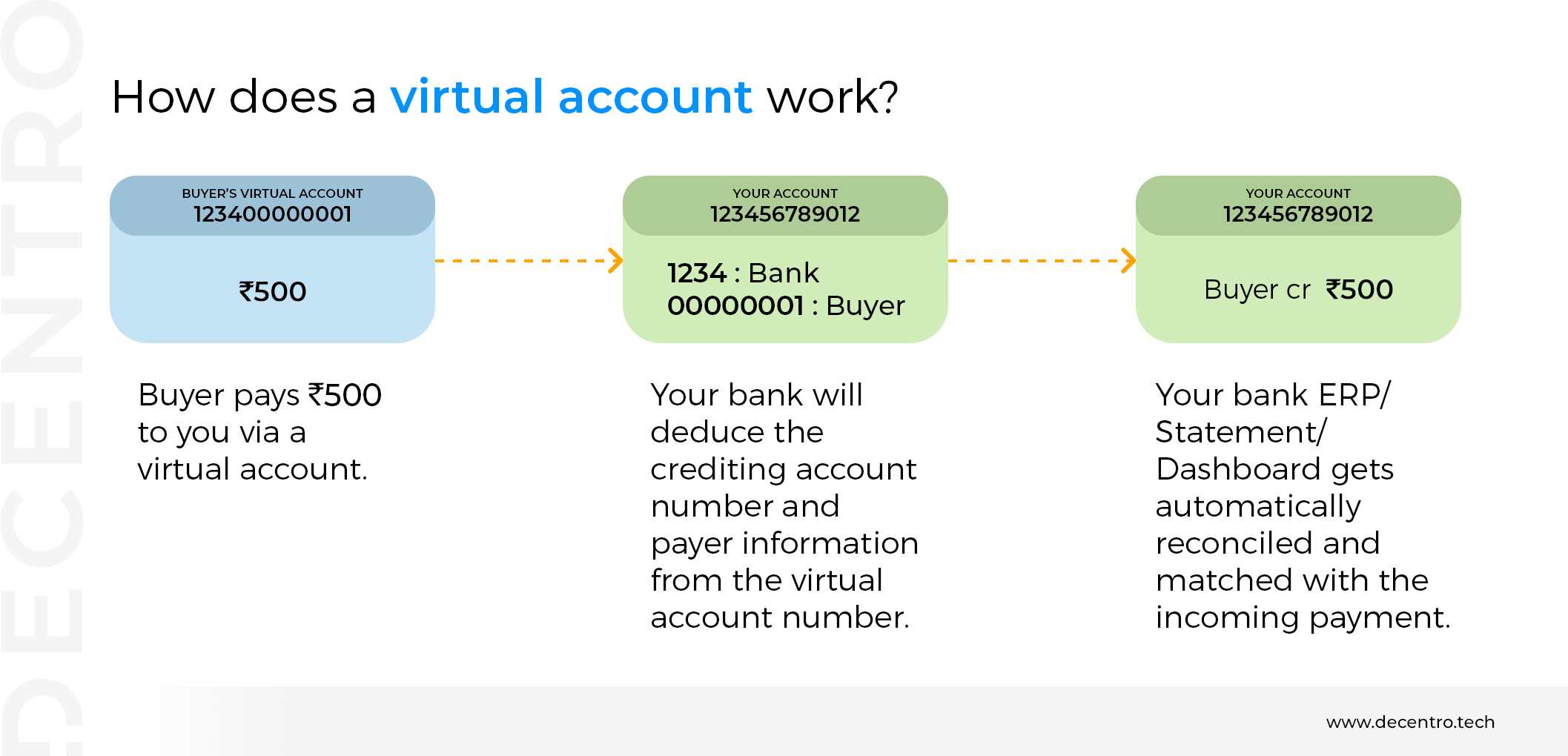

The second type, where virtual accounts exist on top of a business or current account, is where a banking partner could help set up virtual accounts. When a customer transacts through a virtual account, the company can identify the payer’s details through the virtual account number.

The company can deduce customer information and reconcile payments with ease. Not just the details, a business can understand an overview of transactions across departments or geographies. Compliance ensures all regulatory requirements are followed to the dot.

Example: Virtual accounts could be a godsend for colleges and educational institutions to manage student fees easily. Each student can be assigned a virtual account number, for instance, based on their roll number and batch details. The institution can easily e-collect fees via bank accounts and use the account number to track the payment’s origin.

Do Virtual Accounts Need a KYC?

A KYC for a virtual account is not mandatory since the bank conducts the same for the underlying physical escrow or business account. However, the recent RBI guidelines mandate that payment aggregators/facilitators conduct adequate KYC for the end merchant receiving funds from the virtual account.

These accounts add an extra layer of protection against fraud for remote payments. In addition, the virtual account numbers can be set based on the type of usage as single/one-time or multiple/recurring.

- Single Usage: The virtual account deactivates after a single transaction and is aimed for one-time usage. Popular examples include transactions taking place for shopping.

- Multiple Usages: The virtual account number is provided based on the customer’s unique identifier, say their phone number using which they can transact any number of times.

How can Payments be Made to Virtual Accounts?

As mentioned, a virtual account is just like a physical account when receiving money via online banking.

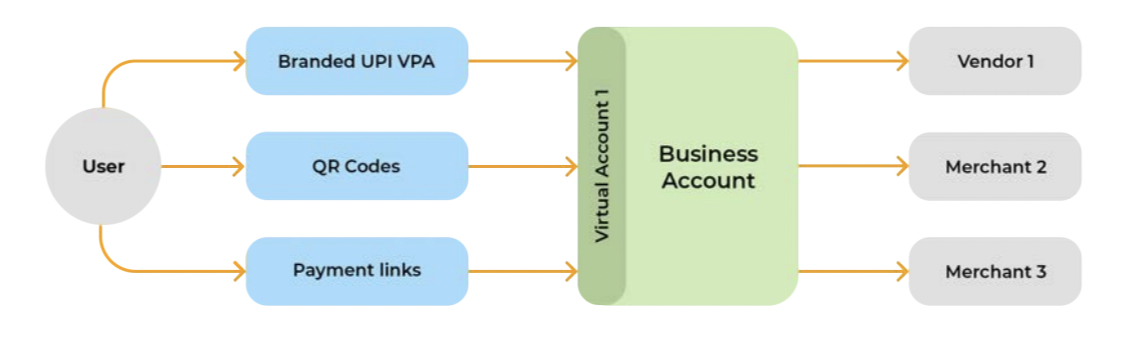

You can transfer funds to a virtual account through traditional bank transfer methods such as NEFT, IMPS, or RTGS. Furthermore, each virtual account created on the Decentro Platform also has a UPI ID and a UPI QR associated with the account. This helps our customers to accept payments via UPI as well.

Why do we need a virtual account?

You and I are better off with an expense management app or a cap on our spending via a third-party app, but what about SMEs and significant enterprises?

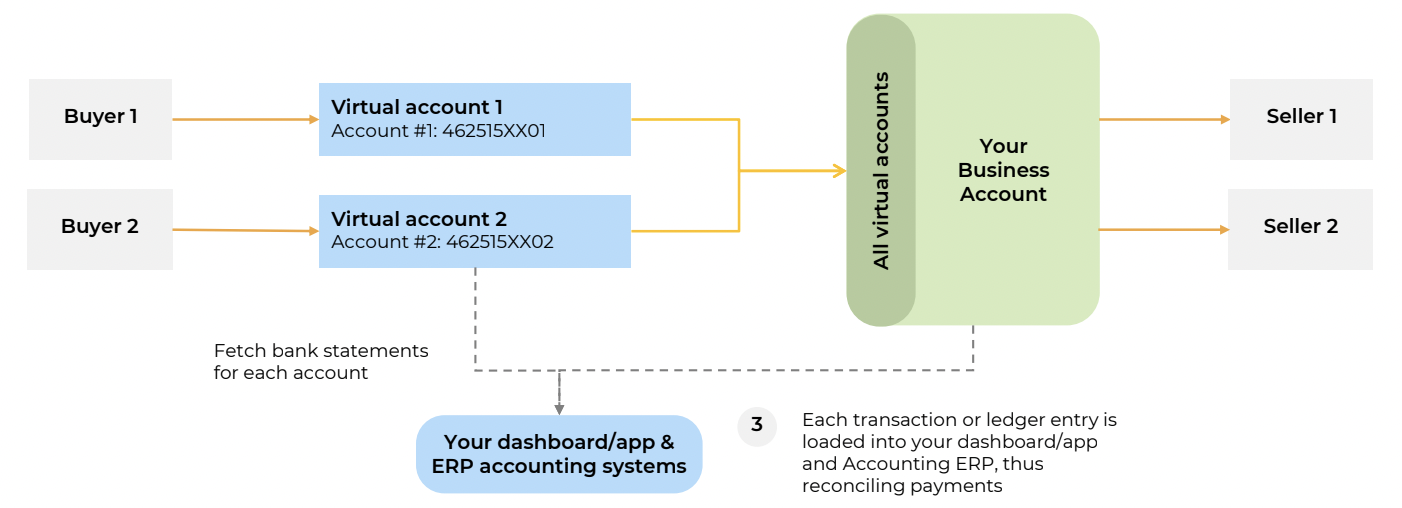

The likes of marketplaces and enterprises with complex funds flows have many streams of cash all flowing into one giant bank account and need the ability to attribute each cash flow to an individual user.

Complexity demands efficiency, and that leaves no room for manual error.

Virtual accounts are fully automated and function in real-time. The ability of a business to track individual payments and automate the reconciliation process, therefore, presenting the most accurate bank account balance, makes it an efficient and almost necessary alternative to a standard bank account.

What is the versatility of Virtual Account API?

With flexibility being the operative term for virtual accounts API, let’s look at exactly what the hype is about,

- Recording of transactions: Virtual accounts APIs can allow you to create unique account numbers like a physical account regarding transacting and usage. One can transfer funds, make payments, and reconcile with zero effort.

- Collection Capabilities: Virtual account API can enable your platform to build a virtual account collection facility for your customers where you can exchange, send, receive, and request money. PAs & PGs can continue to hold the money received in the underlying account balance and settle as per the settlement cycle.

- Escrow Mediation: Virtual account API facilitates the benefits of an escrow account, which gives security against scams and frauds, especially with high asset value and dispute-prone sectors like digital lending.

How do Virtual Bank Accounts Benefit Your Business?

Virtual accounts come with many benefits that make banking & transacting easy for both clients and financial institutions. You must choose the right virtual account service provider to enable your business use case. So whether you are a neobank, an NBFC, a fintech lender, PSP, marketplace platforms, or gig economy platforms, virtual accounts find a pivotal role in your business through the following ways!

1. Automated Payment Reconciliation

The first and most obvious advantage of virtual accounts is organizing payment reconciliation. When a business deals with thousands of transactions daily, payment reconciliation can get quite tough.

An e-commerce business will have payments from multiple sources, such as payment gateways, direct bank transfers, wallet payments, and loans. A finance executive must extract statements from these sources and then reconcile/match those with the funds received in the bank accounts. Ah, it must be a nightmare to keep track of so many transactions.

Using virtual accounts solves all these issues in no time. As mentioned, your banking partner can help you open as many virtual accounts as needed and manage your payments. Therefore, look no further if your business has a subscription model requiring recurring customer payments.

2. Reduced Expenditure

Virtual accounts are the ideal alternative for businesses that want to save on payment gateway transaction costs. Instead of paying a small percentage of the transaction amount, businesses can pay a fixed cost for each payment processed. Consequently, this becomes very helpful while dealing with high ticket transactions, and B2B payments wouldn’t be as demanding as it has been!

3. Visibility and Control – Organized Financial Management

Multiple bank accounts and a decentralized structure naturally result in lower transparency of activity. As a result, they require greater resources to manage cash flow and operational risks.

Managing finances becomes uncomplicated when you have an account of where the money flows from. And that’s exactly what virtual accounts help you do. Accept fixed or variable amounts, start a virtual account payments collection and enable the account for recurring transactions- you make the call. You have a 360-degree view of business lines across the entire organization, providing actionable insight for improved decision-making and risk management.

4. Lower Customer Acquisition Costs (CAC)

We know it’s a little brutal, but customers belong to the no-nonsense category today. Consequently, the last thing they’ll expect is a correspondence from you checking if a payment has been made. Like word-of-mouth referrals do wonders, the bad word wouldn’t take much time to spread.

Enrich your customer experience and lower your acquisition costs along the way. Virtual accounts promise to be fluid, accessible, and integrated into the existing suite, making it a dream offering to work it. They offer broad functionality and facilitate interconnectivity between payables, receivables, and liquidity solutions, enabling a cohesive customer experience.

How can Decentro Help your Business?

Decentro has built infrastructure on top of the bank’s virtual account APIs. Each virtual account created in Decentro’s platform has multiple capabilities, such as its ledger (to track transactions and balances) and UPI compatibility (to enable all UPI payment use cases, including payment requests, links, and QR).

Decentro can help your business set up virtual accounts and manage the same. Here are a few interesting use cases where our APIs can help your business.

Automate Money Movement

Let’s take the example of a B2B marketplace rich with a network of buyers.

Assume this marketplace facilitates the transactions between restaurant owners and farmers to collect farm produce & other products. Each restaurant would be allocated a unique virtual account to manage these payments easily. After purchasing, the restaurant owner deposits the funds in the farmers’ account. The marketplace would cut the due commission from this fund, which can be directly managed via our seamless payout APIs.

Offline Collections

Generate and share dynamic UPI QR codes and payment links for customers’ offline payment use cases. For instance, school fee deposits, loan repayments, rental payments, shopping at stores/malls, etc. QR Code payments make it easy for customers to pay with a scan ‘n tap!

Finance Management

Wish to streamline finances for your store outlets? Decentro will help set up virtual accounts for customers to flow the funds. After deducting the store commission from the account, the remaining can also go to the owner or as per the requirements. Simple & efficient.

Don’t just take our word; Zoozle, one of our customers, simplified collections & reconciled all transactions in real-time with virtual accounts & reduced their go-to-market timelines by 50%!

It’s not just virtual accounts that banking APIs can help your startup with. How about expanding your payment options by launching your custom Buy Now Pay Later product? Or unlocking new revenue streams from existing products? We can help, all within weeks instead of months!

Have you got any questions? We’ll be happy to help you out with the same!

Comments are closed.