Learn how Ledgers API can automate bookkeeping and simplify your work. We go into the basics of ledger accounts and integrating with Decentro’s Ledger APIs.

How Ledgers API Can Transform Your Bookkeeping in 2024

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Millions of startups and SMEs count on fintech solutions to automate time-intensive tasks in an economy that boasts of being a digital disruptor. However, a department knee-deep in operational roadblocks has conveniently taken a back seat regarding this disruption.

Bookkeeping.

For bookkeeping and accounting purposes, it is essential to differentiate between accounts payable and accounts receivable, as the former is a liability and the latter is an asset of the company.

Accounts receivable are the money a company is entitled to receive from its customers for the goods or services it has provided them, whereas accounts payable are the money a company owes to its suppliers or vendors. These two types of accounts are often confused because they are recorded in similar ways in the general ledger. Outsourced bookkeeping services ensure these accounts are correctly managed and reported, maintaining the financial health of the business.

The infamous London Whale incident back in 2012, where J.P. Morgan Chase lost over $2 billion due to a spreadsheet error when a single miscalculation was fed into other calculations, stood testament to the fact that something as small as one wrong data entry could have serious financial complications.

However, spreadsheets are the default choice for many players in the economy today. Despite their accessibility, spreadsheets cannot hold a year’s financial data or replace professional accounting tools.

So here we are with a solution that can help you navigate this treacherous water that needs some pattern-breaking.

Before we delve into the solution you need, let’s look at a few of the book-keeping pain points that an or organization faces,

- Accounts Payable (AP) and Accounts Receivable (AR): There’s much to keep track of in Account Payable and Account Receivable management. These tasks include setting up processes for different vendors and clients, processing payments and receipts, sending pending payment notifications, and much more. These repetitive, rule-based tasks are time-consuming and resource-heavy, mounting additional costs for the organization.

- Double Entry Book-keeping: A general ledger is used by businesses that employ the double-entry bookkeeping method. Each entry has at least one debit and one credit transaction. Double-entry transactions, called “journal entries,” are posted in two columns, with debit entries on the left and credit entries on the right, and the total of all debit and credit entries must balance. Often confused with duplicate entries, double-entry bookkeeping is a big pain point for operations teams in businesses in general.

- Invoicing : Manual invoice processing might take approximately 4-16 days. There is an added need for monitoring receipts, extracting data, creating & sending custom invoices, sending reminders, and much more.

- Reconciliations: Reconciliations are an essential part of all accounting processes. It ensures that the records agree and appear accurately on the financial statements. However, with the large ticket sizes and volume of transactions, the reconciliation nightmare is real in the startup world.

- Compliance and Reporting: This is where our case’s real pain point starts or ends. There is a need to capture and manipulate data to support regulatory reports, create an audit trail or reports, and get confirmation of receipts.

Having jotted down the primary pain points of your organization’s operational journey, it is high time we introduced the solution that can take all this pain away.

We present automation in the form of Ledgers API to you.

Before we delve into the benefits,

What is a Ledger Account?

A ledger account is a book in which a company permanently stores the data of all financial statements and transactions in a classified and summarised manner. It is a single and scalable system of record for all financial transactions and balances on your platform.

When presented as an API [Application Programming Interface], it holds the potential to handle invoices and manage payroll. It also helps relieve the manual burden of bookkeeping by automating daily workflows.

From ensuring accuracy and consistency in financial information, automating these processes via simple Plug-and-Play APIs will save your finance and accounting team from stress and provide a better experience for your clients.

Types of Ledger Accounts

There are 3 types of Ledgers depending on how the accounting and finance team of your organization wishes to track the money movement within,

- Sales Ledger

- Purchase Ledger

- General Ledger

Sales Ledger— A sales Ledger is a ledger in which the company maintains the financial transaction of selling the products, services, or cost of goods sold to customers. This ledger gives the idea of sales revenue and income statements.

Purchase Ledger— A Purchase Ledger is a ledger in which the company organizes the financial transaction of purchasing services, products, or goods from other businesses. It gives visibility into the amount the company pays for other enterprises.

General Ledger – General Ledger is divided into Nominal and Private Ledgers. The nominal ledger gives information on expenses, income, depreciation, insurance, etc. A private catalogue provides private information like salaries, wages, capital, etc. A private ledger is not accessible to everyone.

Why integrate a Ledger API?

With the basics out of the way, here is precisely how a bookkeeping system led by an integrated Ledger API can benefit your organization.

Aggregate multiple accounts in one place

The Operations team can use data aggregation functionality to provide tailored services to your clients, compiling information from multiple accounts to gain insights into their businesses. This saves time for both your Ops manager and the client.

Collect and analyze real-time information

With a deeper understanding of business operations, your team can offer detailed, personalized advice based on real-time data. They can identify cash flow issues and cost savings, helping clients increase efficiency and improve their financial performance. In that way, they can provide tangible benefits that demonstrate their value.

Bypassing untimely or missed reconciliations

Reconciliations should be done regularly to ensure that all account balances agree and to give you a clear view of your financial position. With Ledgers, automatic reconciliation is the differentiator that allows you to be on top of all your financial records.

No Oversights

Ledgers can even record occasional transactions (e.g., an expense or the sale of a product/service), eliminating the possibility of lost or mislaid invoices.

Elimination of Errors of Reversal

Ledgers are designed to bypass the errors of a financial transaction accidentally posted as a debit instead of a credit, e.g., an invoice is entered as a payment or refund. Ledgers present themselves as the perfect bookkeeping option for your financial records, with a feedback loop that allows you to rectify an erroneous entry.

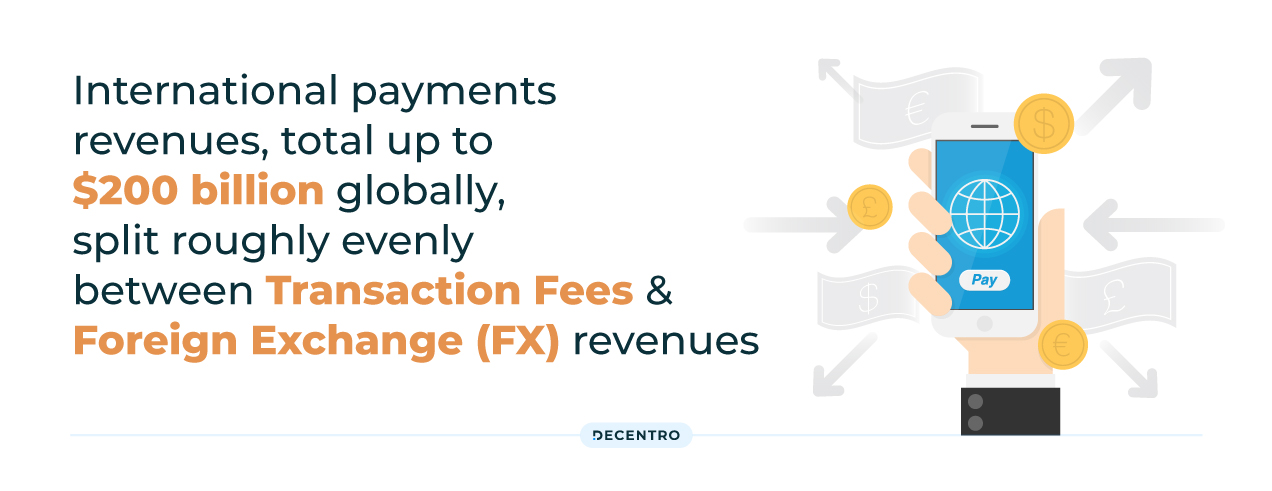

While the above benefits play a crucial role well inside the organization’s four walls, one of the standout characteristics of integrating Ledger APIs is its ability to enable efficient Cross Border Payments.

Traditional B2B cross-border payments are slow and opaque, affecting remittance service providers’ business and cost structure. Using Ledger APIs could also reduce compliance costs and improve the transparency and traceability of transfers. Some of these savings and increased efficiencies could be passed onto customers through lower prices for remittance services.

All in all, a virtual ledger signifies synchronization, accessibility, and automatization. All participants are witnesses of identical data copies who aren’t engaged in the tiresome paperwork anymore. Instead, they benefit from online record-keeping, which embodies speed, convenience, and enhanced security. Compared to the centralized ledgers, which are used by the majority of companies, the resort to the virtual ledger guarantees more robust anti-fraud protection and less probability of error.

Don’t these characteristics describe the essence of first-class digital-first banking?

By simplifying their financial transactions and money movement through a scalable and immutable solution such as Decentro’s Ledgers API, your organization has the bandwidth to focus on scale and customer experience without worrying about handling transaction reconciliation or updates.

Interestingly Decentro’s Ledgers APIs have been instrumental in solving multiple use cases beyond the traditional sphere of balancing the books. Our APIs have been instrumental in enabling the following:

- Cashbacks: Merchants can use ledgers to earmark cashbacks in their ledger and provide cashback to accounts or wallets, including the conversion rates

- Loyalty: Merchants can use ledgers to segregate loyalty points or ‘coins’ that can be used for availing other services within their ecosystem

- Pods: Merchants can use ledgers to create pods that can be used for specific use cases like Savings, Investments, Consumption, etc.

- Reconciliation: Merchants can use ledgers to reconcile the actual flow of funds to what they collect from their consumers through payment gateway, etc.

- Fees: Merchants can use ledgers to levy fees or charges for specific transactions, including items like the forex or transfer fees

- Repayment: Merchants can use ledgers to facilitate repayments on loans or BNPL like a simple Loan Management system (LMS)

For the three million businesses still relying on spreadsheets, solutions like Decentro offer the perfect way to simplify the so-called complicated process. With the core of digital transformation built on efficiency, it is only natural that organizations pivot towards adopting these digital-first resources such as ours as their core strategy to augment revenues and overall profit margins.

From gaining valuable insights from existing data and improving financial risk management, there are umpteen advantages when it comes to deploying automation in an organization’s daily operations.

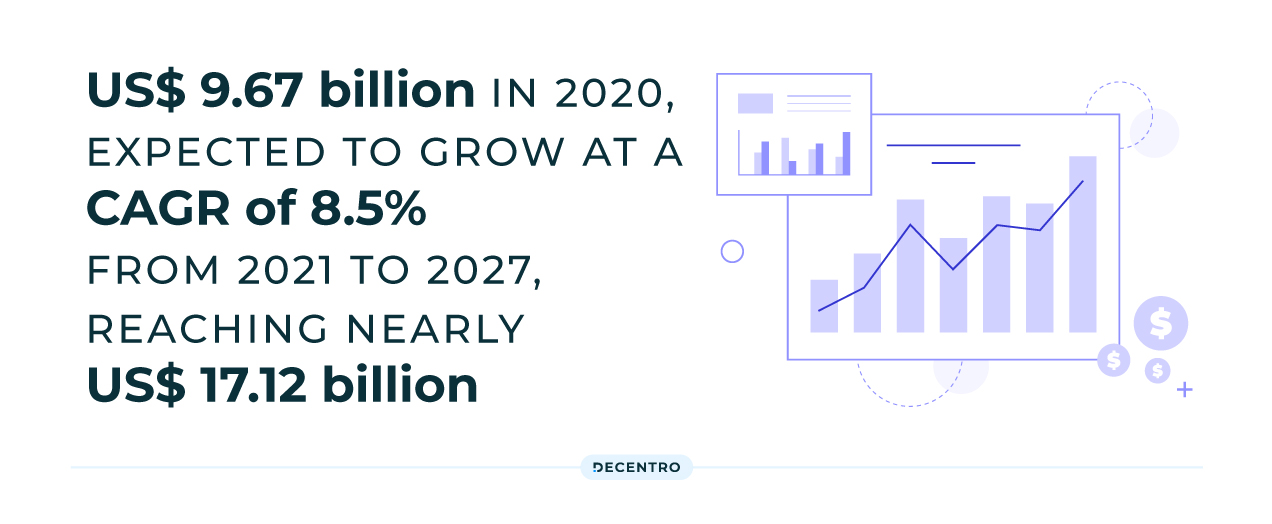

An advantage that has been slowly finding its ground in the economy today. To quote numbers, more than 58% of accounting firms invest in accounting solutions to meet customer needs. In addition, more than 64% of small and medium businesses leverage accounting software to manage their finances.

With our solid footing in a market size valued at US$ 9.67 Bn in 2020, expected to grow at a CAGR of 8.5% from 2021 to 2027, reaching nearly US$ 17.12 Bn, do you wish to be a part of this automation journey?

Frequently Asked Questions

Using Ledgers APIs. When automated workflows for reconciliation and tracking are enforced via easy plug-and-play APIs, the process is significantly improved by updating and implementing standards across the money movement process to enable a communicative, digital flow of timely information.

Double-entry accounting / Double Entry book-keeping can be used in such a scenario, where transactions are recorded in 2 or more accounts using debits and credits. A debit is made in at least one account, and a credit is made in at least one other account. The total debits and credits must balance (equal each other).

Reconciliations are an essential part of all accounting processes. It ensures that the records agree and appear accurately on the financial statements. With Ledgers APIs, automatic reconciliation is the differentiator that allows you to be on top of all your financial records. These consistent and controlled workflows result in the accuracy and reliability of data being tracked. Additionally, automated workflows via Ledgers API establish a more efficient reconciliation preparation and approval process — two common financial close bottlenecks that Finance & Accounting teams often face.

Drop a Comment